Tools and equipment insurance cost

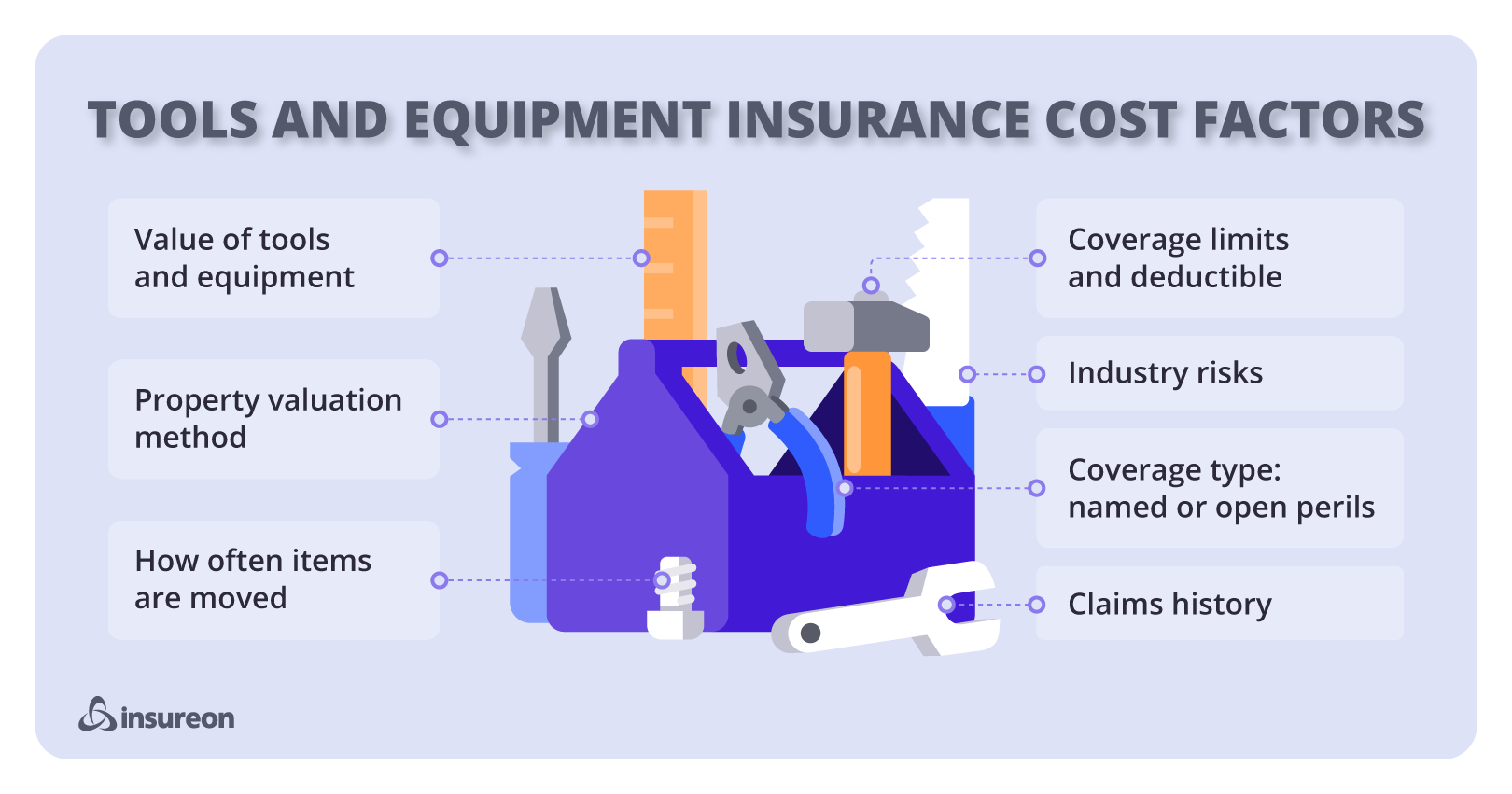

The cost of tools and equipment insurance varies based on a number of factors about your business. Your premium is directly impacted by the type of equipment you wish to insure, your policy limits, industry risk, and more.

What is the average cost of tools and equipment insurance?

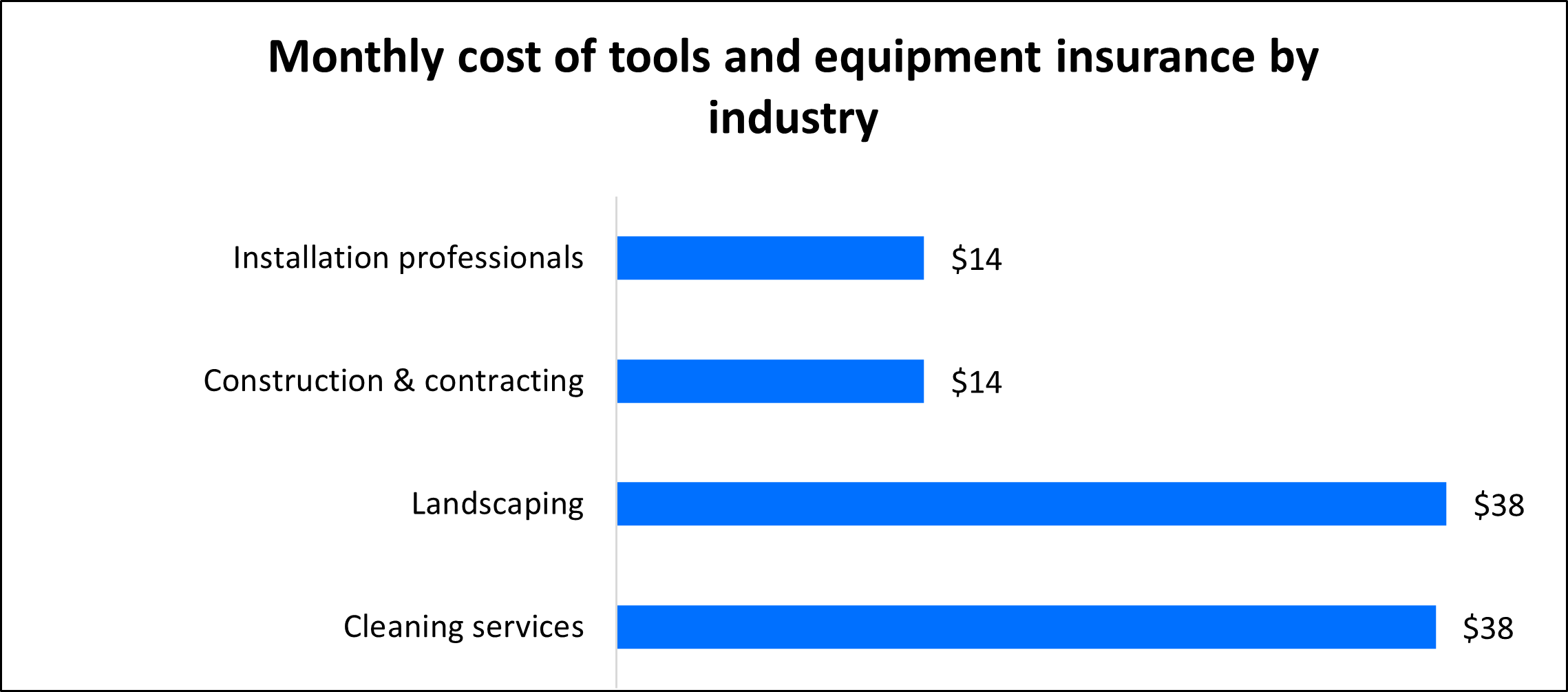

Small businesses pay an average premium of $14 per month, or about $170 annually, for tools and equipment insurance.

Our figures are calculated using the median cost of policies sold by leading insurance companies to Insureon's small business customers. The median offers a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

Factors that affect tools and equipment insurance costs

Here are a few factors that your insurance provider will consider when determining your premium for a tool insurance policy:

- Coverage limits

- Type of property and valuation method

- Types of hazard covered

- Location

- Claims history

- Industry risks

Coverage limits and deductible

A tools and equipment policy provides property coverage for newer items valued at $10,000 or less. It's designed for items that are stored offsite or that travel to job sites, such as hand tools, power tools, saws, computer equipment, laptops, etc. Generally, the cost of your policy depends on the value of the items that you wish to insure, including rented equipment.

Your coverage limit should match the value of the items you are insuring to guarantee you don’t end up paying for property damage out of pocket. Mobile items valued at more than $10,000, such as bulldozers, excavators, backhoes, and other heavy equipment, will require inland marine insurance coverage.

Industry risks

Insurance companies will also look at your industry and profession when determining the cost of any type of commercial property insurance. Small businesses in professions with higher risks and more frequent property claims can expect to pay more for this coverage.

For example, cleaning businesses pay an average of $38 per month for tools and equipment coverage, as they may face a higher risk of damaged or stolen items at a client's premises. General contractors and construction businesses, on the other hand, pay an average of only $14 per month for this policy.

The graph below illustrates how your type of business can affect the premium:

Top industries we insure

Type of property and valuation method

When buying property insurance, you can choose to cover your property in two ways:

- Replacement cost - Replacement value coverage costs more because it pays for the purchase of a brand-new replacement item.

- Actual cash value - You can save money with actual cash value coverage, which instead covers the damaged equipment's depreciated value.

The types of equipment you're insuring will also impact your rates as well. Higher value items are more likely to result in higher premiums than lower cost items. How often you use your items can also impact costs, as more-frequently used items can cost more than infrequently used items.

Types of hazards covered

An equipment policy that covers open perils will cost more than a policy that covers named perils. This is because open perils coverage protects against all losses, except those specifically excluded in the policy, while named perils coverage only protects against losses listed in the policy.

Typically, tools and equipment insurance covers fires, vandalism, theft, and hail damage. Exclusions may include wear and tear damage, earthquakes, floods, equipment breakdown, and vehicle damage. These exclusions can often be covered by commercial property insurance, auto insurance, and specific coverage endorsements.

Location

Insurance providers will assess how safe your items are when determining your premium. For example, office equipment stored at a secure offsite location will cost less to insure than employee tools stored at a construction project in an area of high crime.

Your location and exposure to things like natural disasters, high density populations (and subsequent rises in crime), and other factors can also impact your premiums.

Additionally, insurers may look at how often the items are moved, as well as safety features like sprinkler systems and burglar alarms.

Claims history

A history of insurance claims can impact your insurance rates. A company with a lengthy list of previous insurance claims will likely pay more for its tools and equipment insurance than a company with no claims history.

To keep insurance costs low, you can try to avoid claims by creating a risk management strategy and providing business equipment training to employees.

How can you save money on a tools and equipment insurance policy?

It’s easy to save money on your contractor's tools and equipment policy without compromising on coverage.

Some strategies to keep costs down and avoid more expensive rates include:

Bundle policies

Many small business owners opt for a business owner's policy (BOP), or commercial package policy (CPP), which combines commercial property insurance with general liability coverage at a lower rate than purchasing each policy separately.

When you buy a property and heavy equipment policy, you can choose to pay your premium in monthly installments or annually. Insurers usually offer a discount when you pay the full annual premium.

Manage your risks

Insurers will consider your claims history when setting your premium. Risk management helps you avoid claims and keep your premium low. That includes choosing a secure site to store your pieces of equipment, or installing a burglar alarm on a van or truck.

Choose cheaper coverage options

Opting for lower limits or a higher deductible is an easy way to save money on your premium. However, be sure to choose a deductible you can easily afford. If you can’t pay your deducible, you can’t collect on a claim.

Why do small businesses choose Insureon?

Insureon is the #1 independent agency for online delivery of small business insurance. We help business owners compare quotes from top-rated providers, buy policies, and manage their coverage online.

By completing Insureon’s easy online application today, you can get free quotes for property insurance and other insurance products from top-rated U.S. insurance companies.

Once you find the right policy, you can begin coverage in less than 24 hours and get a certificate of insurance.

Our licensed insurance agents can answer any questions and help ensure you're fully protected against major small business financial losses.

Licensed agents can assist with tools and equipment insurance as well as other popular small business policies, such as general liability insurance and workers' compensation.

Verified business insurance reviews

Hear from customers like you who purchased small business insurance.