Washington workers' compensation insurance

Workers’ compensation insurance is required for every employee in Washington, including part-time workers. This is a monopolistic state, which means coverage must be purchased through the Washington state fund.

Who needs workers’ compensation coverage in Washington state?

Washington is one of four monopolistic states in the nation, which also include Ohio, Wyoming, and North Dakota.

A monopolistic state is one where you can only purchase workers’ compensation insurance from a state fund, and not through a private insurer. In Washington state, workers’ comp is administered through the Washington State Department of Labor & Industries (L&I).

If a business or employer has $25 million or more in assets and an accident-prevention program, it might be permitted to get self-insurance. Every other business with employees must purchase workers' comp through the state fund.

Each business must have a business license and an account with L&I to purchase workers’ comp insurance through the fund. L&I will make classifications based on its own system, which determines coverage rates.

Small businesses can still purchase other insurance policies through private insurers, including common coverages such as general liability insurance, professional liability insurance (also called errors and omissions insurance or E&O), and cyber insurance.

Is workers' compensation mandatory in Washington?

Workers’ compensation insurance is required in Washington state for any business with one or more employees. If you have any employees – even independent contractors – you might be required to buy coverage.

Do you need workers’ comp insurance if you are self-employed?

Sole proprietors and independent contractors should strongly consider buying workers’ compensation insurance, even though it's only required for employees.

Your personal health insurance company might deny a claim if the injury is related to your job. That would leave you paying medical bills out of pocket, which could be even harder if you're out of work while recovering.

Workers' compensation would pay your medical bills, and also supply partial wages for the time you lost due to your job injury. For injuries that result in a fatality, it provides death benefits for your dependents.

Is workers’ comp mandatory in Washington for part-time employees?

Washington state law requires workers’ compensation insurance for both full- and part-time employees.

However, there are circumstances in which a worker would be exempt from the state's workers’ compensation requirements:

- Domestic workers, when there is only one per home, and the employee doesn’t work more than 40 hours per week

- Gardening, maintenance, or repair workers at private homes

- Musicians and entertainers at specific events

- A child under 18 who is employed by a parent for farm work

- Cosmetologists and barbers who rent or lease their space

- Federal employees

For details and a full list of exemptions, check the DLI Employers' Guide to Workers' Compensation [PDF].

Washington state law requires workers' compensation insurance for both full- and part-time employees.

What does workers’ comp cover in Washington state?

Here are several examples of how workers' compensation insurance coverage helps pay expenses for injured workers:

- A fast food worker burns themselves while preparing an order for a customer. Workers' comp would cover their medical treatment and pain medication.

- A caregiver develops a shoulder injury from lifting and turning patients. Workers' comp would cover their surgery, medications, and physical therapy. It also provides temporary disability benefits until they have recovered, including a percentage of their lost wages.

- A software developer is diagnosed with carpal tunnel from typing on their keyboard repetitively over years of working in the office. Workers' comp would cover the cost of the surgery, medications, and physical therapy post-recovery.

- A retail store employee slips on a wet floor and hits their head. In this instance, workers' compensation would cover their emergency room trip, head MRI, and any follow-up medical expenses during their recovery.

What does workers' compensation insurance not cover?

Additionally, here's what your Washington workers' comp policy won't cover:

- Work injuries caused by intoxication, drugs, or company policy violations

- Injuries claimed after a firing or layoff

- Wages for a replacement worker

- Occupational Safety and Health Administration (OSHA) fines

How much is workers' comp insurance in Washington state?

The national average cost of workers’ compensation for small business owners is $45 per month.

Your workers' comp premium is calculated based on a few factors, including:

- Payroll

- Location, such as Seattle

- Number of employees

- Industry and risk factors

- Coverage limits

- Claims history

Though Washington workers' comp policies must be bought from the state fund, you can buy other forms of coverage through Insureon.

How to get workers' compensation insurance in Washington state

The state of Washington's workers’ compensation system is different from most other states. Washington uses a monopolistic state fund, which means that workers’ compensation insurance can only be purchased through a government-operated fund – not through a private insurer.

To apply for workers' compensation, you'll need to open a workers' compensation account through the Department of Labor & Industries' website. You will need to obtain a business license beforehand. Once your account is active and you've entered key information like the type of work your employees do, L&I will calculate your premium. You are then expected to pay your premium, as well as submit quarterly reports.

If you meet specific criteria, such as demonstrating strong financial strength, you may be eligible for self-insurance. In order to be a self-insured employer, you must submit an application with all necessary documentation to the L&I and be approved.

Verified workers' compensation insurance reviews

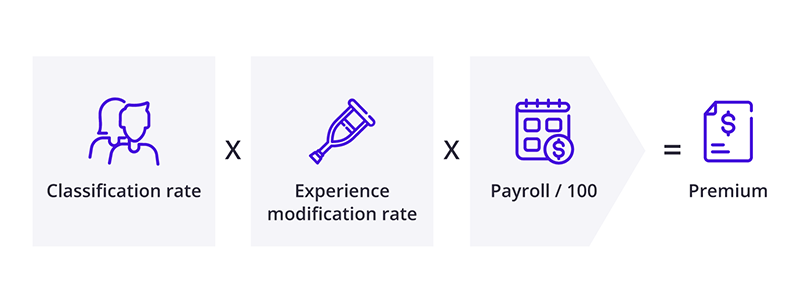

Insurance providers use a specific formula for calculating workers' comp premiums: Classification rate x Experience modification rate x (Annual payroll / $100).

Here's a breakdown of this equation:

- The classification rate reflects your employees' risk. Each worker has a classification code for the type of work they do. Insurers look up those codes in a database to find the associated rate, which is lower for office workers and higher for carpenters, tree trimmers, and others with a higher rate of injuries. Washington relies on the Department of Labor and Industries to determine rates, unlike other states that rely on the National Council on Compensation Insurance (NCCI).

- The experience modification rate (EMR) reflects your business's risk. The average experience modification rate is 1.0, which means a business is similar in risk to others in its profession. Higher EMRs reflect higher risks, such as a history of claims. The EMR only comes into play for annual workers' comp premiums of at least $5,000, so it's not a factor for many small business owners.

- The insurer multiplies these numbers with your payroll divided by 100 to determine your workers' compensation rate. Workers' compensation audits are typically done each year to ensure your business pays the right premium for this coverage.

How can Washington business owners save money on workers' comp?

To save money on workers' comp insurance, it's important to make sure you classify your employees correctly. Employees with desk jobs or other jobs with a low risk of workplace injuries cost less to insure. This also helps you avoid misclassification fines.

In some states, employers can choose to buy pay-as-you-go workers' compensation. However, this type of workers' comp policy is not allowed in Washington state.

Pay-as-you-go workers' comp coverage has a low upfront premium, and lets you make payments based on your actual payroll instead of an estimated payroll. It can be useful for businesses that hire seasonal help or have fluctuating numbers of employees.

A ghost policy is a cheap option in some states, but this is also not allowed in Washington. A ghost policy is a workers' comp policy in name only. It provides no protection or medical benefits, but can fulfill contractual requirements for a workers' comp certificate at a reduced price.

Finally, a documented safety program can help lower workers' comp costs. A safer workplace means fewer accidents, which helps keep your premium low.

How does workers' comp work in Washington state?

Workers' compensation benefits can cover medical and hospital expenses resulting from a workplace injury. It can also cover partial wage replacement if the employee is unable to work, or is delegated to light duty because of an impairment.

Workers’ compensation insurance in Washington state can include coverage for:

- Medical benefits to pay for prescriptions, surgery, and other medical care

- Some travel for medical procedures or appointments

- Reimbursement for lost or damaged property

- Permanent partial disability and permanent total disability

- Job retraining and assistance finding work after an injury

- Death benefits for fatal incidents

Injured employees can visit a medical provider of their choice for emergency treatment, but must see an authorized provider for follow-up care.

Workers' compensation insurance usually includes employer's liability insurance, but that's not the case when it's purchased through a state fund.

Washington employers who want this coverage, which protects against employee lawsuits over injuries, must purchase it as stop-gap coverage. They can usually add it to their general liability policy purchased through a private insurer.

What are the penalties for not having workers’ comp in Washington?

The State of Washington recently increased its penalties for noncompliance with its workers' compensation laws. Penalties include:

- Failure to pay a workers' compensation claim: $1,000 maximum, or double the amount of premiums incurred

- Noncompliance with recordkeeping: $500

- Failure to comply with a statutory provision: $1,000

For details, visit the Washington State Legislature.

Washington state workers’ compensation death benefits

An eligible survivor can receive a one-time benefit plus a monthly survivor’s pension if a family member dies as a result of a work-related injury or illness. The spouse of the deceased worker is automatically eligible for death benefits. The worker’s children are eligible if they are legally dependent.

Washington's workers’ compensation system also covers funeral benefits up to two times the state's average monthly wage.

Workers’ compensation settlements in Washington

Workers’ compensation settlements are agreements between the injured worker, employer, and the insurer to resolve a claim. Most workers’ comp claims in Washington become a structured settlement, which means the injured worker receives periodic payments in installments over time.

Acceptance of a structured settlement would prevent the worker from claiming future benefits for wage loss and permanent disability, but it would not prevent claims for future medical treatment. If a new injury or illness related to the original L&I claim is diagnosed or discovered later, the claim could be reopened.

What is the statute of limitations for Washington state workers' comp?

In Washington state, the workers’ compensation statute of limitations is one year from the date of injury. If the worker has an occupational disease, the statute of limitations is two years from the date it was discovered.

Get free business insurance quotes with Insureon

If you are ready to buy a commercial insurance policy, start a free application with Insureon to compare quotes from top-rated insurance carriers. A licensed insurance agent will help answer your questions and explain your coverage options.

Once you find the right policy, you can usually begin coverage and get your certificate of insurance in less than 24 hours.

Want free expert advice right in your inbox?

By entering your email address and subscribing, you agree to our Terms of Use and Privacy Policy