Additional insured

In an insurance policy, an additional insured refers to anyone other than the policyholder who is covered by an insurance policy. Coverage might be limited to a single event or it could last for the policy's lifetime.

What is an additional insured endorsement?

Both individuals and groups can be given additional insured status, but their protection is more limited than that of the policyholder. The specifics depend on the policy, but an additional insured endorsement typically affords some crucial protection.

Additional insured covers when a third party (i.e., someone who doesn’t work for your business) sues your additional insured, your policy can address the claim. That way, legal defense fees, court fees, and settlement or judgment costs don’t come out of the additional insured’s pocket.

It also covers claims of bodily injuries, property damage, and advertising injuries (e.g., libel, slander, or copyright infringement).

Depending on your industry, additional insured addendums are a fairly common practice. For instance, suppliers or subcontractors may benefit from additional insured status when they work on your premises or on behalf of your business. By contrast, if you subcontract with a company, you may require additional insured protection for yourself before working with another business.

What is the difference between a primary insured and an additional insured?

Simply put, the primary insured is the policyholder, also known as the named insured. This is typically the small business owner who purchases the policy on behalf of the company.

The additional insured is anyone the primary policyholder adds to the policy. Generally speaking, the additional insured benefits from the policy, but does not manage it.

How does a blanket additional insured endorsement differ?

An additional insured endorsement can be used to provide many different levels of coverage. A blanket additional insured endorsement provides the same coverage to a group of people who aren't required to be specifically named, such as drivers or subcontractors.

For example, on a commercial auto insurance policy, a blanket additional insured endorsement provides the same coverage for any driver of your company vehicle. It's a common feature of many liability policies.

A standard additional insured, unlike a blanket insured, requires the parties to be named specifically on the policy.

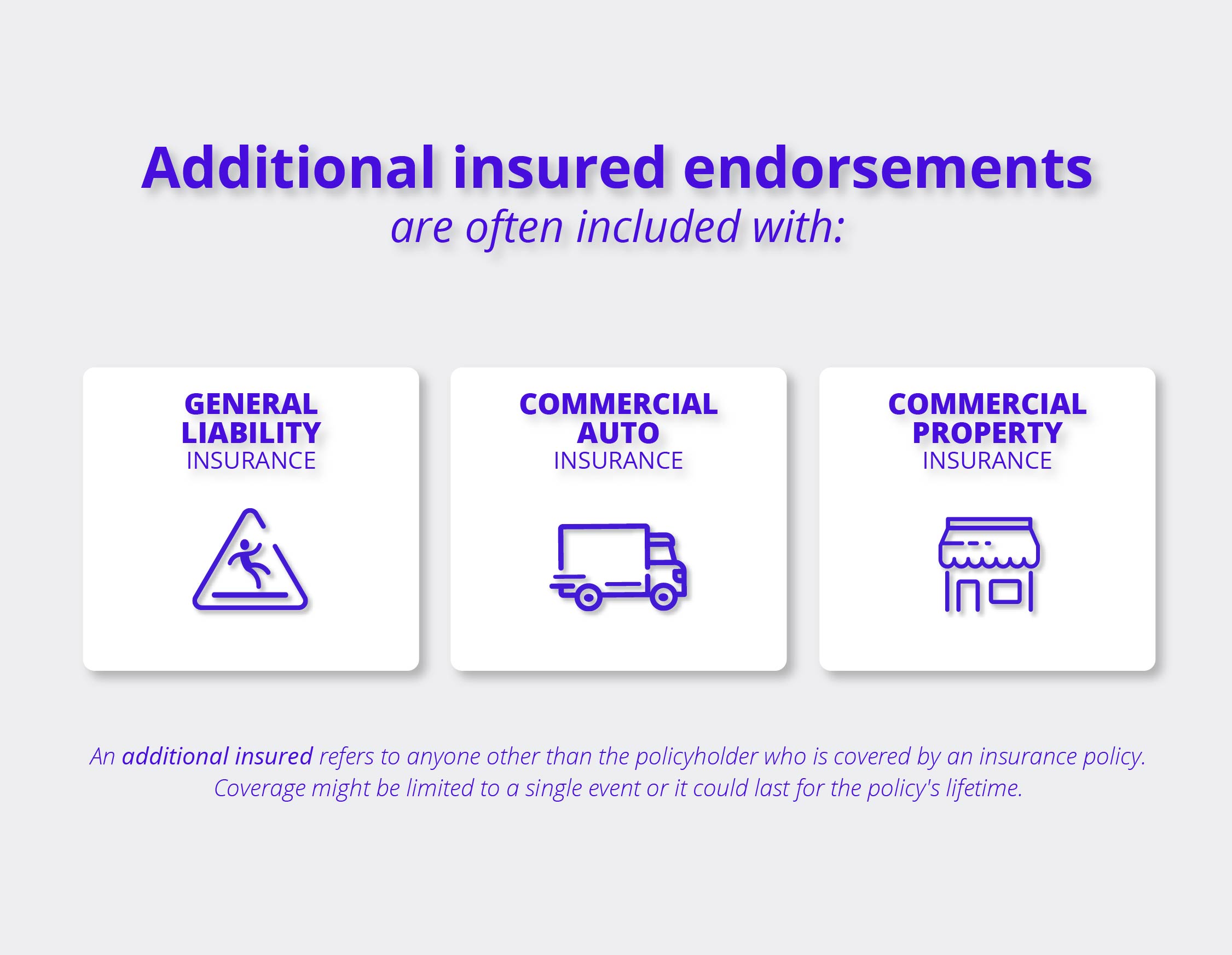

Which policies are eligible for additional insured endorsements?

You can add an additional insured to several small business insurance policies. The most common policies include:

- Commercial general liability (CGL) insurance. You can add an additional insured endorsement to your commercial general liability policy. This often looks like adding general contractors, suppliers, and vendors to your policy to cover them while they work with your business.

- Commercial auto insurance. If you need to add a third party or business partner to your commercial auto insurance policy, you can add them as an additional insured. You can choose between blanket additional insured endorsement, which covers any third party, or a limited endorsement that covers for specific risks and liabilities.

- Commercial property insurance. Many small businesses opt to add third parties, such as property managers and subcontractors, to their commercial property policy. Some commercial leases require this as a rental condition.

Speak to a licensed insurance agent about your business's specific insurance coverage needs.

When should I add someone as an additional insured?

New clients or partners may ask to be included as additional insureds in your insurance policy before they will sign a contract. For the most part, clients and partners will let you know when they require additional insured status in order to work with you.

Though you could theoretically name an additional insured for whatever reason you want, these two scenarios are most common:

- You’re a contractor / subcontractor / business owner, and your client asks to be named as an additional insured on your policy.

- You hire a contractor / subcontractor, and you ask to be named as an additional insured on their policy.

You may ask to be named as an additional insured to provide your business with more liability coverage. For example, say you use a contractor on a project who causes an accident that leads to you being sued. If you’re an additional insured on the contractor’s policy, you can make a claim to pay for the damages and legal fees, rather than relying on your own insurance.

Most companies include language in their contracts for contractors to provide indemnity, or pay for, any liability lawsuits that stem from their work. Companies want assurance that contractors have the means to compensate them in a worst-case scenario, which is why they often ask for additional insured status, too.

Common scenarios for adding an additional insured

When might you want to consider adding an additional insured to your existing insurance policies? Consider the following examples.

- A consulting office hires a cleaning service to assist with regular janitorial services. Their rental lease requires all contractors to be added as additional insureds on the commercial property policy.

- A construction company needs its subcontractor to assist with operating heavy machinery, which requires commercial auto coverage. They add the subcontractor as an additional insured for the duration of the project.

- A landscaping business hires additional workers to help out during a particularly busy season. They add their temporary employees as additional insureds to their general liability policy to ensure that the business is covered in the event of customer property damage or bodily injuries.

Guaranteeing that all necessary third parties are covered is an important part of an effective risk management strategy. It also helps small businesses develop strong business relationships with vendors, property managers, and other business partners.

How to add an additional insured to an insurance policy

To add an additional insured to an insurance policy, consult an Insureon insurance agent and review the policy, identify whether an additional insured can be added, and assess the level of coverage the additional insured is requesting.

You’ll typically need to fill out an additional insured endorsement form. There are a large number of forms available, so make sure to ask your agent for assistance.

Your agent will let you know what limitations apply for the additional insured and can answer any other questions about the policy. If the additional insured is covered for the life of the policy, you may want to just check in and make sure nothing has changed when it’s time to renew the policy or make other changes.

Lastly, when it comes to subcontractors, you can add them as additional insureds, but you may also want to require them to carry their own insurance. Each policy is different, so the extent of protection an additional insured receives is variable.

What are the limitations of additional insured status?

There are some notable limitations to additional insured coverage, such as:

- The endorsement may offer coverage for only a limited type of liability (e.g., vicarious liability).

- Additional insureds typically can’t be added to a professional liability insurance policy. Insurance companies will likely argue that the client is not a licensed professional and therefore can’t be held to the same standard of care. That would preclude the client from being insured under the policy for acts of professional negligence or mistakes.

- A workers' compensation policy also cannot have additional insured amendments, though you can add a waiver of subrogation, which acts similarly.

Tech businesses may be able to negotiate an exception to these general rules around additional insured for professional liability (tech E&O) policies, but it depends on the carrier and coverage. Speak to a licensed insurance agent for more information.

Certificates of insurance for additional insureds

Business partners, clients, and subcontractors can ask for proof of their additional insured status by requesting to see the policyholder’s certificate of insurance (COI). This document lists the commercial policy and its insureds.

If a business needs to use the additional insured protection, the certificate of liability insurance offers the certificate holder the necessary information to begin the claims process.

Get free quotes and compare policies with Insureon

Insureon helps small business owners compare business insurance quotes with one easy online application. Start an application today to find the right policies for your business needs.

You can also speak to a licensed insurance agent to ensure you have the right policy limits for your risk exposures.

What our customers are saying

Want free expert advice right in your inbox?

By entering your email address and subscribing, you agree to our Terms of Use and Privacy Policy