Product liability insurance cost

Product liability insurance is typically included in general liability insurance, the cost of which varies based on a number of factors about your business. Your premium is directly impacted by the risk of customer lawsuits related to your products or completed services.

What is the average cost of product liability insurance?

Product liability insurance is usually included in your general liability insurance policy. Depending on your industry, you may see it referred to as:

- Product liability insurance for retailers, manufacturers, and wholesalers

- Products-completed operations coverage for construction and installation businesses

Small businesses pay an average of $42 per month, or about $500 annually, for general liability insurance.

Our figures are calculated using the median cost of policies sold by leading insurance companies to Insureon's small business customers. The median offers a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

Welcome! A general liability insurance policy is essential if you open your business to the public, handle client property, or rent or own commercial property.

It can protect you from expensive lawsuits for only about 42 dollars per month.

Don't put your business at risk, apply for your policy today. Alert! Alert!

Typical product liability insurance costs for Insureon customers

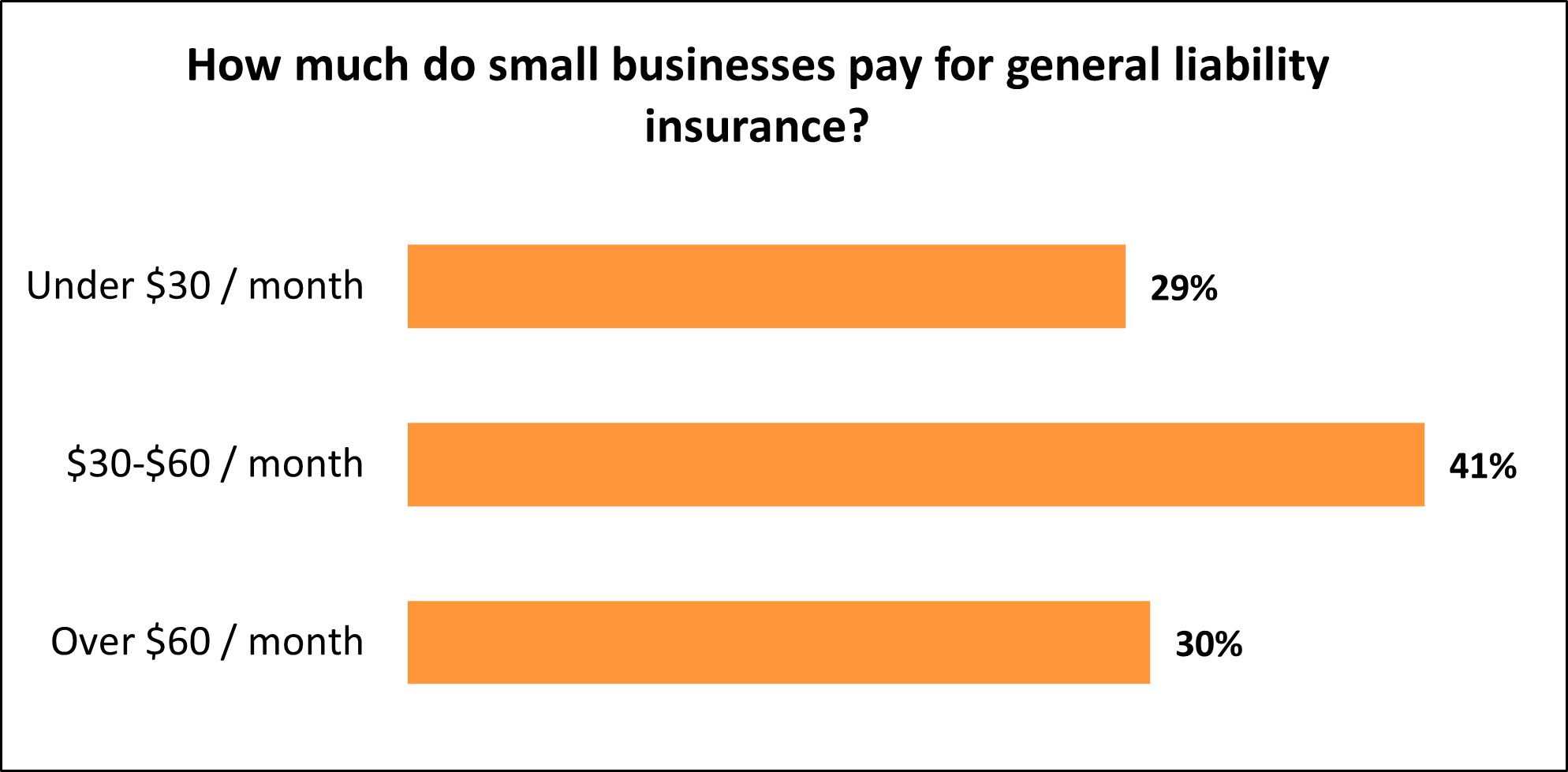

While Insureon's small business customers pay an average of $42 monthly for general liability insurance, more than a quarter (29%) pay less than $30. In addition, 41% pay between $30 and $60 per month. The cost varies for small businesses depending on their risks and the coverage they choose.

How is product liability insurance calculated?

Insurance companies consider several factors when determining how much to charge for a product liability premium, including:

Primary factors

- Business location

- Coverage limits

- Your claims history

- Position in the supply chain

- Industry risks

Other factors that can impact cost

- Business size

- Type of products you sell

- Sales revenue

- Property value

Business location

Your business location plays a significant role in the premium that you pay. For example, a business in an area with more foot traffic may pay a higher premium because they have an increased risk of customer accidents.

Premiums can also vary slightly depending on your state. For instance, small business owners in Oregon pay an average of $37 per month for general liability insurance, while businesses in Wyoming have an average premium of $60 per month.

Below are some average product liability costs across different states, according to Insureon customer data:

| State | Product liability costs |

|---|---|

$40 | |

$40 | |

$41 | |

$42 | |

$42 | |

$42 | |

$42 | |

$44 | |

$45 | |

$49 |

While product liability is recommended for small businesses that manufacture or sell products, you may need other types of business insurance as well.

Most states require by law that small business owners carry workers' compensation insurance to cover medical expenses from work-related injuries, and commercial auto insurance if they have business-owned vehicles.

Find business insurance requirements in your state

Policy limits and deductible

As with other business insurance policies, the cost depends on how much liability coverage you buy. If you choose a policy with higher coverage limits, you can expect to pay a higher premium.

Most small businesses (91% of Insureon customers) choose a general liability policy with a $1 million per-occurrence limit and a $2 million aggregate limit. That means the policy will pay up to $1 million on any single claim, and up to $2 million on all claims during the policy period (typically one year).

Because defense costs and legal fees from product liability lawsuits can be so costly, you may want to consider higher limits. If you're unsure how much coverage your business needs, chat with a licensed insurance agent.

Claims history

Your claims history and the types of claims you've previously filed can impact your insurance premiums.

A history of insurance claims on your record may indicate risk to insurers and increase your costs, which is why it's important to practice risk management and avoid claims.

Position in the supply chain

Industry risks

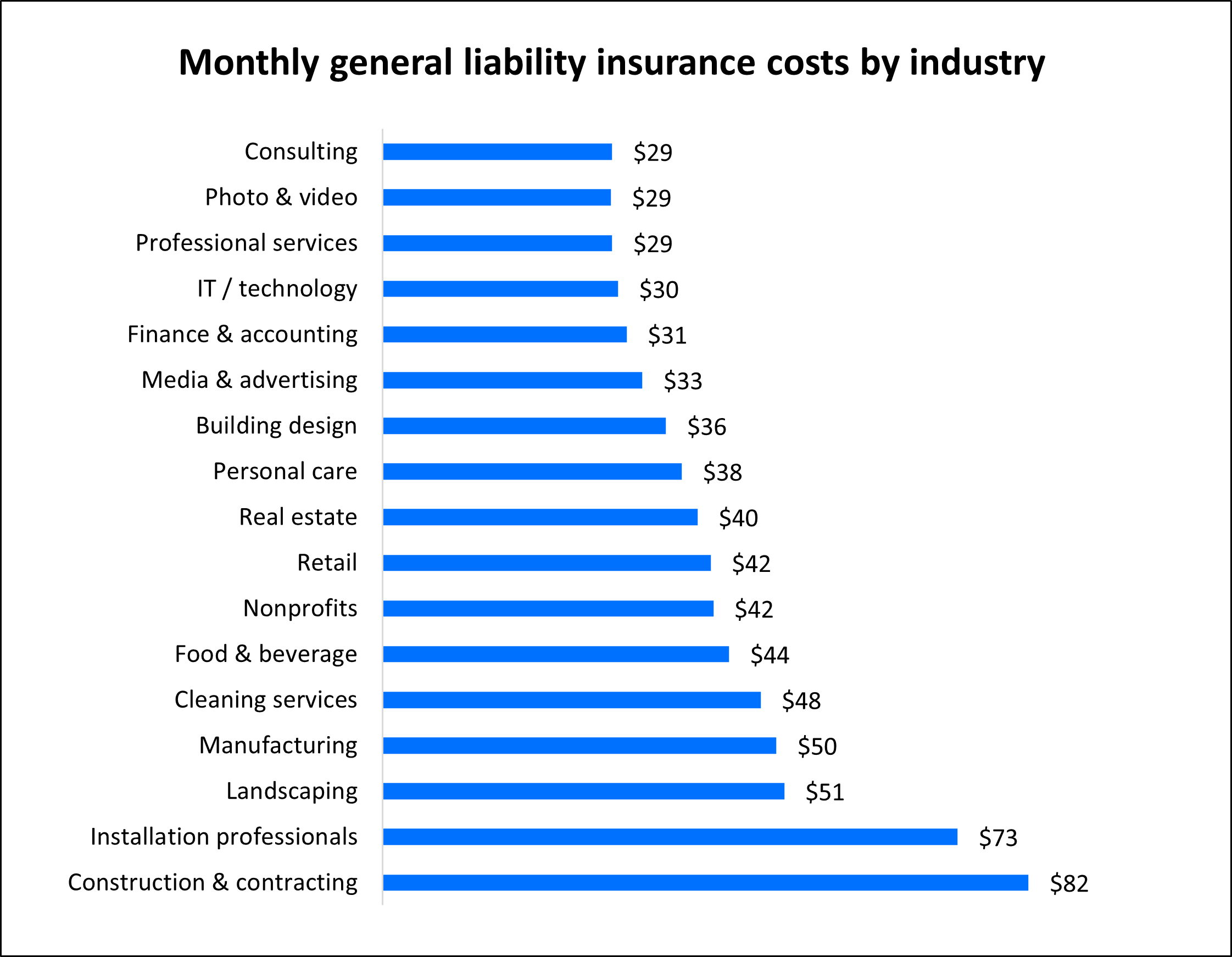

Your industry is the main factor that determines how much general liability insurance costs. Businesses in low-risk industries can expect to pay less for general liability, which includes product liability coverage.

For example, construction businesses pay more for coverage than Amazon or e-commerce retailers because they have a higher risk of third-party bodily injuries and property damage. Other factors such as annual revenue, the number of employees you have, and your claims history can also affect your premium.

The graph below shows how your type of business impacts what you'll pay for general liability insurance:

Top industries we insure

How to save money on product liability insurance

Saving money on general liability coverage involves analyzing risks, reducing liabilities, and comparing general liability and product liability insurance quotes from multiple companies.

Here are a few ways small business owners can save money on product liability insurance:

Bundle your general liability insurance in a BOP. If you also want coverage for business property damage or theft, a business owner’s policy (BOP) is likely the best option for your business. This policy bundles general liability insurance and commercial property insurance at a lower cost than if the policies were bought separately.

Pay your premium annually. Many insurance companies offer discounts for businesses that pay the full annual premium instead of paying in monthly installments.

Risk management. A history of business insurance claims can make your premium go up. To prevent financial losses and higher premiums, you can take steps to reduce your risks of a claim. Product liability insurance covers risks related to your products and completed services, which means you might consider:

- Thoroughly testing any products sold at your shop to detect product defects

- Strict quality control to avoid manufacturing defects

- Rigorous employee training on the installation of appliances or other items

- Proper product labeling to prevent personal injury (such as allergic reactions) and wrongful deaths

- Working with trusted partners in your product supply chain, such as importers and distributors

- Avoiding any type of product that could cause customer and employee injuries, which could result in high medical costs

What if you need to buy product liability insurance coverage separately?

Product liability insurance is typically included as part of a small business owner's general liability policy. The majority of product liability policyholders have their coverage through a standard endorsement to their general liability insurance policy.

While some insurers may write a standalone product liability policy, it's uncommon.

A small portion of businesses purchase a product liability insurance policy outside of general liability coverage. If you do, then your product liability risks will determine the cost of the policy. Higher risks often require a higher cost.

For example, manufacturers and sellers might need a separate product liability policy, or one that includes product recall insurance.

To determine the premium, insurance providers would consider your company's liability exposure and potential risk of facing legal action and legal costs over defective products, design defects, product malfunctions, and other product liability claims.

Verified product liability insurance reviews

Why do small businesses choose Insureon?

Insureon is the #1 independent agency for online delivery of small business insurance. We help business owners compare quotes from top-rated providers, buy policies, and manage coverage online.

By completing Insureon’s easy online application today, you can get free quotes for product liability insurance and other policies from the best carriers for your small business.

Once you find the right policies, you can begin coverage in less than 24 hours and get a certificate of insurance for your small business.