Contractual liability insurance

Contractual liability insurance covers the legal risks that small business owners face when they sign agreements with other businesses. It’s often included in your general liability insurance coverage.

What is contractual liability insurance?

A contractual liability insurance policy (CLIP) protects your business against the financial risks that you take on when you sign a contract.

Any contract you sign may have financial and legal requirements, such as a lease agreement that states you are responsible for lawsuits from customer injuries at your retail store.

A type of contingent liability insurance, contractual liability is also known as a "hold harmless agreement." It indicates you agree to accept liability and financial responsibilities on behalf of the party with whom you signed a contract, ultimately to protect them from liability claims and financial loss.

What does contractual liability insurance cover?

Contractual liability insurance covers the liabilities you assume when you sign a lease or other type of contract. This may include taking responsibility for:

Third-party bodily injuries

Commercial landlords typically require a contractual liability agreement with their tenants. This places responsibility for customer accidents on the business renting the space instead of the landlord.

For example, if a customer files a lawsuit over a slip-and-fall accident at your business, the contractual liability you have with your landlord means any claim of bodily injury or other tort liability must be paid for by your business.

Third-party property damage

The construction and building trades often include contractual liability clauses in the construction contracts they sign. For example, a general contractor might have a contractual liability agreement with the customer and would be responsible for certain claims and risks pertaining to a project, such as property damage liability.

The general contractor might also have liability agreements with subcontractors that pertain to their own work on a job.

Contractual liability insurance covers the liabilities you assume when you sign a lease or other type of contract.

What is excluded from contractual liability coverage?

Keep in mind that there are contractual liability exclusions with this coverage.

Contractual liability insurance won’t cover lawsuits or claims against your business for failure to meet its contractual obligations, such as a customer suing you over a delayed or incomplete project.

It also won’t cover contracts that are incomplete or unsigned by both parties.

What is an indemnity agreement?

An indemnity agreement, also known as an indemnity clause, is an addition to a contract that says your business is responsible for certain losses and claims.

An indemnification agreement is also known as a hold harmless clause or hold harmless agreement.

As the indemnitor, your business would hold the indemnitee harmless for any losses they suffer that are covered by your contractual liability, such as property damage or customer injury.

These are common additions to leases and business contracts, so it’s important to be aware of them and make sure your business is financially protected.

How do easements impact contractual liability?

Contractual liability can also be a factor with easements on your business property and the risk transfer involved.

Easements are considered “insured contracts,” unless they involve construction or demolition within 50 feet of a railroad line.

If your local municipality has an easement for the maintenance of water and sewer lines that cross your property, the municipality has the assumed liability relating to any work it does on your property to service those lines.

In other words, if your local government dug a large pit on your property so it can access a water line, it would be responsible for any liabilities that result.

This is similar to elevator maintenance agreements that landlords sign with contractors. In an elevator shaft easement, the contractor indemnifies the owner against lawsuits relating to the maintenance and operation of the elevator. This means the contractor assumes all risks involving operation of the elevator.

Is contractual liability covered in a general liability policy?

Some types of contractual liability are included in commercial general liability insurance, but it doesn’t cover every risk.

General liability covers business risks such as customer injuries and damage to a customer’s property. This includes legal defense costs, settlements, and judgments.

Your policy will pay for third-party claims related to injuries and property damage, including those you are liable for due to a lease or contract with an indemnity or hold harmless agreement.

For example, general liability coverage is typically required for commercial leases. As a lessee, you might sign a lease for a business property that indemnifies the lessor against customer injuries. In doing so, your business takes on the assumption of liability from the landlord.

Your general liability policy already covers customer injuries, so as a general liability policyholder you would still be covered for those risks.

On the other hand, your general liability policy would not apply if a customer sues you over a breach of contract, or if your work was late, inaccurate, or never delivered. For this, you would need a professional liability policy, also known as errors and omissions insurance (E&O).

How much does contractual liability insurance cost?

The median cost of general liability insurance, including contractual liability, for small business owners is $42 per month, or about $500 annually.

The cost depends on several factors:

- Location

- Size of your business

- Policy limits

- Claims history

What are some examples of contractual liability endorsements?

An insurance endorsement is a clause that’s added to an insurance policy to alter its coverage. An endorsement could add or exclude coverage, depending on how it’s used as part of your risk management plan.

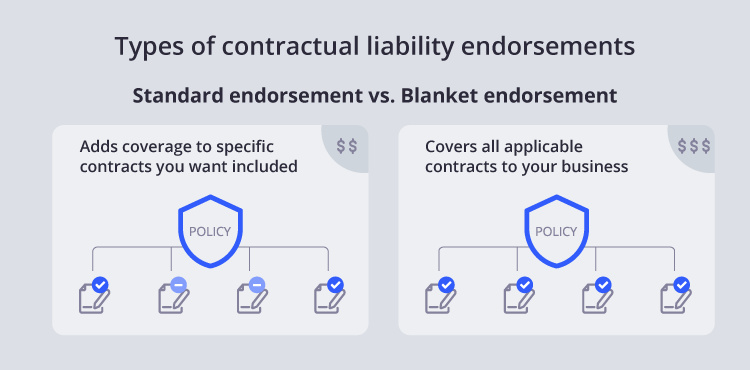

There are two types of contractual liability endorsements you can add to general liability coverage: standard and blanket.

Standard endorsement

A standard contractual liability endorsement adds coverage to specific contracts that you want included in your contractual liability coverage.

To obtain this endorsement, you would give your insurance company a list of each contract that you want to include coverage for. This endorsement is typically less expensive than a blanket coverage endorsement.

An example of a standard endorsement is an additional insured endorsement, such as for a general liability policy.

Blanket endorsement

A blanket contractual liability endorsement would cover all applicable contracts your business has. You wouldn’t have to provide a list of insured contracts to your insurance provider, but it would likely be more expensive than a standard endorsement.

How do I get contractual liability insurance?

Contractual liability insurance is included in most general liability policies.

Complete Insureon’s easy online application today to compare business insurance quotes from top-rated U.S. providers. A licensed insurance agent can help you find the right commercial insurance for your small business. Once you choose a policy, you can begin coverage in less than 24 hours.

Verified general liability coverage reviews

Want free expert advice right in your inbox?

By entering your email address and subscribing, you agree to our Terms of Use and Privacy Policy