Errors and omissions insurance

Errors and omissions insurance

Errors and omissions insurance (E&O) helps cover the cost of a lawsuit if a client claims your work was inaccurate, late, or never delivered. It’s sometimes called professional liability insurance.

Why is errors and omissions insurance important?

E&O insurance protects your business if you’re accused of professional negligence, such as a mistake or oversight that causes a financial loss for a client.

If you provide professional advice or services to clients, you likely need this policy. Your clients might require errors and omissions insurance in the terms of a contract. In some fields, you might need it to get your license.

An E&O policy covers the cost of paying for your legal defense in a lawsuit, including attorney fees, court costs, and the resulting settlement or judgment. You’ll typically pay a deductible, and your insurance provider will pay legal expenses up to your coverage limit.

You might see this policy called professional liability insurance, malpractice insurance, or professional indemnity insurance, depending on your industry.

Three reasons E&O insurance is important for small businesses:

- Provides financial protection against mistakes and oversights

- Fulfills contractual obligations

- Some states require it for specific professions

What does E&O insurance cover?

Most E&O claims and lawsuits are straightforward, such as failure to deliver a service as promised. However, others are more complicated.

When a client hires you to provide a specialized skill, they’re entitled to a reasonable standard of care. If a client is harmed because you failed to meet this standard, then your business could face a lawsuit.

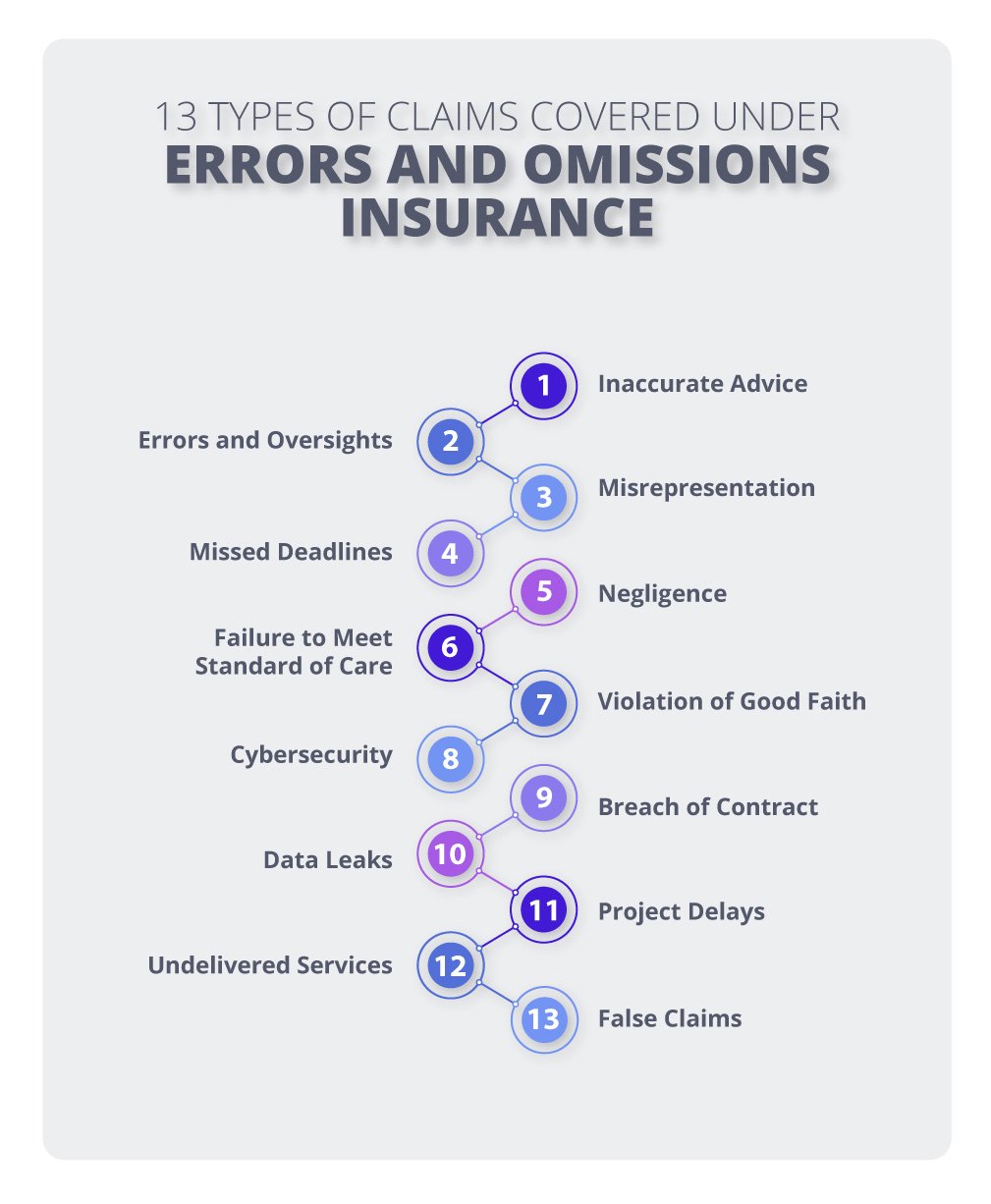

Specifically, errors and omissions insurance covers a wide range of claims, including the following:

Work mistakes and oversights

Even a small error or oversight in your work could end up costing a client money. When the client tries to recoup their losses by suing your business, errors and omissions insurance helps pay for attorney's fees and other legal costs.

Undelivered services

If your business leaves work unfinished, it can interrupt your client’s business plans. When you fail to deliver promised services, a client could sue—especially if it negatively impacts the client’s bottom line.

Missed deadlines

If your business misses a deadline, it could delay your client’s project and result in lost revenue. If a client sues your business over late work, errors and omissions insurance can cover the cost of the lawsuit.

Breach of contract

A client could accuse you or one of your employees of breaching a contract by failing to provide an agreed-upon service. Depending on the severity of the breach, this could potentially result in a lawsuit. E&O insurance would protect your business from an accusation of a breach of contract.

Misrepresentation

If a client accuses you of making a false statement to secure a contract, such as exaggerating your level of experience or knowledge of a subject, the client could sue you for misrepresentation. If a buyer thinks a Realtor falsely described the conditions of a building or a neighborhood, they might seek compensation in court.

Poor communication

If a client's expectations don't align with the services you deliver, then the result could be a lawsuit. To avoid misunderstandings, it helps to outline your company's services and expected outcomes in an agreement or contract that's shared with the client.

How much does errors and omissions insurance cost?

E&O insurance costs an average of $88 per month. About a third of Insureon’s small business customers pay less than $50 per month for their policy.

Your insurance premium is determined by several factors, including:

- Industry risk factors

- Day-to-day operations

- Business size and revenue

- Number of employees

- Policy limits and deductibles

- Claims history

- Any endorsements, such as intellectual property (IP) insurance

Verified errors and omissions coverage reviews

Who needs errors and omissions insurance?

Errors and omissions insurance offers protection across a wide range of industries that provide professional services or advice to their clients and customers. It's designed for both businesses and independent contractors that make a living off of their expertise.

Some professionals may need this coverage to work for a certain client or to comply with state laws. Industries that often require E&O coverage include:

IT professionals

IT professionals typically buy technology errors and omissions insurance, or tech E&O, which includes both E&O insurance and cyber insurance. This bundle protects against lawsuits related to contract disputes, coding errors, and data breaches.

For instance, a client hires an IT consultant to protect their customer data, but a data breach exposes the names and credit card details of thousands of customers. The client believes the IT consultant should have been able to prevent the incident and files a negligence lawsuit. In this case, tech E&O would pay for the consultant's legal costs.

Tech E&O is essential for those who work in cybersecurity or recommend software to their clients. Some clients will only work with tech companies that can prove they have an active E&O insurance policy, even if they have cyber insurance.

Insurance agents

E&O coverage for insurance agents can protect against an oversight that left a client vulnerable to liabilities. It also covers bad advice that led to inadequate coverage. Some clients may require proof of E&O insurance before they agree to work with you. It's also required in some states, depending on the type of work you do.

For example, an insurance agent fails to obtain adequate auto insurance coverage for a client, despite promising to do so. When the client gets in an accident and goes to make a claim, they’re surprised to find themselves uninsured. They sue the insurance agent for failing to secure the appropriate coverage.

Real estate agents

Some states require E&O for real estate agents and brokers. This policy helps pay for lawsuits over failure to close, mismanagement, disclosure errors, and other professional issues. Unless you show proof of E&O insurance, some clients, buyers, or sellers may refuse to work with you.

For instance, a real estate agent makes an error on an MLS sheet, incorrectly listing a home’s square footage as more than it is. The homebuyer realizes the error after purchasing the home and sues the agent. The real estate agent’s E&O policy covers the cost of hiring a lawyer and the eventual court-ordered judgment.

To avoid E&O lawsuits, make sure to treat all clients fairly, document your communications, and describe properties accurately.

Professional services

Many professionals, such as notaries, travel agents, and recruiters, make their living by advising others based on their industry knowledge and expertise. A mistake, such as poor advice or a miscalculation, can have negative consequences for clients, which can lead to a lawsuit.

Errors and omissions insurance can support professional service providers in the event that a client is unhappy with the services provided.

Tax preparers

E&O insurance for tax preparers covers the costs of lawsuits over missed deadlines, accounting errors, or lost documentation. This policy offers indirect protection for the client if there’s a mistake in their taxes. That’s why some clients will ask for proof of insurance before they’ll use your financial services.

For example, a tax preparer fails to file a client’s tax return before the deadline and now the client is forced to pay a costly fine. To recoup the fine, the client sues the tax preparer for missing the filing deadline.

How do I get proof of errors and omissions insurance?

Complete our easy online insurance application to get free quotes from top-rated providers. Insureon's expert insurance agents can help you choose the best errors and omissions coverage for your business's needs.

You can typically get coverage quickly and receive a copy of your errors and omissions insurance certificate on the same day you apply for quotes.

What does errors and omissions insurance not cover?

While errors and omissions insurance covers many aspects related to legal action from a client, it does have a number of coverage exclusions. For example, it only covers the cost of defending against lawsuits—it doesn't pay for lawsuits you initiate. Mistakes that are made intentionally are also not covered.

Unless your policy has prior acts coverage, it will only cover professional liability claims filed while the policy is active and for incidents that occurred after you bought the policy. In this case, endorsements can fill gaps in your errors and omissions coverage.

Other exclusions from errors and omissions insurance coverage include:

Customer injuries and property damage

If you accidentally damage a client’s property or a client is injured at your office, general liability insurance will help pay for the client’s property repairs or medical care. This policy can also cover your legal expenses if the client sues.

Employee injuries

If an employee suffers a work-related injury or illness, workers' compensation insurance can cover their medical expenses and provide disability benefits while they are recovering.

Employee discrimination lawsuits

If a job candidate or employee sues your business for harassment, discrimination, or wrongful termination, then employment practices liability insurance (EPLI) can cover the cost of your legal fees, as well as the cost of a settlement or judgment.

Illegal activities

E&O insurance will not provide coverage for activities that were illegal or purposefully caused harm. Intentional wrongdoings generally do not fall under the umbrella of what insurance will cover.

Damage to business property

If your business property is damaged, destroyed, stolen, or lost, then a commercial property insurance policy can pay to repair or replace the affected items.

Auto accidents

Most states require commercial auto insurance for vehicles owned by a business. If your business uses personal, rented, or leased vehicles, you'll need to purchase hired and non-owned auto insurance (HNOA) instead.

Harm caused by a product

Product liability insurance covers costs if a product made, sold, or distributed by your business injures a customer or damages their property. It's usually included in general liability insurance.

General liability insurance

Business owner’s policy

Workers’ compensation insurance

Commercial auto insurance

Hired and non-owned auto insurance

See how errors & omissions insurance protects you from lawsuits

When it comes to your small business, its success stems from your expertise, fulfilled contracts and happy clients. But what if a client is unsatisfied with the outcome you delivered? This is where a policy like errors and omissions can help.

So, what is errors and omissions insurance? Also known as professional liability insurance, E&O helps protect your business from lawsuits filed by unsatisfied clients.

This coverage applies to work mistakes and oversights, undelivered services, missed deadlines, and accusations of negligence.

Based on several factors including risk, business size, and claims history, the cost of E&O coverage can vary from business to business.

Get free errors and omissions insurance quotes from Insureon today. Click the link to get started.

FAQs about errors & omissions insurance

Review answers to common questions about E&O insurance.

When do you need errors and omissions insurance?

Small business owners may be required to carry errors and omissions insurance in the following situations:

- Your state might require it for your profession. For example, some states mandate a certain amount of E&O coverage for real estate agents.

- Clients might ask you to buy E&O insurance. In many fields, clients might ask you to carry an E&O policy in order to protect themselves against potential legal costs. You may need to produce a certificate of insurance to show that you're insured and to sign a contract.

- E&O coverage is beneficial, and often required, for licensees. Depending on the type of work you do, your state licensing board might require you to carry E&O insurance as part of its licensing requirements.

Even when it's not required, E&O insurance is a key part of risk management. Without it, a simple mistake or oversight could lead to a lawsuit that might devastate your business.

How does errors and omissions insurance work?

Errors and omissions insurance covers legal defense costs related to accusations that you failed to meet the terms of a contract or were negligent in your work.

You'll need to contact your insurance company in order to make an errors and omissions claim. It's a good idea to have information relevant to the claim on hand, such as your policy number and details about the incident.

Be aware that errors and omissions insurance is a claims-made policy. That means your policy must be active both at the time of the incident and when the claim is filed in order to benefit from coverage.

When you buy an E&O policy, you can set a retroactive date to secure coverage for work you've done in the past. With this type of insurance, it's important to maintain continuous coverage so you don't end up paying for legal fees out of pocket.

Is there a difference between errors and omissions insurance and professional liability?

This coverage has a few names, but they all refer to the same policy. Different types of businesses use different terms:

- E&O insurance: This is the preferred term for insurance agents, real estate agents, tax preparers, and IT professionals.

- Professional liability insurance: Architects, consultants, construction companies, and photographers use the term professional liability insurance.

- Malpractice insurance: The term legal malpractice insurance is used by lawyers, while doctors and other healthcare professionals refer to it as medical malpractice insurance.

How does errors and omissions insurance differ from general liability insurance?

Most small businesses can benefit from carrying both general liability and E&O insurance, as these policies protect against different types of lawsuits.

You can look to a general liability policy for protection against common accidents, such as customer slip-and-fall injuries or accusations of slander. These types of claims can happen at any business.

On the other hand, an errors and omissions insurance policy will cover claims of professional negligence, not bodily injuries. You'll want to consider this coverage if your work could harm a client's finances. It's recommended for businesses that provide professional services or expert advice to clients.

Where can I learn more about errors and omissions insurance?

You can find answers to other common questions in our frequently asked questions about E&O insurance.

To get cheap errors and omissions insurance that matches your business's risks and your budget, fill out our easy online application today. A licensed agent can help you choose the best coverage for your small business.