Inland marine insurance cost

The cost of inland marine insurance coverage varies based on a number of factors about your business. Your premium is directly impacted by the value of your business property, your policy limits, industry risk, and more.

What is the average cost of inland marine insurance?

Small businesses pay an average premium of $29 per month, or about $350 annually, for inland marine insurance.

Our figures are calculated using the median cost of policies sold by leading insurance companies to Insureon's small business customers. The median offers a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

Factors that affect inland marine insurance costs

Insurance companies consider a variety of factors when determining your small business insurance costs. These factors include:

- Type of coverage

- Policy limits and deductible

- Type of property and value

- Location

- Claims history

- Industry risks

Type of coverage

Different types of property may need different types of coverage. Policies designed to cover less expensive items will cost less than policies intended for valuable items.

Here are the most common types of inland marine insurance:

- Contractor's tools and equipment insurance, sometimes called equipment floater insurance, is designed to protect newer contractor's equipment and tools valued at less than $10,000. Because it protects lower-value items, this policy is often very affordable.

- Bailee's customer coverage is recommended for businesses that handle customer property, in case the items are damaged while in your care, custody, or control.

- Installation floater insurance covers building materials and other movable property while they're being installed or built at a construction site. That could include an HVAC system or roofing materials.

- Builder's risk insurance is a more comprehensive policy that covers damages during a construction project. For example, it would cover costs if a fire damages a structure in progress and building materials at a construction site.

- Motor truck cargo insurance provides liability coverage for freight or goods while they are being transported by a motorized carrier. Trucking businesses often use this policy to protect client cargo while it is in transit.

Policy limits and deductible

Your policy's coverage limits should be enough to cover a potential claim, whether that's a fire in a food truck or a camera dropped by a photographer at a wedding. Higher coverage limits cost more, but will cover bigger losses.

Note that your deductible also affects the cost of insurance. A higher deductible will result in a lower premium, but you'll have to pay that amount before your insurer will cover a claim.

Type of property and value

Similar to commercial property insurance, the cost of inland marine insurance depends primarily on the value of the items you want to insure. For example, it'll cost more to insure high-value items such as fine art, motor truck cargo, bulldozers, and forklifts.

This is because the cost of claims for property damage and other incidents is higher depending on the value of the transported goods.

For example, a candle maker that regularly transports homemade goods to trade shows and fairs would likely pay less for inland marine insurance than a computer repair business that frequently transports expensive computer systems.

Location

Your location can impact your small business insurance costs. This is because of things like natural disasters and population density, which can increase the likelihood of accidents, incidents, and other forms of property damage.

For example, a consulting business in New York City is likely going to pay higher rates than a consulting business in Boise because of the increased risks of operating in a major city.

Additionally, a business in a state with frequent and devastating natural disasters, such as Florida, is likely going to pay higher rates than a state with relatively fewer natural disasters, such as Michigan.

Claims history

The number of previous insurance claims your business has made can impact future small business insurance rates.

Insurance companies often see previous claims as an indicator of future risk, and may increase your insurance costs accordingly.

For example, a business is involved in an auto accident where the employee is at fault. They make a commercial auto claim, which helps pay for the costs associated with the accident.

During their next year's insurance renewal, the owner notices that their policy rates go up, largely due to the new claims history.

Industry risks

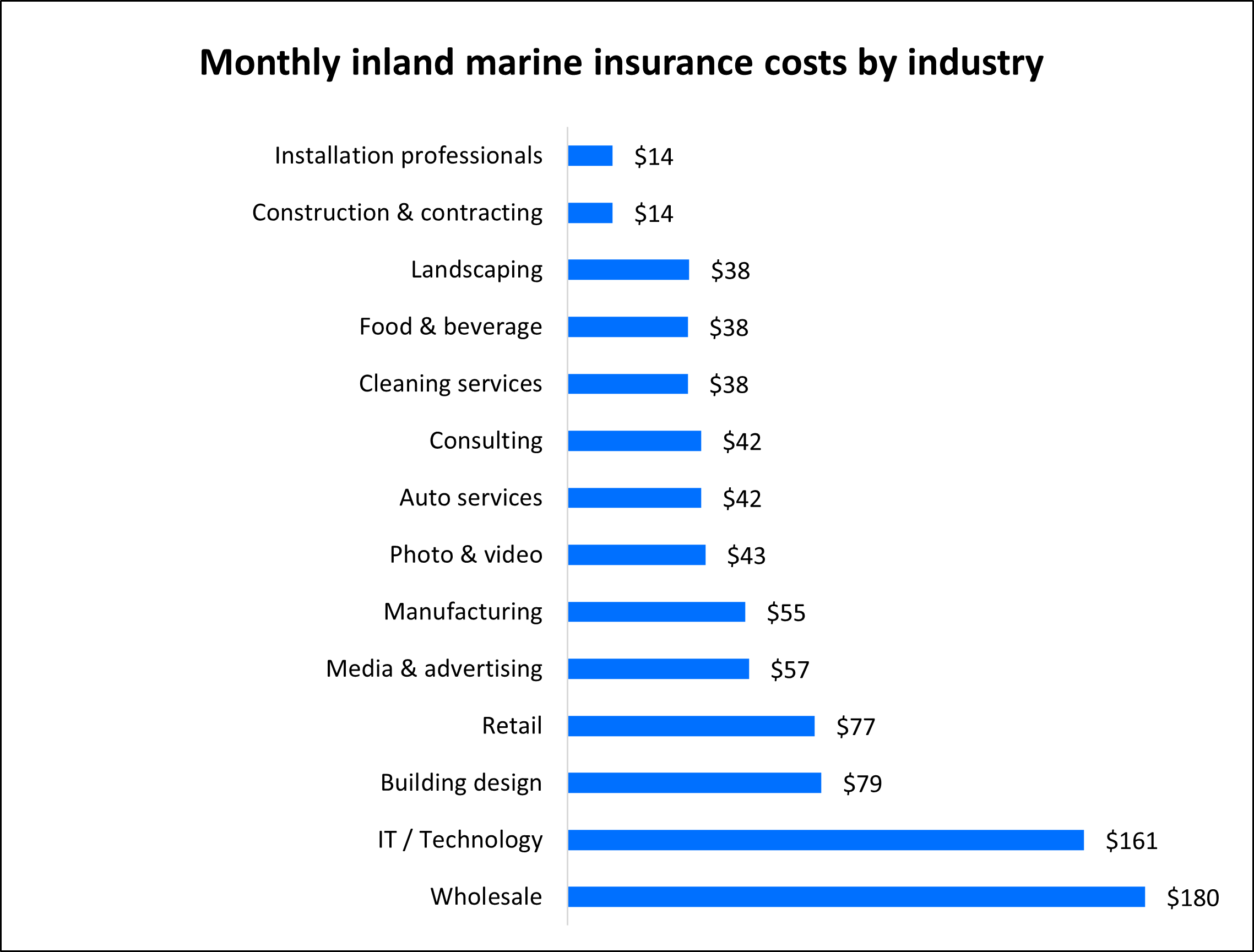

Professionals with expensive equipment choose higher limits and pay more for increased protection. Because your profession determines what kind of property you need, you can estimate how much you'll pay for insurance based on your type of business.

For example, landscapers, installation professionals, and contractors typically need to insure tools and other equipment that are brought to job sites. They often buy contactor's tools and equipment insurance, which isn't an expensive policy.

On the other hand, technology businesses and wholesalers can expect to pay more for inland marine insurance. That's likely a reflection of the cost of insuring expensive electronics and shipping valuable merchandise.

The chart shows how much you can expect to pay for inland marine insurance based on your profession.

Top industries we insure

Does my business need inland marine insurance?

An inland marine insurance policy is a must-have for property brought to clients' homes, stored off-site, or used at a photo shoot or other event away from your office.

That's because a commercial property insurance policy only covers items at a business's fixed location, such as an office or storefront.

Professionals who bring their own equipment to job sites depend on this coverage. If a landscaper's tools are stolen from their truck, or a business's vending machines are damaged by vandalism, commercial property insurance won't cover the damages.

Inland marine insurance covers your business equipment wherever it goes and while it's in transit. Because the premium depends on the value of the insured property, small businesses and contractors don't have to pay a lot for this coverage.

How can you save money on inland marine insurance?

There are a few ways to save money on your inland marine policy and avoid more expensive rates:

Bundle your insurance policies. Small, low-risk businesses can bundle property coverage with another policy, most often general liability insurance in a business owner's policy (BOP). A bundle typically costs less than buying each policy separately while still meeting your business needs.

Pay the annual premium. Insurance providers usually offer a discount when the policyholder pays the annual premium as opposed to the monthly payments.

Lower your risks. Insurance claims will increase your premium, so it's best to avoid claims through risk management. For inland marine insurance, you might:

- Purchase padlocks to secure tools and equipment.

- Invest in a security system for off-site locations.

- Store items away from pipes and other possible hazards.

- Train employees to be vigilant against possible theft.

Get your property appraised. An accurate estimate of your business personal property (BPP) tells you how much insurance you need. Not enough coverage could leave you paying for damages, while too much coverage could mean you're overpaying for insurance.

Why do small businesses choose Insureon?

Insureon is the #1 independent agency for online delivery of small business insurance. We help business owners compare quotes from top-rated providers, buy policies, and manage coverage online.

By completing Insureon’s easy online application today, you can compare free quotes for commercial inland marine insurance and other policies from top-rated U.S. insurance companies. Once you find the right policy, you can begin coverage in less than 24 hours and get a certificate of insurance to show clients, lenders, and landlords that you're insured.

An insurance agent can help you every step of the way if you have questions about coverage options or your business insurance needs.

Verified business insurance reviews

Hear from customers like you who purchased small business insurance.