Why do sole proprietors need insurance?

Sole proprietors don’t have separate business assets and personal assets, which means a lawsuit could prove devastating to both. Business insurance provides crucial protection against legal costs, medical bills, and property repairs, so you can get back to work fast.

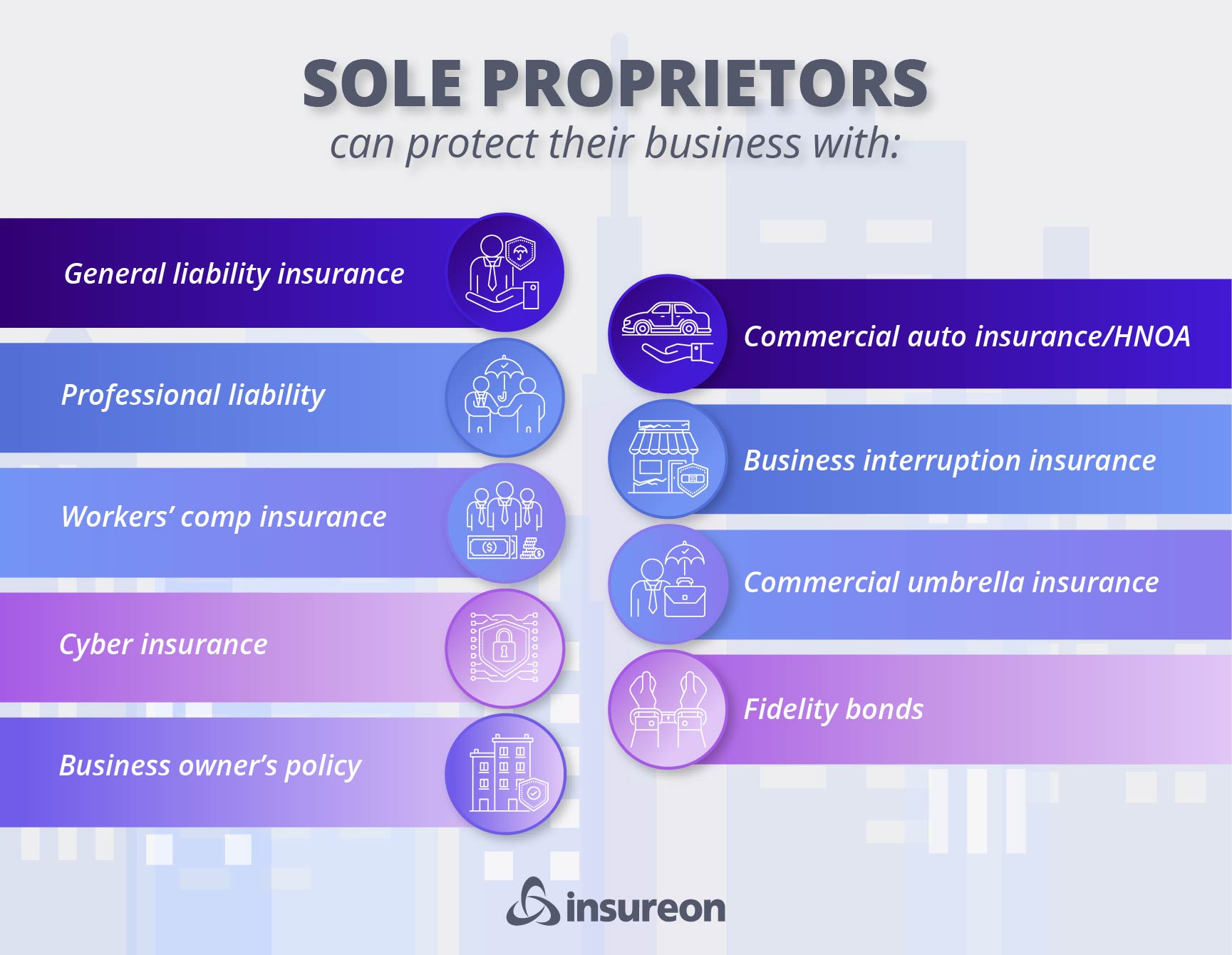

What types of insurance do sole proprietors need?

These insurance policies cover common risks faced by sole proprietors.

General liability insurance

General liability insurance covers the cost of everyday accidents, such as a client who trips and suffers a bodily injury at your office. It may be required for a commercial lease.

- Slip-and-fall accidents

- Accidents that damage client property

- Accidental copyright infringement

Professional liability insurance

Also known as errors and omissions insurance (E&O), this policy covers legal costs when a sole proprietor makes a mistake that negatively affects a client.

- Mistakes that cause a client to lose money

- Missed deadlines

- Accusations of negligence

Workers' compensation insurance

Workers’ compensation insurance shields sole proprietors from work-related medical bills that health insurance might deny.

- Work-related medical expenses

- Disability benefits

- Lost income

Cyber insurance

Cyber insurance helps sole proprietors recover financially from data breaches and cyberattacks. It's strongly recommended for any small business that stores personal information.

- Data breach notification costs

- Data breach investigations

- PR costs for reputational harm

Business owner's policy

A BOP bundles general liability coverage and commercial property insurance at a discount. It protects against the most common lawsuits and business property damage.

- Accidents that harm clients

- Stolen or damaged business property

- Business interruption insurance

Commercial auto insurance

This policy covers costs when a sole proprietor's business vehicle is involved in an accident. Each state has its own requirements for auto liability insurance.

- Auto accident injuries

- Property damage caused by your vehicle

- Vehicle theft and vandalism

How much does sole proprietor insurance cost?

Sole proprietors often qualify for discounts on business insurance. Factors that affect your premium include your profession, business income, and the policy's limits and deductible.

Here are the average costs for top insurance policies sold by Insureon:

General liability insurance: $45 per month

Professional liability: $88 per month

Workers' comp: $54 per month

Verified business insurance reviews

Hear from customers like you who purchased small business insurance.

State insurance requirements

Find business insurance requirements in your state

What insurance do sole proprietors need?

[video: an animated header displays the Insureon logo. Underneath it, a subheading displays the text: "What insurance do sole proprietors need?"]

MALE VOICEOVER: As a sole proprietor, your personal and business finances are legally tied together. If your business gets sued, your personal assets like your savings, home, or car could be at risk.

[video: an illustrated header displays the text: "Sole proprietor: Personal and business finances are tied together. "]

With business insurance, you can safeguard your livelihood and your personal assets from costly claims, accidents, and legal expenses.

[video: an illustrated header displays the text: "Business insurance helps cover:"]

[video: Under above header, three bullet points display the text: "Costly claims"; "Accident bills"; "Legal expenses"]

Let’s take a closer look at some of the top policies that can help protect your business.

[video: an illustrated header displays the text: "General liability covers:"]

[video: Under above header, three bullet points display the text: "Slip-and-fall accidents"; "Client property damage; "Advertising lawsuits"]

General liability insurance covers common third-party risks, such as customer injuries, property damage, or advertising injuries like libel or slander.

[video: an illustrated header displays the text: "Professional liability / E&O covers:"]

[video: Under above header, three bullet points display the text: "Accusations of negligence"; "Work errors that cost clients money"; "Missed deadlines"]

Professional liability insurance, sometimes called errors and omissions, protects you from lawsuits over work mistakes, missed deadlines, and professional oversights that cause a client financial harm.

[video: an illustrated header displays the text: "Workers' comp covers:"]

[video: Under above header, three bullet points display the text: "Work-related medical expenses"; "Disability benefits"; "Lawsuits from employee injuries"]

Workers’ compensation insurance is required in most states if you hire employees. It covers medical costs and lost wages from job-related injuries. Even if you don’t have employees, you may want optional coverage for yourself since personal health insurance usually won’t cover work injuries.

[video: an illustrated header displays the text: "Cyber insurance covers:"]

[video: Under above header, three bullet points display the text: "Data breach response costs"; "Investigations and recovery expenses"; "PR efforts to repair reputational harm"]

Cyber insurance can help protect your business from the high costs of cyberattacks and data breaches, including phishing scams and ransomware.

[video: an illustrated header displays the text: "Commercial auto covers:"]

[video: Under above header, three bullet points display the text: "Auto accident injuries"; "Property damage from vehicles"; "Vehicle theft and vandalism"]

Commercial auto insurance covers accidents involving a vehicle owned by your business. If you use your personal car for work purposes, you may need hired and non-owned auto insurance instead.

So, why is insurance important for sole proprietors?

[video: an illustrated header displays the text: "Why is insurance important?"]

Because your personal and business assets are legally connected, one lawsuit could threaten everything you’ve worked for.

Insurance helps shield your finances, keeps your business running, and may even be required to sign contracts, lease space, or comply with state regulations.

It also builds client trust by showing you take your business seriously and have safeguards in place. Some clients may require you to have insurance to sign a contract.

We make it easy for sole proprietors and small business owners to find the right, most affordable coverage.

Get free quotes for your small business with Insureon today.

Click the link to get started!

[video: an animated header displays the Insureon logo]

Common questions about insurance for sole proprietors

Why is insurance important for sole proprietors?

Here are a few reasons why insurance is crucial for sole proprietors, independent contractors, limited liability companies (LLCs), franchises, and other small business structures.

You may need insurance coverage to sign a contract or a lease. Clients and landlords may require you to carry insurance to protect themselves against potential losses. In some cases, they may ask you to list them as an additional insured on your policy.

You may need insurance to comply with the law. Depending on the laws in your state, you may need coverage for a business-owned vehicle, to obtain a license in your field, or to protect against work-related injuries, which is especially important if you bring on any employees.

You gain client trust by being insured. Even when it's not required, carrying insurance is a sign of professionalism and financial stability. It helps attract clients and can give small business owners an edge over their competitors.

Insurance protects your own business from catastrophic losses. 43% of small businesses have faced or been threatened with a lawsuit, but they often lack the resources that larger companies draw upon to survive a legal battle. Insurance helps your sole proprietorship withstand unexpected costs from customer injuries, fires, and other incidents that might otherwise prove devastating.

How do I get a certificate of insurance?

With Insureon, you can get usually get a certificate of insurance on the same day that you apply for quotes. It’s a simple three-step process:

- Fill out our easy online application.

- Compare free quotes from top-rated insurance providers.

- Buy a policy and download a certificate of insurance.

A certificate of insurance will outline the details of your business liability insurance, such as policy limits, deductibles, and any endorsements. It serves as proof of insurance for clients, landlords, lenders, and anyone else who asks whether your business is insured.

How can I save money on business insurance?

Insurance is usually affordable for sole proprietors and low-risk small businesses. There are a few ways to find cheaper insurance:

Compare quotes. With Insureon, you will instantly get multiple free online quotes from leading insurance companies. Compare insurance options from different providers and consult with our agents to make sure you're not paying too much for insurance while getting what's best for your sole proprietorship.

Bundle policies. Many small business owners buy general liability coverage and commercial property insurance together in a business owner's policy, which costs less than purchasing each policy separately. It's sometimes possible to bundle other policies as well, depending on your profession.

Choose a high deductible. You can customize your insurance policy to save money, such as by choosing a higher deductible or lower policy limits.

Avoid claims. Finally, take steps to reduce your business's risks. Prompt cleanup of spills, the elimination of clutter, and bright lighting can help customers and employees avoid accidents, which helps keep your premiums low.

Does my profession affect what type of insurance I need?

Yes, the type of work you do can affect which business insurance policies you need.

For example, the law in several states requires workers' comp coverage for construction contractors, even if they work alone, due to the high risk of injury. In some states, real estate agents and brokers are required to carry errors and omissions insurance. Plumbers and electricians may need a general liability policy to obtain a license.

It may take a little research to find out which type of business insurance coverage you need, or simply ask a licensed insurance agent.

What other types of coverage do sole proprietors need?

The policies you need depend on the specifics of your business, such as whether you drive for work or have a client who requires a certain type of coverage.

Other insurance policies you may need include:

Business interruption insurance: This policy covers financial losses if your business is forced to close temporarily due to a fire or extreme weather. It can often be added to a business owner's policy.

Hired and non-owned auto insurance: An HNOA policy provides liability protection for sole proprietors and other self-employed business owners who drive their own vehicle for work, or a leased or rented vehicle.

Commercial umbrella insurance: Umbrella insurance covers legal expenses when the limit is reached on another liability policy, such as general liability or commercial auto insurance. Sole proprietors may need this coverage to meet client requirements for higher liability limits.

Fidelity bond: A fidelity bond reimburses clients for employee theft, and may be required in a client contract.