How much does lawn care and landscaping business insurance cost?

Landscaping insurance costs are determined by the policies you buy, the risks your business faces, and the value of your landscaping equipment, such as lawn mowers. Save on small business insurance costs by comparing quotes from different providers with Insureon.

Top landscaping business insurance policies and their costs

Here are the top policies and bonds purchased by landscaping businesses and their average monthly costs:

- General liability insurance: $51 per month

- Workers' compensation insurance: $169 per month

- Contractor's tools and equipment insurance: $38 per month

- Commercial auto insurance: $204 per month

- License and permit bonds: $9 per month

- Commercial umbrella insurance: $88 per month

Our figures are sourced from the median cost of policies purchased by Insureon landscaping customers. The median offers a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

General liability insurance

Landscaping businesses and contractors pay an average of $51 per month, or $610 annually, for general liability insurance. This policy is sometimes called public liability insurance.

General liability insurance covers common third-party lawsuits from clients, including those related to customer bodily injuries, damage to a client's property, and advertising injuries. You can add specialized coverages, such as a pesticide or herbicide applicator endorsement, to cover unique risks.

This is the average policy for landscaping professionals who buy from Insureon:

Insurance premium: $51 per month

Policy limits: $1 million per occurrence; $2 million aggregate

Deductible: $500

Small businesses can often save money by bundling general liability coverage with commercial property insurance in a business owner’s policy (BOP). This discounted bundle covers common liability lawsuits from customers, along with damage to your building or its contents.

Small, low-risk landscaping businesses are often eligible for a BOP. On average, landscaping businesses who purchase from Insureon pay $94 per month, or $1,130 annually, for a business owner's policy.

For landscaping companies that don't have a physical location, you can instead add business personal property (BPP) coverage to your general liability policy, or buy contractor's tools and equipment insurance to cover items that travel to jobsites.

The cost of general liability insurance depends on several factors, such as the coverage limits you choose, the size of your business, the amount of foot traffic you have, and any subcontractors or additional insured endorsements you add.

Your business's risks determine general liability costs

The cost of general liability insurance depends on your risk of a customer lawsuit.

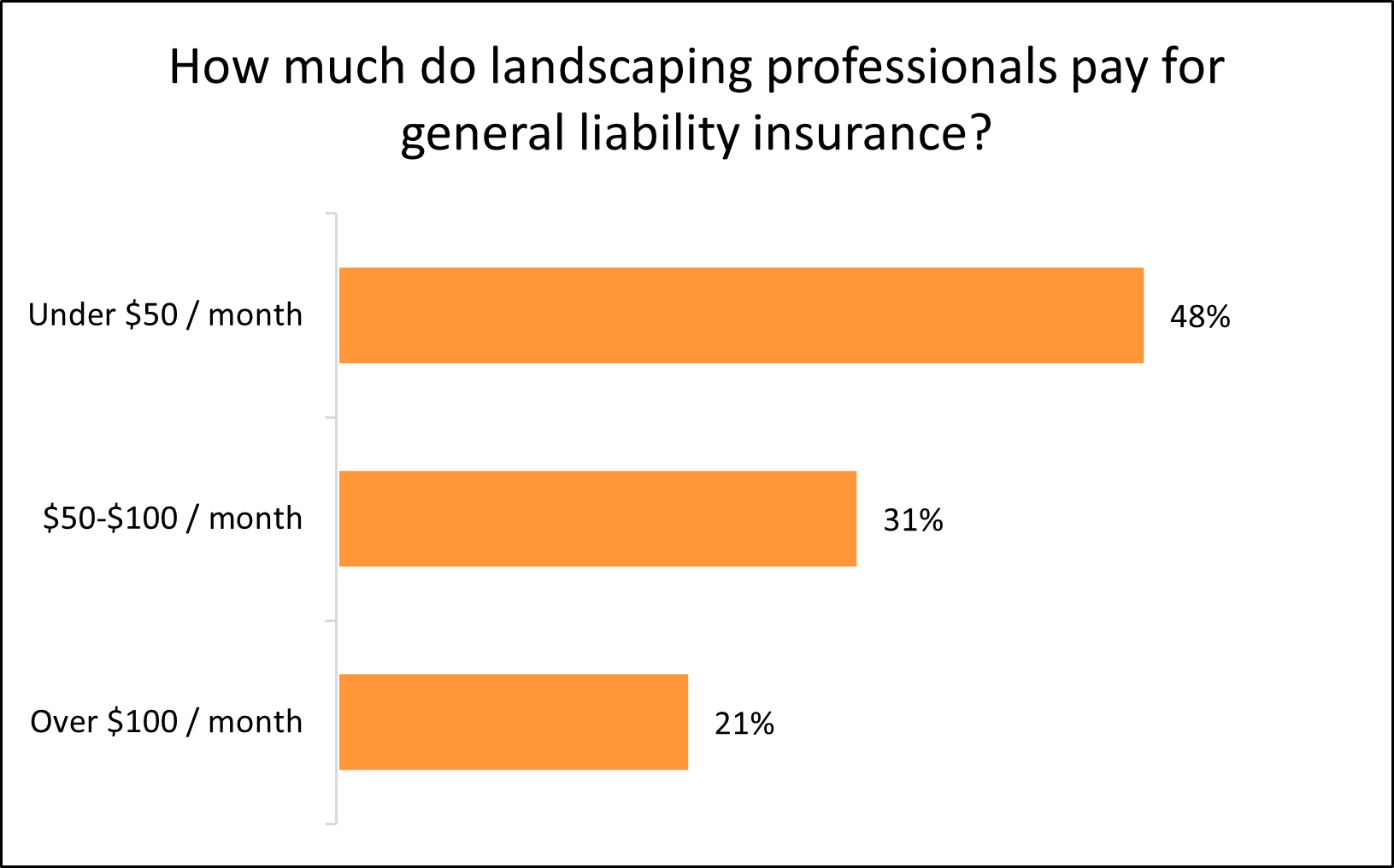

Among landscaping businesses and contractors that purchase general liability insurance with Insureon, 48% pay less than $50 per month and 79% pay less than $100 per month.

Across all landscaping professions, learn how to find affordable general liability insurance.

Your profession is the biggest factor in determining costs

Businesses that interact with many customers and have a higher risk of accidents typically pay more for general liability insurance.

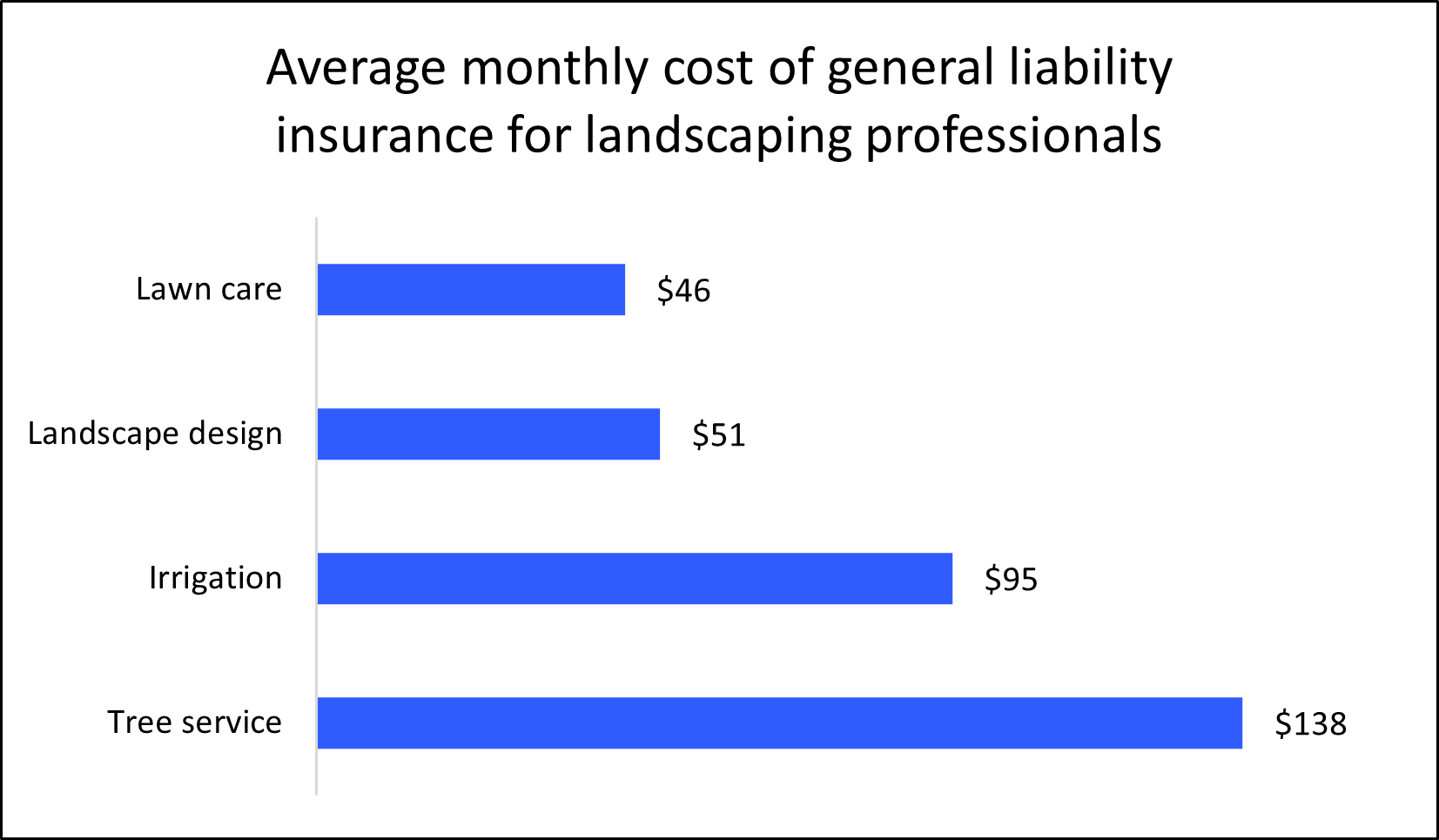

For example, tree service companies can expect to pay more for general liability insurance than lawn care businesses and other lower risk professionals. The average monthly cost for a tree service business is $138, while the monthly average for a lawn care professional is $46.

Other factors that affect your premium include business revenue, building maintenance, years in operation, and location.

As you can see, the cost varies significantly across different landscaping professions:

Policy limits affect the cost of general liability insurance

Policy limits are the maximum amounts your insurance company will pay for covered claims.

The per-occurrence limit is the maximum your insurer will pay for a single incident, while the aggregate limit is the maximum your insurer will pay on any claims during your policy period, typically one year. Higher limits cost more – and provide better coverage.

Most landscaping businesses (94%) choose general liability liability policies with a $1 million per-occurrence limit and a $2 million aggregate limit. As your small business grows, you may need to expand your policy limits.

Save money on business insurance with Insureon

You know you need insurance for your small business, but where to start? And how can you keep costs down?

Insureon is here for you. You can get customized quotes from top carriers.

Most small businesses start with a general liability policy. You can combine property coverage with your liability insurance at a discount of $57 per month.

Maintaining a safe work environment can help you manage risk and lower your insurance costs too.

Get affordable insurance from the best carriers. Start your application now!

Insureon. Protection is peace of mind.

Workers’ compensation insurance

Landscapers pay an average of $169 per month, or $2,029 per year, for workers’ compensation insurance.

Workers' comp is a key policy in landscaping, as workers face a high risk of injury. It helps cover medical bills from job injuries, such as inhalation of pesticides, which your personal health insurance might exclude. It also supplies partial lost wages during recovery in the form of disability benefits.

Most policies include employer's liability insurance, which covers the cost of lawsuits related to workplace injuries. There's usually no limit to how much a workers' comp policy can pay for employee benefits, though it depends on state laws.

The cost of workers' compensation insurance depends on several factors, including number of workers you have and the level of risk involved with their jobs.

Get more information on how to find affordable workers' compensation coverage.

The number of employees drive workers' comp costs

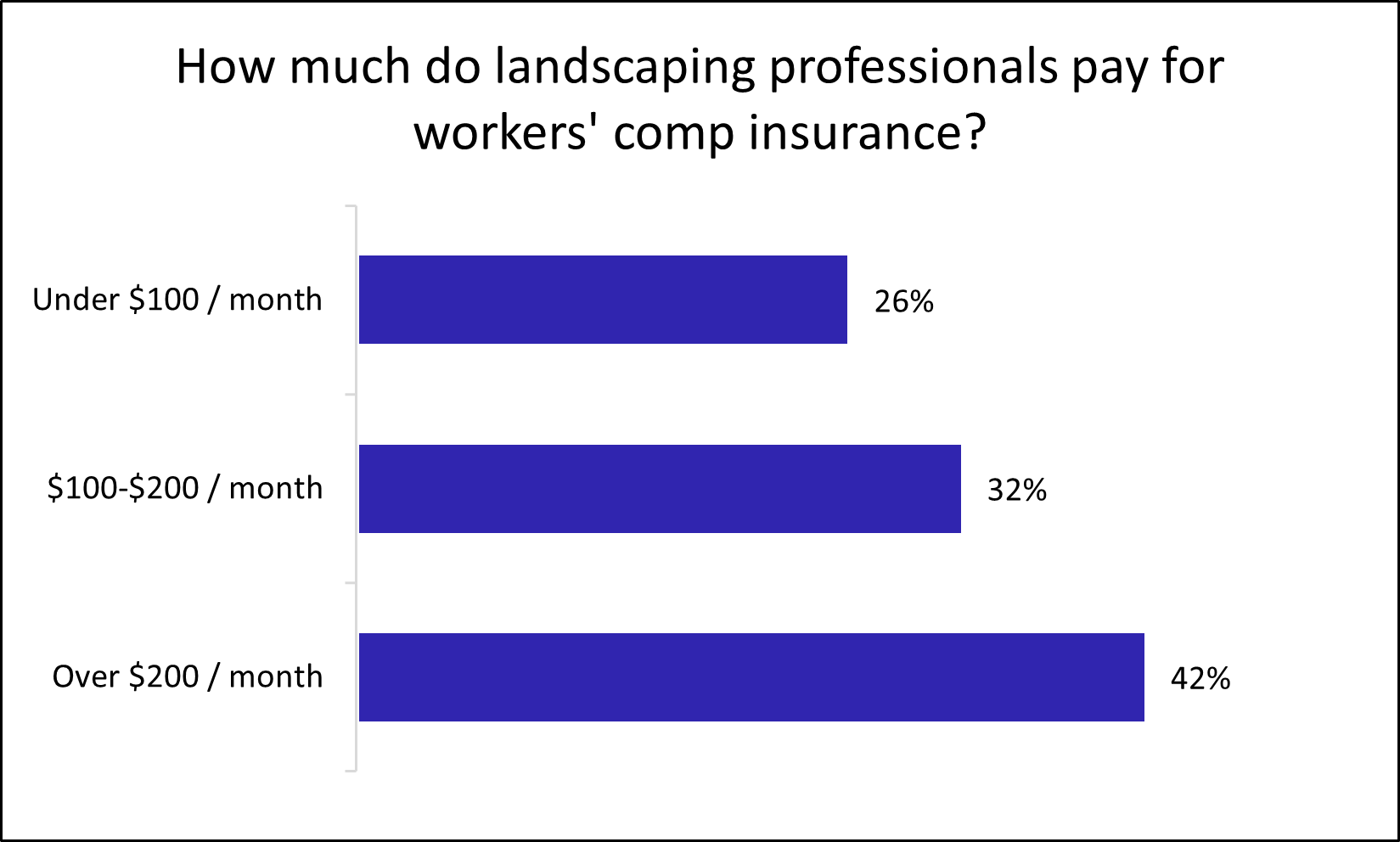

Among landscaping businesses and contractors that buy workers’ compensation insurance with Insureon, 26% pay less than $100 per month and 58% pay less than $200 per month.

Workers' comp costs depend on the number of workers you have in your small business. A larger workforce brings a higher risk of worker injuries, which is why bigger businesses tend to pay more for this type of insurance.

Tools and equipment insurance

Lawn care companies pay an average of $38 per month, or $450 per year, for tools and equipment insurance.

A form of inland marine insurance, this policy helps you avoid financial losses by covering the cost of lost, stolen, or damaged tools and equipment. This includes your lawn mowers, leaf blowers, shovels, rakes, and hoes.

Unlike standard property insurance, this equipment coverage protects your items wherever you bring them, including in transit or at a client's home or other jobsite.

The cost of tools and equipment coverage depends on the value of your landscaping tools and equipment and the type of work you do.

Commercial auto insurance

Landscaping companies and contractors pay an average of $204 per month for commercial auto insurance, or $2,452 annually.

Most states require this coverage for vehicles owned by a landscaping business. For personal, rented, and leased vehicles used by your business, look to hired and non-owned auto insurance (HNOA) instead.

A commercial auto policy provides financial protection in the event of an accident involving your business vehicle. It can help pay for property damage, medical costs, and legal expenses.

The cost of commercial auto insurance depends on several factors, including the policy limits you choose, coverage options, the value of the vehicles, and the driving records of anyone permitted to drive.

Learn more about how to find affordable commercial auto insurance coverage.

Your landscaping vehicles and their use determine commercial auto costs

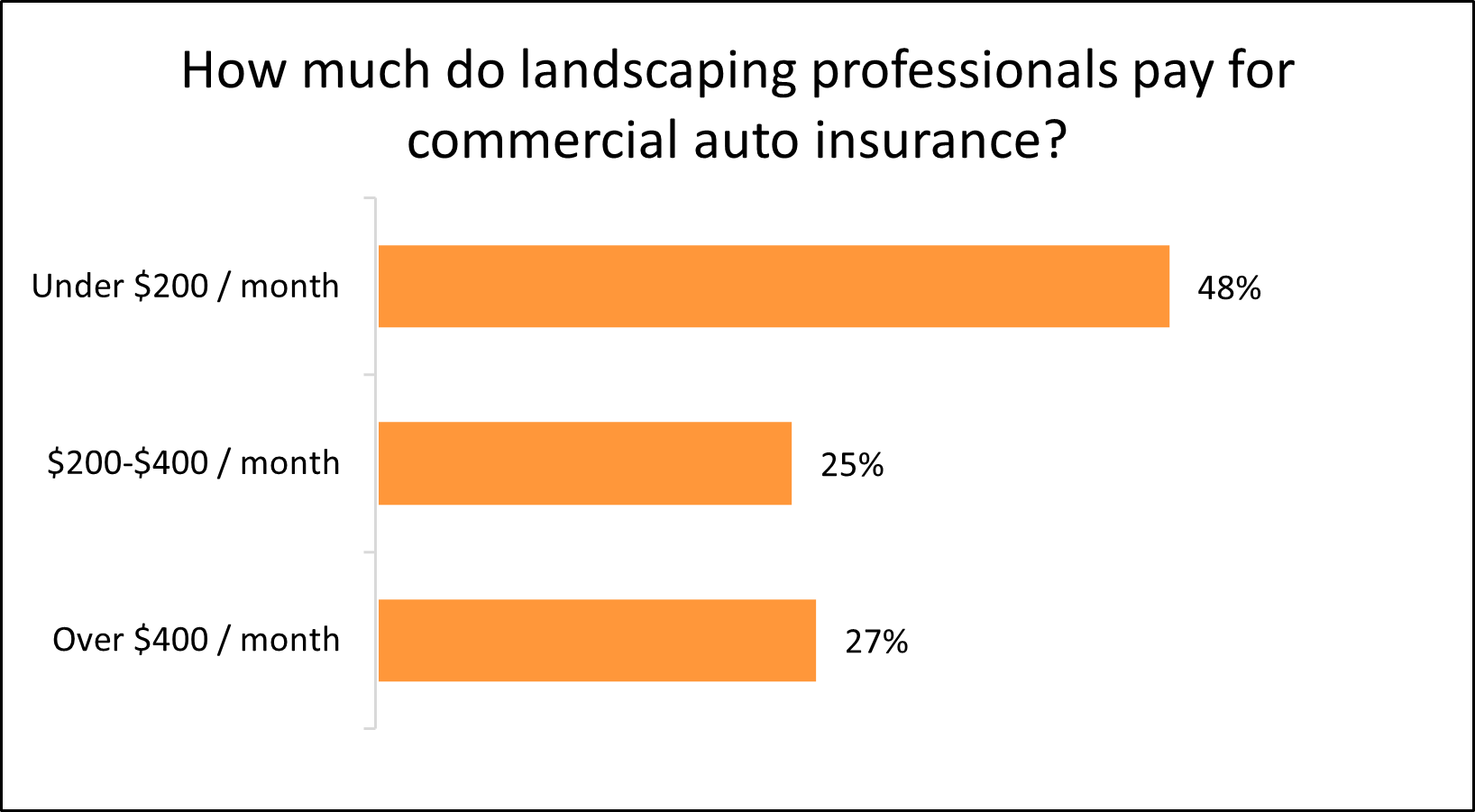

Among landscaping businesses that purchase commercial auto insurance with Insureon, almost half (48%) pay less than $200 per month. And 25% pay between $200 and $400 per month.

Your commercial auto liability cost will depend heavily on the type and number of company vehicles you own, their use, your employees' driving records, and your claims history.

License and permit bonds

On average, landscaping small business owners pay $9 per month, or $112 yearly, for license and permit bonds.

Both of these are types of surety bonds, and reimburses your client if you're unable to fulfill the terms of a contract or other agreement. Unlike a typical insurance policy, you must pay this amount back to the insurer.

License and permit bonds are crucial for landscaping companies since they are often required to get licensed, sign a landscaping contract, and comply with state requirements.

In addition, when you carry a bond, customers know they can trust your company to protect them. In fact, some customers may choose only to hire bonded and insured landscaping companies.

The cost of a surety bond depends on how much coverage you buy, as it's a percentage of the total bond amount. It may also be influenced by your type of work and credit score.

Commercial umbrella insurance

Landscaping service businesses pay an average of $88 per month, or 1,060 annually, for commercial umbrella insurance, which is available in $1 million increments.

This policy boosts the protection of your general liability insurance, commercial auto insurance, and employer's liability insurance. When a claim exceeds the limits of the underlying policy, umbrella insurance kicks in to provide coverage.

Landscaping businesses may need this type of insurance if a client requires liability coverage in excess of $2 million. For example, a client might require you to carry $3 million in general liability coverage before they'll allow your staff onto their property. In that case, you could carry $2 million in general liability insurance along with a $1 million umbrella policy to meet this requirement.

The cost of umbrella insurance depends on your risks and how much coverage you buy. You need to buy a certain amount of underlying coverage before you can buy umbrella insurance.

How do you buy landscaping business insurance with Insureon?

Insureon works with top-rated U.S. providers to find affordable landscaping insurance coverage, whether you work independently as a landscape designer or own an irrigation company with several employees.

Apply today to get free quotes with our easy online application. A licensed insurance agent who specializes in your profession's unique risks will help you find the right types of lawn care insurance for your business needs. Typically, you can get a certificate of insurance within 24 hours of submitting your application, offering instant peace of mind.

What our customers are saying

Want free expert advice right in your inbox?

By entering your email address and subscribing, you agree to our Terms of Use and Privacy Policy