Compare workers’ comp rates by state

Workers’ compensation insurance provides important protections for your employees and your business. However, the cost of workers’ compensation will vary depending on several factors – including the state where you do business.

Continue reading to learn more about states with high and low rates for workers’ comp, how those rates are calculated, and steps employers can take to keep their experience modification rating (EMR)—and costs—down.

You can also start a free online application to get specific quotes for your business and location with Insureon.

How are workers’ comp rates determined?

Every state has its own requirements for workers’ compensation, and each state has a rating bureau that sets the baseline cost (or rate) used in calculating how much you’ll pay in insurance premiums during underwriting.

In general, a state’s insurance costs are based on a combination of the following:

- Business risks

- Benefit levels

- State-specific regulations

- Healthcare costs

While some states have established their own rating bureaus, most rely on the National Council on Compensation Insurance (NCCI). NCCI is a private company that gathers workers’ comp data, analyzes trends, and makes rate recommendations to states.

In most states, you have the option to compare quotes with private insurance carriers or a state workers' comp fund. However, North Dakota, Wyoming, Ohio, and Washington only allow businesses to purchase a policy through a monopolistic workers’ compensation state fund.

Workers' compensation laws in your state

What states have the lowest (and highest) workers’ compensation costs?

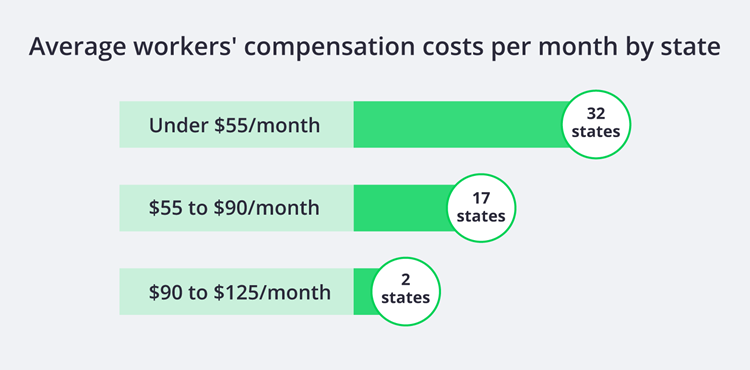

Small businesses pay an average of $45 per month, or $542 annually, for workers' compensation insurance.

Our figures are sourced from the median cost of policies purchased by Insureon customers from leading insurance companies. The median offers a better estimate of what your business is likely to pay because it excludes high and low premium outliers, like high-risk installation businesses that pay much more for workers’ compensation.

While Insureon's small business customers pay an average of $45 monthly for workers’ compensation coverage, 23% pay less than $30 per month. In addition, a little less than half (40%) pay between $30 and $60 per month.

The cost depends on your type of business, its location, your claims history, and the number of employees.

The lowest workers' comp costs per month by state jurisdiction are:

The highest workers' comp rates per month by state jurisdiction are:

These are just a few state examples of the costs for workers' comp. Your state may have different factors and requirements.

What factors impact a state’s workers’ comp costs?

Industry risks, as well as changes in state workers’ compensation laws that affect covered benefits or medical costs, can cause a state’s employer costs to rise or fall. Negotiations between legislators, business lobbies, insurance companies, and unions on workers’ compensation benefits can also impact costs.

While employer costs vary widely among states, this doesn’t mean a state with lower employer costs will offer a more favorable climate for your business. A state’s costs depend on a number of considerations, including the mix of high-risk and low-risk industries.

Some states with a majority of high-risk professions like oil and gas, construction, and fishing, are likely to have higher overall employer costs – but it doesn’t mean that a low-risk business like an accounting firm would pay more for workers’ comp coverage in another state that has an overall lower rate.

Which region has the lowest workers' comp costs?

Each region of the United States has states with low and high costs. For example, although California has a higher rate for workers’ compensation insurance at an average of $62 per month, the states that border it (Arizona, Nevada, and Oregon) all have average costs at $50 or less per month.

Similarly, while Alabama has the highest average monthly cost at $119, Florida and Georgia have average costs at $55 or less.

Although each state’s specific formula for determining workers’ comp rates may be a little different, they follow the same general guidelines.

How can you estimate your workers’ comp costs?

Workers’ compensation insurance is required for most businesses in most states, so it’s an expense that must be calculated into your budget if you have employees. Timing is also important when buying workers' comp coverage.

Most states re-evaluate workers’ compensation rates on an annual basis. Although each state’s specific formula for determining workers’ comp rates may be a little different, they follow the same general guidelines.

For business owners, the amount you will pay in workers' compensation premiums depends on:

- Your payroll. If your business operates in multiple states, it would depend on the number of people you employ who work in each state.

- Claims history. Insurance rates for almost any insurance policy depend, in part, on past workers’ compensation claims – the type, amount, and frequency of losses.

- Worker classification codes. The level of risk associated with your business will also play a role in determining your workers’ comp rates. Workers’ compensation class codes categorize every business and job type by level of risk, and your small business may have a range of worker classifications.

Review requirements and rates for workers’ compensation insurance in your state, or speak with one of our expert insurance agents who are licensed nationwide and happy to answer your questions.

How can you keep your workers’ comp costs down?

While you can’t control the level of risk in your industry, there are strategies you can use to help lower your workers’ compensation costs.

Reduce workers’ comp injury risks at your business

These workplace safety tips can help reduce the frequency and severity of workers’ compensation injuries at your small business:

- Train workers on proper safety protocols

- Have emergency procedures in place

- Supply employees with the proper gear to keep them safe

- Require proper footwear

- Post signs and labels where there are hazards

- Maintain tools and equipment and a clean workplace

- Consider ergonomic furniture and equipment

Choose a pay-as-you-go workers' compensation plan

Pay-as-you-go workers’ compensation insurance offers flexible premiums that change throughout the year. These premiums rely on any changes to your number of employees, as well as your payroll data over the course of one year.

This is a great option for small business owners looking to pay less for workers’ comp, since the initial down payment is likely to be more affordable than a traditional plan.

See if you qualify for a lower premium policy

There are two types of lower premium policies: a minimum premium workers’ comp policy and a ghost policy. Both fulfill the obligation to carry a workers’ compensation policy and provide a certificate of insurance (COI).

However, a ghost policy provides zero workers’ comp coverage, and the availability of these policies is dependent on the state your business operates in.

Establish a return-to-work program for injured workers

If one of your employees suffers a workers’ comp injury, a return-to-work program can help speed their recovery and get them back on the job faster.

Instead of waiting until an employee is recovered enough to resume all of their full-time job duties, a return-to-work program that allows them to perform light or modified work can ease them back in slowly.

These programs may also include retraining employees on a different skillset so they can earn their full pre-injury pay, instead of the partial wages paid under workers’ comp.

When employees come back to work sooner, you save money on wages paid to any temporary employees you had to hire while your injured worker was recovering.

As the most common type of workers’ comp for small businesses, guaranteed cost insurance is a predictable, budget-conscious coverage option where the policyholder pays a fixed upfront premium, and the insurer assumes all of the financial risk.

Find workers' comp quotes from trusted carriers with Insureon

Business insurance can be a tricky thing to navigate on your own, which is why our industry-trained insurance agents do the hard work for you. We're already familiar with your state's workers' comp laws and can provide a free consultation to help you find the insurance policy that complies with those regulations.

Complete Insureon’s easy online application today to compare insurance quotes from top U.S. carriers. Once you find the right policy for your small business, you can begin coverage in less than 24 hours.

Desiree DeNunzio, Contributing Writer

Desiree is a writer and editor with a passion for bringing relevant content to readers. She's edited and written content for online and print publications such as Wired magazine, PCWorld, CNET News, and more.