What is action over exclusion in insurance?

An action over exclusion is a common source of unexpected liability for construction contractors, especially those who regularly work with subcontractors on job sites. Although you might think you have comprehensive insurance coverage, these clauses can leave your business financially exposed in certain situations.

Let's take a look at how an action over exclusion clause works and what you can do to protect your business.

- Get delivery business insurance with Insureon

- After I’ve gained a little experience, how can I grow my delivery contract business?

- What can I do to help me build a strong reputation as a delivery driver?

- How much can I earn from delivery contracts?

- Where can I find “help wanted” ads for delivery driving?

- How can I network to increase my delivery contracts?

- What business and license requirements need to be met to be a contracted delivery driver?

- How can I build my online presence as a delivery driver?

- What can I specialize in as a contracted delivery driver?

- What is a contracted delivery driver?

- How do you become a contracted delivery driver?

What is an action over exclusion?

An action over exclusion clause is sometimes known as a third-party over action exclusion or an employer's liability exclusion. It’s a clause that denies coverage for bodily injury claims from employees of subcontractors when they’re passed on to the insured party (typically a general contractor or property owner) through a lawsuit.

If your policy doesn't exclude this coverage, your insurer will handle both the legal defense costs and any damages awarded up to your policy limits. However, if this coverage is excluded, the claim will be denied, and you may be on the hook for settlements or judgments that can easily reach six to seven figures.

This clause is typically found in commercial general liability (CGL) policies and not in workers' compensation insurance, even though it’s directly related to employee injury claims. This matters because many small contractors assume they're fully protected if they carry workers' compensation and general liability insurance. They may not realize that a hidden general liability exclusion could leave them fully liable for legal costs and damages when a subcontractor's injured employee sues their business. The legal fees, settlement, or judgment could be significant, which could force the business into bankruptcy or closure.

What is the process for action over claims?

The process for an action over claim begins when an employee of a subcontractor is injured on the job. Instead of relying on workers' compensation benefits from their employer, the injured employee sues a third party, like a general contractor, installation contractor, or property owner, claiming they were responsible for creating unsafe working conditions.

When a third-party lawsuit is filed, the contractor or property owner typically files a claim under their general liability insurance policy to cover their legal defense and potential damages. However, this is where the 'over clause' comes into play.

Actions over claims essentially go over the workers' compensation system, where injured employees receive guaranteed benefits and can’t sue their employer regardless of who caused the accident. By pursuing a third-party lawsuit, the injured worker can hold another company involved in the project liable.

How is an action over exclusion worded?

An action over exclusion clause can be difficult to spot in a policy because the words "action over exclusion" may not be used. The clause is often buried and typically written with language specific to the insurance industry.

An example of action over exclusion in a policy might look like this:

"This insurance does not apply to ‘bodily injury’ to: An employee of any contractor or subcontractor working directly or indirectly for any insured, arising out of and in the course of employment..."

This sentence has enormous financial implications. It removes coverage for many claims that occur on construction and other job sites where multiple contractors work together.

What is an action over exclusion endorsement?

Action over coverage is often added through third-party action over exclusion endorsements that modify the standard commercial general liability policy.

Common endorsement forms where the action over insurance coverage may appear include:

- CG 21 47: Employment-related practices exclusion

- CG 24 26: Amendment of insured contract definition

Some construction insurance carriers also use manuscript endorsements, which are customized endorsements written specifically for individual policies.

How does an action over exclusion work?

To understand how action over exclusion affects businesses, consider this general liability insurance claim example:

A drywall installation subcontractor's employee falls off scaffolding while working on a construction project and suffers serious injuries. The injured employee then sues the general contractor, claiming that job-site negligence contributed to his fall. He argues safety protocols weren't enforced. When the general contractor learns of the lawsuit, he turns to his commercial general liability policy and files a claim.

Unfortunately, there’s an action over exclusion in the general contractor's policy, and the insurance carrier denies coverage for the incident. The general contractor is now completely on his own. He must pay all legal defense costs and any settlement or judgment out of pocket. The expenses could be financially devastating for his business.

If action over isn’t excluded in the general contractor's policy, the insurance carrier accepts the claim and provides coverage according to the policy terms. They handle the legal defense and cover a settlement or damages up to the policy limits. The general contractor's financial exposure is limited to his deductible, which allows him to focus on operating his business instead of dealing with a potentially devastating lawsuit.

Why action over exclusions matter for contractors

Many contractors operate under a false sense of security when it comes to subcontractor-related injuries. They often think they're completely safe from liability because the injured worker isn't their employee and the subcontractor carries their own workers' compensation insurance.

Although this assumption sounds reasonable, action over exclusions can leave your business exposed to liabilities, even if you didn't directly hire the injured worker. Subcontractors' employees can still sue you, claiming your actions or negligence contributed to their injury. Without proper coverage, your business could face significant out-of-pocket expenses.

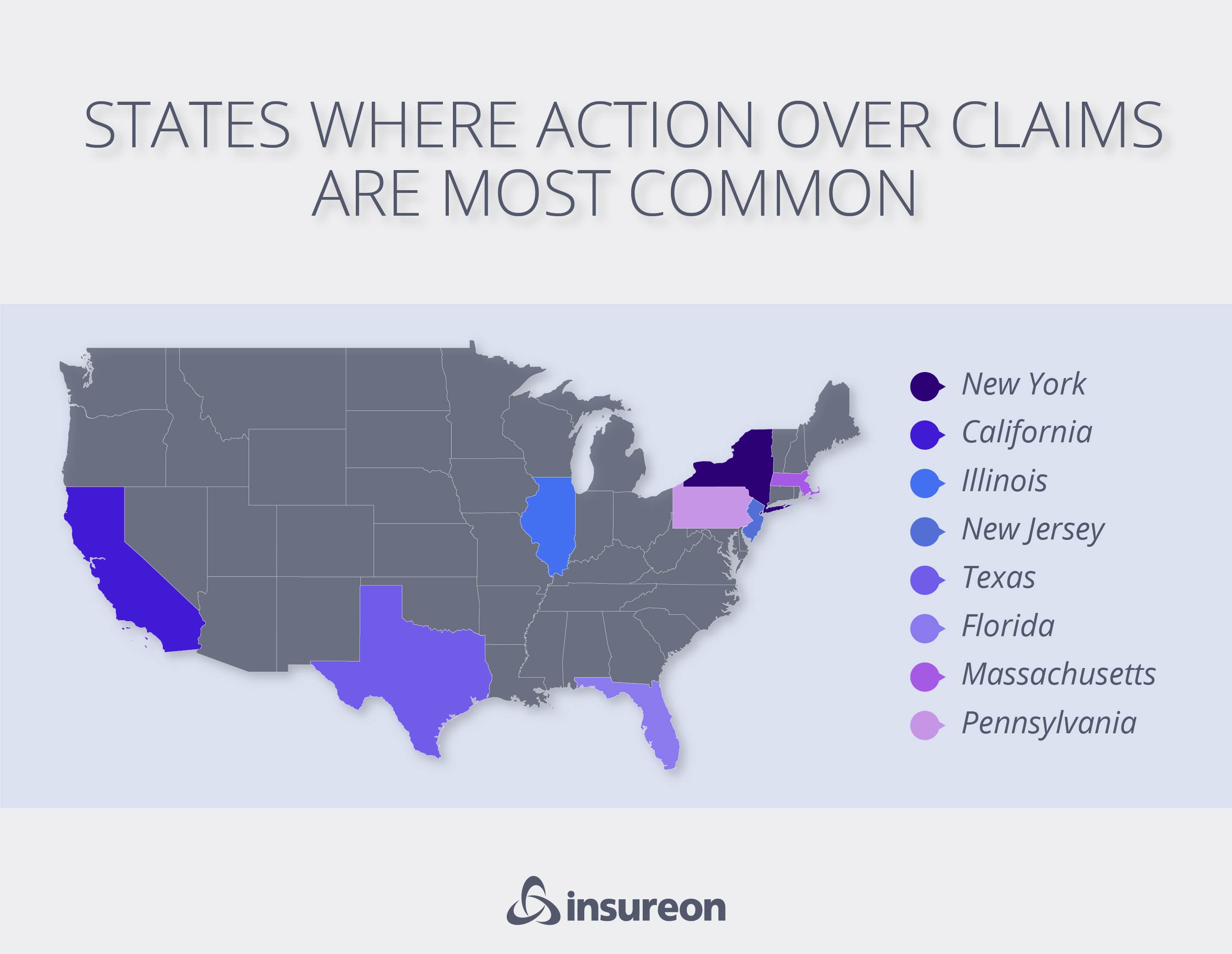

Where are action over claims most common?

Some states see far more action over claims than others due to increased construction activity, strong labor protections, and a higher frequency of litigation.

States that stand out for action over claims include:

New York

New York tops the list due to its Scaffold Law (New York Labor Law 204/241), which gives injured construction workers broad rights to sue property owners and general contractors. The action over exclusions in New York City policies can lead to expensive lawsuits.

California

California sees frequent action over claims because of its large construction industry and strict safety regulations. This combination creates many opportunities for disputes to arise.

Illinois

Illinois courts have historically been receptive to third-party lawsuits, which encourages more action over claims compared to states with stricter rules. This highlights the importance of getting the right commercial insurance in Illinois.

New Jersey

New Jersey combines protective labor laws with a high rate of litigation, which creates an environment where injured subcontractor employees are more likely to file third-party lawsuits against general contractors and property owners.

Texas

Texas has unique risks due to its widespread use of independent contractors in construction. This may result in increased exposure to general contractors and property owners when accidents happen.

Florida

Florida has a booming construction industry where contractors rely heavily on subcontractors. This leads to more action over claims.

Massachusetts

Massachusetts has a complex construction liability environment where it can be challenging to determine fault. This often leads to action over situations where contractors, subcontractors, and other parties try to shift responsibility.

Pennsylvania

Pennsylvania has ambiguous liability standards in construction claims. When the rules aren't clear, it's easier for disputes to arise between contractors and others.

Is action over exclusion required in every state?

The action over exclusion isn't legally required in every state, but insurance companies often add it to policies in high-risk areas. Insurers know expensive lawsuits are more likely in certain states, so they protect themselves by adding this exclusion to their standard policy language. That's why business owners should review their policies and understand what protections they have.

Which insurance policies are affected?

Commercial general liability insurance

Workers’ compensation insurance

Umbrella and excess liability insurance

Does workers’ compensation protect against these lawsuits?

Will umbrella insurance help?

How can businesses protect themselves from action over claims?

While action over exclusions can create a significant coverage gap, there are some practical things you can do to protect your business from lawsuits as part of your risk management strategy. First, review your CGL policy and look for action over exclusion language. The wording can vary, so take your time to ensure you don't miss anything.

If you aren't sure if your policy contains an action over exclusion, ask your agent for help with understanding your coverage. If your policy has coverage gaps, your agent might suggest a policy modification or additional coverage.

Another way to protect your business is to require subcontractors to provide a current certificate of insurance (COI) before they set foot on your job site. This document proves they carry their own liability and workers' compensation coverage. Make sure their coverage limits are adequate for the work they're performing. Also, be sure to review COIs regularly since insurance policies can lapse or be canceled without notice.

It's important to use strong language in your contract to shift liability away from your business. Include clear indemnification clauses that require subcontractors to hold harmless and defend your business against claims arising from their work. An attorney can help you draft a contract that reduces the risk of costly legal disputes.

Also, consider requiring subcontractors to name your business as an additional insured on their liability policies. This added layer of protection ensures your company is covered under their policy if you're named in a lawsuit related to their work.

If your CGL policy includes an action over exclusion, look for an umbrella policy that closes the coverage gap. An insurance professional can help you find an umbrella policy that doesn't mirror the same exclusions as your CGL policy.

Common industries at risk from action over exclusion

Certain industries face a much higher action over exclusion risk due to the nature of their work, their use of subcontractors, and the types of accidents that occur in their field.

Here are some of the most affected industries:

Construction

Roofing

Electrical

HVAC

General contracting

Landscaping and tree services

Any business using subcontractors

Top construction contractors we insure

Get the best coverage for your business with Insureon

It's easy to get insurance for your small business with Insureon. Just fill out our online application to receive quotes from trusted providers. Our expert insurance agents are available to answer any questions and help you find the most affordable small business insurance for your needs.

Most small business owners can get same-day coverage and easily download a certificate of liability insurance (COI) as soon as they purchase a policy.

Cyrus Vanover, Contributing Writer

Cyrus is a finance and insurance writer who is passionate about helping people and businesses succeed. He is also the author of the book "Earn a Debt-Free College Degree." He has written for some of the largest financial institutions in the country including TD Bank, Citizens Bank, and many credit unions. Cyrus has also contributed to Newsweek. Based in the Blue Ridge Mountains of Virginia, he enjoys hiking the local trails and exploring old Civil War battlefields and other historical sites in his spare time.