What to know about business bonds and commercial insurance

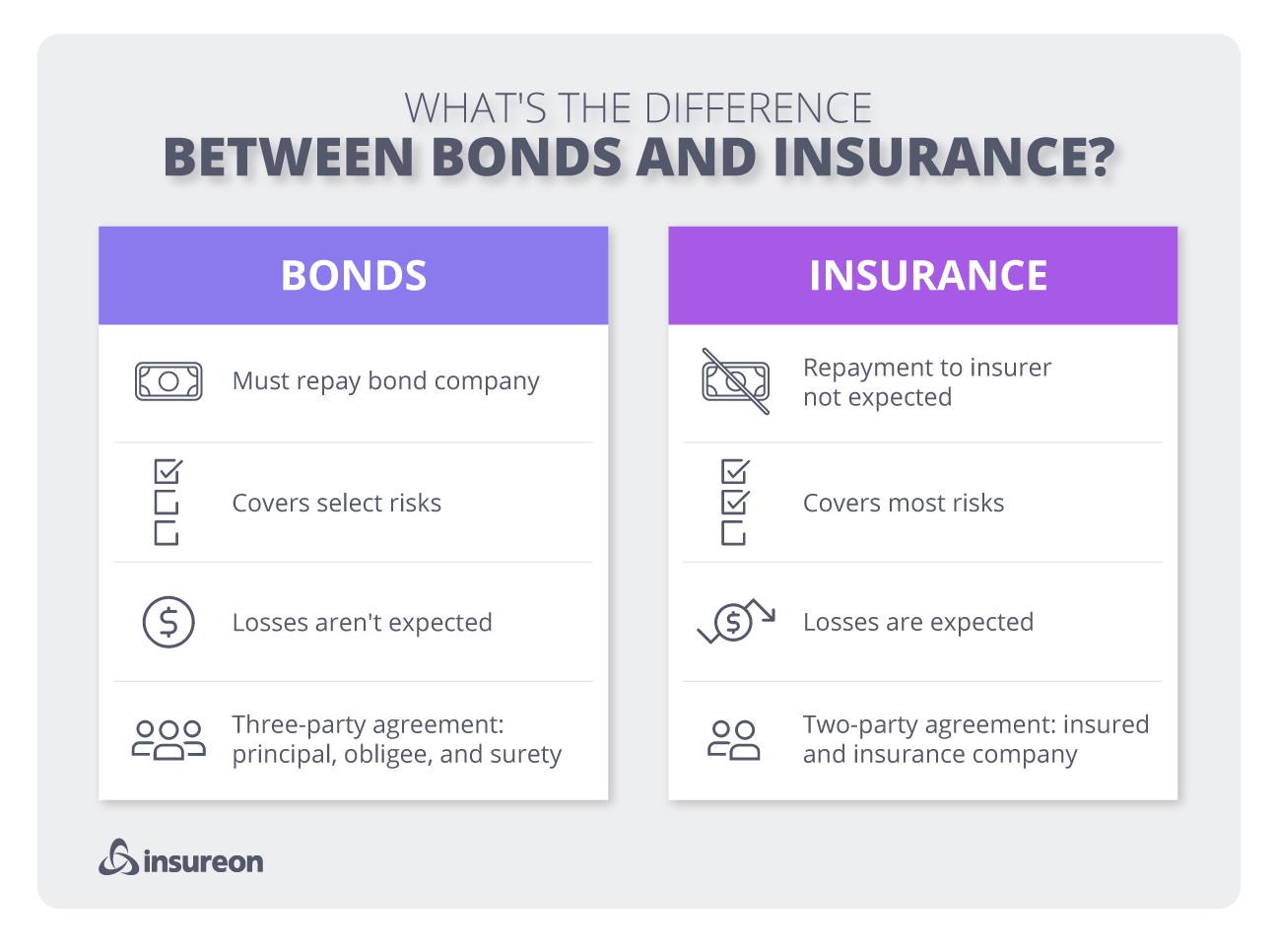

Both bonds and insurance signify that your business is dependable. A bond pays your clients back when a contract is broken, while insurance covers the cost of accidents and lawsuits. You may need a bond to work with certain clients, or to get a license for your profession.

Recommended bonds for small business

Small business owners most often purchase these different types of bonds.

Surety bonds

A surety bond guarantees that your small business will fulfill its contract. If you fail to do so, then the insurer reimburses your client. You may also see it called a business service bond.

- Failure to deliver services

- Incomplete work

- Staffing shortages

Fidelity bonds

A fidelity bond reimburses your client if one of your employees steals from them. It's sometimes called an employee dishonesty bond.

- Illegal money transfer by an employee

- Employee theft

- Employee fraud

License and permit bonds

License bonds and permit bonds guarantee that a business will perform its contracted work and adhere to regulations. You may need them for a business license or permit.

- Incomplete work

- Failure to follow regulations

- Failure to meet industry standards

Janitorial bonds

A janitorial bond is a type of surety bond for cleaning and janitorial businesses. It reimburses your clients in the event of employee theft.

- Theft of money

- Stolen property

- Contract requirements

Why do small businesses need bonds?

Small business owners most often need bonds in order to conduct business legally or sign a client contract. They also help attract clients to your business.

Some professionals need a bond in order to get a license and conduct business. Professions that require bonds for a license include plumbers, electricians, insurance agents, general contractors, and notaries public. The laws in your state will specify the type of bond and amount needed.

Your clients might require you to buy a bond. This is often the case for cleaning businesses and IT businesses. Clients may require your business to buy a bond before they'll allow your employees onto their property, or trust them to handle sensitive data.

Finally, bonds help you attract new clients. Bonds show your business is responsible and give clients peace of mind that they'll be covered in a loss. Larger clients in particular will be more likely to seek out bonded companies, so bonds can give your company an edge over the competition.

How do commercial bonds work?

A bond is an agreement between three entities:

- A business (the obligor)

- A client (the obligee)

- An insurance company (the surety)

A bond is more similar to a line of credit than an insurance policy. If the terms of the bond are broken (for example, an employee steals from a client), the surety company reimburses the client, and your business must then pay that amount back.

The only exception is a fidelity bond, which does not require the business owner to repay the bonding company. This specific type of surety bond resembles a standard commercial insurance policy.

How much do bonds cost?

Bonds are typically very affordable. The cost of a bond depends primarily on the bond amount and your credit rating.

The median costs for Insureon customers are:

Surety bonds: $10 per month

Fidelity bonds: $90 per month

Janitorial bonds: $10 per month

What our customers are saying

What if I need another kind of bond?

Bonds can be confusing. You may see the same bond referred to by different names, and some industries require several different types of bonds.

This is true for the construction industry in particular. Here are a few examples:

A license bond or permit bond may be required to get a construction license or permit. Local laws determine when you need licensure or a building permit.

A contract bond, performance bond, or construction bond is a type of surety bond that guarantees a construction business or contractor will fulfill the terms of their contract.

A bid bond is a bond that a construction company may need in order to bid on a project. If the company wins the bid but cannot begin the project, the bond issuer will compensate the client.

A payment bond guarantees that all subcontractors, suppliers, and other third parties involved with a project will be paid.

If you're unsure what type of bond you need, contact a licensed insurance agent. They can help you get the right bonds and insurance to meet requirements and attract new clients to your business.