Commercial umbrella insurance cost

The cost of commercial umbrella insurance varies based on a number of factors about your business, including your industry's level of risk, the amount of coverage you buy, location, and more.

What is the average cost of umbrella insurance coverage?

Small businesses pay an average premium of $75 per month, or about $900 annually, for commercial umbrella insurance.

Our figures are calculated using the median cost of policies sold by leading insurance companies to Insureon's small business customers. The median offers a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

Commercial umbrella insurance boosts liability coverage when you reach the maximum policy limit on your underlying general liability insurance, commercial auto insurance, or employer's liability insurance.

Most small businesses purchase this extra coverage as a way to meet client's demands for limits exceeding $2 million.

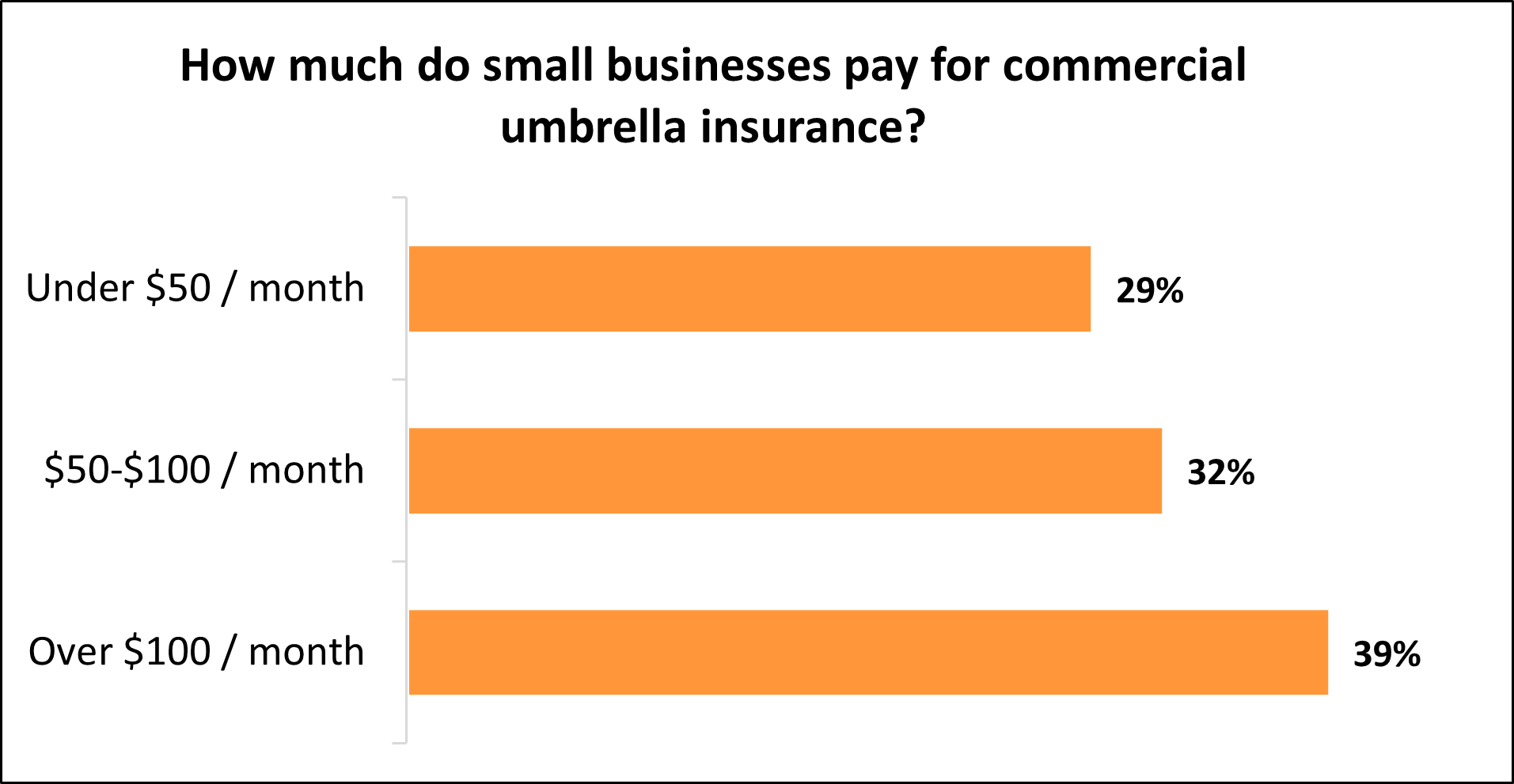

Typical business umbrella insurance costs for Insureon customers

While Insureon's small business customers pay an average of $75 monthly for commercial umbrella insurance, 29% pay less than $50 per month, and 32% pay between $50 and $100 per month.

The cost varies for small businesses depending on their risks and the amount of coverage they choose.

Factors that impact umbrella insurance rates

A number of factors will determine your umbrella insurance costs, including:

- Policy limits and deductible

- Claims history

- Location

- Property handling

- Business size and revenue

- Types of coverage

- Industry risks

Policy limits and deductible

The cost of umbrella insurance increases with the amount of insurance coverage. In short, you'll pay more for higher liability limits.

Generally, it costs about $40 per month for each $1 million of additional coverage you buy.

For example, raising the limits on your general liability insurance from $2 million to $5 million might cost an additional $120 per month over the cost of the underlying policy.

Commercial umbrella insurance boosts your limits across several liability policies. If you only need coverage added to one liability insurance policy, then you could purchase excess liability insurance.

To select the most cost-effective policy for your business, assess its potential liabilities and determine whether it needs the extra protection that commercial umbrella insurance provides.

Claims history

Previous liability claims against your business could increase the cost of your umbrella liability policy. The fewer claims you have on your record, the lower your insurance costs will be.

Underwriters often see previous insurance claims as an indicator of future risk, and will adjust insurance rates accordingly.

This doesn't just apply to umbrella insurance claims, either. Even if you made a claim on another policy, such as general liability insurance, it could still increase your umbrella insurance rates.

Location

The city, region, or state where your business property is located could impact your commercial umbrella coverage costs.

Your local laws and regulations could impact your insurance costs. New York businesses, for example, will likely pay different rates than those in Texas.

Because state laws mandate the levels of insurance required for small businesses for policies such as workers' compensation and commercial auto, your business may need an umbrella policy to expand your coverage in order to remain compliant.

Higher density areas often have higher insurance rates as well, due to the increased rates of incidents due to higher populations.

Find business insurance requirements in your state

Property handling

If you regularly handle customer property, you may be at increased risk of a property damage lawsuit.

The more customer property your business handles, the higher your rates might be due to the increased risk of you or an employee causing property damage or destruction.

For example, a computer repair business could pay higher rates than a fully digital business due to the increased risk associated with handling hardware.

Business size and revenue

The bigger your business and the more revenue you generate, the more you will likely pay for commercial umbrella insurance coverage.

This is, in large part, because the more work you perform for clients, the more opportunities there are for errors, accidents, and incidents.

A solo general contractor, for example, will have different business needs and insurance rates than a large commercial building company.

Types of coverage

The cost of your umbrella policy will depend, in part, on what policies are being expanded.

For example, an umbrella policy for a company that only carries an auto policy will likely cost less than a business with general liability, commercial auto, and employer's liability insurance.

Industry risks

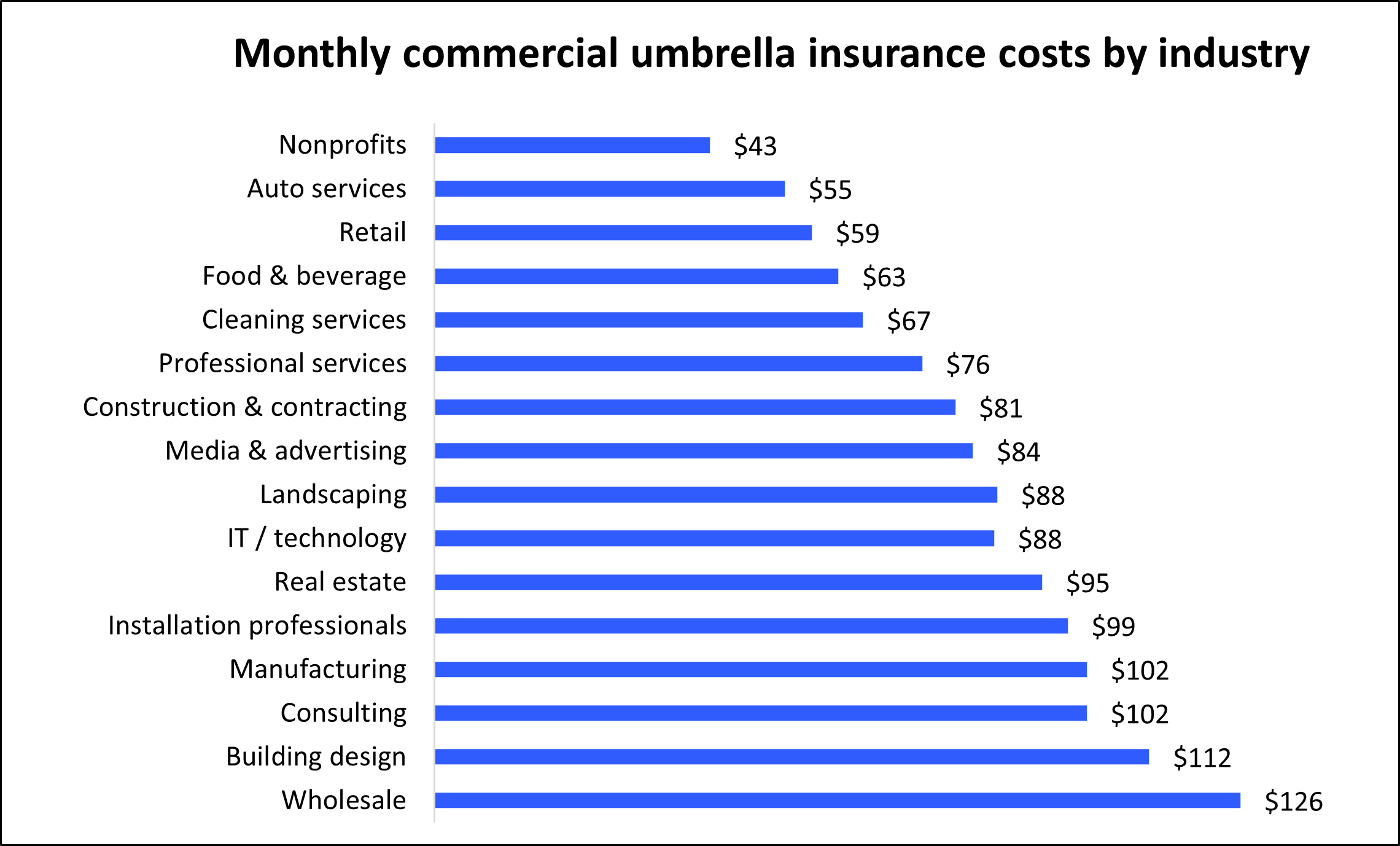

Our analysis of commercial umbrella insurance providers reveals that for small businesses, your industry has the biggest impact on your premium.

Businesses in industries that are vulnerable to costly lawsuits may need higher limits than those with limited liability, and will pay a higher premium for umbrella insurance.

For example, building design professionals pay an average of $112 monthly for umbrella coverage, while nonprofits pay an average of only $43 per month. The graph below illustrates how the type of business affects what you'll pay for a commercial umbrella insurance policy.

Depending on the industry that you work in, such as construction or cannabis, you may be required by your state to carry general liability insurance.

For other businesses, such as those in real estate, insurance, or healthcare, you may need professional liability insurance (also called errors and omissions insurance) before you can get a license.

Top industries we insure

Does my business need umbrella insurance?

Commercial umbrella insurance increases the coverage limits of your underlying insurance policies in $1 million increments.

It's fairly common for a client's contract to call for a $5 million limit on a policy. In that case, an umbrella policy with a limit of $3 million would be added to a business liability policy with a $2 million limit to reach the total requested amount.

It's important to make sure you're fully protected against the high costs of a lawsuit. At any business, a visitor could trip and suffer an injury. The resulting legal and medical expenses might escalate to the point where they could sink your business.

Even if no one outside your company visits your office, someone could still hold your business liable for damages. For example, businesses that run advertising campaigns or post on social media could face a lawsuit if they post content that doesn't belong to them, or make a false claim about a competitor.

When someone sues your business – even if it's a frivolous lawsuit – you'll have to pay legal defense costs, such as the cost of hiring an attorney. If you lose the suit, you could end up paying a fortune in a court-ordered judgment or a settlement.

Umbrella insurance kicks in when your underlying policy reaches its limit, which could save your business from a devastating loss. Because the premium is based upon your level of risk and how much coverage you buy, small businesses like LLCs and sole proprietorships often pay only a small monthly premium for this coverage.

How can you save money on umbrella insurance?

There are a few ways to keep umbrella insurance costs down and avoid more expensive rates, including:

Pay your entire premium upfront. You can typically pay your premium in monthly or annual installments. It might be tempting to go with a smaller monthly payment, but consider paying the full premium instead. Many insurers offer discounts on annual premiums.

Proactively manage your risks. Umbrella insurance covers your liability risks across several policies, and fewer claims mean lower insurance rates.

For example, if a client at a real estate business falls in the office and suffers a major injury that goes beyond the standard policy, an umbrella insurance would kick in and provide additional financial coverage. However, subsequent insurance policies purchased by the real estate agency may be higher due to the claims.

Business owners can create a comprehensive risk management plan to avoid claims. For example, you might:

- Develop a thorough training program for employees

- Invest in a security system

- Compile rules for posting to social media

- Create procedure checklists and reviews

- Minimize hazards on your business premises

- Limit who can drive business vehicles to avoid claims on your auto insurance policy

You can also learn more about saving money on other types of insurance, from our pages on cheap general liability insurance and cheap commercial auto insurance.

Are there any exclusions to umbrella insurance coverage?

You can only buy an umbrella policy for general liability, commercial auto, and employer’s liability policies. You must first buy one or more of these policies before you can buy umbrella coverage for each one.

Other business insurance coverages, such as workers’ compensation, cyber insurance, and commercial property insurance, are excluded from umbrella coverage.

Why do small businesses choose Insureon?

Insureon is here to bring you peace of mind. The right insurance policies can help you avoid expensive out-of-pocket costs and save money on some of the biggest small business risks.

By completing Insureon’s easy online application today, you can get free quotes for commercial umbrella insurance and other policies from top-rated U.S. insurance companies.

You can also consult with an insurance agent on your business insurance needs if you have questions about umbrella coverage or other small business policies, such as a business owners' policy (BOP) or a general liability policy.

Most small business owners begin coverage and receive a certificate of insurance within 24 hours of applying.

Verified business insurance reviews

Hear from customers like you who purchased small business insurance.