Directors and officers insurance cost

The cost of directors and officers insurance (D&O) varies based on a number of factors about your business. Your premium is directly impacted by the type of work you do, the size of your business, your financial strength, industry risk, and more.

What is the average cost of D&O insurance?

Small businesses pay an average premium of $138 per month, or $1,653 annually, for directors and officers insurance.

Our figures are calculated using the median cost of policies sold by leading insurance companies to Insureon's small business customers. The median offers a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

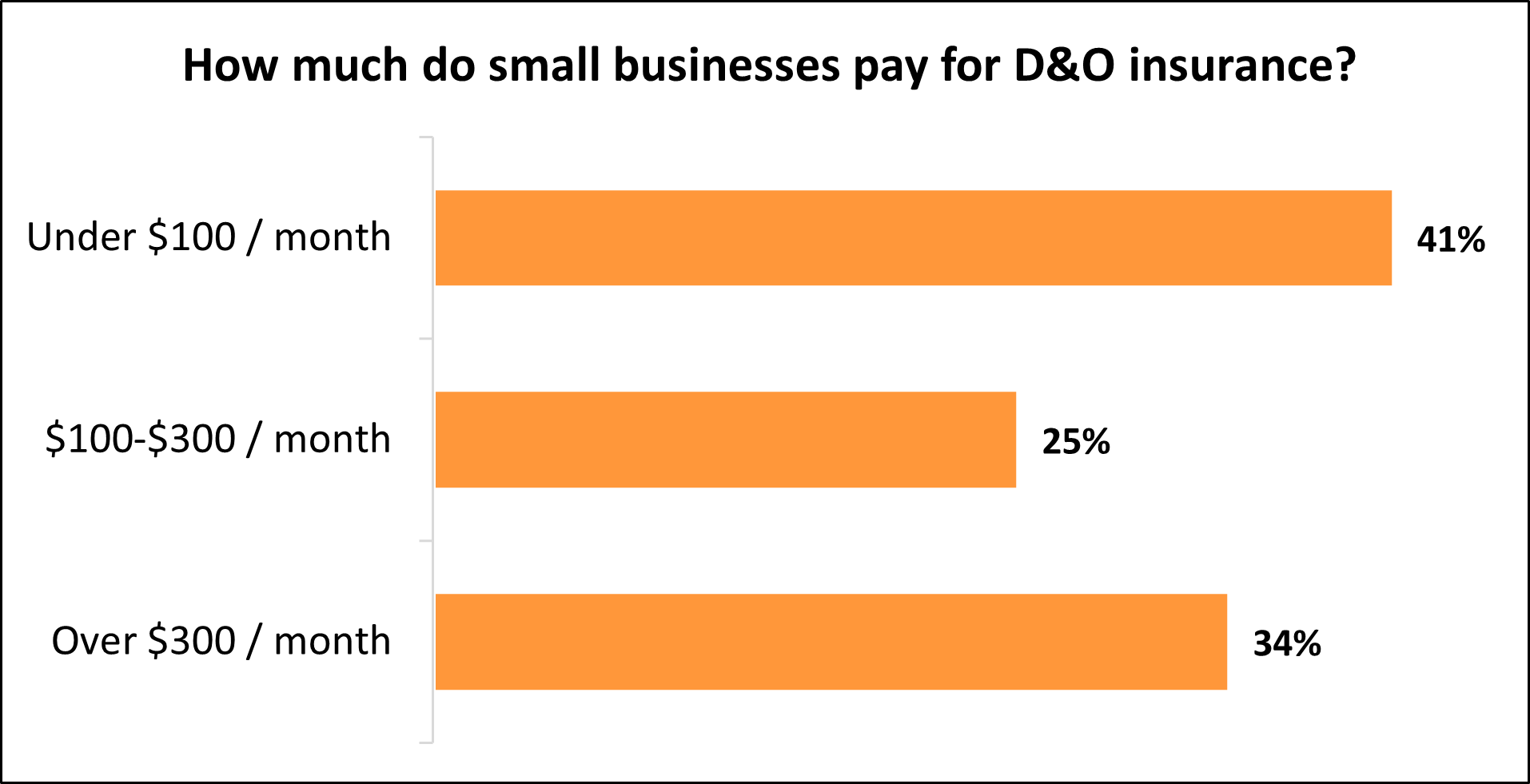

Typical directors and officers insurance costs for Insureon customers

While Insureon's small business customers pay an average of $138 monthly for directors and officers liability insurance, 41% pay less than $100 per month for their policies, and another 25% pay between $100 and $300 monthly.

The cost varies for small businesses depending on their risks and the coverage they choose.

Understanding D&O insurance cost factors

Insurance company underwriters consider several factors when determining how much to charge for a D&O insurance policy, including:

- Industry risks

- Coverage limits and deductible

- Number of directors on the board

- Number of employees

- Location

- Annual revenue

- Risk management

- Claims history

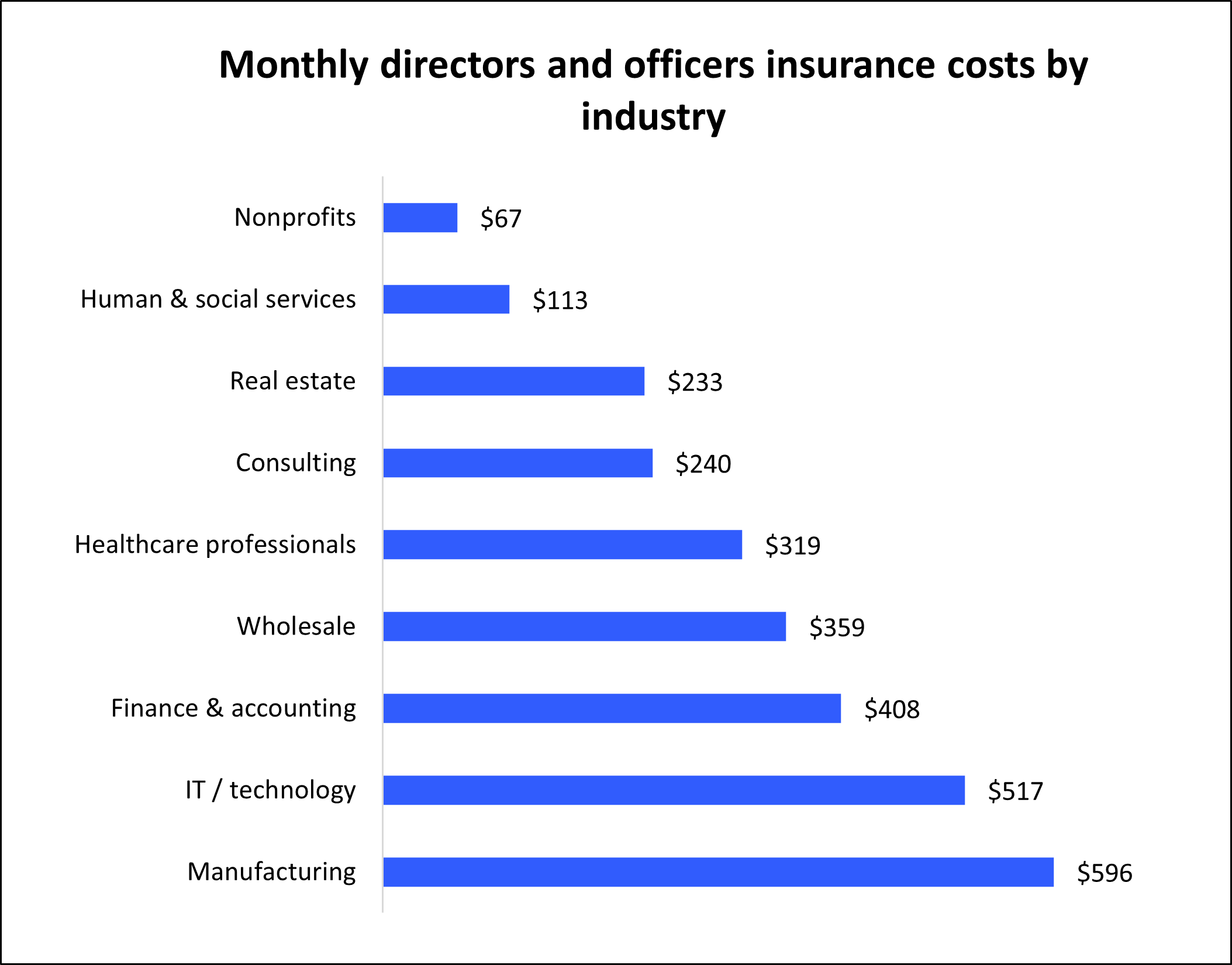

Industry risks

Your industry can have a big impact on your premium.

Industries where directors’ decisions carry more weight on business outcomes tend to face higher risks—and higher insurance costs. For example, manufacturing and technology businesses often have to make large upfront investments and rely heavily on their directors’ strategic choices.

As a result, manufacturers pay an average of $596 per month and technology businesses typically pay $517 per month for this coverage. These industries often face lawsuits related to board-level decisions that can significantly affect the company’s financial health.

Healthcare professionals fall somewhere in the middle, paying about $319 per month. Their directors make important decisions regarding compliance and patient care, which carry real risk, but not to the same extent as industries with significant capital investments.

In contrast, nonprofits pay an average of only $67 per month. Their boards usually focus more on managing grants or donor budgets rather than making high-stakes investment decisions, which means fewer lawsuits tied to director actions and therefore much lower premiums.

Top industries we insure

Coverage limits and deductible

If you want a D&O policy that covers more expensive lawsuits, you’ll need to increase your coverage limits—which means you’ll pay a higher premium to your insurance company.

The limits on directors and officers insurance coverage can vary significantly. Each policy has a per-occurrence limit and an aggregate limit:

- Per-occurrence limit. While the policy is active, the insurer will pay up to this amount to cover any single claim.

- Aggregate limit. During the lifetime of the policy (usually one year), the insurer will pay up to this amount to cover claims.

When buying a policy, it's a good idea to make sure the deductible is something you can easily afford. If you can’t pay for it in a crisis, your insurance won’t activate to cover your claim. The average deductible that Insureon customers select for D&O insurance is $2,500.

The right amount of coverage depends on your business needs. You want coverage that will cover a potential lawsuit, without buying more than you need. Chat with a licensed insurance agent if you're unsure which exclusions, deductible, or limits are right for your small business or startup.

Number of directors on the board

The size of your board of directors can influence your D&O insurance premium. In general, the more directors you have, the greater the chance of disagreements, mismanagement claims, or wrongful acts. Each additional director increases the pool of decision-makers who could be named in a lawsuit, which raises the overall risk for the insurance provider.

Because of this, your insurance carrier may view larger boards as a higher exposure and adjust premiums accordingly. Smaller boards, on the other hand, typically represent less risk of a D&O claim, which can help keep insurance costs lower.

Number of employees

The number of employees your business has can also affect your D&O insurance premium. As your workforce grows, the potential for disputes, claims of mismanagement, or employment-related lawsuits increases. Employees may bring claims against directors and officers for issues such as wrongful termination, discrimination, or failure to follow company policies.

With more employees, there are more possible points of conflict and a higher likelihood leadership decisions could be challenged. Because of this added exposure, insurance carriers may raise premiums for businesses with a larger staff compared to those with only a few employees.

Location

Certain states and regions have stronger employee protection laws, more active regulators, or higher rates of D&O lawsuits. Operating in these areas increases the likelihood your directors and officers could face claims related to employment practices, shareholder disputes, or regulatory compliance.

Insurance carriers take these regional risks into account when setting premiums. For example, companies based in states with a reputation for frequent litigation may face higher D&O insurance costs than those in areas with fewer claims.

Annual revenue

Your company’s annual revenue is a key factor in determining D&O liability coverage premiums. Higher revenue often signals a larger, more complex business with greater visibility, more stakeholders, and typically more directors on the board. With more directors making high-stakes decisions that can significantly affect company performance, there’s a greater chance of disputes and lawsuits.

Because the legal fees of defending and settling claims tend to rise with both company size and board size, insurance providers generally charge higher premiums for businesses with greater earnings. Smaller companies with fewer directors and lower revenue usually present less exposure and may benefit from more affordable coverage.

Risk management

Strong risk management practices can help lower your D&O insurance cost. Especially if your company has clear policies, documented procedures, and proactive measures to reduce the likelihood of disputes.

For example, a well-structured HR department that provides employee training, enforces anti-harassment policies, and maintains consistent documentation can show carriers the business is actively managing its risks.

By demonstrating your company takes compliance, governance, and workplace culture seriously, it reduces the chance of claims being brought against directors and officers. This can make your business a safer bet for insurers and potentially lead to more affordable premiums.

Claims history

If your business has a track record of frequent or severe claims, carriers are more likely to view you as a higher risk. A long list of past lawsuits or regulatory actions suggests a greater chance of future claims against your directors and officers, which leads to higher premiums.

On the other hand, companies with little to no claims history are generally seen as lower risk. A clean record can help you qualify for cheaper D&O insurance rates.

Do I need D&O insurance?

Though it's not required by state law like workers' compensation, D&O insurance is equally important when you have a board of directors. Additionally, some private equity and venture capital firms may require this coverage before investing in a startup.

Each time a board member makes a decision on behalf of your business, a lawsuit is a possibility. An employee could file a wrongful termination claim, or the board of directors could be held responsible for misrepresentation or a breach of fiduciary duty.

When someone sues your business—even if it's a frivolous lawsuit—you'll have to pay legal defense costs, such as the cost of hiring an attorney. If you lose the suit, you could face significant financial losses in a court-ordered judgment or a settlement.

D&O insurance covers all of these costs, which could save your business from bankruptcy. It also helps attract top talent to your business, since potential candidates know their personal assets will be protected in the event of a lawsuit.

Because the premium is based on your risk profile and industry, many small businesses pay only a small monthly premium for this coverage.

How can you save money on D&O insurance?

Directors and officers liability insurance benefits both private companies and public companies. Regardless of business type, there are steps you can take to keep your costs low and avoid more expensive rates, such as:

Bundle policies. Many insurers offer options to purchase different types of coverage together for a discount. You can often bundle D&O coverage with other types of management liability insurance, such as employment practices liability insurance (EPLI).

Shop around and compare quotes. Premiums can vary significantly between insurers, so it pays to get multiple quotes. Comparing coverage options ensures you’re getting the best protection at a competitive price.

Pay your entire premium upfront. While it's tempting to pay the low monthly premium, many insurance companies offer a discount when you pay the full annual premium instead.

Proactively manage your risks. A comprehensive risk management plan can help you avoid D&O claims, which helps keep your premium low. For example, you might:

- Form internal protocols for hiring and firing employees to improve retention

- Respond promptly to claims of harassment

- Standardize the decision-making process to ensure board decisions are well-informed

- Institute a formal review process for important decisions

Why do small business owners choose Insureon?

Insureon is the #1 independent agency for online delivery of small business insurance.

We help business owners get peace of mind by comparing quotes from top-rated providers, buying policies, and managing their coverage online. By completing Insureon’s easy online application today, you can get free quotes for directors and officers insurance and other business insurance policies from top-rated U.S. insurance companies.

Our insurance agents are available to help answer any questions you may have, such as the differences between Side A, Side B, and Side C in a D&O policy.

Once you find the right coverage for your small business, you can begin coverage in less than 24 hours and get a certificate of insurance for your small business.

Verified business insurance reviews

Hear from customers like you who purchased small business insurance.