North Carolina workers' compensation insurance

North Carolina law specifies that any business that employs three or more people is required to carry workers’ compensation coverage. This insurance policy provides medical benefits in the event of a work-related accident.

Who needs workers’ comp in North Carolina?

Every state has different requirements for workers’ compensation insurance. Any business that employs three or more people is required to carry workers’ compensation insurance in North Carolina.

While this is the general rule, a few categories of workers are exempt:

- Some railroad workers are exempt because they are covered under federal policies

- Casual employees (for example, those whose employment is not in the trade, business, or profession of the employer and is casual in nature)

- Domestic employees of a household

- Farm laborers, if the employer has fewer than 10 full-time, non-seasonal employees

- Federal government employees

- Commission-based sellers of agricultural products

Any business that involves the presence of radiation is also required to have workers’ compensation insurance, even if the business has less than three employees.

For details, visit the NC Industrial Commission's page on employers' requirements.

Is workers’ comp mandatory in North Carolina for part-time employees?

If a North Carolina business employs three or more individuals, whether full- or part-time, it must provide workers’ comp coverage. Part-time employees are required to have workers’ compensation insurance in North Carolina if they do not fall into one of the above exceptions.

Do you need workers’ comp in North Carolina if you are self-employed?

It's always a good idea to buy workers' comp, even if it's just for yourself. Health insurance providers can deny claims for work-related injuries, which is why even sole proprietors may choose to carry coverage. It'll also supply part of the wages you'd otherwise miss out on while recovering from a work injury.

As for when it's required, sole proprietors who have no employees, members of a limited liability company (LLC), and partners are not counted as employees and are not required to have workers’ compensation coverage.

Officers of a corporation might choose to be excluded from coverage but are still counted toward the three-employee minimum. Executive officers, directors, and committee members of a nonprofit are not counted under some circumstances.

Independent contractors are not required to have coverage, but several factors affect whether a person is an independent contractor for the purposes of workers’ compensation. North Carolina law has specific criteria for determining if someone is an independent contractor.

What does workers' comp cover for North Carolina businesses?

Here are several examples of how workers' compensation insurance coverage helps pay expenses for injured workers:

- An owner-operator truck driver is injured in an auto accident and hospitalized, but never recovers enough to return to work. They receive permanent disability payments, in addition to compensation for their medical expenses.

- A retail store employee slips on a wet floor and hits their head. In this instance, workers' compensation would cover their emergency room trip, head MRI, and any follow-up medical expenses during their recovery.

- A registered nurse develops a shoulder injury from lifting and turning patients. Workers' comp would cover their surgery, medications, and physical therapy. It also provides temporary disability benefits until they have recovered, including a percentage of their average weekly wage.

- A fast food worker burns themselves while preparing an order for a customer. Workers' comp would cover their medical treatment and pain medication.

What does workers' compensation insurance not cover?

Additionally, here's what your workers' comp policy won't cover:

- Injuries caused by intoxication, drugs, or company policy violations

- Injuries claimed after a firing or layoff

- Wages for a replacement worker

- Occupational Safety and Health Administration (OSHA) fines

How much does workers' compensation insurance cost in North Carolina?

The average cost of workers’ compensation in North Carolina is $52 per month.

Your workers' comp premium is calculated based on a few factors, including:

- Payroll

- Location, such as Raleigh

- Number of employees

- Industry and risk factors

- Coverage limits

- Claims history

How is workers' comp coverage purchased in North Carolina?

Business owners in North Carolina have three choices when it comes to buying a workers' compensation policy:

- Private insurance companies. You could contact each workers' compensation insurance carrier independently to compare their products and rates, but that's where agents and brokers like Insureon come in. As the nation's leading digital insurance agency, Insureon partners with 40+ top-rated insurance carriers to deliver the right coverage for your business. Fill out an easy online application to get started.

- Self-insurance. North Carolina employers who qualify can self-insure their workers’ compensation claims, either individually or as part of a group fund. To apply for self-insurance status, employers must file an application with the North Carolina Department of Insurance (DOI), specifically the Self-Insurance Division. To qualify, individuals must be financially sound and have proof of a surety bond. Group funds may have different requirements.

- The assigned risk residual market. If they’re unable to qualify, they can buy it from the state’s assigned risk residual market, the North Carolina Workers' Compensation Insurance Plan (NCWCIP), which is administered by the North Carolina Rate Bureau (NCRB). This is the insurance coverage of last resort for employers that are unable to qualify for standard coverage due to their high-risk status.

Verified workers' compensation insurance reviews

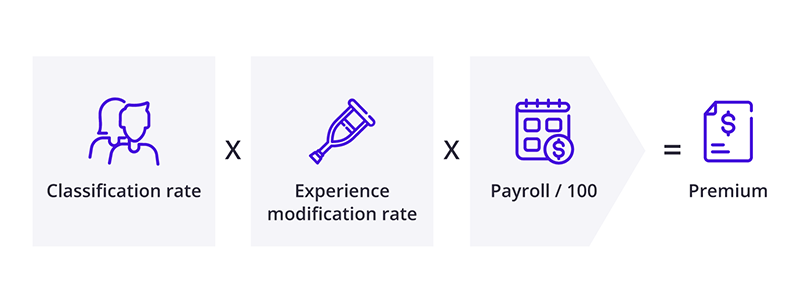

Insurance providers use a specific formula for calculating workers' comp premiums: Classification rate x Experience modification rate x (Annual payroll / $100).

Here's a breakdown of this equation:

- The classification rate reflects your employees' risk. Each NC worker has a classification code for the type of work they do. Insurers look up those codes in a database to find the associated rate, which is lower for office workers and higher for carpenters, handyman contractors, and others with a higher rate of injuries. North Carolina uses the North Carolina Rate Bureau database, unlike other states that rely on the National Council on Compensation Insurance (NCCI).

- The experience modification rate (EMR) reflects your business's risk. The average experience modification rate is 1.0, which means a business is similar in risk to others in its profession. Higher EMRs reflect higher risks, such as a history of claims. The EMR only comes into play for annual workers' comp premiums of at least $5,000, so it's not a factor for many small business owners.

- The insurer multiplies these numbers with your payroll divided by 100 to come up with your workers' comp premium. Workers' compensation audits are typically done each year to ensure your business pays the right premium for this coverage.

How can North Carolina business owners save money on workers' comp?

To save money on workers' comp insurance, it's important to make sure you classify your employees correctly. Employees with desk jobs or other jobs with a low risk of injury cost less to insure. This also helps you avoid misclassification fines.

In some cases, small business owners can choose to buy pay-as-you-go workers' compensation. This type of workers' comp policy has a low upfront premium, and lets the policyholder make payments based on their actual payroll instead of estimated payroll. It's useful for businesses that hire seasonal help or have fluctuating numbers of employees.

A ghost policy is a cheap option in some states, including North Carolina. A ghost policy is a workers' comp policy in name only. It provides no protection, but can fulfill contractual requirements for a workers' comp certificate at a reduced price.

Finally, a documented safety program can help lower workers' comp costs. A safer workplace means fewer accidents, which helps keep your premium low.

How does workers' comp work in North Carolina?

Workers' compensation insurance covers the cost of medical treatment when an employee suffers a workplace injury or develops an occupational disease. This policy also provides compensation for lost wages, typically two-thirds of the employee's average weekly wage, until they return to work.

In the state of North Carolina, workers' compensation benefits include:

- Medical care by a provider chosen by the employer or insurer

- Reimbursement for travel related to medical treatment

- Temporary total disability or partial disability benefits until the employee recovers

- Permanent partial disability benefits for lasting impairment, such as a back injury

- Permanent total disability benefits for employees who are unable to return to work

- Vocational rehabilitation services

- Death benefits for fatal incidents

Most workers' comp policies include employer's liability insurance, which can help cover legal expenses if an employee blames their employer for an injury. However, the exclusive remedy provision in most workers' comp policies prohibits an employee from suing their employer if they accept workers' comp benefits.

What are the penalties for not having workers’ comp in North Carolina?

There are strict penalties for failure to comply with North Carolina workers’ compensation law, including fines and possible criminal prosecution.

The North Carolina Industrial Commission imposes a fine of one dollar per employee per day for failure to secure coverage. This penalty carries a $50 per day minimum and a $100 per day maximum, regardless of the number of employees. To put it in perspective, if an employer fails to carry coverage for one year, it would face a fine between $18,250 and $36,500.

If the failure to secure coverage is found to be “willful,” the employer could be charged with a felony. If the failure is neglectful, it could be ruled a misdemeanor. Any person whose job it is to maintain workers’ compensation insurance for an employer can be held personally liable for the compensation owed to an injured worker. That person could also face criminal charges.

If an injury occurs, the employer would be responsible for medical treatment costs and wage replacement benefits, even if it did not carry the required insurance. Therefore, the protection that a workers’ compensation settlement would offer to an employer would not exist.

Without the protection offered by workers' comp, the employee could also sue the employer for damages.

Workers’ compensation death benefits in North Carolina

Workers’ compensation death benefits in North Carolina can, under certain circumstances, be more flexible than in some other states.

The North Carolina Supreme Court created what is called the “Pickrell presumption,” which means that if the exact cause of death is unknown and the circumstances of the accident are unexplained, the dependents of a deceased worker might still be able to receive workers’ compensation benefits.

A surviving spouse and minor children are presumed to be wholly dependent. The spouse would need to be living with the deceased worker or living apart for justifiable cause. A minor child is any child under 18 years old, including adopted children, stepchildren, acknowledged illegitimate children who are dependent on the worker at the time of death, and any children born after the worker’s death.

If there are no wholly dependent family members, benefits would go to partially dependent individuals, based on the amount of support that the deceased worker had been providing. Benefits can also be paid to next of kin in a lump sum. If there is no next of kin, workers’ compensation insurance pays only for burial expenses.

The weekly death benefit is two-thirds of the deceased worker’s average weekly wage, payable for a minimum of 500 weeks, or until a child turns 18. Burial expenses can be paid up to $10,000.

Workers’ comp settlements in North Carolina

There are a variety of reasons why an injured employee would find it advantageous to choose a settlement to close a workers' compensation claim. It would provide immediate cash to pay medical bills and avoid a lengthy hearing process, but it’s also beneficial for the employer.

Once a lump sum settlement is reached, the claim is closed and the employer can no longer be responsible for additional costs. It also saves the time and cost associated with litigation or further negotiations.

There are three ways to reach a workers’ compensation settlement in North Carolina:

A compromise settlement agreement is a full and final settlement of a workers' comp claim. Generally, this would result in a single lump sum payment to the injured worker. Occasionally, it can be in the form of a structured settlement, which does not change the result but is paid to the worker in installments over time. This generally happens when there are very serious injuries that result in ongoing long-term care.

A Form 26A settlement means that the insurance company has agreed to the classification of the work-related disability and would pay the agreed-upon amount in weekly installments.

A Form 21 settlement is similar to the above, except it is with respect to temporary – not permanent – disability benefits. Unlike a lump sum agreement, the injured worker could file a second claim after two years if treatment is still required.

Workers’ compensation statute of limitations in North Carolina

The workers’ compensation statute of limitations in North Carolina is two years from the date of the injury. If the injured person does not file the Form 18 claim within that time, the claim will not be able to be processed.

North Carolina law specifies that an employer is required to immediately report any work-related injury or illness to its insurance carrier. If the employee must miss more than one day of work, or if the medical expenses are more than $2,000, the employer or carrier must file a report to the Industrial Commission within five days.

That report must also be provided to the employee, along with a blank report that the employee can use to file a claim.

Get free workers’ comp quotes with Insureon

If you are ready to buy a workers' compensation policy, start a free application with Insureon to compare quotes from top-rated insurance carriers. A licensed insurance agent will help answer your questions and explain your coverage options. Once you find the right policy, you can usually begin coverage and get your certificate of insurance in less than 24 hours.

Want free expert advice right in your inbox?

By entering your email address and subscribing, you agree to our Terms of Use and Privacy Policy