General liability insurance costs

The cost of general liability insurance varies for small businesses depending on several factors. As part of the underwriting process, insurers will consider your industry, where you are located, your business operations, and your history of claims.

What is the average cost of commercial general liability insurance?

Small businesses pay an average premium of $45 per month for general liability insurance. Annual policy costs range from around $250 to over $3,000 per year, depending on certain factors about your business.

A general liability policy covers accidents that harm customers, which is why businesses with heavy foot traffic pay more for this coverage. Other factors that can affect your premium include your business location, revenue, and the policy limits and deductible you choose.

Our figures are calculated using the median cost of policies sold by leading insurance companies to Insureon's small business customers. The median offers a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

Typical general liability insurance costs for Insureon customers

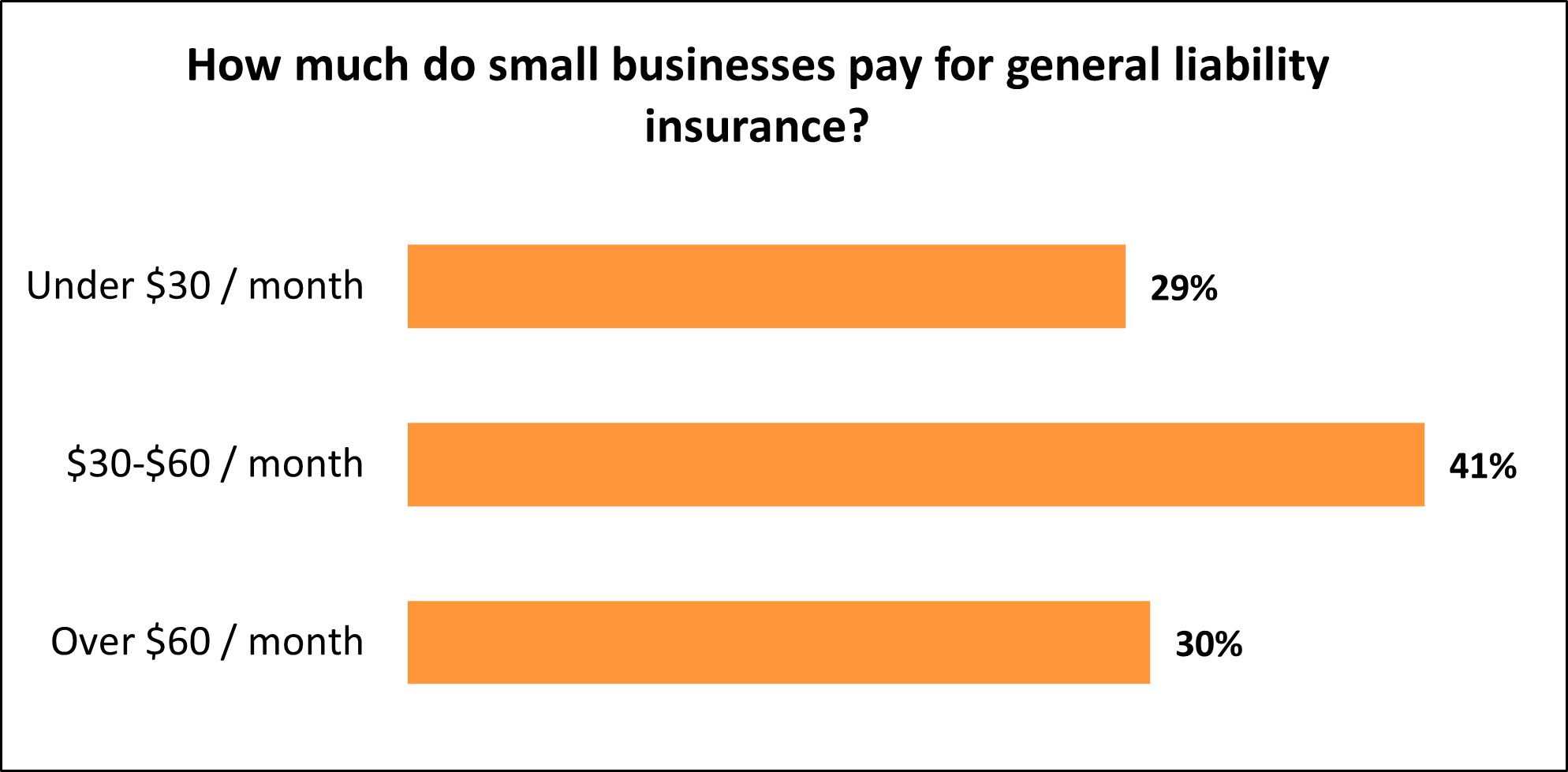

While Insureon's small business customers pay an average of $45 monthly for general liability coverage, 29% pay less than $30 and 41% pay between $30 and $60 per month. Annual premiums range from a low of $265 to a high of $3,030.

The cost varies for small businesses depending on some factors outside your control, such as your business size, along with the amount of coverage you choose to buy.

Understanding general liability insurance cost factors

Your insurance provider calculates your general liability premium based on a number of factors, including:

- Your industry and type of work

- Your policy limits and deductible

- Location of your business

- Number of employees

- Annual revenue

- Condition of your business premises

- Your class code and payroll

- Experience in your profession

- Insurance claims history

An annual general liability insurance audit can help you determine if you have the right coverage or if you need to make adjustments. For instance, you may need higher coverage limits as your business grows and expands.

Industry risks

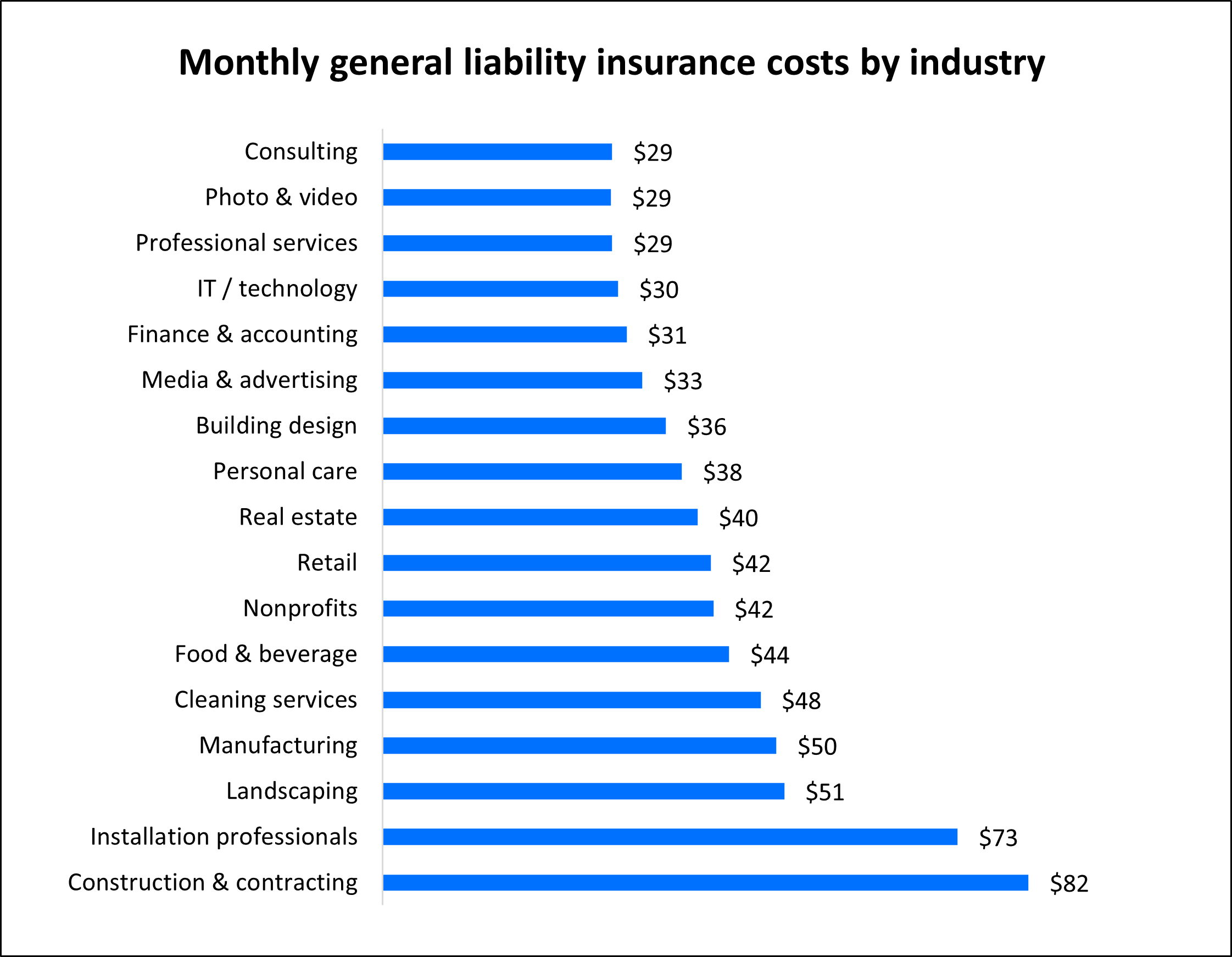

Our analysis of general liability insurance costs reveals that for small businesses, your industry has the biggest impact on your premium. Generally, insurance companies charge high-risk industries higher premiums, while low-risk industries enjoy lower rates.

For example, brick-and-mortar retailers open to the public are exposed to more risk than IT consultants working from a home office. The graph below illustrates how the type of business affects what you'll pay for general liability insurance coverage.

Depending on the industry that you work in, such as construction or cannabis, you may be required by your state to carry comprehensive general liability insurance.

For other businesses that provide professional services, such as those in real estate, insurance, or healthcare, you may need professional liability insurance (also called errors and omissions insurance) before you can get a license.

Policyholders who work in construction, cleaning, and landscaping have the highest general liability insurance premiums because they often do work that involves other people's property. General liability policies can pay for damage you or your employees cause to someone’s property.

Top industries we insure

Policy limits and deductible

If you want car insurance that pays for a wide range of damage, you have to pay more for it. The same rule applies to business liability insurance. If you want a policy that covers more expensive accidents and lawsuits, expect to pay more than you would for basic coverage.

Most small business owners choose general liability policy limits of $1 million / $2 million. This includes:

- $1 million per-occurrence limit. While the policy is active, the insurer will pay up to $1 million to cover claims from a single incident.

- $2 million aggregate limit. During the policy period (usually one year), the insurer will pay up to $2 million to cover all claims.

Ninety-one percent of Insureon customers select a general liability policy with these coverage limits. Five percent of our customers choose a policy with $2 million / $4 million limits, the next most popular choice.

When buying a policy, it's a good idea to make sure the deductible is something you can easily afford. If you can’t pay for it in a crisis, your insurance won’t activate to cover your liability claim. The average deductible that Insureon customers choose for general liability insurance is $500.

The right amount of insurance coverage depends on your business needs. You want coverage that'll cover a potential lawsuit, without buying more than you need. Chat with a licensed insurance agent if you're unsure how much coverage is appropriate.

Business location

Your business location can play a large role in the premium that you pay. For example, businesses that are situated in areas with higher crime rates or increased foot traffic may have to pay higher premiums than those located in less risky areas.

Premiums can also vary slightly depending on your state. Here are some examples of the average cost of general liability insurance across different states:

| State | General liability insurance cost |

|---|---|

$42 per month | |

$49 per month | |

$42 per month | |

$42 per month | |

$42 per month | |

$44 per month | |

$52 per month | |

$43 per month | |

$43 per month | |

$40 per month |

While general liability is recommended for many small businesses, most states will require by law that small business owners carry workers' compensation insurance if they have employees, and commercial auto insurance if they have business-owned vehicles.

Find business insurance requirements in your state

Number of employees

A larger workforce brings more opportunities for accidents, such as damage to someone else's property.

For example, if an employee spills a drink on a client's laptop, the client could sue your company to recoup the cost of repairing or replacing it.

Or if a customer slips and gets injured because an employee failed to mop up a spill, they could sue to recover their medical expenses. General liability insurance covers a wide range of accidents, including those caused by employees.

That's why your premium is tied to the number of employees you have. During the application process, you'll likely have to provide a breakdown of all full- and part-time employees, as well as the number of subcontractors or consultants you employ, so your insurance provider can accurately assess your risks.

Annual revenue

The amount of revenue your business generates can affect your insurance costs. Generally speaking, increased revenue leads to higher insurance premiums.

However, the impact depends on your industry. Construction businesses, for example, are sensitive to revenue increases. The cost of general liability can jump a decent amount as revenue increases, since insurance companies assume they are taking on more risk when they earn more.

On the other hand, office-based businesses, such as IT companies, typically see a marginal increase in general liability prices when their revenue increases. Due to the nature of the work, higher revenue doesn't involve higher risks, so they aren't as impacted.

Does my business need general liability insurance?

A general liability insurance policy (sometimes called public liability insurance) is a must-have for small businesses, especially those with a storefront or other public space. It provides crucial protection against the potentially devastating costs of a lawsuit over a bodily injury, property damage, copyright infringement, food contamination, or advertising injury.

At any business, a visitor could suffer a slip-and-fall injury. If the visitor sues, legal fees can escalate to the point where they could sink your business.

Even if no one outside your company visits your office, someone could still hold your business liable for damages. For example, businesses that run advertising campaigns or post on social media could face a lawsuit if they post content that doesn't belong to them, or make a false claim about a competitor.

When someone sues your business—even if it's a frivolous lawsuit—you'll have to pay legal defense costs, such as the cost of hiring an attorney. If you lose the suit, you could end up paying a fortune in a court-ordered judgment or a settlement.

Without this type of coverage, you'd have to pay these expenses out of pocket, which could include medical bills, witness fees, or a costly settlement.

Commercial general liability insurance covers all of these costs, which could save your business from bankruptcy. This policy also provides coverage for small business owners when they sign contracts with other businesses.

Because the premium is based upon your level of risk, small businesses and contractors often pay only a small monthly premium for this type of business insurance.

How can you save money on general liability insurance?

There are several steps you can take to find cheap general liability insurance and avoid paying expensive rates:

Bundle your insurance policies. Business owners can often save money when they purchase multiple insurance policies from the same provider. For example, if your business is considered low risk, you may qualify for a business owner’s policy. A BOP bundles general liability insurance and commercial property insurance (which covers stolen or damaged business property) together at a reduced rate.

Pay your entire premium upfront. Your general liability policy premium can typically be paid in monthly or annual installments. It might be tempting to go with a smaller monthly payment, or only get short-term coverage, but consider paying the full premium. Many insurers offer discounts for premiums paid annually.

Manage your risks. If your small business has a clean claims history, you can expect lower insurance rates. An effective way to do this is to create a comprehensive risk management plan. For example, you might:

- Train employees to promptly clean up spills

- Invest in a security system

- Compile rules for posting to social media

- Create procedure checklists and reviews

- Minimize hazards on your premises

Skip unnecessary add-ons. While you might need to add a client to your policy as an additional insured, keep in mind that endorsements will raise your premium. Avoid any unnecessary riders, such as a blanket endorsement or extra expense coverage on a BOP, unless you need it.

Why do small businesses choose Insureon?

Insureon is the #1 independent agency for online delivery of small business insurance. We help business owners compare quotes from leading providers, buy policies, and manage their insurance coverage online.

By completing Insureon’s easy online application today, you can get free quotes for general liability insurance and other policies from top-rated U.S. insurance companies.

You can reach out to one of our licensed insurance agents if you have questions about general liability or other types of insurance, such as workers' comp or commercial auto insurance.

Once you find the right policy for your small business, you can begin coverage in less than 24 hours and get a certificate of insurance for proof of coverage.

Verified general liability coverage reviews

The average costs on this page were derived from our data on 40,000 small business owners who purchased policies through Insureon. Most of our customers have less than five employees, annual revenue ranging from less than $50,000 to more than $200,000, and five years or less in business.