Cheap general liability insurance

Saving money on commercial general liability insurance involves analyzing your risks, reducing your liabilities as much as possible, and comparing insurance quotes from multiple providers.

How do I find cheap general liability insurance?

General liability insurance covers common business risks, such as a customer’s bodily injury at your business, damage to a customer’s property, or an advertising injury. If a customer blames your business for an injury or other harm, a general liability policy would help pay for any resulting medical payments and defense costs, including legal fees.

Starting at $21 per month, a general liability insurance policy can be affordable for several types of small businesses.

There are many ways for you to keep costs low and avoid more expensive rates. For example, you can compare rates from different insurance companies, such as through Insureon's easy online application that retrieves quotes from multiple trusted carriers.

In addition, bundling your general liability policy with other insurance products, choosing cost-saving options on your general liability insurance coverage, and managing your risks to avoid insurance claims can also help you pay less.

Table of contents

- Compare general liability quotes

- Bundle general liability insurance with other policies

- How much does general liability insurance cost?

- Customize your general liability policy

- Manage risks to keep premium low

- Cheapest states to purchase general liability insurance

- Cheapest industries to purchase general liability insurance

- Find affordable general liability insurance with Insureon

- Additional coverages to consider

Compare general liability insurance quotes

Getting quotes from multiple insurance companies is one of the best ways to find affordable commercial general liability (CGL) insurance. You could go straight to the source and contact each carrier directly, or you could work with an online insurance agency like Insureon for a simpler and easier experience.

At Insureon, you can get general liability insurance quotes from top-rated providers, such as The Hartford and Chubb, with a single online application. Our licensed insurance agents are available to help you customize a policy for your business's unique needs, making sure you meet state laws and your profession's requirements.

Once you select the general liability insurance policy you need, you can get coverage and a certificate of insurance (COI) in less than 24 hours.

Bundle general liability with other policies

Many small businesses save money on general liability insurance with a business owner’s policy (BOP). A BOP combines general liability coverage and commercial property insurance in one policy, and is usually less expensive than buying them separately.

A BOP typically provides coverage for:

- Injuries to customers, clients, and other third parties

- Damage to property owned by your business or a third party

- Product liability for items manufactured, distributed, or sold by your business

- Libel, slander, and copyright infringement

Depending on your profession, you may be able to bundle other types of coverage as well, such as professional liability insurance or business interruption insurance.

How much does general liability insurance cost?

The average cost of general liability insurance for Insureon's customers is $45 per month.

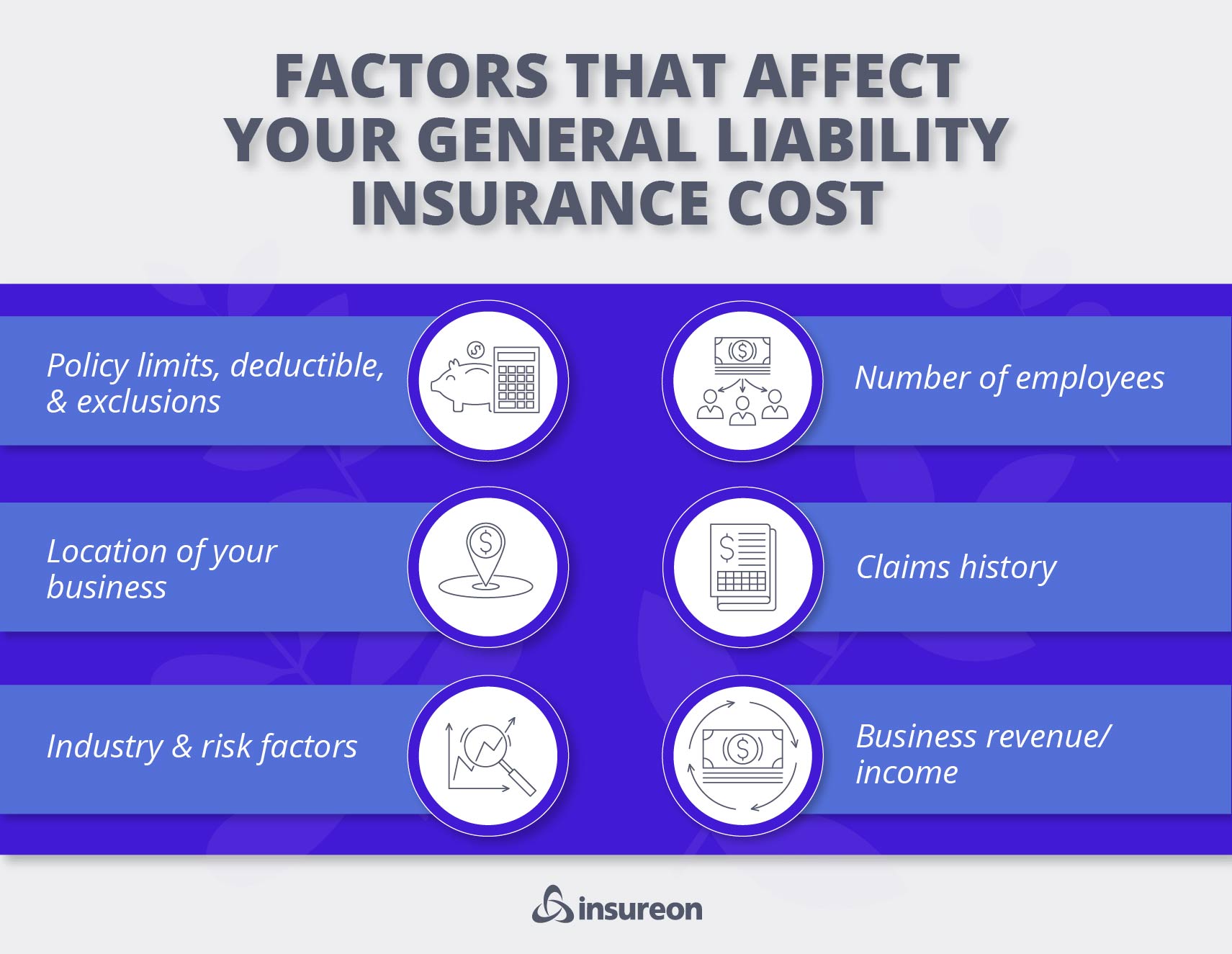

General liability insurance premiums are calculated based on several factors, including:

- Industry risks

- Location

- Business operations

- Number of employees

- Policy limits and deductible

Verified general liability coverage reviews

Customize your general liability policy

When buying a general liability policy, it’s important to make sure you’re fully covered in case of an accident, while also keeping your premium as low as possible. You’ll need to take a close look at your business and its coverage needs, which may require help from an agent.

Some ways of saving money on a general liability premium are rather easy. For example, many insurance companies offer a discount if you pay your entire premium on an annual basis rather than monthly.

Other ways to save money on your general liability policy through customization include:

Choose the right policy limits and deductible

How you set your general liability insurance limits and deductible can have a tremendous impact on your business insurance costs.

Every general liability policy has a per-occurrence limit and an aggregate limit. The per-occurrence limit is the maximum amount the insurance provider will pay on a single claim. The aggregate limit is the most it’ll pay for all claims during the policy period, which is usually one year. The higher your coverage limits, the more expensive your premium.

While it's tempting to choose lower limits, you could end up paying more in the long run if you have an expensive claim but not enough insurance to cover it.

If you have several liability policies, another option is commercial umbrella insurance. This policy offers an affordable way to increase your insurance coverage across multiple policies, not just your general liability policy.

Finally, you can save money by choosing a higher deductible, but there's also a tradeoff. Insurance companies won't provide any benefits until you've paid the deductible, so make sure it's an amount you can easily afford.

Examine the exclusions and other insurance options

Your general liability policy may include coverage you don’t necessarily need. If that's the case, see if you can have it removed to lower your premium. You might also consider a different policy that doesn’t have those extras.

Likewise, you’ll want to make sure the policy's exclusions don’t leave out risks you want to insure. You may be able to add an endorsement to a policy that's lacking coverage you want, such as product liability insurance.

When it’s time to renew your policy, your insurer might conduct a premium audit to make sure your risks match your coverage. They'll look at your business and its financial records to make sure your insurance coverage accurately reflects your risks.

Find cheap general liability insurance with Insureon

You know you need insurance for your small business, but where to start? And how can you keep costs down?

Insureon is here for you. You can get customized quotes from top carriers.

Most small businesses start with a general liability policy. You can combine property coverage with your liability insurance at a discount of $57 per month. Maintaining a safe work environment can help you manage risk and lower your insurance costs too.

Get affordable insurance from the best carriers. Start your application now! Insureon. Protection is peace of mind.

Your claims history is a significant factor in setting your general liability premium. Risk management programs, training, and safety reviews with your employees can help you avoid claims and keep your premium at an affordable rate.

Reduce accidents at your business

If your business is open to the public, make sure your entrances and exits are well lit and all areas are free of obstructions. This includes walkways and parking areas. Inspect your property on a regular basis to prevent slip-and-fall accidents before they happen.

If any unsafe issues arise, such as a wet floor or a broken step, make sure you post a warning sign and fix the problem promptly. Document your efforts for ongoing repairs, and establish a procedure for employees to report and eliminate hazards.

Test your products and make sure instructions are clear

To avoid product liability lawsuits, you'll want to ensure the safety of your products. This is true for manufacturers, retailers, and wholesalers, as anyone in the supply chain could be held liable for a defective product or similar issue.

Any product you sell should undergo rigorous safety testing before you offer it to the public. Whatever documentation or instructions you include with your products should be easy to understand and explain any risks associated with their use.

Make sure anything you publish—whether on social media, your website, or advertisements—avoids any risk of personal injuries and advertising injuries. That includes libel, slander, invasion of privacy, and reputational harm.

For example, a customer might file a lawsuit if you post a photo of them without permission on your business's Facebook page. If you compare your business to other companies, make sure you can prove whatever you claim.

Establishing a set of rules for advertising campaigns and social media posts, and offering guidelines for your employees, can help avoid a lawsuit.

Establish a protocol for other people's property

If your business handles other people's property, make sure you follow the best practices within your field and train your employees on risk management.

For example, employees at a computer repair shop might be prohibited from bringing drinks into the repair room, or a bar might prohibit customers from charging their phones at the counter.

Depending on your industry, you may need to secure additional coverage for belongings in your care, custody, or control, such as garage keepers insurance for customer vehicles stored at a repair shop.

As with other safety measures, make sure you document your efforts and check that your employees are following the correct procedures.

Cheapest states to purchase general liability insurance

Though it may not be the primary factor, policyholders in certain states can expect to pay less for general liability insurance than others.

By bundling your general liability coverage with commercial property insurance in a business owner's policy, you can expect to pay less than purchasing each of these coverages separately in several states.

Here are some states where general liability insurance costs are lower than average, along with costs for business owner's policies:

| State | General liability insurance cost | Business owner's policy cost |

|---|---|---|

$35 per month | $58 per month | |

$36 per month | $51 per month | |

$38 per month | $60 per month | |

$39 per month | $59 per month | |

$40 per month | $55 per month | |

$40 per month | $58 per month | |

$40 per month | $51 per month | |

$42 per month | $59 per month | |

$42 per month | $73 per month | |

$42 per month | $75 per month |

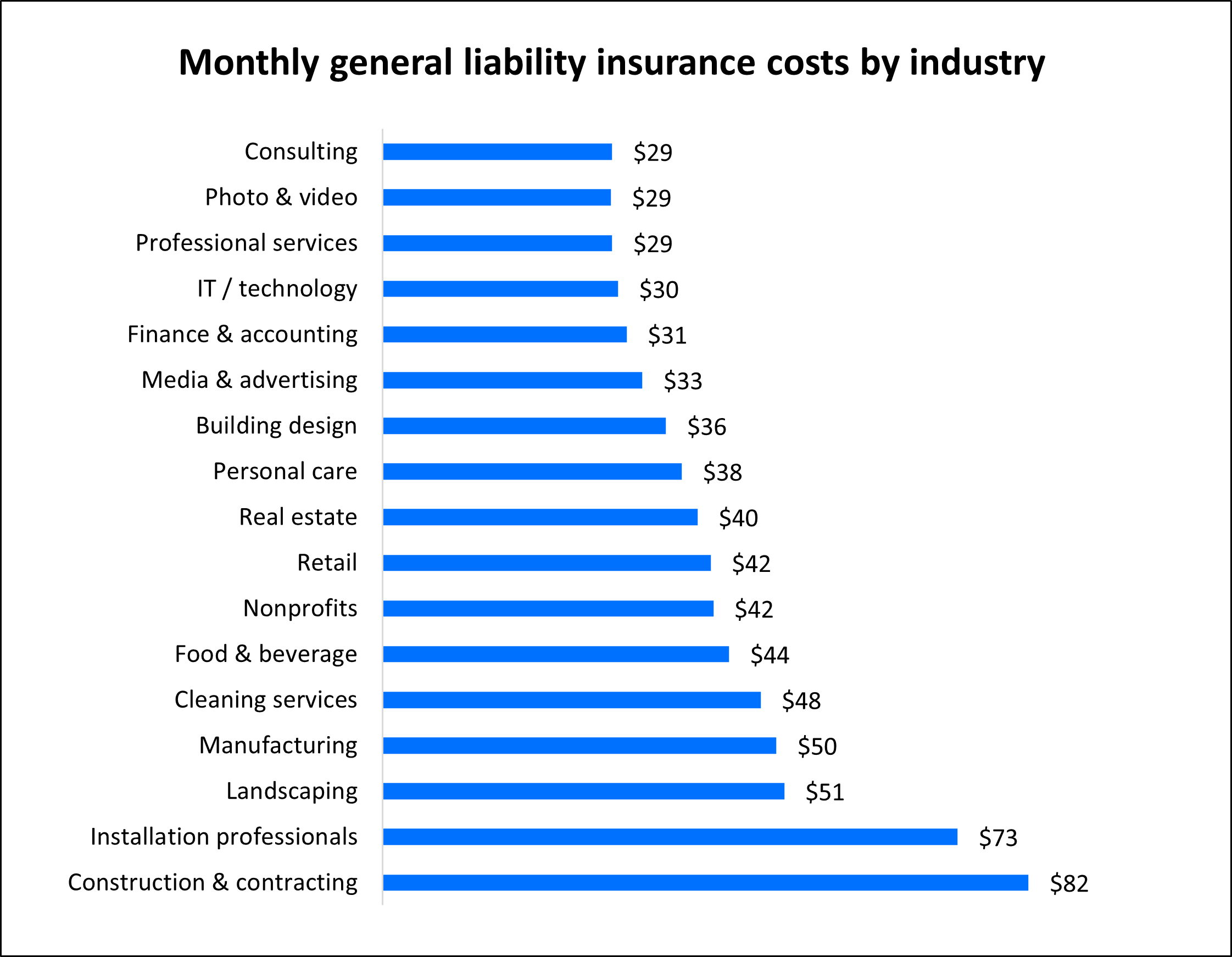

Cheapest industries to purchase general liability insurance

In addition to your location, your industry can affect how much you pay for general liability insurance. Generally speaking, industries that have a lower risk of third-party bodily injuries or property damage can expect to pay a lower premium.

For example, photographers, real estate professionals, and companies that offer professional services have minimal risks compared to more hazardous industries like construction and installation.

Here's a look at general liability insurance costs for different industries.

How to find affordable general liability insurance with Insureon

Complete Insureon’s easy online application today to get free quotes for general liability insurance coverage from top-rated U.S. companies. You can also speak with an agent about the types of coverage your business needs and if there are any discount bundles available for general liability and other business liability insurance.

Once you find the right policy, you can usually begin coverage and get your certificate of insurance in less than 24 hours.