Installation business insurance cost

Installation professionals can save money on business insurance by comparing quotes from different providers with Insureon. Your premium depends on the type of policy, coverage limits, deductibles, and factors such as your business's location and number of employees.

Top installation business insurance policies and their costs

Here are the top insurance policies and bonds purchased by installation businesses and their average monthly costs:

- General liability insurance: $73 per month

- Workers' compensation insurance: $193 per month

- Commercial auto insurance: $216 per month

- Contractor's tools and equipment insurance: $14 per month

- Cyber insurance: $145 per month

- Commercial umbrella insurance: $99 per month

- Surety bonds: $13 per month

Our figures are sourced from the median cost of policies purchased by installation businesses through Insureon. The median offers a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

General liability insurance

Installation businesses and contractors pay an average premium of $73 per month, or $879 per year, for general liability insurance.

This policy helps pay for legal costs if a customer trips over your ladder and suffers an injury, or if an installer accidentally damages a customer's property. It also covers advertising injuries, which include slander, libel, and copyright infringement.

This is the average general liability policy for installation businesses that buy from Insureon:

Premium: $73 per month

Policy limits: $1 million per occurrence; $2 million aggregate

Deductible: $500

Insureon’s licensed agents typically recommend a business owner’s policy over a standalone general liability policy. A BOP combines general liability insurance with commercial property insurance to protect your tile, glass, or HVAC installation company, and costs less than purchasing each policy separately.

Small, low-risk businesses are typically eligible for a BOP. Businesses with higher risks can often save money with a commercial package policy (CPP), which offers liability and property coverage with more coverage options and higher policy limits.

The cost of general liability depends on several factors

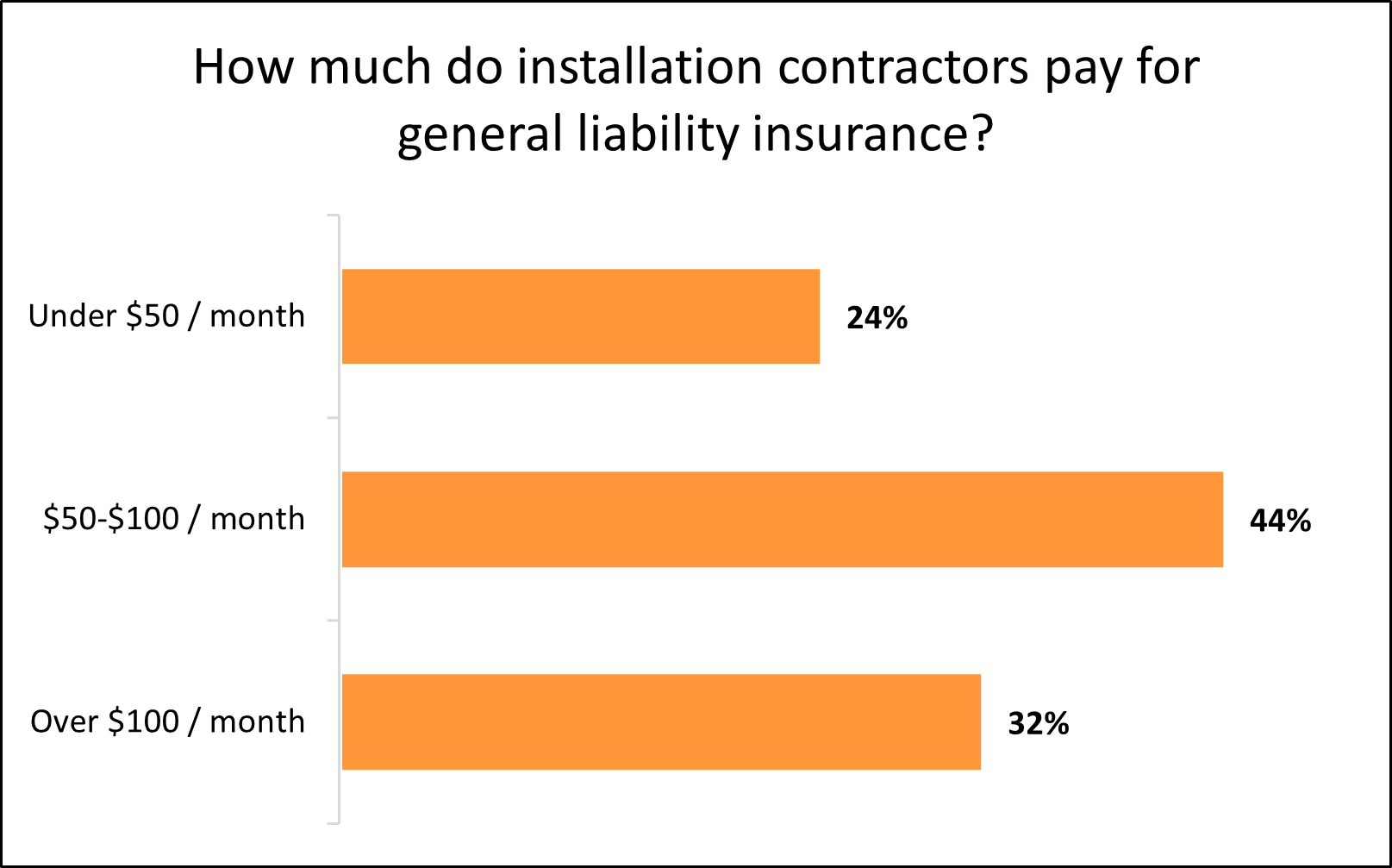

Among installation businesses and independent contractors that purchase general liability coverage with Insureon, 24% pay less than $50 per month and 68% pay $100 or less each month.

The amount you pay depends on several factors, such as the size of your business, how often you interact with customers, and your business revenue.

Businesses with larger premises, such as a fence installation business with a two-story office and a storage yard, typically pay more for general liability insurance than smaller businesses, such as a siding installation business with only a few employees.

Your industry risks, years in operation, claims history, and location will also affect your insurance premium.

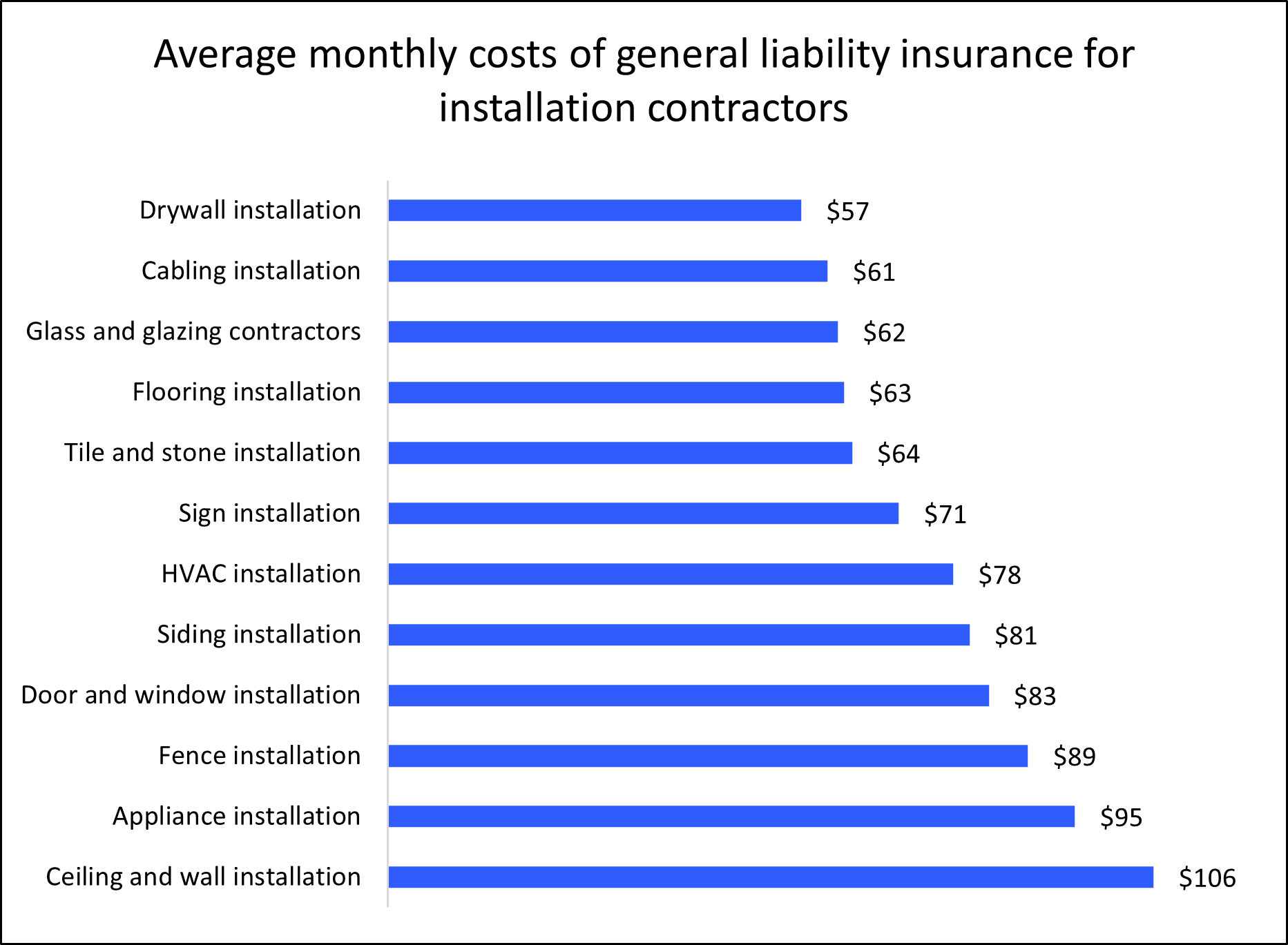

Industry risks affect the cost of general liability insurance

When determining your insurance premium, providers look at the claims history for businesses that are similar to your own. General liability premiums are higher for professions that often report bodily injuries or property losses.

For example, a ceiling installer could accidentally injure someone if a portion of the ceiling fell, while businesses that install drywall or cables are less likely to cause injuries and other damages.

The average cost of general liability for a ceiling installation business is $106 per month, while the average for drywall installers is $57 per month. As you can see, premiums vary significantly across professions.

Choose limits that match your installation company's budget

Policy limits are the maximum amounts your insurer will pay on covered claims. Most installation business owners (95%) choose a general liability policy with a $1 million per-occurrence limit and a $2 million aggregate limit.

The per-occurrence limit is the maximum your insurer will pay for a single incident, while the aggregate limit is the maximum they will pay for all claims during your policy period, typically one year.

Choosing lower limits is one way to get an affordable premium, but you'll also want to make sure it's enough to cover a lawsuit.

Learn other ways to save, how to choose coverage limits, and more on Insureon's general liability insurance cost analysis page.

Workers' compensation insurance

Installation businesses pay an average of $193 per month for workers' compensation insurance, or $2,320 annually. This insurance policy covers medical expenses when an employee is injured on the job, and it also provides disability benefits while they're recovering and unable to work.

Typically, state laws require installation businesses that have employees to carry this coverage. It's also recommended for sole proprietors, as health insurance plans can deny claims when an injury or illness is related to your job.

Most workers' comp policies include employer's liability insurance, which covers the cost of lawsuits related to workplace injuries.

The cost of workers' comp depends on several factors, such as your business's location, the number of employees you have, and the type of work they do. Learn more about how workers' comp costs are calculated and how to save money on your policy.

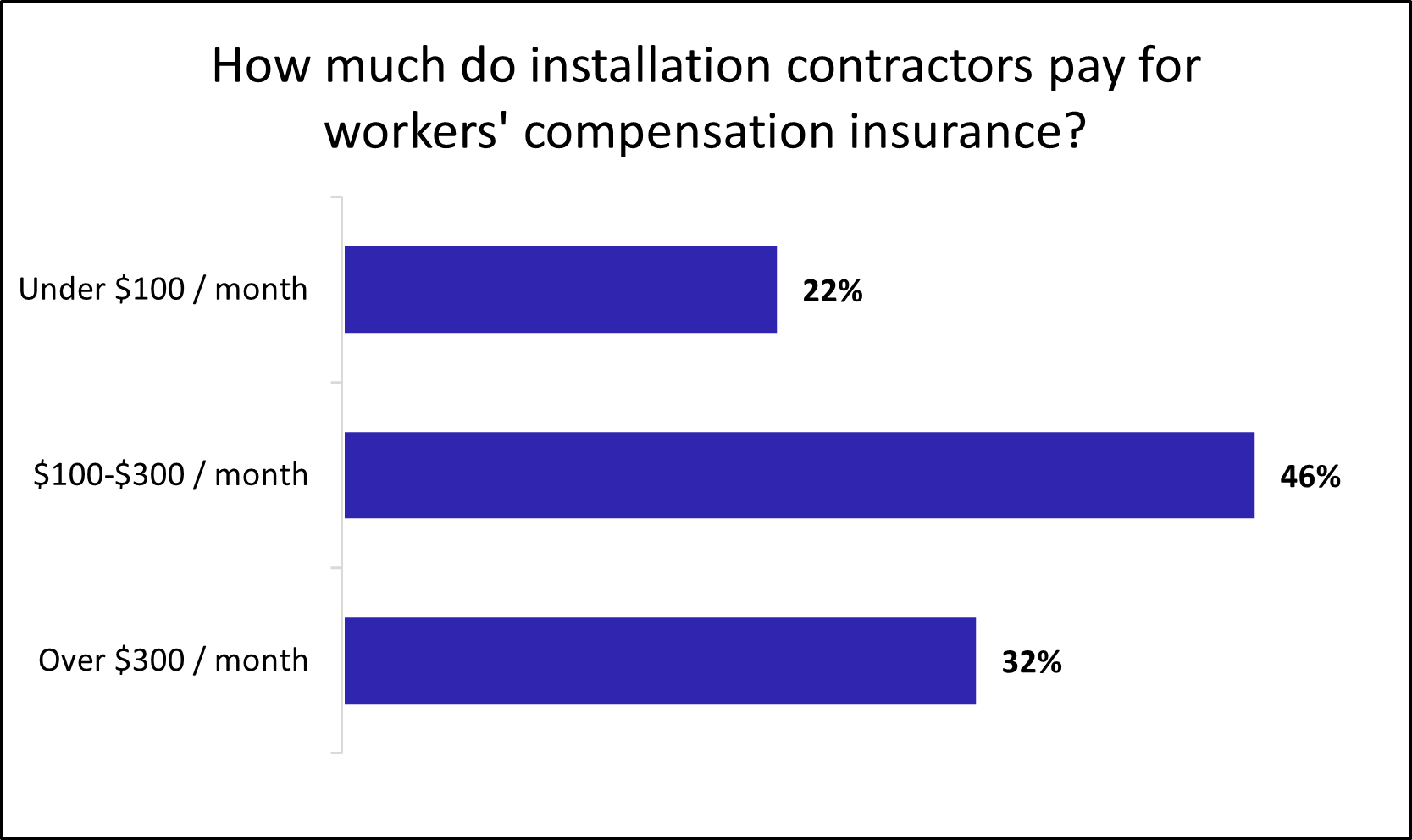

Workers' comp costs depend on your workforce

Among installation businesses that purchase workers’ compensation insurance with Insureon, 22% pay less than $100 per month and 46% pay between $100 and $300 per month.

Insurance companies primarily look at the number of employees you have and their level of occupational risk when determining your premium.

Commercial auto insurance

Installation businesses pay an average of $216 per month, or $2,588 per year, for commercial auto insurance. This policy can pay for property damage and medical bills when your truck or other vehicle gets into an accident. It can also cover vehicle theft, vandalism, and weather damage.

Most states require a commercial auto policy for businesses with company-owned vehicles, such as HVAC trucks and appliance company vans. For personal, rented, and leased vehicles used for work purposes, look to hired and non-owned auto insurance (HNOA) instead.

The cost of commercial auto insurance depends on several factors, including the policy limits you choose, the value of your vehicle, and the driving records of anyone permitted to drive. Learn how insurers calculate your premium and how to save money on your commercial auto policy.

Contractor’s tools and equipment insurance

On average, installation businesses pay only $14 per month, or $169 per year, for contractor’s tools and equipment insurance.

A form of inland marine insurance, this policy covers the cost of lost, stolen, or damaged tools and equipment. Unlike standard property insurance, it protects your items while they're in transit, at a customer's home, or stored off-site.

The cost of contractor's tools and equipment coverage depends on the value of your tools and equipment and the type of work you do.

Cyber insurance

Small businesses pay an average of $145 per month, or $1,740 annually, for cyber insurance. You might also see this policy called cyber liability insurance or cybersecurity insurance.

Cyber insurance helps installation companies recover financially after a data breach or cyberattack. It can help pay for customer notification costs, fraud monitoring services, and other costs necessitated by state data breach laws.

The cost of cyber insurance depends on the amount of personal information handled by your installation business, along with the number of employees who can access it.

Commercial umbrella insurance

Installation businesses pay an average of $99 per month, or $1,189 annually, for commercial umbrella insurance, which is available in $1 million increments.

This policy boosts the protection of your general liability insurance, commercial auto insurance, and employer's liability insurance. When a claim exceeds the limits of the underlying policy, umbrella insurance kicks in to provide coverage.

Installation businesses may need this type of insurance if a client requires liability coverage in excess of $2 million. For example, a client might require you to carry $3 million in general liability coverage before they'll allow your workers onto their property. You could carry $2 million in general liability insurance along with a $1 million umbrella policy to meet this requirement.

The cost of umbrella insurance depends on your risks and how much coverage you buy. You need to buy a certain amount of underlying coverage before you can purchase umbrella insurance.

Surety bonds

Installation businesses pay an average of $13 per month for surety bonds, or $158 annually. A surety bond reimburses your client if you're unable to fulfill the terms of a contract or other agreement.

The cost of a surety bond is a percentage of the total bond amount. It may also be influenced by your type of work and your credit score.

Key factors influencing policy costs

Your insurance provider calculates your installation business insurance premiums based on a number of factors, including:

- Industry and trade: High-risk industries or trades, such as HVAC or electrical cable installation, will have more costly premiums than lower-risk activities like installing flooring.

- Business equipment and property: Higher-value equipment is more likely to result in more expensive premiums than lower-cost items. Equipment that is used more frequently also tends to cost more to cover than infrequently used items.

- Business size and revenue: Insurance companies assume businesses and contractors that are making more money, such as those in the installation industry, are also going to be facing increased industry exposure, which results in higher premiums.

- Location: Businesses that are located in areas prone to natural disasters, increased foot traffic, or high crime rates may have to pay higher premiums than those located in areas where these factors are less present.

- Number of employees: The more employees or contractors that are on staff, the more opportunities there are for accidents to happen or for potential damage to occur to someone else's property.

- Types of insurance coverage purchased: Some policies are required to obtain certain installation projects or contracting work. These required policies often are needed to cover more expensive accidents and lawsuits, which tend to cost more than basic coverages.

- Coverage limits and deductibles: Higher coverage limits and lower deductibles will typically increase premium costs, while lower limits and a higher deductible can help keep insurance rates low.

- Claims history: An installation business with a lengthy list of previous insurance claims will likely pay more for insurance than a company with no claims history.

How do you buy installation business insurance with Insureon?

Insureon works with top-rated U.S. providers to find affordable installation business insurance, whether you work independently as an appliance installer or own a tile and stone business with several employees.

Apply today to get free quotes with our easy online application. A licensed insurance agent who specializes in your profession's unique risks will help you find the right type of business insurance and answer any questions. Typically, you can get a certificate of insurance (COI) within 24 hours of submitting your application.

What our customers are saying

Want free expert advice right in your inbox?

By entering your email address and subscribing, you agree to our Terms of Use and Privacy Policy