Workers’ comp insurance for contractors and construction businesses

Workers’ compensation insurance for construction businesses and contractors covers medical costs and lost wages for work-related injuries and illnesses. This policy is required in almost every state for businesses that have employees.

What does contractor workers’ compensation insurance cover?

In the construction industry, physical labor brings a high risk of injuries that could place a tremendous financial burden on your business. For instance, if a carpenter has an accident with a nail gun, it could lead to hefty medical bills and downtime.

Workers’ compensation insurance can pay for medical expenses when an employee is injured on the job or develops an occupational illness. Workers’ compensation benefits also cover part of the wages that are lost when an employee suffers a temporary or permanent disability.

Sole proprietors may also decide to buy this policy for financial protection against work injuries, which health insurance might not cover.

Here’s what a workers’ compensation insurance policy provides:

For injured workers, sole proprietors, or independent contractors

- Immediate medical care, including emergency room expenses

- Ongoing medical care, such as physical rehabilitation

- Disability benefits while the employee or contractor is unable to work

- Death benefits to the dependents if an employee dies from a work-related injury

For business owners

Employer’s liability insurance – typically included in a workers’ comp policy – protects construction businesses when an employee decides to sue a business owner over an injury.

Employer’s liability insurance typically helps cover:

- Attorney’s fees

- Court costs

- Settlements

Even when a lawsuit is without merit, you might still have to pay for an expensive court battle if not properly insured.

How are workers' compensation insurance costs calculated?

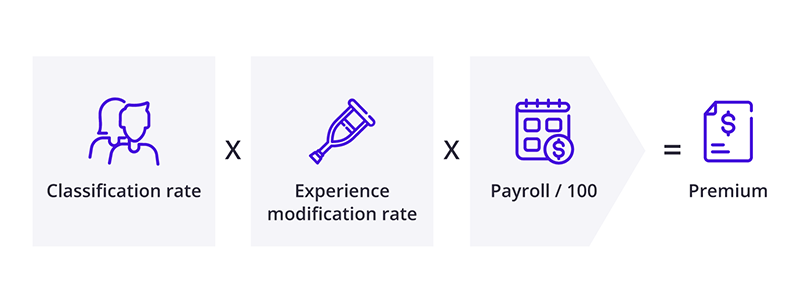

The amount you pay for workers’ compensation insurance is a specific rate based on every $100 of your business’s payroll. Your premium is determined by the type of work done by your employees (classification rate), your experience modification rate (claims history), and your payroll (per $100).

The formula providers use in underwriting to calculate workers' comp rates is: Classification rate x Experience modification rate x (Annual payroll / $100).

State laws set workers’ comp requirements for construction and contracting businesses

Every state creates its own workers' compensation laws. For instance, every construction business in Pennsylvania is required to carry workers' compensation insurance for its employees, including full-time, part-time, and seasonal workers. Georgia businesses, on the other hand, only need to carry workers' comp when they have three or more employees.

States often have stricter requirements for construction companies than other types of businesses due to the industry's increased risk of injury. Roofing contractors in particular are usually required to buy workers' comp coverage, regardless of whether or not they have employees.

Even when independent contractors, sole proprietors, and members of limited liability companies and partnerships qualify for an exemption, they can choose to purchase workers' compensation coverage for the financial protection it offers.

Workers' compensation laws in your state

What are monopolistic states for workers' compensation?

In certain states, construction and contracting businesses must purchase coverage through a monopolistic workers' comp state fund. Those states are:

If you purchase workers’ comp through a monopolistic state fund, it might not include employer’s liability insurance. However, you can purchase it as stop gap coverage from a private insurance company.

How much does contractor workers' comp insurance cost?

Construction companies and contractors pay an average of $254 per month, or $3,054 annually, for workers' compensation coverage.

Insurance costs for construction professionals are based on a few factors, including:

- Number of employees

- Types of construction and contracting services performed

- Payroll and business revenue

- Your claims history

- Where your business operates

Lower your workers' comp insurance costs with risk management

Construction professionals face high risks due to the physical nature of the work – not to mention the hazards of saws, ladders, and other essential equipment. If an employee suffers an injury, it can lead to a costly workers' compensation claim – and a rise in your premium.

Luckily, owners of construction companies can mitigate risks by providing safety training and reducing hazards in the workplace. For example, you can also make sure your workers are equipped with protective gear, such as gloves and goggles. This can lower your rate of workplace injuries, along with your workers' compensation insurance rates.

Other business insurance policies for contractors and construction companies to consider

Workers' compensation provides crucial protection against workplace injuries, but it doesn't cover every risk. Construction small business owners and general contractors should also consider:

General liability insurance: Covers expenses related to client injuries and property damage, along with copyright infringement claims.

Business owner's policy (BOP): Bundles general liability coverage and commercial property insurance at a discount. It protects against the most common lawsuits and property damage.

Commercial auto insurance: Protects vehicles owned by your construction or contracting business. It typically pays for accidents, vehicle theft, and vehicle damage. If you use your personal vehicle for business, you may need hired and non-owned auto insurance (HNOA).

Contractor’s tools and equipment insurance: A form of inland marine insurance, this policy helps pay for the repair or replacement of a contractor's tools and equipment if they are lost, stolen, or damaged on route to or at the job site.

Professional liability insurance: Also known as errors and omissions insurance (E&O), covers professional mistakes and oversights, such as a contractor missing a deadline for a project.

Surety bonds: Provides a guarantee that your company will fulfill its contract. Otherwise, it reimburses the client for their loss.

Builder’s risk insurance: Pays for damage done to a structure still under construction, such as a fire or vandalism at a construction site.

Contractors pollution liability (CPL) insurance: Also called environmental insurance, this policy covers pollution liability risks for contractors and subcontractors.

Additional insured endorsement: This extends coverage to anyone other than the policyholder, and can be required by clients, contractors, and subcontractors depending on the project or contract.

Get free quotes and buy online with Insureon

Are you ready to safeguard your construction or contracting business with workers’ compensation or another type of insurance? Insureon helps contractors find affordable insurance coverage from top-rated insurance carriers with one easy online application today. Once you find the right policy, you can begin coverage and get a certificate of insurance in less than 24 hours.

Verified workers' compensation insurance reviews

Want free expert advice right in your inbox?

By entering your email address and subscribing, you agree to our Terms of Use and Privacy Policy