How does workers' comp work for remote employees?

Remote work has been on the rise for years. COVID-19 shifted that trend into overdrive. Since the start of the pandemic, more than 60% of U.S. employees have worked from home at some point.

As more people telecommute, small business owners are wondering whether workers’ comp is required for their remote employees – and how it works if someone gets hurt.

Here are answers to some of the most common questions you may have about workers’ compensation for your remote employees. We’ll explain workers’ comp requirements, how it works, what it covers, and how to reduce the risk of remote worker injuries.

Is workers’ comp required for remote workers?

Workers’ comp coverage is required by almost every state when your business has one or more employees. That includes remote workers.

Workers’ compensation covers costs related to a worker’s job-related illness or injury, including:

- Medical bills

- Lost wages

- Disability benefits

Most policies also include employer’s liability insurance. If an employee sues you over their injury, this can pay for:

- Lawyer fees

- Court costs

- Settlements or judgments

Workers’ comp insurance usually covers any injury that “arises out of and in the course of employment.” That means an injury that happens while an employee is doing work-related activities, during work hours, may be a valid claim – even at home.

Your job is to make sure your remote employees know to quickly report any work-related injuries to you. Do your best to document the incident, and then submit the claim to your insurance company.

How does worker’s comp work for remote employees?

Employees usually see remote work as a perk. For employers, it has some drawbacks.

When employees work from home, you have little control over the safety of their workspace. If a remote employee is injured while working, witnesses may be hard to come by when verifying the incident.

Injuries are only covered by workers’ comp if they happen “in the scope and course of employment” or “in furtherance of employment.” So how can you tell if a remote worker’s injury qualifies?

State interpretations vary, but most use the personal comfort doctrine. This says that workers should be compensated for injuries that occur while doing things like getting a drink of water or taking a bathroom break while working.

The rules are hardly black and white, however. Just because your employee’s on the clock, it doesn’t necessarily mean the injury is work-related. It depends on their actions and the circumstances.

For example, say a remote worker trips over her dog and breaks her shoulder while making coffee in her kitchen during the work day. Even though she was working, the court found that the injury wasn’t work-related. They reasoned that the risk of tripping over her dog had nothing to do with her job.

The good news is, your insurance provider (and perhaps the courts) will sort all that out. Your job is to make sure your remote employees know to quickly report any work-related injuries to you. Do your best to document the incident, and then submit the claim to your insurance company. State laws vary, but you may also need to report it to your state’s workers’ comp board.

After the claims process gets underway, there’s very little that you’ll need to do as an employer. The smart thing to do is to reduce the risk before injuries happen, which can help keep your workers’ comp costs low.

Take steps to reduce telecommuting risk of work-related injuries

Wherever your workers are, you want to keep them safe. Injuries hurt their health and your bottom line. That’s because workers’ comp premiums stay lower if you avoid claims.

Remote work often blurs the line between professional and personal time. That can make it hard to figure out if a worker’s injury is actually related to their job.

These steps can help keep workers safe from injury, and also create an at-home work environment that reduces business risk.

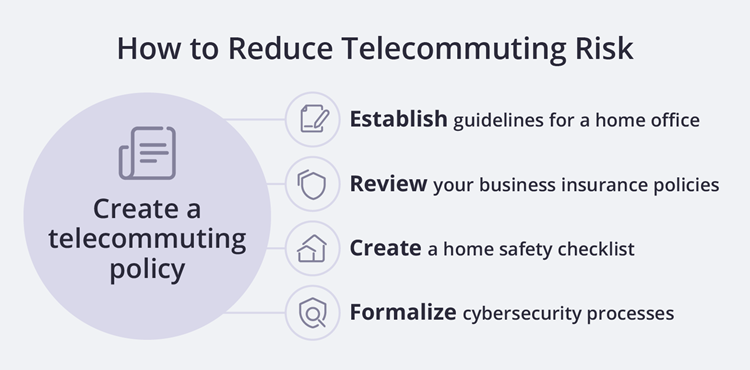

Create a telecommuting policy

Just like your company’s policies for things like work attire and time off, you should have a policy for telecommuting. This policy can:

- Define the employee’s job duties

- Set expectations around virtual communication, meetings, and status updates

- If your employees are required to clock in and out, document the process for tracking hours virtually

Establish guidelines for a home office

Part of the beauty of remote work is being able to work from anywhere, but some employees might take advantage of that fact. To maintain productivity, ask your employees to sign a remote work agreement that outlines guidelines for their home working environment. Typically employees would agree to:

- Comply with all company policies while working remotely

- Find a distraction-free workspace at home

- Follow an agreed-upon schedule for work hours, meals, and breaks

It’s also a good idea to provide guidelines for their remote workspace. These could include instructions to designate a work area equipped with:

- A desk, chair, and closeable door

- Proper lighting

- Proper equipment (computer, mouse, phone, headset)

Workers can have some flexibility, but the majority of their workday should be spent in this home office.

Create a home safety checklist

To avoid on-the-job injuries at home, make a home safety checklist for your employees to follow. The guide should identify physical hazards like:

- Loose cords

- Overloaded electrical outlets

- Poor lighting

It should also provide tips for reducing potential risks, such as eliminating clutter in the employee’s home office.

Your checklist should include information about ergonomics too. This can help employees work more comfortably and reduce the chance of injuries such as carpal tunnel syndrome.

Formalize cybersecurity processes

The risk of a data breach or cyberattack on your business increases with remote workers. When those employees use their personal Wi-Fi network or computer for work, the risk skyrockets.

You can reduce the risk of a cyberattack by requiring all home employees to use only company-issued devices. These devices should have antivirus software installed to help prevent attacks. Every employee should also receive basic training on common cybersecurity threats, such as phishing.

Perhaps the best protection against telecommuter cyber threats is use of a virtual private network (VPN). A VPN provides your employees with secure access to your company’s systems and servers.

You may also want to consider purchasing cyber insurance. This can protect your business from the costs of a data breach or cyberattack.

Cyber liability insurance covers expenses such as:

- Cyber extortion payments

- Hiring an expert to investigate a cyber incident

- Notifying affected customers

- Credit and fraud monitoring services

- Crisis management and public relations

- Business interruption expenses

Review your business insurance policies

Workers’ compensation is one of many business insurance policies that can protect your business against unexpected costs and provide peace of mind. For instance, employment practices liability insurance (EPLI) protects your business if an employee sues for violation of rights, such as wrongful termination or discrimination.

You may want to speak with an insurance agent to make sure you have the insurance coverage you need. There are policies available for almost every kind of business risk.

The coronavirus pandemic has made remote work the new normal, and created both opportunities and challenges for small businesses. If you have employees, your workers’ comp coverage should cover them at your business and on the clock at home. By setting clear expectations and creating telecommuting policies, you can help keep your employees safe no matter where they are.

Compare quotes from trusted carriers with Insureon

Complete Insureon’s easy online application today to compare quotes for small business insurance from top-rated U.S. carriers. Once you find the right policy for your small business, you can begin coverage in less than 24 hours.