Best general liability insurance for small businesses

When buying commercial general liability insurance, not every provider offers the same coverage and support. Find the best U.S. insurance company for your type of business, your budget, and your geographical area.

What are some of the best companies selling general liability insurance in 2026?

Every small business is different, which is why there's no one insurance company that we recommend when buying general liability insurance.

Insureon is the #1 digital agency for small business insurance, partnering with 40+ U.S. insurance providers to find the best insurance coverage for your needs. We've helped over 450,000 small businesses get protected with more than 1.8 million policies.

When you compare quotes with our free application, we do the work for you by retrieving quotes from the companies that best match your business needs. The most important factors are:

- Best-rated general liability insurance companies, in terms of financial strength

- Best providers for your industry

- Best providers for your business's location

- Best carriers for bundling general liability insurance

Some providers offer general liability insurance for certain professions, and others operate only in limited areas. Many carriers offer a business owner's policy (BOP), which bundles general liability insurance with commercial property insurance at a lower cost than buying the policies separately.

All of our insurance partners are rated excellent or superior by AM Best, a global credit rating agency specializing in the insurance industry.

Best-rated general liability insurance companies

When buying a general liability policy with Insureon, you'll get quotes from some of the biggest names in the industry. We do the research for you, providing customized quotes only from those carriers who match your risks.

Keep in mind, the cheapest policy isn't always the best choice, as coverage options differ by more than price alone.

Based on financial strength and overall rating, our top providers for general liability insurance include:

The Hartford

- AM Best rating: A+

- Customer rating: 4.8/5 for claims

- Coverage area: Nationwide

Acuity

- AM Best rating: A+

- Customer rating: 96% claims satisfaction

- Coverage area: 30+ states, based in the Midwest

Liberty Mutual

- AM Best rating: A (Excellent)

- Customer rating: 90% highly satisfied with claims process

- Coverage area: Nationwide

Chubb

- AM Best rating: A++

- Customer rating: 98% satisfaction rate

- Coverage area: Nationwide

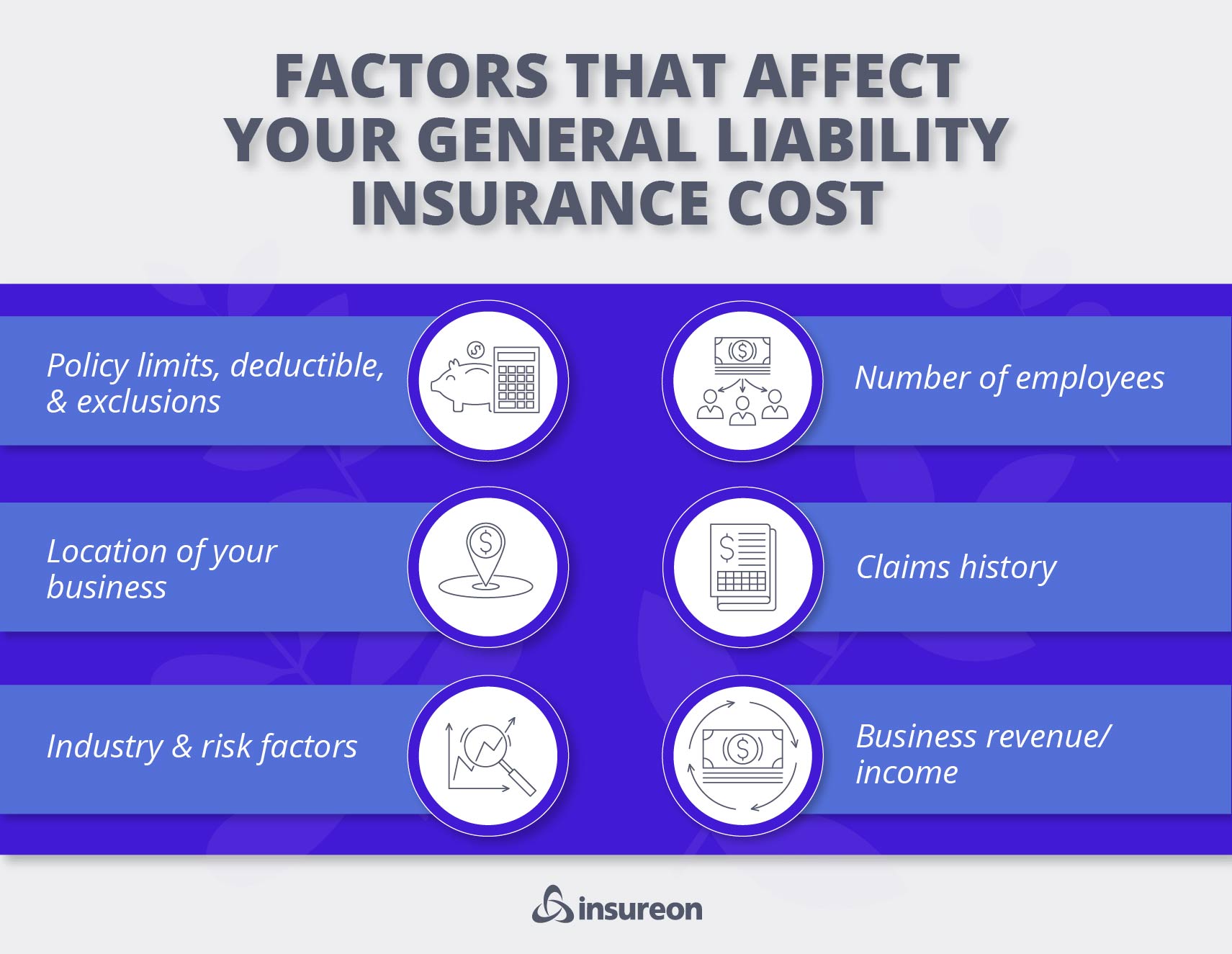

How much does general liability insurance cost?

The average cost of general liability insurance is $45 per month for Insureon's customers. Annual premiums range from around $250 to over $3,000 per year.

General liability insurance premiums are calculated based on several factors, including:

- Industry and risk factors

- Business operations

- Location

- Number of employees

- Policy limits and deductible

- Claims history

- Annual revenue

Verified general liability coverage reviews

Best general liability insurance providers by industry

When searching for general liability insurance for your small business, your profession is a key factor. Additionally, the best general liability for an LLC may not be the best fit for an independent contractor.

An insurance provider who understands the unique risks of your profession and business structure can help make sure you're covered for the relevant exposures.

Many carriers offer business interruption insurance, also called business income insurance, as an important add-on to a business owner's policy. This policy covers daily operating costs and other expenses when a fire or other covered property claim forces your business to close.

Here are the recommended providers of general liability insurance for our top industries:

Technology

Startups and other small IT businesses often choose The Hartford, Chubb, and Hiscox for their general liability coverage.

The Hartford offers a comprehensive business owner's policy for tech companies, which includes general liability, commercial property coverage, and business income insurance.

Chubb has insured tech companies for more than 40 years, and has a team of specialized underwriters.

Hiscox is another affordable option for small tech companies seeking a general liability policy, offering flexible payment options and a dedicated claims representative when you need one.

Construction

Contractors and small construction businesses often look to Acuity, The Hartford, and Liberty Mutual for general liability insurance.

Acuity is a regional carrier with the strength and resources of a national carrier, offering specialized coverages for contractors and an overwhelmingly positive claims experience.

The Hartford has unmatched expertise in the construction industry, with dedicated underwriters for this industry. The Hartford's business owner's policy includes business income insurance, which covers costs if property damage forces you to close temporarily.

Liberty Mutual offers a wide range of coverages for the construction industry. It's the preferred insurance carrier of the American Society of Concrete Contractors, providing tailored insurance solutions for concrete contractors.

Cleaning services

Cleaners often rely on Acuity, The Hartford, Hiscox, and Chubb for general liability insurance.

Acuity is an affordable option for small cleaning businesses seeking a general liability policy, with competitive rates and high customer service scores.

The Hartford provides comprehensive, tailored coverage for cleaning companies, and it's one of the nation's most trusted providers.

Hiscox offers flexible payment options and a dedicated claims representative when you need one.

Chubb is a well-established company that offers customized coverage for a wide range of cleaning companies.

Healthcare

The Medical Protective Company (MedPro Group), The Hartford, Hiscox, and Chubb offer general liability insurance for a wide range of healthcare professionals and medical facilities.

MedPro Group is the largest provider of malpractice insurance in the U.S., but provides other types of coverage as well, including general liability.

The Hartford specializes in insurance for outpatient healthcare, offering coverage for audiologists, dentists, and podiatrists.

Hiscox offers general liability insurance for healthcare professionals, including customized policies for acupuncturists and nutritionists.

Chubb has dedicated professionals who know the risks of the healthcare industry, offering specialized coverage for physicians, hospitals, home healthcare agencies, and more.

Food and beverage

Food and beverage businesses have several strong options when it comes to insurance, including The Hartford, Travelers, Liberty Mutual, and Chubb.

The Hartford offers a wide range of liability coverage for food services, ranging from coffee shops to full-service restaurants and ice cream shops.

Travelers has years of experience in the industry and it's a trusted source of insurance for restaurants with catering services.

Liberty Mutual offers specialized insurance for food services, including coverage for liquor liability, kitchen fires, and delivery vehicles.

Chubb has a dedicated program for small businesses in this industry, offering coverage for unique risks for everything from food trucks to banquet halls and beyond.

Best general liability insurance providers by state

Your state is another consideration when it comes to the best carriers for general liability insurance. Some providers have a limited area of operations, so they might not offer business insurance coverage for your area.

Your location also affects business insurance costs, including general liability premiums. Every state has different rates for litigation, healthcare, and other expenses relevant to claims.

Here are the most popular small business insurance companies in our top five states, based on the number of general liability policies sold:

| State | Top 3 general liability insurance companies |

|---|---|

The Hartford Acuity Liberty Mutual | |

The Hartford Chubb Hiscox | |

Acuity The Hartford Chubb | |

The Hartford Liberty Mutual Hiscox | |

The Hartford Hiscox Liberty Mutual |

Best carriers for bundling general liability insurance

Many insurance companies offer a discount when you bundle general liability with other business insurance products.

The most popular choice for small businesses is a business owner's policy, which bundles general liability coverage with commercial property insurance at a discount. Most small, low-risk businesses are eligible for a BOP.

Another common option is a commercial package policy (CPP), which is designed for small and midsized businesses with moderate risks. A CPP also bundles general liability and business property insurance, but with a broader range of coverage options and higher limits than a business owner's policy.

These insurance carriers offer some of the best options for general liability packages:

The Hartford

The Hartford includes business income insurance in its business owner's policy, which most other carriers don't automatically include. This coverage ensures your business can withstand the financial impact of a forced closure due to a fire or other covered property claim.

You can include additional coverages, such as:

- Data breach insurance

- Business income for off-premises utility services

- Other specialized policies

Liberty Mutual

Liberty Mutual offers both a business owner's policy and a commercial package for small to midsized businesses, available to more than 300 types of businesses. You can also add other coverages, such as:

Acuity

Acuity's version of a business owner's policy is the "Bis-Pak," which combines property insurance, general liability, and business income coverage. This package includes a few extras, such as coverage for additional business locations or projects, and $10,000 in ordinance or law coverage.

You can customize your policy with a range of property and liability endorsements, or add on other types of coverage, such as employment practices liability insurance (EPLI) or errors and omissions insurance (E&O).

Travelers

Travelers sells a business owner's policy with an option for lost income coverage, along with additional insurance options:

Chubb

Chubb's business owner's policy is available for small business owners with up to $30 million in revenue across more than 500 different professions. The company offers a wide range of customizations, including:

- Privacy and data breach

- Employment practices liability

- Electronic data liability

- Equipment breakdown

- Professional liability insurance, for certain professions

What are the risks of not having general liability insurance?

Small business owners often buy general liability insurance coverage because they need it to sign a client contract, get a license for their profession, or rent a commercial space.

Even when it's not required, the potentially devastating cost of a lawsuit makes it a good idea to carry this coverage.

General liability insurance covers:

- Accidents that cause a customer's bodily injury

- Accidental damage to a customer's property

- Defamation claims, including slander and libel

- Advertising injuries, such as copyright infringement and false advertising

- Harm caused by products, including food contamination

Liability claims can happen to any small business—and without protection, the financial impact could shut your doors permanently. General liability helps you recover from these incidents, while reducing your risks can help you avoid claims and keep your premiums low.

Business owner’s policy

Workers’ compensation insurance

Professional liability insurance

Cyber insurance

Errors and omissions insurance

How do I find the right general liability insurance coverage?

Insureon helps you find the right business liability insurance for your needs from the nation's leading carriers. Get quotes for general liability, workers' comp, and other policies in one place by filling out our easy online application.

Our expert insurance agents can answer any questions you might have. They'll make sure your coverage matches your profession, your budget, and any unique risks.

Most small business owners can get insured within 24 hours of applying for quotes. Policyholders can download a certificate of insurance (COI) at any time for proof of coverage.

The average costs on this page were derived from our data on 40,000 small business owners who purchased policies through Insureon. Most of our customers have fewer than five employees, annual revenue ranging from less than $50,000 to more than $200,000, and have been in business for five years or less.

Want free expert advice right in your inbox?

By entering your email address and subscribing, you agree to our Terms of Use and Privacy Policy