Commercial auto insurance cost

The cost of commercial auto insurance coverage varies based on a number of factors about your business. Your premium is directly impacted by the number of vehicles your business owns, their value, their business use, and more.

What is the average cost of commercial auto insurance?

Small businesses pay an average premium of $147 per month, or $1,762 annually, for commercial auto insurance, also known as commercial car insurance.

Our figures are calculated using the median cost of policies sold by leading insurance companies to Insureon's small business customers. The median offers a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

Your costs may vary based on the type of vehicle, with commercial trucks, cargo trailers, and utility trailers costing more on average than other vehicles, such as vans and sedans.

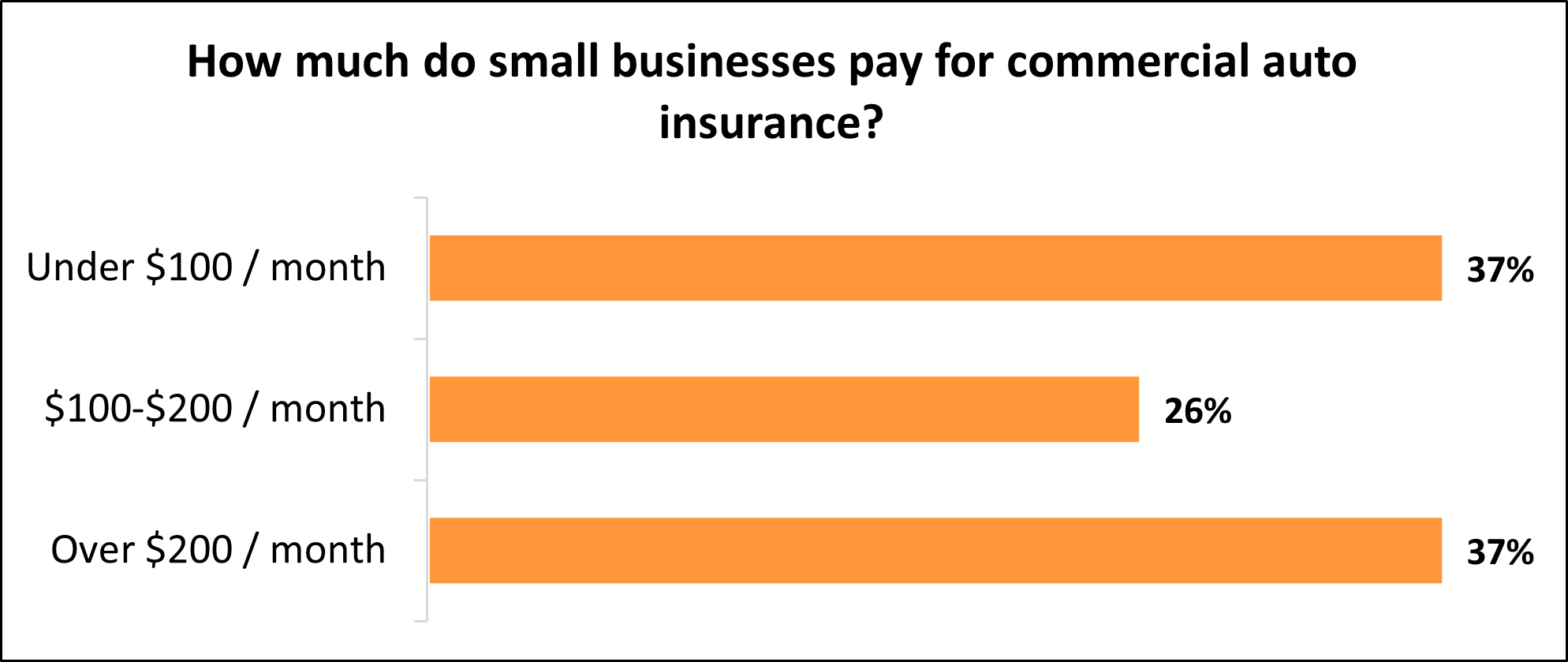

Typical commercial auto insurance costs for Insureon customers

Among Insureon's small business customers, 37% pay less than $100 per month for commercial auto insurance and 26% pay between $100 and $200 per month.

The cost varies for small businesses depending on how many work vehicles they own and the type of insurance coverage they choose.

Top professions that need commercial auto insurance

Don't see your profession? Don't worry. We insure most businesses.

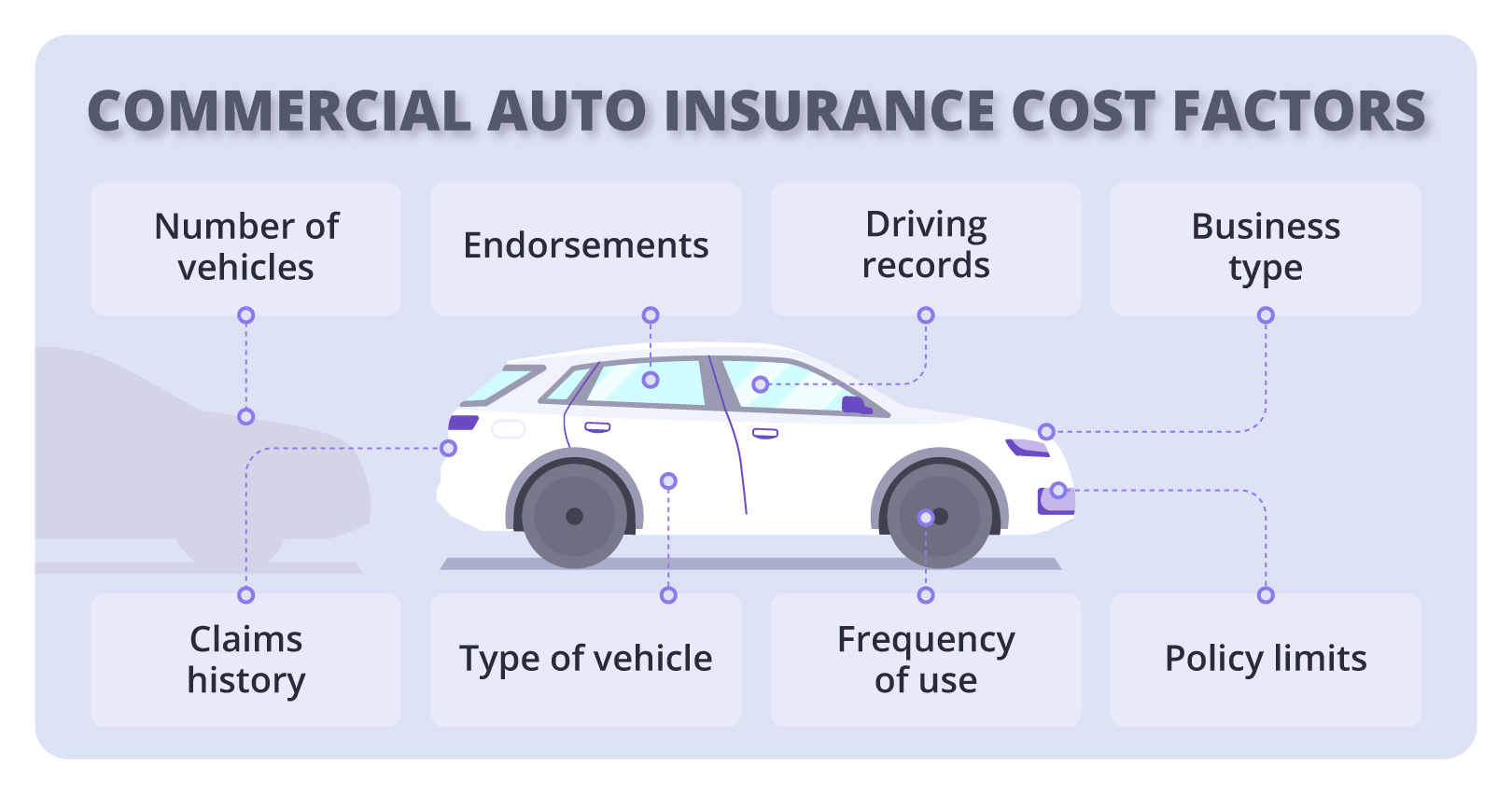

Factors that impact commercial auto insurance rates

Like your personal auto insurance policy, your business insurance company will consider the following factors in its commercial auto insurance rate premium estimator process:

- Your coverage limits and deductible

- The type of coverage you choose

- Claims history

- You and your employees’ driving records

- Location

- Number of vehicles and vehicle types

- Your industry risks

Chat with a licensed insurance agent if you're unsure which coverage options to choose, and get free commercial auto insurance quotes.

Policy limits and deductible

If you want car insurance that pays for a wide range of damage, you need to choose higher per-occurrence limits and aggregate limits on your policy. Higher coverage limits cost more than basic coverage.

When choosing limits, make sure you're meeting your state's requirements for auto insurance. Most states require commercial auto insurance for businesses that own vehicles.

You’ll likely need a certain amount of property damage liability and bodily injury liability coverage. These cover the damage your vehicles may cause to other vehicles, property, and individuals.

Let's say an auto policy has $1 million / $2 million liability insurance limits. That means:

- $1 million per-occurrence limit. While the policy is active, the insurer will pay up to $1 million to cover any single accident.

- $2 million aggregate limit. During the lifetime of the policy (usually one year), the insurer will pay up to $2 million to cover insurance claims.

When buying a policy, you can choose a higher deductible to save money on your premium. However, make sure the deductible is something you can easily afford. If you can't pay the deductible, your insurance won’t activate to cover your claim.

The right amount of coverage depends on your business needs. You want liability limits that'll cover a potential auto accident, without buying more than you need. Chat with a licensed insurance agent if you're unsure which limits are right for your business.

Types of coverage

The type of auto coverage you buy has a big impact on your commercial auto insurance costs. You can choose auto liability only, or comprehensive coverage and other types of physical damage coverage.

Auto liability coverage is required by law in most states and protects you if you or your employees are to blame for an accident in your commercial vehicle. Auto liability is your lowest cost option, and provides limited coverage to help pay for:

- Physical damage to other vehicles or property

- Medical expenses from bodily injuries to another party

If you opt for comprehensive auto insurance, your coverage will increase – but so will your insurance rates. In addition to what’s covered under auto liability coverage, comprehensive commercial auto insurance covers theft and damage due to weather, vandalism, or fire.

Additional endorsements like uninsured motorist coverage, medical payments coverage, bobtail insurance, or collision coverage can further increase your premium. For an accurate auto insurance quote, make sure to provide details about your insurance needs.

You can also opt for hired and non-owned auto insurance (HNOA) if your company leases or rents cars, or uses personal vehicles for business purposes. Because it doesn't cover damage to your own vehicle, you can expect to pay a little less for HNOA coverage.

HNOA is important because although your personal auto insurance will cover your work commute, it likely has exclusions for work-related mishaps such as errands you make as part of your job.

Claims history

Previous claims can indicate a higher risk to insurance companies and increase your commercial policy cost.

A small business with a history of previous insurance claims will likely end up paying higher premiums than a small business without any prior claims.

Driving history

If you or your employees have a history of collisions or accidents, your rates may increase. The demographics of your employees may also play a factor, such as age and length of driving history.

Encouraging safe driving among your staff could help keep your premiums low.

Location

Your location may have an impact on your commercial auto insurance rates.

Certain locations have higher population densities, more traffic, higher crime rates, and a greater frequency of natural disasters, which may lead to increased insurance rates. The cost of living is another factor, with higher repair costs often leading to higher premiums.

Locations with higher population densities also tend to have a higher proportion of uninsured drivers, which can increase risk and subsequently raise insurance premiums.

Find commercial auto insurance requirements in your state

Number of vehicles and vehicle types

The number of vehicles your business has is a major factor that determines your insurance costs.

The more vehicles you have, the higher your premiums will be. A business with a fleet of vehicles will pay more than a company with just a few sedans or vans.

Additionally, the types of vehicles your business uses will also impact your costs.

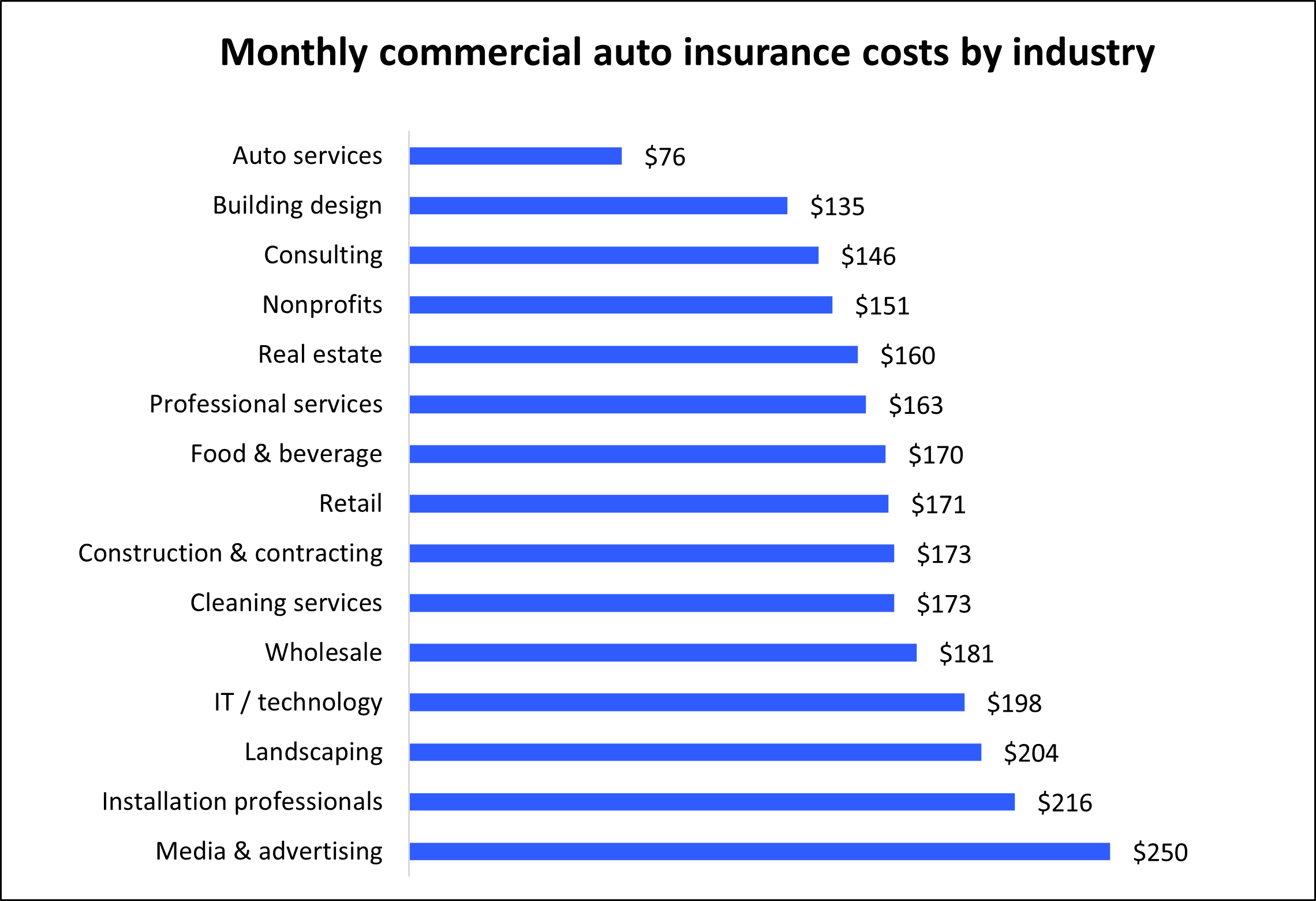

Industry risks

Your type of business also affects how much you will pay for a commercial auto insurance policy, along with your vehicle use.

For example, a food truck filled with valuable equipment or a tow truck that’s always on the road will likely have higher rates. So might construction vehicles, like dump trucks, that frequent dangerous jobsites.

Auto services, for example, pay an average of $76 per month, while businesses with higher risk, such as construction and installation contractors, will pay on average $173 and $216 per month, respectively. Industries with even greater risks, such as trucking businesses, pay an average of $816 per month for auto insurance coverage.

However, keep in mind that the number of vehicles and their value have a bigger effect on your premium than your industry.

How can you save money on commercial auto insurance?

Saving money on auto insurance is easy. The following will help reduce your out-of-pocket expenses and avoid more expensive rates:

- Purchase insurance as a bundle. Bundling policies will help you save money over buying policies individually.

- Pick the right policies for your needs. For example, landscapers might need different policies and limits than IT consultants.

- Practice good risk management. Ensuring your employees are driving safely, your vehicles are well-maintained, and your business has good policies and procedures will help you avoid accidents and keep your costs low.

- Compare quotes across multiple providers with Insureon.

Why do small business owners choose Insureon?

Insureon is the #1 independent agency for online delivery of small business insurance. By completing Insureon’s easy online application today, you can get free quotes for commercial auto insurance and other policies from top-rated U.S. insurance carriers.

Once you find the right policies for your small business, you can begin coverage in less than 24 hours and get a certificate of insurance for your small business.

Verified business insurance reviews

Hear from customers like you who purchased small business insurance.

Learn more about business insurance costs

Don't see your profession? Don't worry. We insure most businesses.