Workers’ compensation insurance for consultants

Workers’ compensation insurance

Workers’ compensation insurance covers medical costs and lost wages for work-related injuries and illnesses. This policy is required in almost every state for businesses that have employees.

Workers’ comp insurance protects employees at your consulting firm

Even in the relatively low-risk field of consulting, your employees are still susceptible to repetitive motion injuries, slip-and-fall injuries, and other accidents. Your business could be exposed to serious legal and financial consequences if you are held liable.

Workers’ compensation insurance provides coverage in three primary areas:

- Employee work injury expenses

- State law compliance

- Employee injury lawsuits

What coverage can workers’ compensation insurance provide for consulting businesses?

Consultants help other businesses make informed decisions and save money. Consulting firms should consider a workers' comp policy to protect their business from common operational risks, including:

Employee work injury expenses

If an employee suffers an injury at your consulting office, you could be held responsible for medical expenses. Workers’ compensation insurance helps cover:

- Medical bills

- Ongoing care

- Missed wages during recovery

- Funeral expenses for fatal incidents

- Death benefits

Employee injury lawsuits

An employee who trips because of dim lighting, clutter, or a broken step could accuse your business of negligence. If your consulting firm is sued for failure to provide a safe work environment, employer’s liability insurance, typically included in workers’ comp, can compensate your business for:

- Attorney’s fees

- Court costs

- Settlements or judgments

How much does workers' comp for consulting businesses cost?

Consulting businesses that purchase with Insureon pay an average of $40 per month for workers' compensation insurance, but you could pay more or less depending on your risks.

Insurance costs for consulting professionals are based on a few factors, including:

- Consulting services offered

- Business equipment and property

- Revenue

- Location

- Number of employees

How is the cost of workers' comp calculated for consulting businesses

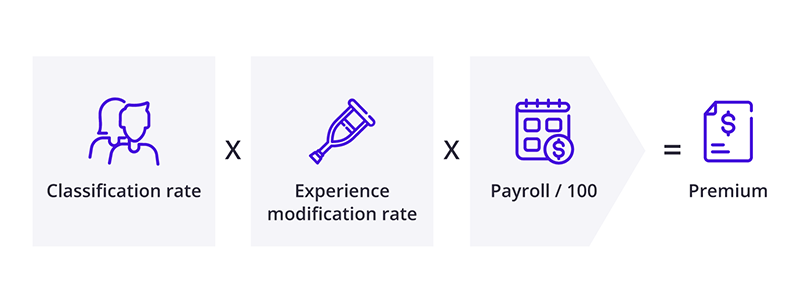

The amount you pay for workers’ compensation is a specific rate based on every $100 of your business’s payroll. Your premium is determined by the type of work done by your employees (classification rate), your experience modification rate (claims history), and your payroll (per $100).

The formula providers use in underwriting to calculate workers' comp rates is:

Lower workers’ comp costs with risk management

Even office workers are at risk for an injury. They could slip on a wet floor or trip over a power cord. If one of your consultants is injured on the job, it could lead to an insurance claim — and a rise in your premiums.

Whether you work in HR, market research, or management consulting, you can mitigate risks by providing safety training and maintaining a safe work environment. Taking these steps could reduce workplace injuries along with insurance rates.

State laws set workers’ comp requirements for consulting businesses

In most states, consulting firms must provide workers’ compensation insurance as soon as they hire their first employee. Without this policy, you can face heavy fines and even jail time.

Each state sets its own requirements for workers’ compensation. For example, every consulting business in New York must carry workers’ compensation for its employees – even part-time workers. However, Alabama businesses are only required to carry workers’ compensation when they have five or more employees.

While independent contractors, sole proprietors, and partners don’t have to carry workers’ compensation insurance, they can purchase a policy to protect themselves, too. It's a good idea to carry this coverage for financial protection against work injuries, which health insurance might not cover.

Workers' compensation laws in your state

Monopolistic state funds for workers’ compensation

In certain states, consulting businesses must purchase coverage through a monopolistic workers' comp state fund. Those states are:

If you purchase workers’ comp through a monopolistic state fund, it might not include employer’s liability insurance. However, you can purchase it as stop gap coverage from a private insurance company.

Other important policies for consultants

Workers’ compensation insurance covers employee injuries, but it does not provide coverage for many common business risks. It's important to consider protection against client injuries, business property damage, and other risks with policies such as:

Professional liability insurance covers legal costs related to business mistakes or decisions that resulted in revenue loss and legal action by a client. It's sometimes referred to as errors and omissions insurance (E&O).

General liability insurance covers expenses related to common accidents, including third-party injuries, accidental damage to client property, and advertising injuries.

Business owner’s policy (BOP) bundles general liability coverage with commercial property insurance, typically at a lower rate than if the policies were purchased separately.

Cyber insurance is important for businesses that handle personal information. It helps consulting firms recover from costly data breaches and cyberattacks.

Commercial auto insurance covers costs in the event of an accident involving your consulting business's vehicle. Most states require this coverage for vehicles owned by a business.

Fidelity bonds provide reimbursement if one of your employees steals from a client. They are often required for client contracts.

Get free quotes and buy online with Insureon

Are you ready to safeguard your consulting firm with workers’ compensation insurance or another policy? Complete Insureon’s easy online application today. Once you find the right policy, you can begin coverage in less than 24 hours.

Verified workers' compensation insurance reviews

Want free expert advice right in your inbox?

By entering your email address and subscribing, you agree to our Terms of Use and Privacy Policy