Errors and omissions insurance cost

The cost of errors and omissions insurance (E&O), also called professional liability coverage, varies based on a number of factors about your business. Your premium is directly impacted by your industry, the type of work you do, your location, and more.

What is the average cost of errors and omissions insurance?

Small businesses pay an average premium of $61 per month, or about $735 annually, for errors and omissions insurance.

Our figures are calculated using the median cost of policies sold by leading insurance companies to Insureon's small business customers. The median offers a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

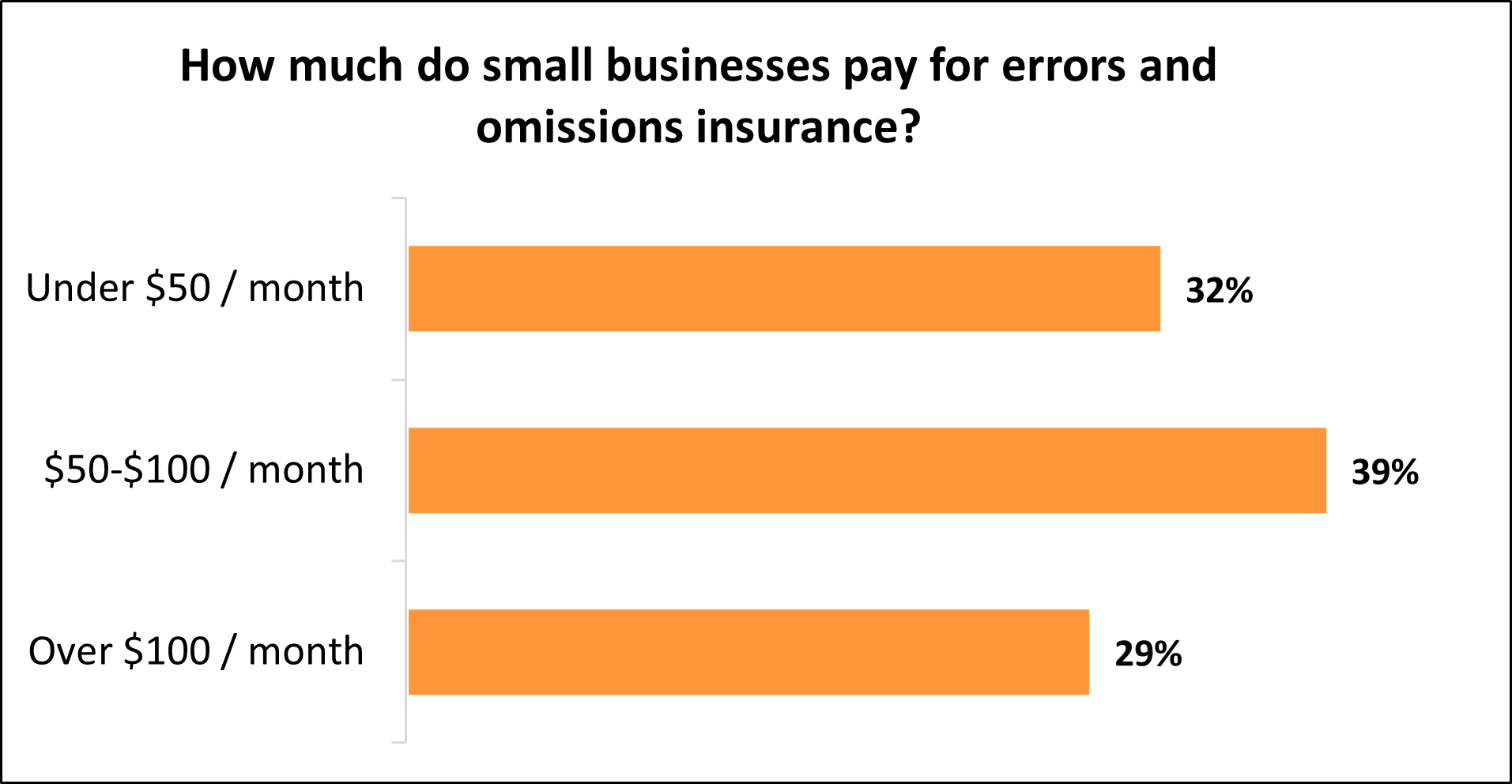

Typical errors & omissions insurance costs for Insureon customers

While Insureon's small business customers pay an average of $61 monthly for errors and omissions insurance, 32% pay less than $50 per month for their policies, and another 39% pay between $50 and $100.

The cost varies for small businesses depending on the types of risks they have and the coverage they choose.

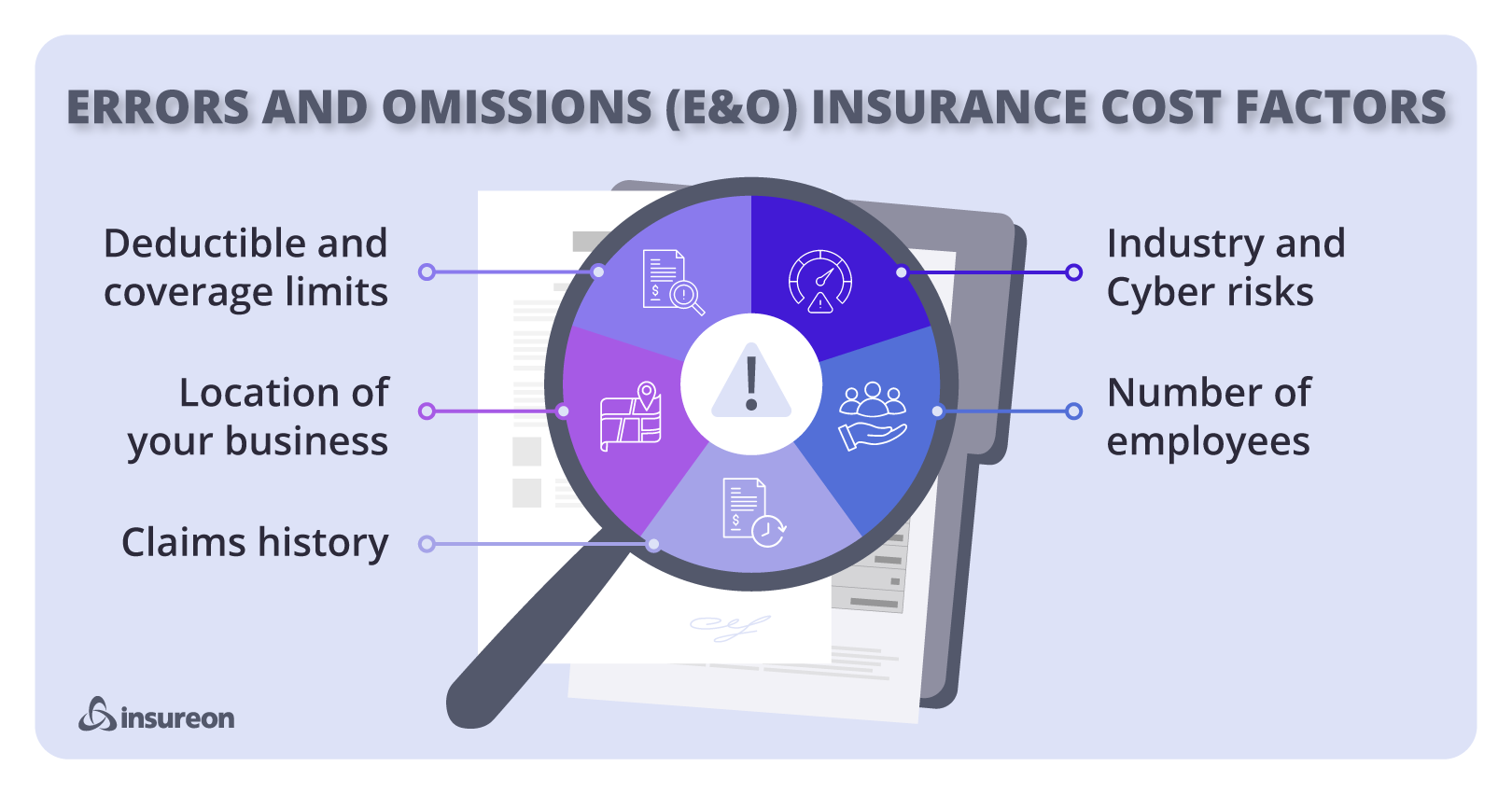

Factors that impact errors and omissions (E&O) insurance rates

Multiple factors impact how much your E&O insurance policy costs during underwriting, including:

- Policy limits and deductible

- Types of coverage

- Location

- Claims history

- Number of employees

- Business income

- Industry risks

Policy limits and deductible

If you want an errors and omissions insurance policy that covers more expensive lawsuits, you’ll need higher limits – which means you’ll pay a higher price.

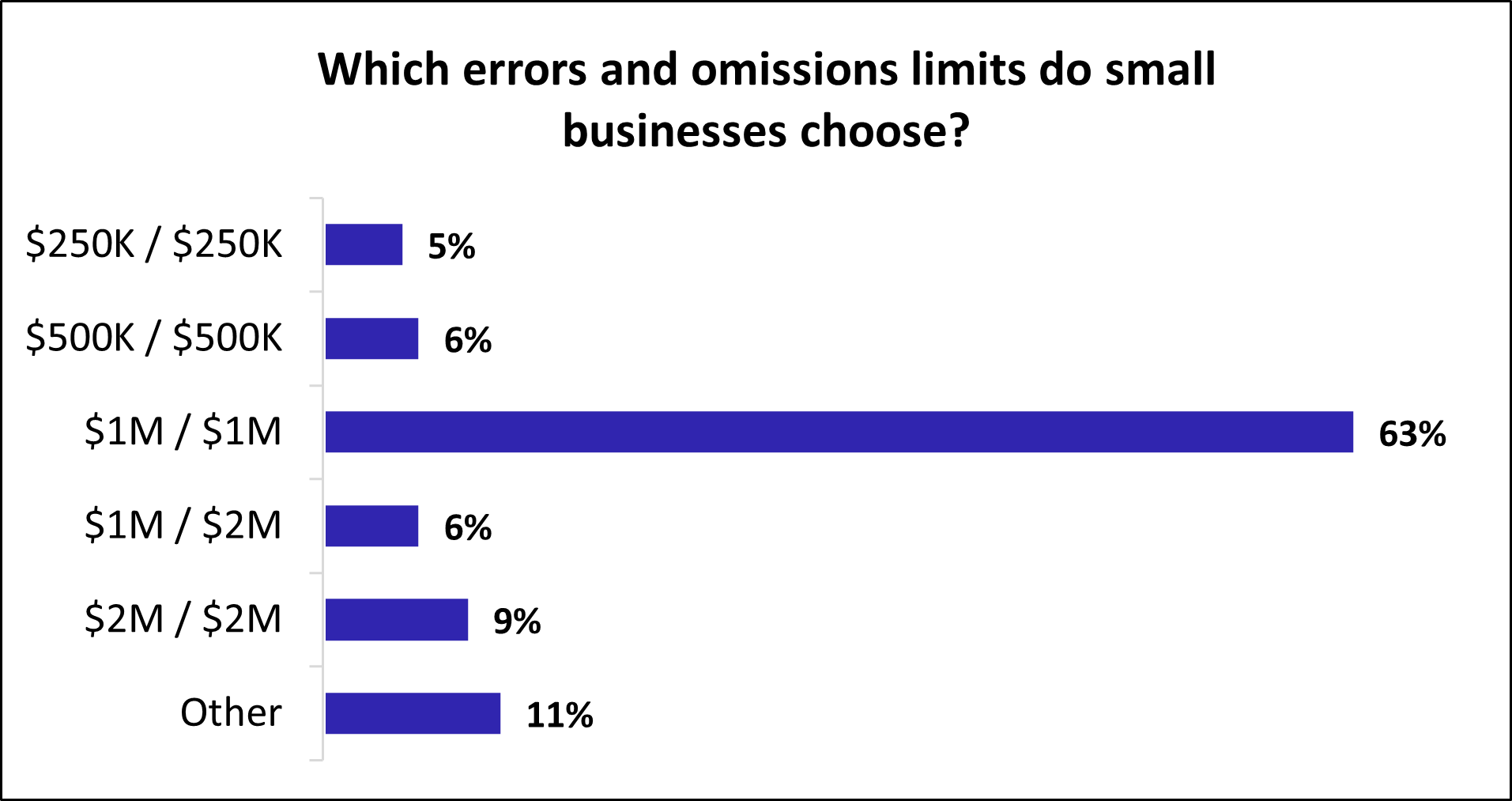

The limits on E&O coverage vary significantly, from $250,000 to $2 million. Errors and omissions coverage with $1 million / $1 million limits is the most popular option for small businesses. This includes:

- $1 million per-occurrence limit. While the policy is active, the insurance company will pay up to $1 million to cover any single claim.

- $1 million aggregate limit. During the lifetime of the policy, the insurer will pay up to $1 million to cover E&O claims.

The majority of Insureon customers (63%) choose an E&O insurance policy with $1 million / $1 million limits. Nine percent of our customers choose an E&O policy with $2 million / $2 million coverage limits, the next most popular choice.

When buying a policy, it's a good idea to make sure the deductible is something you can easily afford. If you can’t afford to pay for a higher deductible in a crisis, your insurance won’t activate to cover claims. The average deductible that Insureon customers select for errors and omissions insurance is $2,500.

If your business needs coverage beyond the standard policy limits, you can also purchase excess liability insurance to increase your E&O limits. This type of coverage kicks in once you’ve exhausted the limits of your primary E&O policy.

Adding excess liability provides an extra layer of protection—especially valuable for businesses that handle high-dollar contracts or work in highly litigious industries—but it will also increase your overall insurance premium. The higher your total coverage limit, the more your insurer is potentially on the hook for, and that additional risk is reflected in your rate.

The right amount of errors and omissions insurance coverage depends on your business needs. You want coverage that'll cover a potential lawsuit, without buying more than you need. Chat with a licensed insurance agent if you're unsure which limits are right for your business.

Types of coverage

The cost of E&O insurance depends not only on your industry and risk level, but also on the type of coverage you need. In many cases, errors and omissions coverage can be bundled or customized with additional protections to better fit your business operations.

For example, if you're in the tech industry, errors and omissions insurance is often available as part of a technology errors and omissions (Tech E&O) policy, which includes both E&O and cyber insurance. Sometimes called technology professional liability insurance, a tech E&O bundle is especially helpful for IT professionals and businesses that handle sensitive client data, since cyber risks like data breaches are a major concern.

In other cases, E&O insurance may be offered as an endorsement to a general liability policy. Additional endorsements can be added to cover specific exposures, such as intellectual property (IP) liability, which protects against claims of copyright or trademark infringement.

You may also be required to carry certain E&O coverage limits or endorsements to qualify for a client contract or project. These project-specific requirements can impact your policy costs and coverage structure.

Location

Where your business operates can have a significant impact on the cost of E&O insurance. Insurers consider location when assessing risk and setting premiums, as certain areas may have state-specific insurance requirements or regulations.

For example, businesses in states like California or New York may see higher premiums compared to those in less litigious regions, simply due to the legal environment and historical claim trends.

If your business works across state lines or serves clients in multiple jurisdictions, that can also influence the structure and price of your policy. Some projects may even require E&O coverage that complies with specific local or contractual standards, especially in regulated industries like finance, healthcare, or construction.

| State | Errors and omissions insurance cost |

|---|---|

$82 per month | |

$71 per month | |

$71 per month | |

$83 per month | |

$78 per month | |

$67 per month | |

$72 per month | |

$70 per month | |

$62 per month | |

$63 per month |

Claims history

Your business’s claims history is one of the key factors insurers use to evaluate risk. If you've had multiple past claims or even one large claim, insurers may see your business as higher risk, which can lead to increased E&O insurance premiums.

A clean claims history, on the other hand, can help keep your costs lower.

Investing in strong documentation practices, ongoing employee training, and proactive risk management can go a long way toward preventing future claims. Demonstrating your business has procedures in place to avoid mistakes and manage client expectations shows insurers you're committed to minimizing risk – something they reward with more favorable rates.

Number of employees

The size of your business—and the number of employees you have—can influence the cost of your errors and omissions insurance. More employees often mean more exposure to potential errors, which increases your overall risk in the eyes of insurers.

As your team grows, it's important to ensure your E&O policy is updated to reflect changes in staffing and responsibilities. Having clear internal processes and employee training in place can help manage risk and keep your insurance costs more predictable.

Business income

Your business’s annual revenue is another key factor insurers consider when determining E&O insurance costs. In general, higher income means higher premiums.

That’s because a business with greater revenue often has more clients, larger contracts, or higher-value projects – leading to increased risk exposure and potentially more expensive claims. Insurers price your policy accordingly to reflect the scale and scope of your operations.

Industry risks

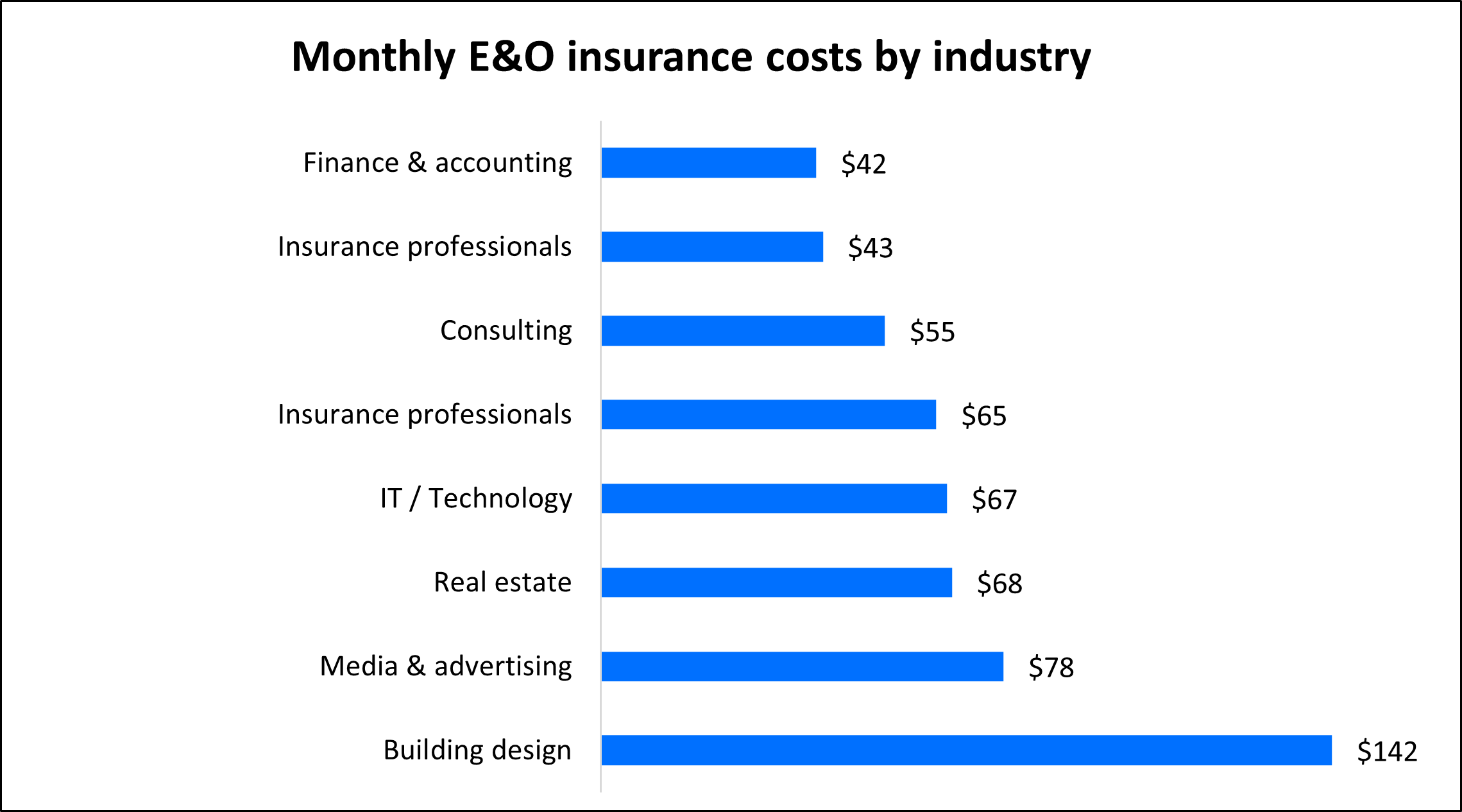

Your industry plays a major role in how much you’ll pay for errors and omissions insurance. Our analysis shows high-risk professions tend to pay significantly more than lower-risk ones – often by hundreds of dollars per year.

For example:

- Engineers pay an average of $142 per month for E&O insurance, due to the high liability associated with design flaws or structural issues leading to property damage.

- Insurance professionals pay an average of just $43 per month, reflecting their lower risk of causing physical or costly financial harm.

- Notaries public pay relatively low rates for notary E&O coverage as well, typically starting around $16 to $20 per month, depending on location and policy limits.

Certain industries—such as real estate agents, healthcare professionals, lawyers, and financial advisors—may require E&O insurance to obtain a license or sign client contracts. Even if it’s not mandatory by state law, having coverage can help protect your business from expensive legal claims tied to professional mistakes, missed deadlines, or perceived negligence.

The chart below shows how E&O insurance costs vary widely based on your profession:

Top industries we insure

Does my business need E&O insurance?

Errors and omissions insurance is a must-have for small businesses that provide expert advice or services, such as IT consultants or professional services. You may see it referred to as professional liability insurance or malpractice insurance depending on the industry.

Experts can still make mistakes or oversights, or give professional advice that causes financial loss for a client. If the client sues, attorney’s fees, court costs, and other legal costs can escalate to the point where they could sink your business.

Even if you've done nothing wrong, you're not immune to lawsuits. For example, your business could lose a key individual who you need to complete a project on time, or a client could sue over a budget overrun that was out of your hands.

When someone sues your business – even if it's a frivolous lawsuit – you'll have to pay legal defense costs, including the cost of hiring an attorney. If you lose the suit, you could end up paying a fortune in a court-ordered judgment or a settlement.

E&O insurance covers all of these costs, which could save your business from bankruptcy. Because the premium is based upon your level of risk and your industry, many small businesses pay only a small monthly premium for this coverage.

How can you save money on E&O insurance?

There are a few steps you can take to help reduce your E&O premium and avoid more expensive rates:

Shop around. Insurance companies offer a range of errors and omissions premiums and coverages. Compare quotes from different carriers with Insureon's easy online application.

Pay your entire premium upfront. Policyholders can choose to pay insurance premiums once a month or once a year. While making a smaller payment each month requires less money up front, it may cost more in the long run. Insurers often offer discounts to businesses that pay an annual premium.

Bundle policies. Depending on your industry, it's sometimes possible to bundle errors and omissions insurance with another policy, such as general liability insurance. For example, tech professionals can buy E&O insurance and third-party cyber insurance together in a bundle called tech E&O. This often costs less than purchasing each policy separately.

Keep continuous coverage. Continuous coverage is key if you don't want to pay out of pocket for E&O lawsuits. While it’s possible to purchase coverage when you start a project and drop coverage when you complete the project, this cost-cutting strategy can backfire for errors and omissions and other claims-made policies. To file a liability claim, your insurance must be active:

- When an alleged mistake occurs

- When the claim is filed

Reduce your risks. Your errors and omissions claims history is a big factor when calculating your premium, which is why it's important to avoid lawsuits in the first place. Many errors and omissions lawsuits stem from client disputes. To reduce the risk of hefty legal fees, you can:

- Strive to meet the standard of care for your industry

- Communicate clearly, especially when an issue arises

- Document all contracts and communications with clients

Why do small business owners choose Insureon?

Insureon is the #1 independent agency for online delivery of small business insurance. We help business owners find peace of mind by enabling them to compare quotes from top-rated providers, buy policies, and manage their coverage online.

By completing Insureon’s easy online application today, you can get free errors and omissions insurance quotes from top-rated U.S. insurance companies. Our licensed insurance agents can also answer any questions you have about other types of insurance as well.

Once you find the right policies for your small business, you can begin coverage in less than 24 hours and get a certificate of insurance for your small business.

For more information about E&O insurance coverage, visit our frequently asked questions (FAQ) about E&O.