Top cleaning businesses we insure

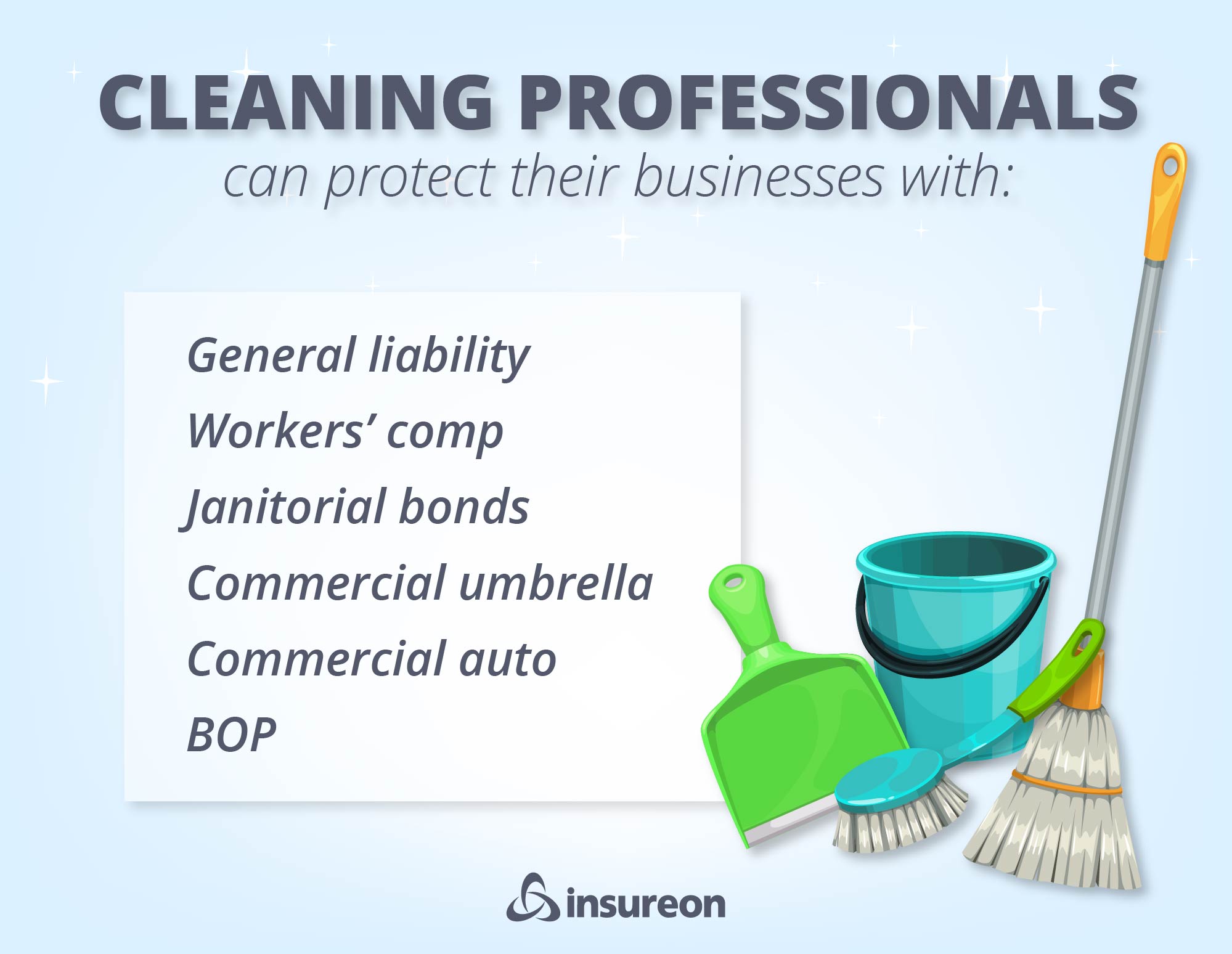

Recommended insurance coverage and bonds for cleaning professionals

A client slipping on a wet floor or the theft of expensive cleaning equipment could financially devastate a small cleaning company. Insureon helps you find the insurance you need to survive accidents and lawsuits.

General liability insurance

A general liability policy covers common cleaning risks, such as client property damage and injuries. It's often the first policy purchased by a cleaning business.

- Clients slipping on wet floors

- Damage to customer property

- Advertising injury lawsuits

Workers’ compensation insurance

Almost every state requires workers' comp for cleaning businesses that have employees. It also protects sole proprietors from work injury costs that health insurance might deny.

- Employee medical bills

- Disability benefits

- Lawsuits from employee injuries

Janitorial bonds

Janitorial bonds are a type of surety bond. They reimburse clients in the event of employee dishonesty, such as a housekeeper who steals from a home.

- Theft of money from a client

- Stolen property

- Forgery and fraud

Commercial auto insurance

Commercial auto insurance provides property and liability coverage in an accident involving your business vehicle. It also covers vehicle theft and vandalism.

- Car accidents

- Vandalism and theft

- Weather damage

Business owner's policy

Small business owners are often eligible for a business owner's policy. A BOP bundles general liability and commercial property insurance at a discount.

- Client injuries

- Accidents that damage a client's property

- Damage to your building or its contents

Commercial umbrella insurance

Umbrella insurance boosts business insurance coverage for general liability insurance, commercial auto insurance, and employer's liability insurance.

- Multi-vehicle auto accidents

- Customer injury lawsuits

- Employee injury lawsuits

Does my cleaning business need commercial auto insurance?

Cleaning businesses that purchase commercial auto insurance often:

- Have a vehicle titled to their business

- Drive to and from worksites

- Carry cleaning supplies, equipment, or products used for work

- Transport employees

- Rely on delivery drivers or couriers

Check the laws in your state to see when coverage is required.

How much does cleaning business insurance cost?

Small cleaning businesses usually pay less for insurance than larger businesses.

Several factors affect the cost of cleaning insurance, including:

- The type of cleaning services you offer, such as maid services, janitorial services, or Airbnb cleaning

- Business property, such as commercial carpet cleaners and vacuum cleaners

- Your business revenue

- Your business location, as well as where you operate

- How many employees you have

- Policy limits and deductibles

Protect your cleaning business today

[video: an animated header displays the Insureon logo. Underneath it, a subheading displays the text: "What insurance do I need for my cleaning business?"]

MALE VOICEOVER: From house cleaners to commercial janitorial services, cleaning businesses face several risks daily. Having the right insurance will protect your cleaning company from accidents, equipment theft, and other financially devastating claims.

[video: an illustrated header displays the text: "The right coverage will help your business survive unexpected claims and lawsuits."]

So, which types of business insurance should a cleaning business carry?

[video: an illustrated header displays the text: "What types of insurance do I need for my cleaning business?"]

The most popular and often required policies include:

[video: an illustrated header displays the text: "The most common policies that a cleaning business needs include..."]

General liability insurance, which protects against basic third party risks, such as a customer injury, or damage to their property.

[video: an illustrated header displays the text: "General liability guards against:"]

[video: Under above header, three bullet points display the text: "Customer bodily injuries"; "Damaged customer property"; "Libel and advertising injuries"]

Workers' compensation insurance is usually required for businesses with employees, and protects against workplace illnesses or injuries.

[video: an illustrated header displays the text: "Workers' compensation helps with:"]

[video: Under above header, three bullet points display the text: "Employee medical expenses"; "Disability benefits"; "Legal fees from lawsuits"]

Commercial auto insurance covers vehicle theft, vandalism, and accidents involving your company's vehicle. Most states require this coverage for businesses that own vehicles.

[video: an illustrated header displays the text: "Commercial auto covers:"]

[video: Under above header, three bullet points display the text: "Physical damage and collisions"; "Injuries caused by your vehicle"; "Repairs due to weather or vandalism"]

A business owner's policy, or BOP, bundles general liability and commercial property coverage together. It usually costs less than purchasing each of these policies separately.

[video: an illustrated header displays the text: "A business owner's policy covers:"]

[video: Under above header, three bullet points display the text: "Client accidents"; "Stolen or damaged business property"; "Business interruptions"]

Janitorial bonds provide reimbursement to your client if an employee steals from them. These bonds are sometimes required in client contracts.

[video: an illustrated header displays the text: "Janitorial bonds cover:"]

[video: Under above header, three bullet points display the text: "Employee theft or fraud"; "Illegal funds transfer by an employee"; "Client contract requirements"]

Your unique business operations will likely determine what types of insurance you need and how much of a specific coverage you should carry. It's best to speak with your insurance agent to understand which policies can meet both your business needs and your budget.

[video: an illustrated header displays the text: "Speak with your insurance agent to find the right policies for your cleaning company."]

Get free insurance quotes for your cleaning business with Insureon today.

[video: an illustrated white header displays the text: "Insureon is your #1 agency for small business insurance"]

Click the link to get started.

[video: an animated header displays the Insureon logo]

Insureon helps a wide range of businesses get the coverage they need from top-rated U.S. insurance carriers. Complete our easy online application to get free insurance quotes.

Our licensed insurance agents can help you choose the best cleaning insurance policies that meet the needs of your small business.

You’ll typically be able to get coverage quickly and receive a copy of your insurance certificate on the same day.

State insurance requirements

See cleaning business insurance requirements in your state

How do I get cleaning company insurance?

It's easy to get business insurance for your cleaning company with Insureon. You'll need to have some basic info about your business on hand, such as annual revenue and number of employees, to get free quotes.

You can buy a policy online and get a certificate of insurance in three easy steps:

- Complete a free online application.

- Compare insurance quotes and choose a policy.

- Pay for your insurance policy and download a certificate of insurance.

Insureon's licensed agents work with top-rated U.S. insurance companies to find the right coverage for your cleaning business, whether you work independently or have several employees working for you.

Verified business insurance reviews

Hear from customers like you who purchased small business insurance.

FAQs about cleaning business insurance

What do cleaning business owners need to know about state laws?

The requirements for cleaning businesses often depend on local laws, particularly state laws. Here are a few instances where your business needs to comply with state and municipal laws:

- You may need a business license. States, counties, and cities often require a license for every business, including cleaning services. A vendor’s license or business license allows you to collect and report sales tax on the cleaning supplies you buy, if you charge your clients for the products you use.

- Certain tasks require a contractor's license. Pressure washing and other cleaning tasks that involve wastewater discharge may require a contractor's license, again depending on local laws.

- Your business has its own name. You typically must register under a "doing business as" or DBA name if you call your business by any name other than your own.

- You have employees. Most states require businesses with employees to have workers’ compensation insurance. This policy covers medical bills if an employee suffers a work-related injury or illness. Your employees’ regular health insurance is unlikely to cover medical expenses from a work-related mishap.

- Your business owns a vehicle. Almost every state requires commercial auto insurance for vehicles owned by a business. States also have different requirements for the amount of auto insurance needed.

Do I need a bond for my cleaning business?

Janitorial bonds are required in some circumstances. They show clients your business is dependable, which is especially important when you're starting a cleaning business. Here are a few instances where you might need a bond:

- Your state requires a bond. In some states, your cleaning business must be bonded or insured in order to get licensed. Your state laws will specify the bond amount.

- Clients might require a bond. Before they'll allow your cleaners onto their property, some clients might require you to buy a bond. They want guaranteed reimbursement in the event of employee theft.

- A bond gives you an edge over competitors. Being fully licensed, bonded, and insured can help you promote your business. Clients often choose companies with this protection over those that go without.

In other industries, you might see a janitorial bond called a surety bond or a fidelity bond.

Do self-employed cleaners need insurance?

If you're self-employed, you probably have fewer resources to draw upon in the event of a lawsuit or other business disruption. Additionally, homeowner's insurance and other personal insurance policies won't provide coverage for incidents related to work.

For example, if you're injured on the job, health insurance likely won't cover your medical bills. And if you get into an auto accident in your own vehicle while driving to a client's home, your personal auto policy won't provide coverage.

Clients and government contracts could also require you to carry insurance for your cleaning business, regardless of its size.

That's why cleaning insurance for the self-employed is crucial, whether you're a sole proprietor or an independent contactor. It's also worth forming a limited liability company (LLC) so your personal assets aren't at risk for business liabilities.

What other types of coverage do cleaning businesses need?

To fully protect your cleaning business from all risks and liabilities, you may need additional coverage. Cleaners should consider the following business insurance policies:

- Commercial property insurance covers your business’s physical location and business personal property (BPP) at that location, such as cleaning equipment. You can bundle this coverage with general liability insurance in a business owner's policy at a discount, or just add a BPP endorsement to your general liability policy if you don't have an office.

- Inland marine insurance provides coverage for products, tools, and equipment while they're in transit, stored off-site, or used at a jobsite. Standard property insurance only covers these items while they’re stored at your business.

- Contractor's tools and equipment coverage is a specific type of inland marine insurance for newer items valued at under $10,000. It's perfect for floor polishers, mops, carpet cleaners, and other commercial cleaning equipment.

- Hired and non-owned auto insurance (HNOA) provides liability coverage for personal, rented, and leased vehicles used by your business. Your personal auto insurance is unlikely to cover you for a work-related accident, such as visiting a client’s home or delivering supplies.

Read our blog posts

Workers' compensation covers the costs of work-related injuries and illnesses, like medical bills and lost wages. Here’s how workers’ comp insurance works, and what you need to know as a business...

Thank you for being the economic backbone of our communities. Behind every small business is a story of independence and resilience, from late nights and big ideas to the courage to bet on...

A sole proprietorship is a business that’s owned and operated by one person, while a limited liability company (LLC) can be formed by an individual or a group of entrepreneurs. Each has their own...

Want free expert advice right in your inbox?

By entering your email address and subscribing, you agree to our Terms of Use and Privacy Policy