How much does consultant insurance cost?

Consultants can save money on insurance by comparing quotes from different providers with Insureon. The cost depends on the types of business insurance purchased, coverage limits, deductibles, and factors such as your business's location and number of employees.

Top consulting business insurance policies and their costs

Here are the top insurance policies purchased by consultants and their average monthly costs:

- General liability insurance: $29 per month

- Professional liability insurance: $55 per month

- Workers' compensation: $40 per month

- Cyber insurance: $92 per month

- Commercial auto insurance: $146 per month

Our figures are sourced from the median cost of policies purchased by consulting businesses through Insureon. The median offers a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

Save money on business insurance with Insureon

You know you need insurance for your small business, but where to start? And how can you keep costs down?

Insureon is here for you. You can get customized quotes from top carriers.

Most small businesses start with a general liability policy. You can combine property coverage with your liability insurance at a discount of $57 per month.

Maintaining a safe work environment can help you manage risk and lower your insurance costs too.

Get affordable insurance from the best carriers. Start your application now!

Insureon. Protection is peace of mind.

General liability insurance costs for consultants

Consulting businesses pay an average premium of $29 per month, or $350 per year, for general liability insurance.

General liability insurance covers legal costs if a client trips in your office and suffers a bodily injury, or if a consultant accidentally damages a client's laptop. It also covers advertising injuries, which include slander, libel, and copyright infringement.

This is the average general liability insurance policy for consulting businesses that buy from Insureon:

Premium: $29 per month

Policy limits: $1 million per occurrence; $2 million aggregate

Deductible: $500

Insureon’s licensed agents typically recommend a business owner’s policy (BOP) over a standalone general liability policy. A BOP combines general liability insurance with commercial property insurance to protect your consulting office and computers, and costs less than purchasing each policy separately.

Consultants pay an average of $42 per month, or $500 annually, for a BOP. Small, low risk businesses are typically eligible. Businesses with higher risks can often save money with a commercial package policy (CPP), which offers liability and property coverage with more coverage options and higher policy limits.

The cost of a business owner's policy depends primarily on the value of your business property, including your building if you own it.

Your industry risks affect general liability costs

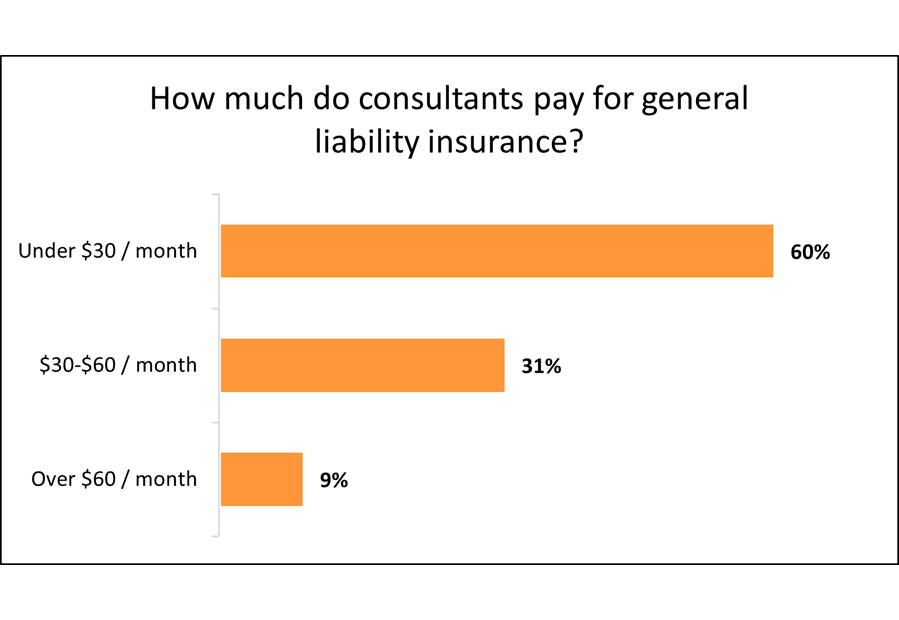

Among consulting businesses that purchase general liability insurance with Insureon, 60% pay less than $30 per month and 31% pay between $30 and $60 each month.

The amount you pay depends on several factors, such as the size of your business, how often you interact with clients, and your business revenue.

Businesses with larger premises can expect to pay more for general liability coverage than smaller businesses. For example, a cybersecurity consulting firm will likely pay more for this policy than an education consultant who works from their home.

Your industry risks, years in operation, claims history, and location will also affect your insurance premium.

Common general liability policy limits for consultants

Policy limits are the maximum amounts your insurer will pay on covered claims. Most consultants (89%) choose general liability policies with a $1 million per-occurrence limit and a $2 million aggregate limit. As your small business grows, you may need to expand your policy limits.

The per-occurrence limit is the maximum your insurer will pay for a single incident, while the aggregate limit is the maximum they will pay for all claims during your policy period, typically one year.

Choosing lower limits is one way to get an affordable premium, but you'll also want to make sure it's enough to cover a lawsuit.

Learn other ways to save, how to choose coverage limits, and more on Insureon's general liability insurance cost analysis page.

Professional liability insurance costs for consultants

Consultants pay an average of $55 per month, or $662 annually, for professional liability insurance. This policy is sometimes referred to as errors and omissions insurance or E&O insurance.

Professional liability insurance offers critical coverage for consultants, including legal fees related to accusations of professional negligence. For example, if a research consultant makes a recommendation that leads to financial losses for a client, this policy would cover the costs of the resulting lawsuit.

This is the average E&O policy for consulting businesses that buy from Insureon:

Premium: $55 per month

Policy limits: $1 million per occurrence; $1 million aggregate

Deductible: $1,000

The cost of professional liability insurance for consultants depends on several factors, such as your line of work, claims history and the policy limits you choose.

Your risks drive the cost of professional liability insurance

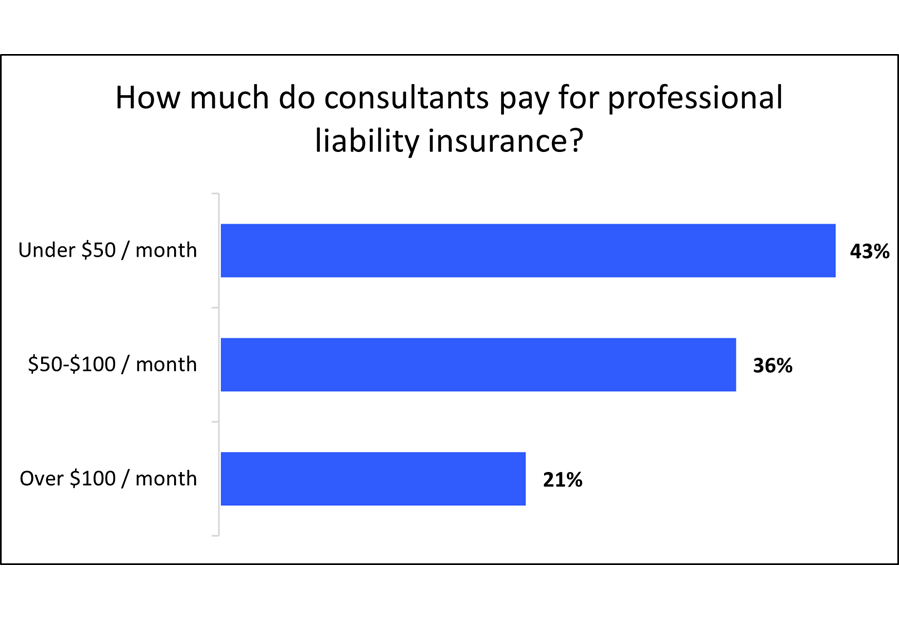

Among consulting businesses that purchase professional liability insurance with Insureon, 43% pay less than $50 per month and 36% pay between $50 and $100 per month.

Consultants who have been sued in the past or who own a large company may pay more for this insurance coverage. Providers will also look at the type of professional services you offer when determining your premium.

Professional liability policy limits for consulting businesses

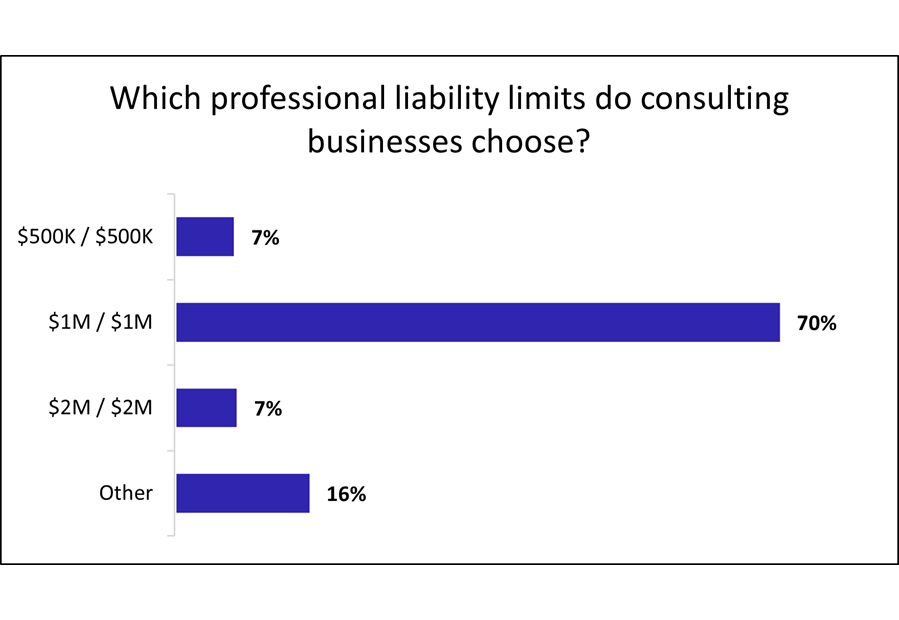

Most consultants (70%) choose professional liability policies with a $1 million per-occurrence limit and a $1 million aggregate limit. Higher limits cost more—and provide better coverage.

Workers’ compensation costs for consultants

The average cost of workers’ compensation insurance for consultants is $40 per month, or $477 per year. This insurance policy covers medical expenses when an employee is injured on the job, and it also provides disability benefits while they're recovering and unable to work.

To comply with your state’s requirements and avoid penalties, consulting businesses typically must purchase this coverage for their employees. It's also recommended for sole proprietors, as health insurance plans can deny claims when an injury or illness is related to your job.

Most workers' comp policies include employer's liability insurance. This policy covers attorney’s fees, court costs, and other expenses related to workplace injury lawsuits.

The cost of workers' comp depends on several factors, primarily the number of employees and the type of work they do.

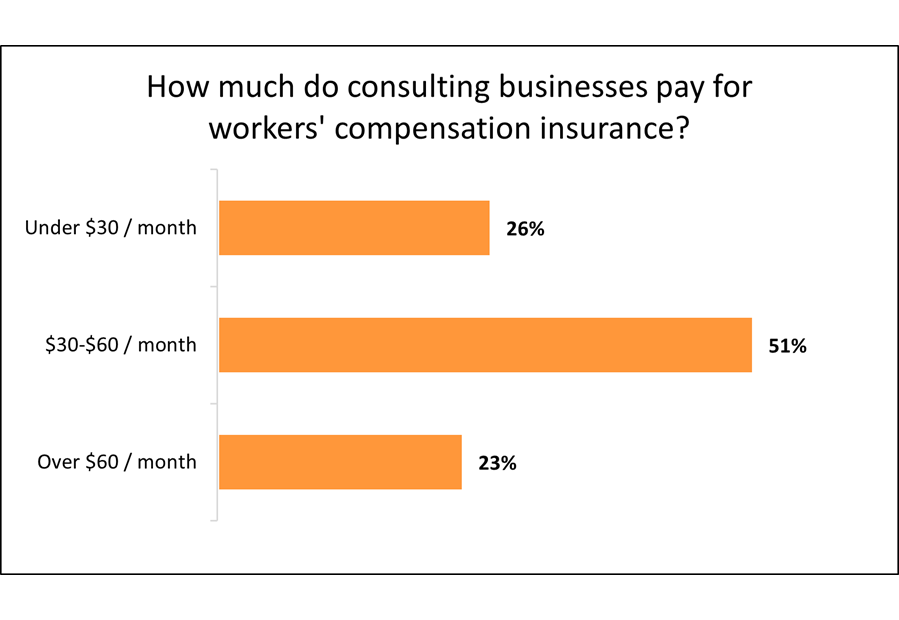

Workers' comp costs vary depending on your employees

Among consulting businesses that purchase workers’ compensation insurance with Insureon, 77% pay $60 or less per month.

Insurance companies look at the size of your workforce and each worker's level of occupational risk when determining your premium.

Cyber insurance costs for consultants

Consultants pay an average of $92 per month, or $1,105 annually, for cyber insurance. You might also see this policy called cyber liability insurance or cybersecurity insurance.

Cyber insurance helps consulting companies recover financially after a data breach or cyberattack. It can help pay for customer notification costs, fraud monitoring services, and other costs necessitated by state data breach laws.

This policy is vital for consulting firms that collect credit card numbers, Social Security numbers, or other personal information. The cost of cyber insurance depends on the amount of sensitive data your company handles.

Commercial auto insurance costs for consultants

Consulting firms and consultants pay an average of $146 per month, or $1,757 per year, for commercial auto insurance. This policy can pay for property damage and medical bills when your company car gets into an accident. It can also cover vehicle theft, vandalism, and weather damage.

Most states require a commercial auto policy for businesses with company-owned vehicles. If you drive your own car to meet clients, consider hired and non-owned auto insurance (HNOA), which covers personal, rented, and leased vehicles used for business purposes.

The cost of commercial auto insurance depends on several factors, including the policy limits you choose, the value of your vehicle, and the driving records of anyone permitted to drive.

How do you buy consulting business insurance with Insureon?

Insureon works with top-rated U.S. providers to find affordable consulting business insurance and fidelity bonds, whether you work independently as a management consultant or own a marketing consulting firm with several employees.

Apply today to get free quotes with our easy online application. A licensed insurance agent who specializes in your profession's unique risks will help you find the right types of insurance and answer any questions. Most small business owners get their certificate of insurance within 24 hours of submitting an application.

What our customers are saying

Want free expert advice right in your inbox?

By entering your email address and subscribing, you agree to our Terms of Use and Privacy Policy