Cheap cyber insurance

Saving money on cyber insurance starts by analyzing your risks, bolstering your cyberattack safeguards with a comprehensive risk management plan, and comparing quotes from multiple insurance companies.

How do I find cheap cyber insurance?

Cyber insurance helps protect your business from data breaches, ransomware attacks, cyber extortion, malware, social engineering, and other costly cyber incidents. If your company stores sensitive customer information, processes payments, or relies on digital systems, cyber insurance covers financial losses and other expenses like:

- Data recovery

- Legal fees

- Customer notification

- Credit monitoring

- Public relations / crisis management

- Data breach investigations

- Ransom payments

- Regulatory fines

Cyber insurance starts at $73 per month, making it a smart investment for businesses of all sizes, especially those in tech, retail, healthcare, and professional services.

There are several ways to help reduce the cost of your cyber coverage and avoid more expensive rates. You can compare quotes from top-rated insurance carriers through Insureon’s online application, which makes it easy to find the best policy for your budget.

You may also save by choosing a higher deductible, taking steps to improve your cybersecurity and reduce risk, or bundling cyber insurance with other coverage like a BOP or a tech E&O policy for tech-based businesses.

Table of contents

- Compare cyber insurance quotes

- Bundle cyber insurance with other policies

- How much does cyber insurance cost?

- Customize your cyber liability policy

- Manage risks to keep premium low

- Cheapest states to purchase cyber insurance

- Cheapest industries to purchase cyber insurance

- Find affordable cyber insurance with Insureon

- Additional coverages to consider

Compare cyber insurance quotes

Getting quotes from multiple insurance companies is one of the best ways to find affordable cybersecurity insurance. You could contact each carrier directly, or save time by using an online insurance marketplace like Insureon for a faster, easier experience.

With Insureon, you can compare cyber insurance quotes from top-rated providers like Chubb and Coalition, using a single, simple online application. Our licensed insurance agents can help you customize a policy that fits your industry, budget, and specific cyber risks, while also making sure you meet state regulations and any contractual obligations.

Once you choose the right cyber insurance policy, you can get covered and receive a certificate of insurance (COI) in less than 24 hours.

Bundle cyber insurance with other policies

One of the most effective ways to save on cyber insurance—and simplify your coverage—is to bundle it with other policies. For tech businesses, cyber liability coverage is often included with a technology errors and omissions (tech E&O) policy. This combined coverage protects against both cyber crime and claims of professional negligence, making it a smart and comprehensive choice for IT consultants, software developers, and other technology professionals.

Cyber coverage can also be added to a general liability policy or to a business owner’s policy (BOP), which bundles general liability and commercial property insurance. This is a great option for small businesses that want to extend their protection to include cyber risks without buying a standalone cyber policy.

No matter your industry, bundling can streamline your insurance and help you get the protection you need at a better rate.

How much does cyber insurance cost?

Insureon customers pay as low as $73 per month for cyber insurance. The cost of cyber liability insurance is based on several factors during underwriting, including:

- Amount and type of sensitive information handled, such as credit card and Social Security numbers

- Your industry

- Coverage limits and policy exclusions

- Number of employees

All of these factors will be instrumental in determining how much cyber insurance your small business needs.

What our customers are saying

Customize your cyber liability policy

Every business faces unique cyber risks, which is why it’s important to tailor your cyber insurance policy to fit your specific needs and budget. Whether you're a solo consultant or run a growing firm, you can work with an insurance agent to adjust key elements of your coverage.

Choose your coverage limits and deductible

Your coverage limit is the maximum amount your insurer will pay for a claim, while your deductible is what you pay out of pocket before coverage kicks in. Higher limits offer greater protection but typically come with a higher premium. Choosing a higher deductible can help lower your monthly or annual costs, but make sure it’s an amount your business can comfortably afford in the event of a claim.

Decide how you want to pay

Many small business owners choose to pay their cyber insurance premium annually to avoid monthly processing fees and simplify their budgeting. However, monthly payment options may be a a better choice if you prefer to spread out the cost over time. No matter which you choose, understanding your payment terms helps you stay covered without interruption.

Find cheap cyber insurance with Insureon

You know you need insurance for your small business, but where to start? And how can you keep costs down?

Insureon is here for you. You can get customized quotes from top carriers.

Most small businesses start with a general liability policy. You can combine property coverage with your liability insurance at a discount of $57 per month. Maintaining a safe work environment can help you manage risk and lower your insurance costs too.

Get affordable insurance from the best carriers. Start your application now! Insureon. Protection is peace of mind.

One of the most effective ways to reduce the cost of your cyber insurance policy is to actively manage your cyber risks. Insurance carriers will offer better rates to businesses that show strong security practices and a commitment to reducing their exposure.

To keep your premium low, consider taking the following steps:

- Use multi-factor authentication (MFA) on all accounts to reduce the risk of unauthorized access

- Keep software and computer systems up to date with the latest security patches to avoid vulnerabilities

- Encrypt sensitive customer data

- Train employees on cybersecurity best practices, such as spotting phishing emails and using strong passwords

- Create an incident response plan so your team knows how to react quickly to a breach

- Regularly back up your data to minimize downtime and data loss in the event of an attack

- Establish a formal BYOD policy that clearly defines data security requirements and acceptable use for remote work

Not only can these practices reduce the chance of a costly security breach or other cyber threat, but they also show insurers that your business is a lower risk—potentially leading to more affordable coverage.

Cheapest states to purchase cyber insurance

| State | Cyber insurance cost |

|---|---|

$110 per month | |

$111 per month | |

$117 per month | |

$131 per month | |

$131 per month | |

$135 per month | |

$140 per month | |

$165 per month | |

$167 per month | |

$176 per month |

Cheapest industries to purchase cyber insurance

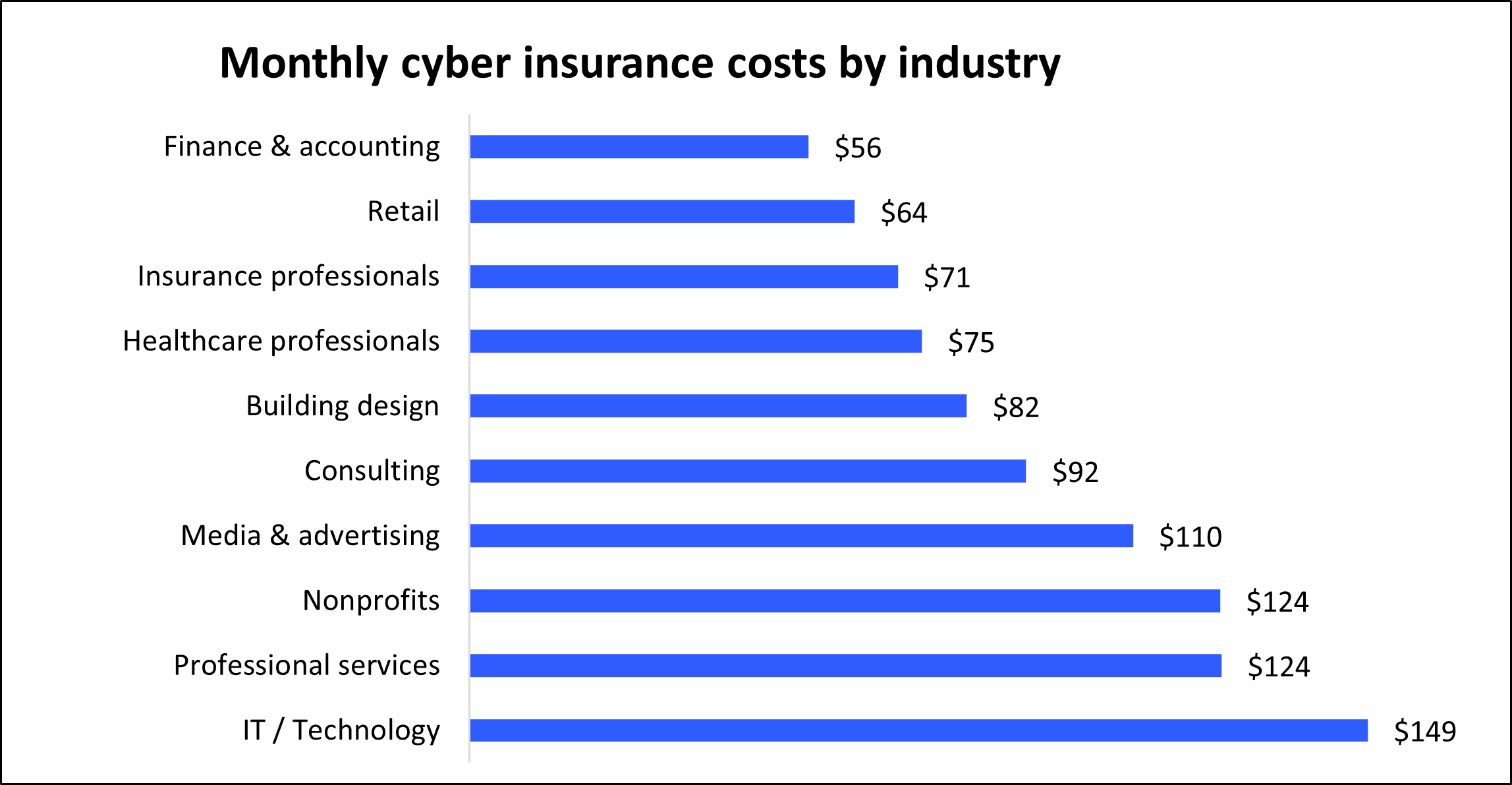

Just like with other types of insurance, your industry plays a big role in determining the cost of your cyber insurance. Businesses in lower-risk industries typically pay less, while those that handle sensitive data or manage cybersecurity for others tend to pay more.

For example, finance and accounting businesses have lower monthly costs around $56 per month, compared to IT professionals that pay $149 per month. This is because they generally have fewer cyber exposures compared to companies that manage client networks or store large volumes of personal data. Small businesses in these lower-risk sectors can often find affordable cyber coverage that fits within their budget.

Startups—especially those in non-tech fields or small IT startups with limited exposure—may also qualify for more affordable cyber insurance. These businesses are often cost-conscious and looking for essential protection that won’t break the bank.

Want to see how your industry compares? Here’s a look at average monthly cyber insurance costs for top industries:

How to find affordable cyber insurance with Insureon

Complete Insureon’s easy online application today to get free quotes for cyber insurance coverage from top-rated U.S. companies. You can also speak with an agent about the types of coverage your business needs and if there are any discount bundles available.

Once you find the right policy, you can usually begin coverage and get your certificate of insurance in less than 24 hours.

General liability insurance

Workers’ compensation insurance

Professional liability insurance

Business owner’s policy

Commercial auto insurance