How to read a certificate of insurance form

When a new client hires your company, they want to know that working with you won’t increase their legal liability. Similarly, when you hire vendors or subcontractors for your firm, you want assurance that hiring them won’t harm you financially.

How do both parties put these concerns to rest? By obtaining a certificate of liability insurance from an insurance company.

A certificate of insurance (COI) form is a document that establishes proof of insurance, most often for a general liability policy. It lists you or your business as the policyholder or named insured. The form also specifies the type of liability insurance involved, the policy limits, and the effective dates of coverage, or policy period.

This shows everyone involved that you are adequately insured. By reviewing a COI, your customers can close deals knowing there’s an insurance safety net in place. (See a certificate of insurance example [PDF]).

Why is a certificate of insurance important?

Most business owners strive to be competent, honest, and truthful. Sadly, reality may fall short of expectations. Vendors and business partnerships might:

- Not be as skilled as promised

- Fail to mention prior legal disputes

- Claim to have insurance, but it expired years ago

Asking for a current COI helps verify a potential vendor or subcontractor’s financial responsibility claims. When lining up work with a new client or vendor, never hesitate to provide or ask for a certificate of insurance form. It’s simply a good business practice.

In what cases are certificates of insurance necessary?

Certificates of insurance have a wide application in the business world. Any time parties to a transaction are concerned about losses and legal liability – something most small businesses worry a lot about – certificates of insurance play an important role.

Here are some cases in which COIs are essential:

- A commercial property owner wants to confirm that a tenant has commercial general liability coverage, which protects against common business risks. The landlord wants to make sure that if a customer trips and falls on the landlord’s property, the tenant’s insurance policy will protect the tenant and landlord from the cost of a lawsuit.

- A manufacturer requests a COI from a contractor prior to beginning a facility renovation. Now the owner knows they won’t have to pay for any structural damage the remodeler may cause.

- A building design firm wants to insulate itself against the risks of bringing subcontractors onto its construction sites. Getting proof of insurance eliminates the risk of having to pay for any medical expenses from injured workers employed by the subcontractor.

- A municipal government asks an engineering firm to provide a COI before starting a road construction project. This creates a liability barrier for the municipality, should the engineering firm draft a faulty design.

As you can see, whenever businesses engage in projects that can trigger losses for multiple parties, a certificate of insurance is the go-to document.

What are the main sections of a certificate of insurance form?

The Association for Cooperative Operations Research and Development (ACORD), a nonprofit insurance organization, provides a standard form used by most insurers, agents, and brokers. You may see it called the ACORD 25 or simply an ACORD certificate of insurance. This template COI includes:

- Date: When the form was issued.

- Disclaimer: Legal wording that says the certificate is a representation of your coverage, not the actual insurance policy.

- Producer: The insurance agent or broker who issued the certificate.

- Insured: The name and address of the person(s) or business covered by the policy.

- Insurance coverages: The type of insurance – typically general liability, professional liability, commercial auto, excess liability, or workers’ compensation. This section also shows policy numbers and the policy’s effective date and expiration date.

- Insurers: All companies providing the coverage listed above.

- Coverage limits: How much coverage in dollars the policy provides for each incident (per-occurrence limit) and for all claims during the policy period (aggregate limit).

- Description of operations, locations, and vehicles: A catch-all space to respond to specific requests, such as being listed as an additional insured.

- Certificate holder: The person or company to whom the COI was issued.

- Cancellation: Notice that the certificate holder will be notified if the insured cancels the policy before the expiration date.

- Signature: Signature of the agent, broker, or an authorized representative of the agent or broker.

How to get a certificate of insurance

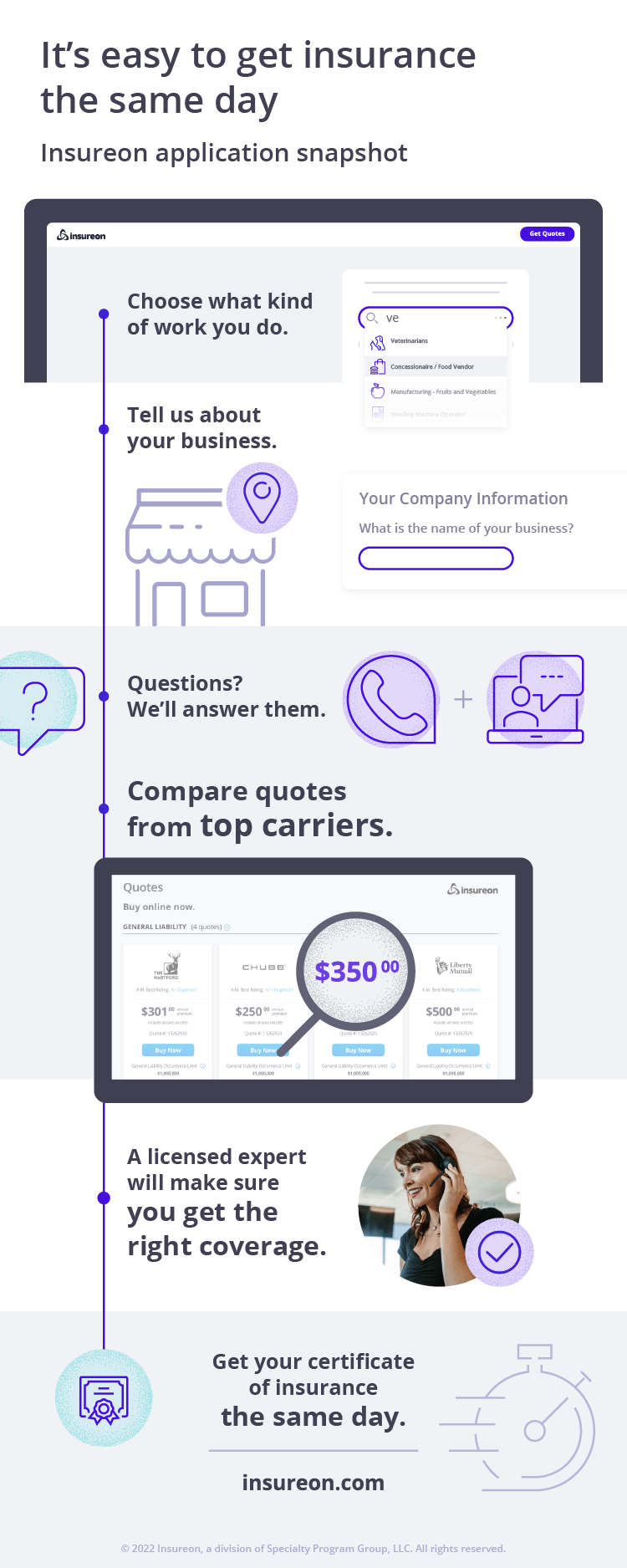

Some insurance carriers will snail mail you a certificate after you buy a policy or request a replacement certificate. With Insureon, about 80% of business owners can receive their certificate within hours of starting an application. Businesses that are more difficult to insure can usually get a certificate within 48 hours.

With Insureon, the process starts with our free online application, which takes a few minutes to complete. You’ll receive free quotes from top-rated U.S. carriers that you can compare on your own, or you can speak with a licensed Insureon agent to make sure you have a policy that fits your needs.

After choosing and paying for your policy, you can download your certificate as soon as your policy is issued.

How to review a certificate of insurance

When you request a certificate of insurance from a person or business, you'll want to look the form over carefully. Once you receive it, here’s what to look for:

- Make sure the company name on the form matches the vendor name that you are hiring.

- Verify that the policy expiration date does not come before the completion date of your project. If it does, ask the vendor to submit another COI confirming the policy’s renewal.

- Check the type of coverage. You likely want them to have general liability insurance and workers’ compensation coverage. These policies will cover you for any third-party losses (property damage, bodily injuries, etc.) the vendor causes, as well as any injuries to their employees during your project.

- Determine that the vendor’s liability limits meet or exceed the limits on your own insurance and any state insurance requirements. If they don’t, consider requiring the person to purchase additional insurance.

In rare cases, business owners will present counterfeit COIs because they can’t afford to maintain genuine insurance. If you have any reason to doubt someone, request the COI directly from the person’s insurance agent or broker.

Is a certificate of insurance form the same as an insurance policy?

No, an insurance certificate is only a summary of existing insurance coverage. When you give a customer your COI, you’re not entering into a contract to cover that person’s losses. You’re just providing proof that you have insurance.

If you want to provide coverage to the certificate holder, you can make your customer an “additional insured” on your policy. This is easy to do. Just call or email your agent or broker and ask the person to amend your declarations page to include the name of your customer.

Get a certificate of insurance with Insureon

With Insureon, small business owners can get free insurance quotes from top-rated providers with one easy application. A licensed insurance agent can help with any exclusions or endorsements on your business insurance coverage. Once you purchase a policy, you can download a certificate of insurance or request one from your carrier online with Insureon’s Customer Portal.

Harry J. Lew, Contributing Writer

Harry is an experienced content marketing strategist, writer, and editor, with a focus on insurance, B2B, and financial planning. He has a working knowledge of SEO practices, small business insurance lines, and transforming complex information into clear, useful insights.