General liability insurance

General liability insurance

General liability insurance covers common risks like customer injuries, customer property damage, and advertising injuries. It protects your business from the high costs of lawsuits and helps you qualify for leases and contracts.

What is general liability insurance?

General liability insurance protects against the most common risks of running a business. It's typically the first policy small business owners purchase.

This type of business liability insurance provides financial protection if a customer slips and suffers an injury at your business, or if you accidentally damage someone's property. This policy also covers personal and advertising injuries, including defamation and copyright infringement.

It's sometimes referred to as commercial general liability insurance or CGL insurance.

Why is general liability insurance important for small businesses?

Small business owners often need general liability insurance as part of the requirements for a lease, loan, or contract. For example, you might need to show a certificate of insurance when you sign a lease for an office.

General liability provides crucial protection against costly lawsuits that can affect any business, and it's affordable. The average premium is only $45 per month for Insureon customers.

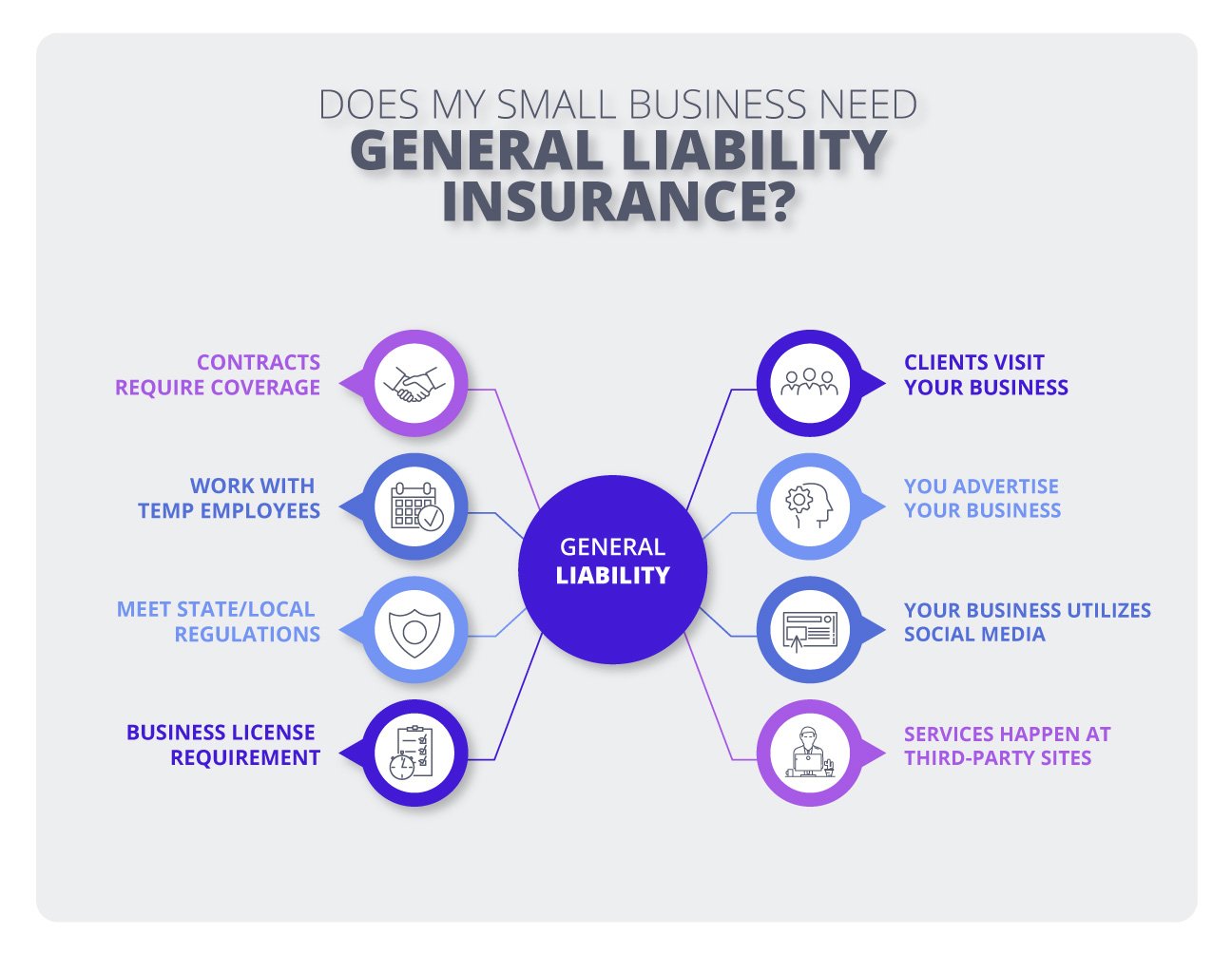

General liability coverage is essential if your business:

- Has a location that is open to the public

- Works closely with customers or clients

- Visits clients or handles client property

- Rents or owns commercial property

- Advertises its services in print or online

What does general liability insurance cover?

General liability insurance provides coverage for common liability claims from third parties, or people outside your business.

Specifically, your commercial general liability (CGL) policy provides coverage for:

Customer or client bodily injuries

If a customer or other third party is hurt in an accident at your business, general liability insurance can help pay for their medical treatment. It also covers legal defense costs if a customer sues over a bodily injury.

Customer or client property damage

A general liability insurance policy can cover expenses when your business accidentally causes property damage or loss of an item belonging to a third party.

Product liability

Most general liability policies include product liability insurance, which covers defective products, food contamination, labeling errors, and other product risks.

Additionally, contractors may need this coverage for their completed operations, such as a newly installed water heater that leaks and damages a customer's floor.

Personal injuries and advertising injuries

If your business advertises in print or online, it could be sued for slander, libel, false advertising, invasion of privacy, or copyright infringement. General liability insurance can help pay legal defense costs from advertising injuries, including any resulting settlement or judgment.

How much does general liability insurance cost?

The average cost of general liability insurance is $45 per month for Insureon's small business customers.

Insurers look at several factors when calculating premiums, such as:

- Your industry risks

- Location

- Number of employees

- Coverage limits and deductible

- Claims history

Verified general liability coverage reviews

Who needs general liability insurance?

Most small businesses need general liability insurance, especially if you have a storefront or an office that's open to the public. Any business that interacts with clients and customers will benefit from this coverage.

That's true even if you work from home. You can't rely on homeowner's insurance to cover business-related claims, such as a delivery person who slips on an icy front step.

Landlords, mortgage companies, business partners, and clients often require general liability coverage. Most small business owners buy this policy right after they start their business.

Is general liability insurance required by law?

Generally not, but states may mandate it for certain industries like construction, such as for general contractor licensing. Depending on your type of business, you may need liability coverage to get a license or a permit for your work.

Your business may need to show an ACORD certificate of insurance as proof of your general liability insurance coverage. This document verifies that your business can handle any injury or property damage lawsuits.

How do I get proof of general liability insurance?

Hey there! Yeah, up here in the corner. Good news: You've purchased your policy to protect your business! But that's only the beginning...

A licensed expert will email you a certificate of insurance the day you buy a policy. I'd do it, but, you know, I'm an animated talking head.

The certificate means peace of mind. And you can access it on the Insureon online customer portal where you can review policy info and all of your insurance documentation.

Need additional assistance? Or want to make changes? Yeah, no problem! Call toll free, or reach out to a dedicated account manager with questions about billing and claims.

We're with you now, and as you grow. Behind the scenes, but there when you need us. Insureon. Protection is peace of mind.

Traditional insurance agents can take weeks to send a certificate of insurance to new customers, which could be an issue for a policyholder who has a pending contract or lease.

With Insureon, you can usually get proof of insurance the same day you apply for quotes. You’ll need to provide basic information about your business, such as:

- Business name

- Business operations

- Number of employees

- Estimated annual revenue

- Years of experience

What does general liability insurance not cover?

While general liability insurance is essential for most small businesses, it does not provide all the protection you need. For instance, your policy does not include coverage for:

Professional mistakes and breach of contract

Professional liability insurance covers lawsuits related to professional negligence. That includes undelivered services, missed deadlines, breach of contract, and other errors and oversights.

This policy is sometimes required by law for real estate agents, insurance agents, and physicians.

Depending on the industry, you might see it referred to as errors and omissions insurance (E&O) or malpractice insurance.

Employee injuries

Workers' compensation insurance covers medical bills and disability benefits for employees who are injured on the job. It's required in most states for businesses that have employees.

Even sole proprietors can benefit from workers' comp, as personal health insurance may deny claims for injuries related to your job.

Business property damage and theft

A business owner's policy (BOP) covers theft, fires, storms, and other incidents that damage or destroy business property.

A BOP bundles general liability insurance with commercial property insurance at a discount. Small businesses with low risks are often eligible for this coverage.

A commercial package policy (CPP) also includes these coverages, but it's designed for small and medium-sized businesses with higher risks. Both BOPs and CPPs often include business interruption insurance, also called business income coverage, which covers lost profits and other financial losses tied to a temporary closure.

Businesses that don't own or rent a building can protect their property with a business personal property (BPP) endorsement on their general liability policy instead.

Employee discrimination lawsuits

Employment practices liability insurance (EPLI) covers legal expenses related to harassment, discrimination, wrongful termination, and other violations of employee rights.

Vehicles used by a business

Personal auto insurance policies almost always exclude business use, outside of your commute.

Most states require that vehicles owned by a business have commercial auto insurance. The amount of auto liability insurance you need also depends on state laws.

Personal, leased, and rented vehicles used for work purposes can be covered by hired and non-owned auto insurance (HNOA), which you can add to a general liability policy.

Liquor liability

Liquor liability insurance covers legal fees from incidents involving people who became intoxicated at your business. That could include drunk driving, assault, and vandalism.

This policy is often required for businesses that sell or serve alcohol, such as restaurants and bars. You can buy it as a standalone policy or add it to your general liability policy.

Workers’ compensation insurance

Professional liability insurance

Cyber insurance

Commercial property insurance

Commercial umbrella insurance

FAQs about general liability insurance

Review answers to frequently asked questions about general liability insurance coverage.

Do I need general liability insurance if I'm self-employed?

Any business type—limited liability companies (LLCs), independent contractors, and even subcontractors—can be sued and held liable for customer injuries, property damage, or advertising injuries.

If you don’t want to purchase a commercial general liability (CGL) policy, you can ask your clients to add you to their policies as an additional insured. This will protect you for as long as you work for the client who insures you.

In addition to carrying general liability coverage for themselves, contractors sometimes must buy owners and contractors protective (OCP) liability insurance to protect project owners and win contracts.

What is the standard general liability limit?

Most small business owners choose general liability policy limits of $1 million per occurrence / $2 million aggregate (also called general aggregate). This means the policy will pay up to $1 million to cover a single incident, with a $2 million limit for the policy period, typically one year.

If your business has high risks or a contractual requirement for higher limits, you can boost your coverage with commercial umbrella insurance. Umbrella insurance increases your maximum policy limits, so your insurance company can cover more expensive claims.

Ideally, aim for coverage that's affordable and matches your business needs. You'll want enough coverage to pay for a lawsuit if you're sued. Consider the size of your business and frequency of customer interactions to determine your exposures and risk of financial loss.

Are commercial general liability and general liability the same?

Yes. Commercial general liability insurance, CGL insurance, and general liability insurance are different names for the same type of business insurance.

In the past, it was called public liability insurance.

What are general liability insurance exclusions?

General liability insurance has several exclusions. It won't cover intentional injuries or property damage—which can be criminal offenses—along with willful negligence.

While a general liability policy typically covers damage to someone else’s property, that doesn't include items in your care, custody, and control. You can fill this gap with bailee coverage, which is a type of inland marine insurance.

Other common exclusions include:

- Pollution

- Data breaches

- Proximity to a railroad

- Garages

- Injuries sustained by a subcontractor's employee

To fill gaps in coverage, you can often add endorsements to your policy.

What is coverage A, B, and C for commercial general liability insurance?

There are three liability categories included in a general liability policy:

- Coverage A: Bodily injury and property damage. This coverage pays for claims that your business injured someone or damaged their belongings.

- Coverage B: Personal and advertising injury. Claims of defamation, copyright violations, and invasion of privacy fall under this category.

- Coverage C: Medical payments. This type of "no-fault" insurance pays for medical expenses if someone outside your business is injured.

Where can I learn more about general liability insurance?

You can find additional information in our frequently asked questions about general liability insurance.

If you have any other questions about coverage, you can contact an Insureon agent.

Obtén más información sobre el seguro de responsabilidad civil general (en español).