Builder’s risk insurance cost

The cost of a builder's risk policy (also called course of construction insurance) is based on the total completed value of your structure along with other project factors. This includes the cost of all materials and labor, but excludes land value.

What is the average cost of a builder's risk policy?

Small businesses pay an average premium of $105 per month, or about $1,259 annually, for builder's risk insurance.

Our figures are calculated using the median cost of policies sold by leading insurance companies to Insureon's small business customers. The median offers a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

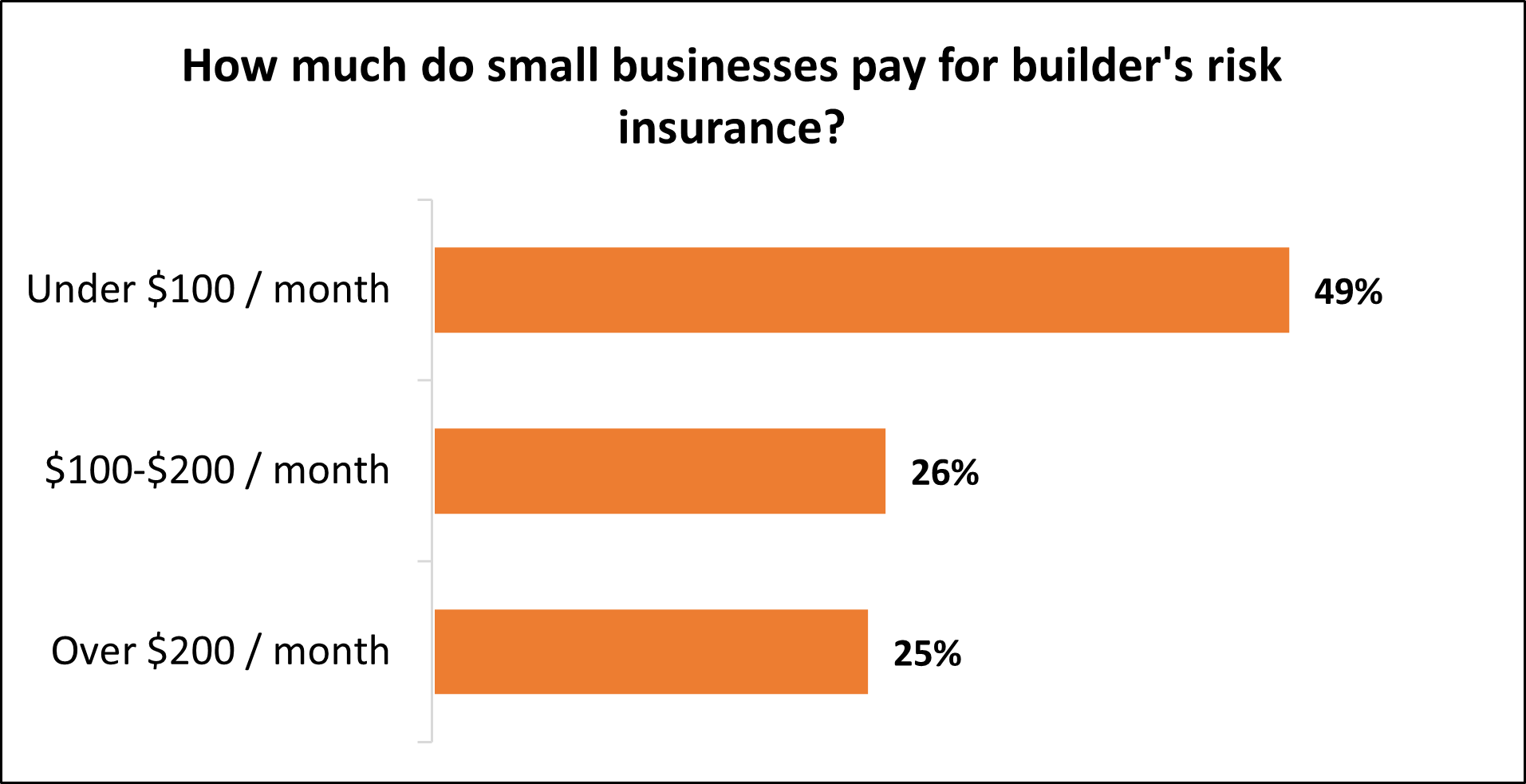

Typical builder's risk insurance costs for Insureon customers

While Insureon's small business customers pay an average of $105 monthly for builder's risk insurance coverage, 49% pay less than $100 and 26% pay between $100 and $200 per month.

The cost depends on the construction project. Policy costs are typically between 1% and 4% of the total completed value of the structure, which includes construction costs.

Understanding builder's risk insurance cost factors

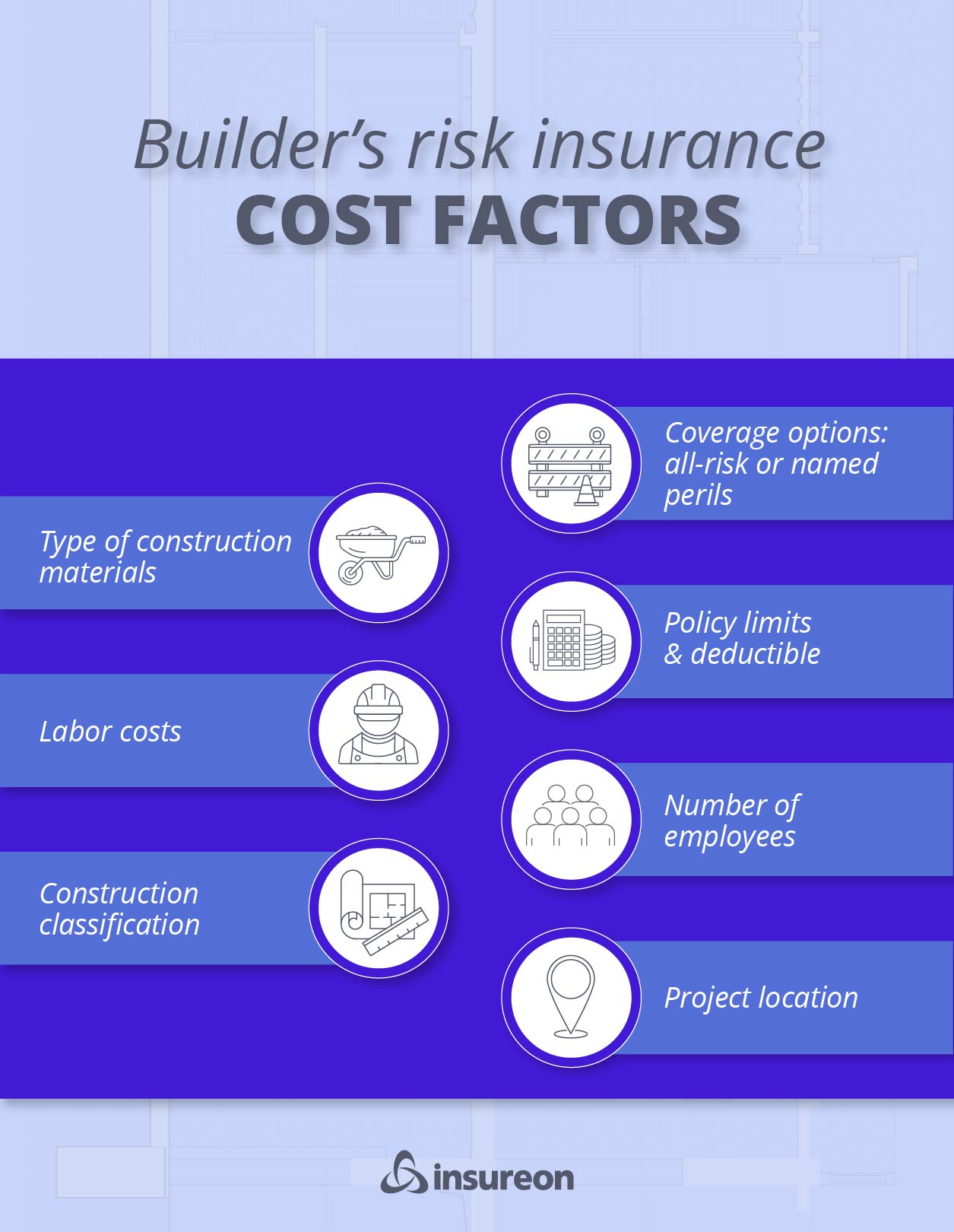

Your policy limit is just one factor that will impact your builder's risk insurance rates.

Your insurance provider will also look at the following when calculating your premium:

- Coverage limits and deductible

- Materials and labor

- Construction types and classifications

- Number of employees

- Location

- Coverage options

- Project cost and length

Coverage limits and deductible

Builder’s risk insurance comes in a wide range of coverage limits. Higher limits cost more, but cover more expensive claims.

A builder's risk policy covers incidents such as vandalism or theft of building materials at a construction site, up to the policy limit. For example, this policy covers costs if a natural disaster causes water damage to the existing structure, or a fire on a job site destroys a pile of lumber.

To protect your small business from all risks, you should consider purchasing additional liability coverages, such as general liability insurance for financial protection against third-party bodily injuries and property damage; commercial property insurance to cover damage done to your own business property; and professional liability insurance, for protection against lawsuits related to performance and workmanship.

View our recommended policies for both well-established and new construction businesses and contractors.

Materials and labor

For building projects that involve expensive construction materials or high labor costs, you would need a builder's risk policy with higher limits. This will increase your premium.

Many builder’s risk policies have multimillion-dollar coverage limits that can, for example, cover $10 million or more of damage per incident.

If you have materials and equipment that you bring from one job site to another, you may need inland marine insurance or contractor's tools and equipment coverage.

These policies protect your tools and other property while in transit, which isn't the type of perils that builder's risk insurance covers.

Construction types and classifications

Builder’s risk insurance policies sometimes provide different coverage limits for different construction classifications and construction types. For example, a plan might include a $5 million limit for a frame structure and a $10 million limit for a joisted masonry structure.

Similarly, the size of the construction site could also impact your premium, as the cost of builder's risk insurance for a residential property would likely be less than coverage for a larger commercial structure.

You can also add coverage extensions and additional endorsements, such as coverage for a temporary structure or debris removal after a loss.

Number of employees

It's simple: The more workers you have, the more opportunities there are for incidents (e.g., employee theft) to occur. For this reason, a business with a large number of employees will likely pay more for a builder's risk policy than one with just a few workers doing a small renovation project.

If an employee is injured on the job, builder's risk insurance typically does not cover their medical bills or legal expenses. Instead, you would need workers' compensation insurance.

Location

The location of a construction project can significantly impact the premium you pay. For example, job sites located in areas with higher crime rates or at an elevated risk of natural disaster may have to pay higher premiums than those located in areas where these occurrences are lower.

For instance, small business owners in Florida or Texas may have a higher cost for a builder's risk insurance policy than those taking on projects in Colorado due to the seasonal on-site risk of hurricane or other storm damage.

While builder's risk premiums may fluctuate based on where a project is located, it could still save you in the long run should any damage occur to your structure or building materials due to a covered event.

Coverage options

A policy that covers open perils costs more than a policy that covers named perils. Open perils coverage protects against all losses, except for any exclusions listed in the policy. Named perils coverage only protects against losses listed in the policy.

Project cost and length

The total project cost is often a major factor when it comes to builder's risk insurance. Typically, the insurance cost equals between 1-4% of the total project.

Additionally, how long your project takes can impact your insurance premiums. For example, a real estate developer commissioning a large apartment complex will likely pay more than a single homeowner paying for one remodeling project.

How can you save money on builder’s risk insurance?

There are several things you can do to keep your builder's risk coverage costs low and stay in your construction budget.

Some strategies include:

- Pay the annual premium. Insurance companies usually let you choose between an annual payment or smaller monthly payments, with a discount for the annual payment.

- Buy a master policy. Some businesses reduce their builder’s risk insurance costs by purchasing a master policy that provides continuous coverage without an expiration date. These plans are ideal for general contractors and other contractors who handle a continuous stream of projects.

- Purchase your own policy. Make sure you're the one responsible for buying a builder's risk policy. If the property owner or project owner already has this policy, contractors and subcontractors can likely get included as an additional insured.

- Manage your risks. Claims on your insurance make your premium go up. You should try to reduce and/or prevent all type of risks to avoid claims and keep your premium down.

Insuring your small business doesn't have to cost a fortune. At Insureon, we help you find affordable coverage that meets the unique needs of your small business, through a single online application. That way you can get peace of mind without breaking the bank.

Why do small businesses choose Insureon?

Insureon is the #1 independent agency for online delivery of small business insurance. We help business owners compare quotes from top-rated providers, buy policies, and manage their different types of coverage online.

By completing Insureon’s easy online application today, you can compare free quotes for builder's risk insurance and other types of property insurance and small business policies from top-rated U.S. insurance companies. Insureon insurance agents are available to help answer any questions and provide guidance about your coverage needs.

Once you find the right coverage for your small business, you can begin coverage in less than 24 hours and get a certificate of insurance for your small business.

Verified business insurance reviews

Hear from customers like you who purchased small business insurance.