Construction and contractor insurance costs

Construction companies and contractors can save money on business insurance by comparing quotes from different providers with Insureon. Your premium depends on the type of policy, coverage limits, deductibles, and factors such as your business's location and number of employees.

Top construction business insurance policies and their costs

Here are the top policies purchased by construction businesses and contractors and their average monthly costs:

- General liability insurance: $82 per month

- Business owner's policy (BOP): $98 per month

- Workers' compensation insurance: $254 per month

- Commercial auto insurance: $173 per month

- Professional liability insurance: $74 per month

- Commercial umbrella insurance: $81 per month

- Builder's risk insurance: $105 per month

- Surety bonds: $8 per month

Our figures are sourced from the median cost of policies purchased by Insureon customers. The median offers a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

General liability insurance

Construction businesses and contractors pay an average of $82 per month, or $981 annually, for general liability insurance.

General liability insurance provides financial protection against common lawsuits from customers. It can cover costs if someone sues your business for a bodily injury, property damage, or copyright infringement.

This is the average policy for construction professionals who buy from Insureon:

Insurance premium: $82 per month

Policy limits: $1 million per occurrence; $2 million aggregate

Deductible: $500

Small businesses can often save money by bundling general liability coverage with commercial property insurance in a business owner’s policy (BOP).

The cost of general liability insurance depends on factors such as the coverage limits you choose, the size of your business, the amount of foot traffic you have, and any subcontractors or additional insured endorsements.

Your business's risks determine general liability costs

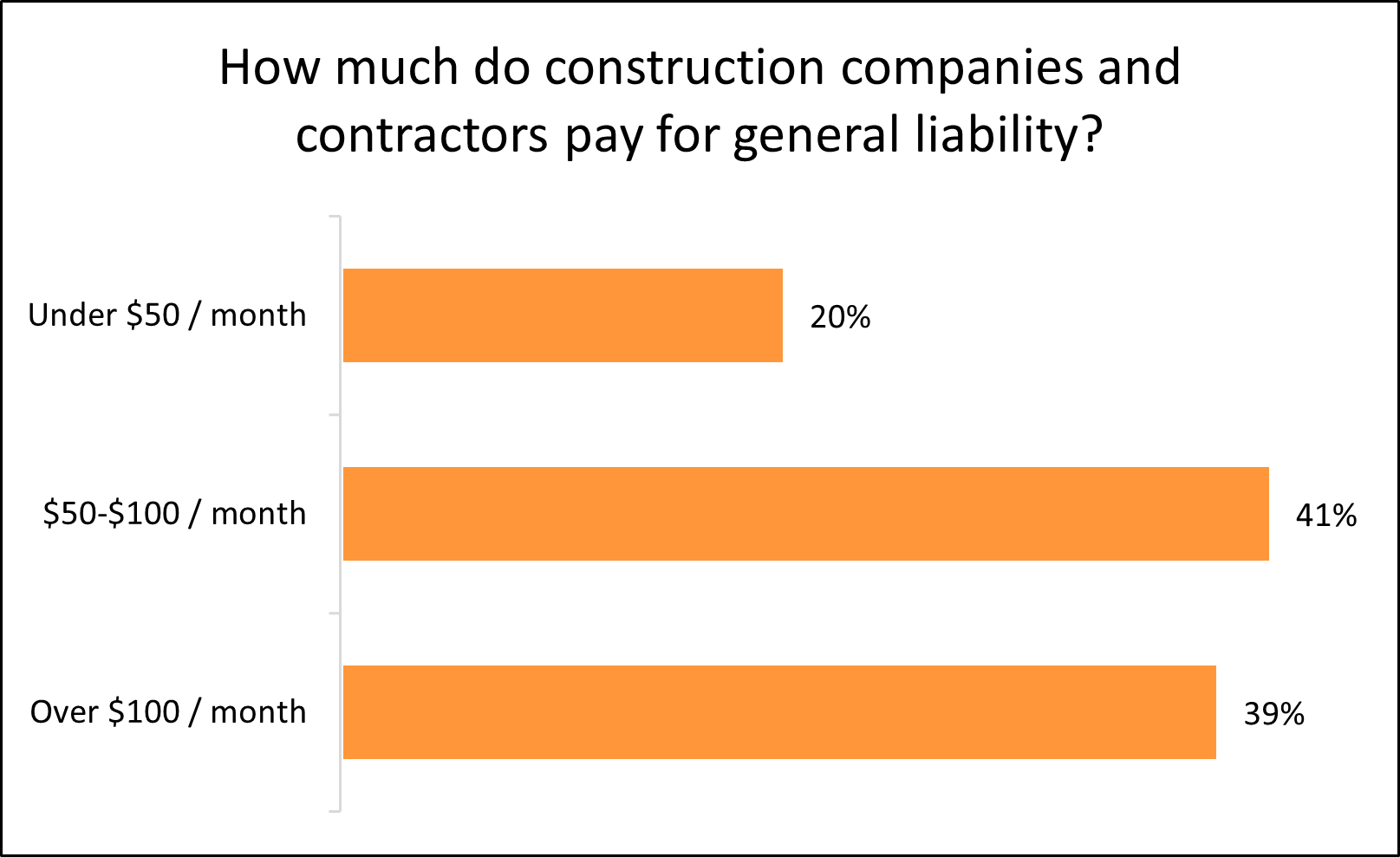

The cost of general liability insurance depends on your risk of a customer lawsuit. Among construction businesses and contractors that purchase general liability insurance with Insureon, 20% pay less than $50 per month, and 61% pay less than $100 per month.

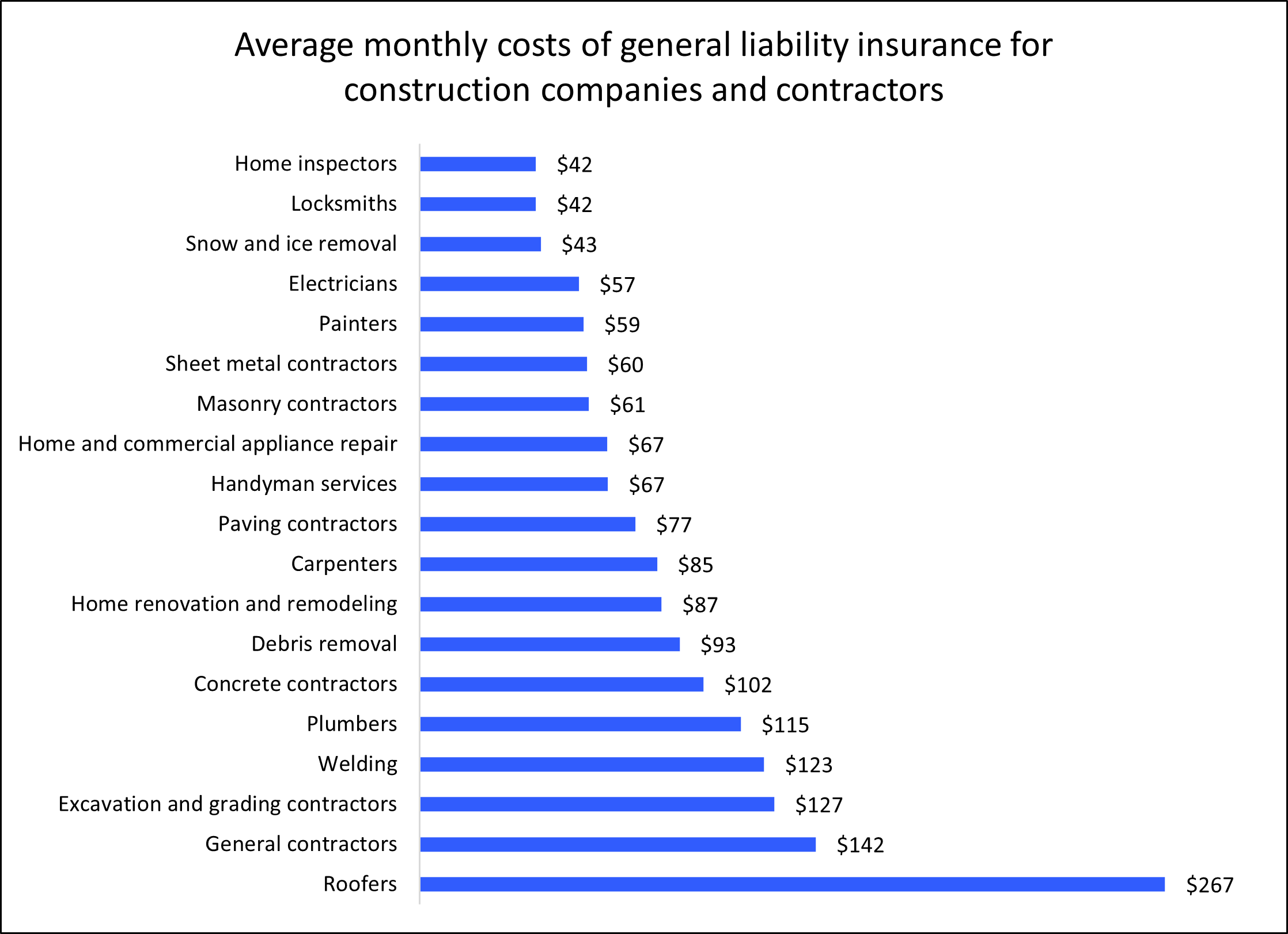

Your profession is the biggest factor in determining costs

Businesses that interact with many customers and have a higher risk of accidents typically pay more for general liability insurance.

For example, roofers can expect to pay more for general liability insurance than locksmiths and other lower-risk professionals. The average monthly cost for a roofer is $267, while the monthly average cost for a locksmith is $42.

Other factors that affect your premium include business revenue, building maintenance, years in operation, and location. As you can see, the cost varies significantly across professions.

Policy limits affect the cost of general liability insurance

Policy limits are the maximum amounts your insurance company will pay for covered claims.

The per-occurrence limit is the maximum your insurer will pay for a single incident, while the aggregate limit is the maximum your insurer will pay on any claims during your policy period, typically one year. Higher limits cost more – and provide better coverage.

Most contractors and construction businesses (97%) choose general liability insurance policies with a $1 million per-occurrence limit and a $2 million aggregate limit. As your small business grows, you may need to expand your policy limits.

Learn more on how to save money on your policy.

Business owner's policy (BOP)

Construction businesses and contractors pay an average of $98 per month for a business owner's policy, or $1,173 annually. Most choose a BOP with a $1 million per-occurrence limit and a $2 million aggregate limit.

A BOP bundles general liability coverage with commercial property insurance at a discount. It provides financial protection against common lawsuits from customers and also covers the cost of stolen, damaged, or destroyed business property.

The cost of a business owner's policy depends on factors such as the limits you choose, the size of your business, the amount of foot traffic you have, and the value of your business property and equipment.

Workers’ compensation insurance

Construction businesses and contractors pay an average of $254 per month, or $3,054 per year, for workers’ compensation insurance.

Workers' comp is a key policy in construction, as workers face a high risk of injury. It helps cover medical expenses from job injuries, which your personal health insurance might exclude. It also supplies partial lost wages during recovery in the form of disability benefits.

Most policies include employer's liability insurance, which covers the cost of lawsuits related to workplace injuries.

There's usually no limit to how much a workers' comp policy can pay for employee benefits, though it depends on state laws.

The cost of workers' compensation insurance depends on several factors, including the number of employees you have and the level of risk involved with their jobs.

Get more information on how to save money on your workers' comp policy.

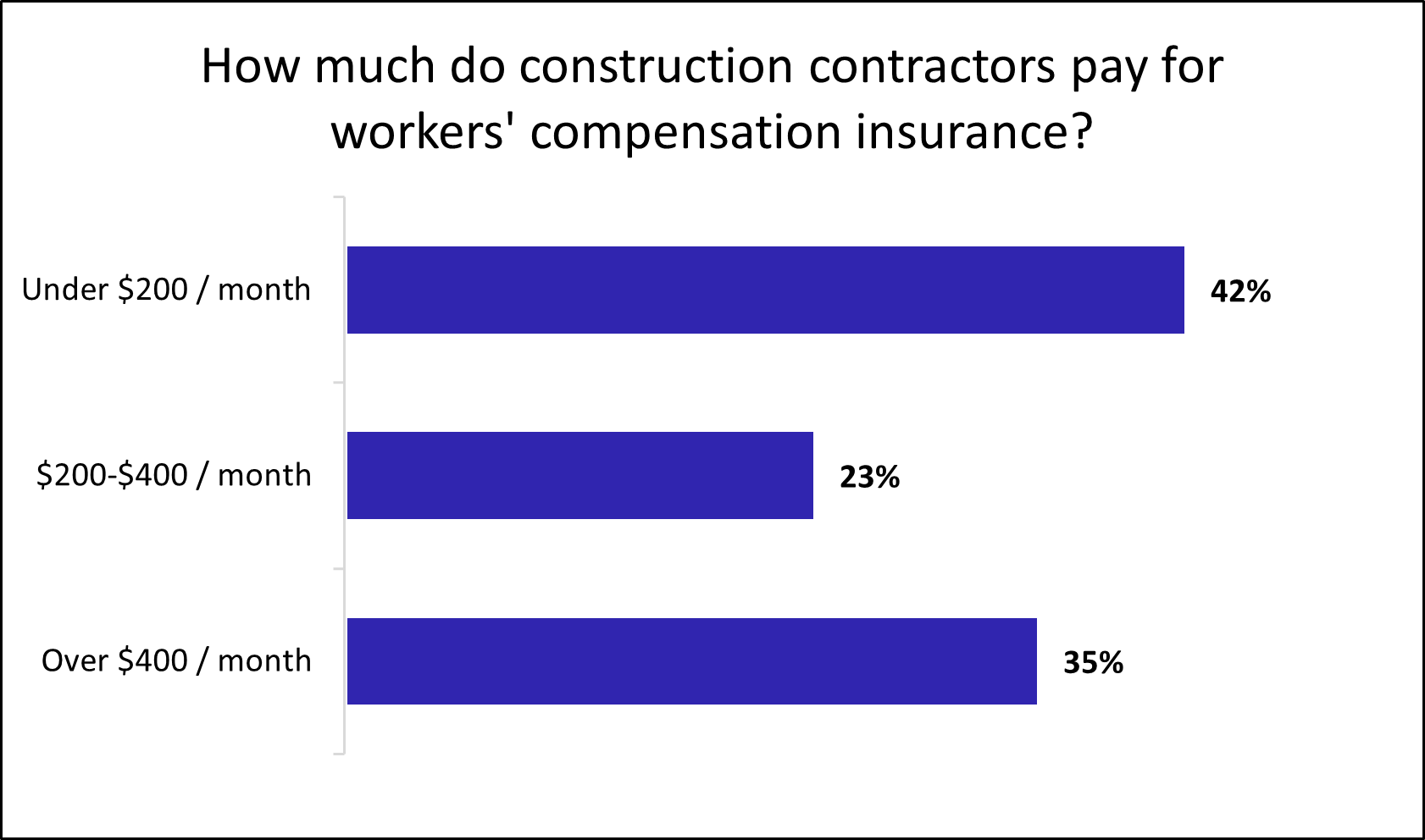

The number of employees determines workers' comp costs

Among construction businesses and contractors that purchase workers’ compensation insurance with Insureon, 42% pay less than $200 per month and 65% pay less than $400 per month.

A larger workforce brings a higher risk of worker injuries, which is why bigger businesses tend to pay more for this type of insurance.

Commercial auto insurance

Construction businesses and contractors pay an average of $173 per month for commercial auto insurance, or $2,075 annually.

Most states require this coverage for vehicles owned by a business. For personal, rented, and leased vehicles used by your business, look to hired and non-owned auto insurance (HNOA) instead.

A commercial auto policy provides financial protection in the event of an accident involving your business vehicle. It can help pay for property damage, medical costs, and legal expenses.

The cost of commercial auto insurance depends on several factors, including the policy limits you choose, coverage options, the value of the vehicle, and the driving records of anyone permitted to drive.

Professional liability insurance

Construction businesses pay an average of $74 per month for professional liability insurance, or $886 annually. This policy is occasionally required by state law, though it's more often needed for licenses and contracts.

Professional liability insurance covers the cost of lawsuits from clients who sue over a mistake, missed deadline, or breach of contract. It's sometimes referred to as errors and omissions insurance (E&O).

Construction contractors who buy this coverage from Insureon can often bundle it with general liability insurance for a discount. The average cost of this bundle is $112 per month for Insureon customers.

The cost of professional liability insurance depends on several factors, including the type of business you have, your claims history, and the policy limits you choose.

Get more information on how to save money on your professional liability insurance.

Commercial umbrella insurance

Construction businesses and contractors pay an average of $81 per month for commercial umbrella insurance, or about $977 annually.

This policy boosts the limits of your underlying general liability, commercial auto, or employer's liability insurance. When the underlying policy reaches its limit, commercial umbrella insurance activates to cover any costs over that limit.

The cost of commercial umbrella insurance depends primarily on the amount of coverage you purchase.

Builder's risk insurance

Construction businesses and contractors pay an average of $105 per month, or $1,259 per year, for builder's risk insurance. This policy is sometimes called course of construction insurance.

A builder's risk insurance policy provides coverage for structures and materials during a construction project. It will help pay for fires, vandalism, and other types of damage to a structure in progress.

The cost of builder's risk insurance depends on the value of the structure, including materials and labor.

Surety bonds

Construction businesses pay an average of $8 per month for surety bonds, or about $100 annually. A surety bond reimburses your client if you're unable to fulfill the terms of a contract or other agreement.

The cost of a surety bond is a percentage of the total bond amount. It may also be influenced by your type of work and your credit score.

Key factors influencing policy costs

Your insurance provider calculates your construction business insurance premiums based on several factors, including:

- Industry and trade: High-risk trades, such as electrical, roofing, or steel work, will have more costly premiums than low-risk trades like welding or carpentry. Whether contractors perform commercial or residential work can also impact the bottom line of an insurance policy.

- Business equipment and property: Higher-value items are more likely to result in more expensive premiums than lower-cost items. Items that are used more frequently also tend to cost more to cover than infrequently used items.

- Business size and revenue: Insurance companies assume businesses that are making more money, such as those in the construction industry, are also going to be facing increased industry exposure, which results in higher premiums.

- Location: Businesses that are located in areas prone to natural disasters, increased foot traffic, or high crime rates may have to pay more expensive premiums than those located in areas where these factors are less present.

- Number of employees: The more employees that are on staff, the more opportunities there are for accidents to happen or for potential damage to occur to someone else's property.

- Types of coverage purchased: Some policies are required to obtain certain contracting work or project types. These required policies often are needed to cover more expensive accidents and lawsuits, which tend to cost more than basic coverages.

- Coverage limits and deductibles: Higher coverage limits and lower deductibles will typically increase premium costs, while lower limits and a higher deductible can help keep insurance rates low.

- Claims history: A company with a lengthy list of previous insurance claims will likely pay more for insurance than a company with no claims history.

How do you buy construction insurance with Insureon?

Insureon works with top-rated U.S. providers to find affordable insurance coverage that fits your business. Apply today to get free quotes with one easy online application. A licensed insurance agent who specializes in your profession's unique risks will help you find the right coverage and answer any questions.

Typically, you can get a certificate of insurance (COI) within 24 hours of submitting your application.

What our customers are saying

Want free expert advice right in your inbox?

By entering your email address and subscribing, you agree to our Terms of Use and Privacy Policy