Does business insurance cover breach of contract?

When you’re providing services to a client or customer, it’s essential to have a signed contract in place to outline the scope of your work, payments, and deadlines. A detailed contract sets clear expectations about your responsibilities and provides important legal protection for your business.

However, if either party fails to follow the terms of the contract, they could face a breach of contract lawsuit. Even if you’re not at fault, an accusation of contract negligence could damage your reputation and your bottom line.

Here’s what you need to know about what represents a breach of contract, and how small business insurance can protect your business from client lawsuits over an alleged breach.

What is a breach of contract?

A breach of contract occurs when a party to an agreement doesn’t fulfill their contractual obligations. For example, you could be accused of a breach of contract if you miss a deadline. You might accuse your client of a breach if they don’t pay you as promised. Either way, the breaching party could end up in legal trouble.

There are two types of contract breaches, immaterial breaches and material breaches:

- An immaterial breach is sometimes known as a minor or partial breach. In these cases, the terms of the contract were violated, but no provable harm resulted. For example, let’s say a management consultant violates their contract terms by delivering a report a day late. This would represent an immaterial breach unless the client could prove this small delay caused them financial harm.

- A material breach is sometimes called a full breach of contract. It occurs when one party violates the terms of the contract, causing financial harm to the other. For instance, if a landscaper fails to start an agreed-on project, that would be a material breach of contract.

Most states require that breach of contract claims allege actual financial injury to a party. If your business is successfully sued for breach of contract, you could face significant costs. Even if you’re not to blame, court costs and attorneys’ fees can quickly add up.

What happens if your client sues for breach of contract?

A client can sue for breach of contract in any court that has jurisdiction, like small claims court or trial court in the state where the contract was signed. Federal court may even be appropriate if the parties are from different states or federal law is at issue.

A successful breach of contract case against your business could result in both reputational and financial damage. Types of damages awarded to a client could include:

- Restitution: You could be ordered to pay back any money your client paid you.

- Compensatory damages: You could be ordered to pay your client any money they might have lost due to your breach. This could be actual damages, or an estimate of future losses (like business you might have cost a client).

- Specific performance: You could be ordered to follow through on the terms of the contract. This usually applies when money won’t be adequate compensation for what was lost due to the breach, like unique property in a real estate transaction.

- Punitive damages: If your breach of contract is particularly outrageous, you may be required to pay extra damages as punishment.

If you’re found to be in breach of a client contract, the amount of damages you’ll have to pay could be substantial. Depending on the state, you could also be ordered to pay the other party’s attorneys' fees and court costs.

A breach of contract occurs when a party to an agreement doesn’t fulfill their contractual obligations.

Who is at risk for a breach of contract lawsuit?

Any business that enters into a business relationship with a customer could be sued for breach of contract. While a client could file a lawsuit over a verbal agreement, a breach of contract action usually relates to a written business contract.

Often, accusations of breach of contract relate to claims of professional negligence. A simple mistake or oversight could easily lead to a breach of contract claim. Businesses that provide a service or offer clients expert guidance are particularly at risk.

Here are a few examples:

- Imagine that you’re an accountant who’s hired to handle a client’s corporate tax return. Due to a clerical mix-up, you miss the filing deadline and your client is subject to penalties. You might be accused of breach of contract.

- Let's say that you’re an IT consultant, and a client hires you to select and implement a new network security system to improve cybersecurity. A few weeks after the project is finished, the client suffers a data breach. The client might sue to recover their damages.

- Perhaps you’re a general contractor who miscalculates the total cost of a home renovation. When you inform the client that the cost will be much higher than the amount specified in the contract, the client files a breach of contract lawsuit.

There are lots of different situations that can lead to a contract dispute. Without protection, a client lawsuit could cost your business time and money you can’t afford to lose. Luckily, you can get insurance to help keep your business safe.

What insurance could protect you from breach of contract lawsuits?

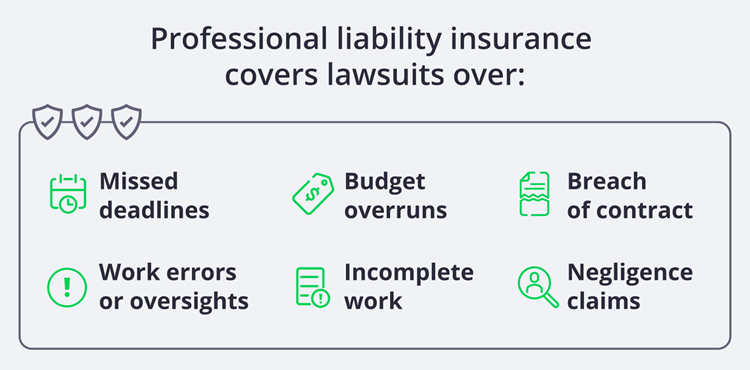

If you intentionally breach a business contract, no insurance policy will protect you. However, a breach of contract that arises from your mistake or oversight could be covered by professional liability insurance. This policy, also called errors and omissions insurance (E&O), will cover breach of contract lawsuits related to:

- Work errors and oversights

- Undelivered services

- Missed deadlines

- Budget overruns

- Incomplete work

- Accusations of negligence

Professional liability insurance is a claims-made policy, which means it only covers breach of contract claims that occur while your policy is in force. That’s why it’s important that you maintain continuous coverage for maximum protection.

Breach of contract insurance isn’t legally required to start or operate a business. However, some clients might ask to see proof of professional liability coverage before they agree to sign a contract with you. Not only can this type of insurance reduce risk, but it can also help you attract new customers.

E&O insurance is one of the most important business insurance policies you can have. If you’re an IT professional, you should consider purchasing tech E&O insurance. This policy bundles errors and omissions insurance with cyber insurance, often at a lower rate.

Professional liability claims cover a broad range of errors and oversights that may cause you to fail to deliver your agreed-upon services. For example:

- Suppose your architecture firm drafts blueprints for a new construction project. Several weeks in, an error is discovered that requires rework on the building. In this case, breach of contract insurance could cover your legal fees and any settlement with your client.

- Let’s say that you’re a web developer, and a client hires you to build a new website before a major product launch. When the client reviews the site, they claim that several pages you agreed to build are missing, and files suit over lost revenue due to the delayed launch. In this case, E&O insurance would pay for your attorney costs and any judgment against you.

- Imagine that you own a janitorial services business, and one of your clients falsely accuses you of breaking an expensive piece of art. You successfully defend against their lawsuit, and your professional liability insurance policy covers your legal fees and court costs.

Although your professional liability coverage could protect you from a client lawsuit over breach of contract, there are steps that you can take to help prevent a contract dispute from escalating into legal action.

How do I avoid accusations of breach of contract?

Having professional liability insurance is valuable, but the best way to avoid breach of contract accusations is to prevent them from happening in the first place. Here are five ways that you can reduce the risk of contract negligence claims against your business:

1. Draft a detailed contract

Make sure your client contract details exactly what’s expected of all parties, from the work you’ll deliver, to roles and responsibilities, to deadlines and payment schedules.

You may want to include:

- A hold harmless clause or limited liability disclaimer, which prevents other parties from suing you in certain circumstances

- An arbitration clause that requires the parties to resolve any contract disputes through an arbitration process

- A “force majeure” or “act of God” clause that suspends the contract if an event beyond you or your client’s control interferes with your ability to proceed

You may also want to consult a contract lawyer for legal advice on the best provisions to include in your agreements, based on your profession.

2. Document everything

If a client threatens to sue your business for breach of contract, you’ll need the right documentation to defend yourself. Good record-keeping is essential here. In addition to a signed, written contract, you should also save copies of relevant correspondence including email conversations, receipts, order forms, and time-tracking documents.

3. Don’t overpromise

When you discuss a new project with a client, set realistic expectations from the beginning. Don’t overpromise on a deadline or budget that may not work or could force you to cut corners. It’s always better to give yourself a little breathing room in case the unexpected happens.

4. Communicate with clients

When you start a new client project, set clear expectations and regularly update clients on your progress and potential roadblocks. Most clients understand that projects can get derailed by unforeseen issues.

If you’re concerned that a project is running over budget or falling behind schedule, you need to let your clients know as soon as possible. With a proactive approach, you can often revise a contract and avoid a business dispute.

5. Stick to your strengths

As a small business owner, it’s important to focus on what you do best, and not offer services that are outside your field or area of expertise. For instance, if you’re a general contractor, you shouldn’t be offering electrician services unless you or one of your employees has formal training. When you advertise work that is outside your skill set, there’s a greater risk of work errors, and that can land your company in court.

Any small business can get hit with a breach of contract lawsuit. With the right insurance coverage and good business practices, you can lower your risk and protect your bottom line.

Complete Insureon’s easy online application today to compare quotes for business insurance from top-rated U.S. carriers. Once you find the right policy for your small business, you can begin coverage in less than 24 hours.