Surety bonds

Surety bonds

Surety bonds act as a contract between a business, a client, and an insurance company. They guarantee the surety company will reimburse the client if the business fails to deliver contracted services.

Why are surety bonds important?

Larger clients and government agencies often require proof of a surety bond before they'll work with your business. State laws also mandate bonds for certain professions.

Even the most reliable business could suddenly lose a valuable employee, or run out of needed materials due to a supply chain disruption. Surety bonds provide a guarantee that your client won't lose money if your business unexpectedly can't fulfill its obligations. It's a crucial part of risk management when small businesses take on big projects.

Even when it’s not required, a commercial surety bond is a way to prove your small business is reliable. It may give you an edge over non-bonded competitors, which could mean the difference between winning or losing a project.

You may need a surety bond to:

- Sign a client contract

- Sign a federal or state government contract

- Get licensed in your state

- Conduct specialized work, such as pesticide application

- Bid on a project

What do surety bonds cover?

A surety bond guarantees that your client will receive financial reimbursement in the event your business fails to complete a project or fulfill the terms of a contract. Different types of surety bonds help you qualify for contracts, bid on projects, or obtain necessary licenses and permits.

Specifically, surety bonds often provide coverage for:

Failure to complete a project

If a commercial builder takes on a large construction project, but supply chain issues delay some of the materials they've ordered, they may not be able to finish the project by the agreed upon deadline.

Failure to comply with standards or regulations

If an inspection reveals that wiring installed in a home by an electrician isn't up to code, a surety bond can reimburse the property owner for the cost of hiring another contractor to do the rewiring.

License and permit requirements

Some professionals may need license or permit bonds to comply with state licensing laws or to get a permit for a certain type of work.

For example, state laws require general contractors in California to carry a $25,000 surety bond (also called a contractor license bond), while notaries public in Florida must have a $7,500 surety bond (notary bond).

Employee theft

A type of surety bond called a fidelity bond provides reimbursement in the event of employee theft. Unlike other bonds, you do not have to repay claims covered by a fidelity bond.

For example, if an employee at a financial planning firm conducts an illegal electronic funds transfer to their own account, a fidelity bond can reimburse the client for the amount that was stolen.

How much do surety bonds cost?

The cost of a surety bond is a small percentage of the total bond amount, known as the bond premium. It may be higher for riskier industries, such as construction.

For example, a $50,000 surety bond might cost between $500 and $7,500, or 1% to 15% of the bond amount.

Surety underwriters will consider the following factors:

- Bond amount

- Type of bond

- Industry risks

- Your credit score

- State laws

- Financial history

Verified business insurance reviews

Hear from customers like you who purchased small business insurance.

Who needs a surety bond?

Surety bonds protect many different types of businesses, and there are different types of bonds for a wide range of risks. You may need a bond to bid on a project, get a license, or obtain a work permit, depending on your industry and the type of work you do.

Here are a few examples of professions that often rely on commercial bonds or are required to carry them.

Construction businesses

Construction companies and contractors typically need construction bonds and insurance, and in some locations, general contractors must carry a bond to obtain a license. The amount of the bond is specified by state law or the client.

The construction industry has several types of commercial surety bonds, such as:

- Bid bonds guarantee the business will fulfill a contract as outlined in a bid for a project.

- Contract surety bonds guarantee that all obligations of a contract are met, from start to finish.

- Performance bonds guarantee that a project will be completed according to the client's specifications.

- Payment bonds guarantee pay for all involved parties, including subcontractors, if a contractor defaults on their payment.

- Maintenance bonds protect the project owner from the cost of any defects found after work is completed.

Professional services

Business owners who provide professional services often need a bond in order to sign a contract with a client or comply with state requirements for their profession. For example, state laws usually require notaries public to carry notary bonds that protect the public from potential errors.

Some states require anyone who prepares income tax returns for someone else to obtain a tax preparer bond. Tax bonds are another type of surety bond that some state and local governments require for commercial taxpayers that serve as a financial guarantee that they will act in the best interests of their clients.

Wholesalers

Wholesalers may also need surety bonds, usually to reassure clients that they'll deliver products as promised in a contract.

Insurance professionals

Insurance professionals often need to get bonded before they can obtain a license and legally go into business. The requirements vary by state. For example, insurance adjusters in New York must carry a $1,000 surety bond in order to get their license.

Auto dealers

Surety bonds are often required by state law for both new and used auto dealers. An auto dealer bond protects the public from fraud or misrepresentation by the dealer.

Cleaning businesses

Clients often require cleaning companies to carry bonds, which in this case are called janitorial bonds. If one of your employees steals jewelry or cash from a client, the insurance company will reimburse the client up to the bond amount.

Healthcare facilities

Healthcare facilities that manage public funds or patient assets are often required to have a surety bond. For example, a nursing home that handles their patients' Social Security payments or personal funds would likely need a surety bond to comply with state laws.

What do surety bonds not cover?

While a surety bond protects your clients from financial loss, it does not protect your own business against damages or losses. In fact, your business is responsible for paying the surety provider back for any amount it pays to a client.

That's why you also need small business insurance. For instance, a surety bond does not include coverage for:

Damaged client property

Though surety bonds are sometimes used to cover theft of client property, they won't provide coverage for property damage. Look to your general liability insurance policy for financial protection against accidental damage to a client's property.

Accidental injuries

General liability insurance also provides financial protection against accidental injuries, such as a client who slips and suffers an injury at your office. You may need this policy to fulfill the terms of a lease, loan, or contract.

Breach of contract

If a client sues your business for a breach of contract, mistake, or negligence, professional liability insurance would help cover your legal defense costs. This policy is also called errors and omissions insurance (E&O) or malpractice insurance, depending on the industry.

Data breaches

Cyber insurance covers expenses related to data breaches and cyberattacks, including the cost of notifying affected customers or fulfilling other requirements of state data breach laws.

General liability insurance

Business owner’s policy

Workers’ compensation insurance

Commercial auto insurance

Cyber insurance

FAQs about surety bonds

Review answers to frequently asked questions about surety bonds.

How do surety bonds work?

A surety bond offers a financial guarantee that an insurance company will reimburse your client if your business doesn’t complete a project, breaks the terms of a contract, or fails to adhere to regulations.

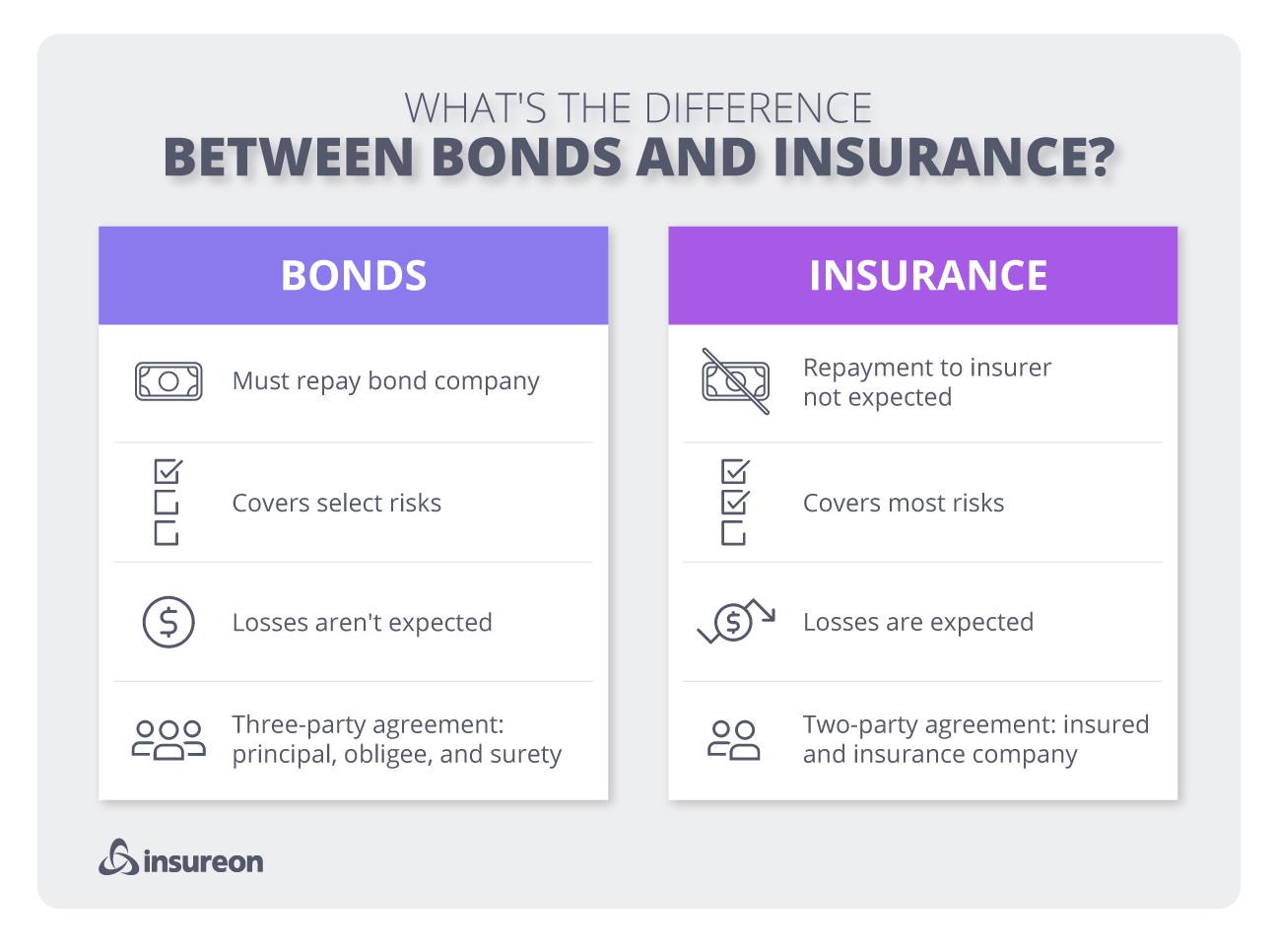

Surety bonds are a three-party agreement between:

- Your business (the principal)

- Your client (the obligee)

- The company that supplied the bond (the surety)

Surety bonds do not work like standard small business insurance policies, which pay out claims to the policyholder. Instead, the surety company reimburses your client directly.

Unlike an insurance policy, you must pay this amount back to the insurer or surety bond company. In a way, a surety bond is more like a line of credit than insurance, with your insurance company acting as a lender.

The only exception is a fidelity bond, which does not require the business owner to repay the bonding company. This specific type of surety bond resembles a standard commercial insurance policy.

When do you need a surety bond?

When you first start working with a client, they may ask you to purchase a surety bond in a specific amount before they'll allow workers on their premises. State laws often have surety bond requirements before you can get a license or work legally in a certain profession.

For example, you may need a surety bond to sign a construction contract, or work for your local government on a project.

In addition to standard surety bonds, there are miscellaneous bonds for specific risks. For example, a travel agency might need an airlines reporting corporation (ARC) bond to issue plane tickets, or a vendor might need a concessionaire bond to operate on someone else's property.

Surety bonds protect your clients from financial loss, which means they may be willing to work with your company even if your business is relatively new. They can rest assured you'll meet contractual obligations, or reimburse them fully if the bond requirements are not met.

You'll want to research the laws in your state to make sure you're carrying all the necessary bonds and insurance for your profession. You can also consult with an insurance agent who can help you find the right coverage.

How do you get a surety bond?

It's easy to get a surety bond with Insureon, the number one online marketplace for small business insurance.

First, fill out our free online application to get quotes for general liability insurance, workers' compensation insurance, and other policies. An insurance agent can help you add other coverages, such as a surety bond, and answer any questions.

We'll help make sure you get the right coverage from providers who are ranked highly by A.M. Best, without paying too much for insurance and bonds.

What’s the difference between surety bonds and fiduciary bonds?

A surety bond is a financial guarantee that a contract will be completed. A fiduciary bond is a type of surety bond used in courts, financial institutions, and other places where a trusted figure is in a position to cause financial harm if they act irresponsibly.

Municipal and federal government entities, such as probate courts, often require anyone performing a fiduciary role to have a fiduciary bond. A fiduciary role refers to someone managing the property and assets of someone else, such as a financial advisor, guardian, or someone overseeing the execution of a will.

There are numerous types of fiduciary bonds, including probate bonds, estate bonds, and public official bonds, which guarantee a public official will faithfully carry out their duties.

Court bonds (also called judicial bonds) aren't always fiduciary bonds. For example, appeal bonds and bail bonds don't involve anyone with a fiduciary role.

Is an indemnity bond a type of surety bond?

Yes, an indemnity bond is a type of surety bond that ensures that a party receiving funds from another will be paid according to a contractual agreement. Indemnity bonds are commonly used in commercial contracts, leases, and other licensing or loan agreements.

What's the difference between being licensed, bonded, and insured?

A company is bonded when it has a surety bond. It's insured when it has other insurance policies, such as general liability insurance or workers' compensation insurance. Finally, it's licensed when it has obtained the licenses necessary to operate legally.