A guide to the best vendor insurance

Liability insurance like general liability can protect vendors, exhibitors, and concessionaires from lawsuits, while property insurance will provide coverage against theft and storm damage. Additionally, workers' compensation will cover employees from on-the-job injuries or illnesses. Because lawsuits can be so expensive, you may need insurance to participate in an event or set up shop in a certain location.

Why do vendors need liability insurance?

Many venues will require vendors to carry liability insurance in order for them to cater, sell, or display their goods. And most trade shows, farmers’ markets, art fairs, ballparks, and universities require vendors to carry specific amounts and types of liability coverage.

In addition to liability coverage, business property insurance can protect your equipment and inventory, and state laws might require vendors to carry workers' comp and commercial auto insurance.

What types of vendors need liability insurance?

Anyone who deals with the public is at risk of a liability lawsuit. Someone could sue over a bodily injury, damaged personal property, or any number of reasons.

Those serving food face a great deal of liability risk. This includes food trucks and other food vendors, along with bakeries, ice cream shops, and caterers.

A customer could trip over your display. Your cooking equipment could catch fire. Produce sold at a farmers’ market or a roadside stand could be contaminated and cause an illness.

Artisans and other vendors who sell homemade crafts, candles, jewelry, or any other goods could also face a lawsuit. A table or booth could collapse, injuring a customer. Someone might sue, claiming they were harmed by one of your products. A competitor might claim that you stole one of their designs.

Even exhibitors at a conference, tradeshow, or other special events face risks of third-party injuries or property damage. Fortunately, there are a variety of vendor insurance options available to help protect your business from lawsuits.

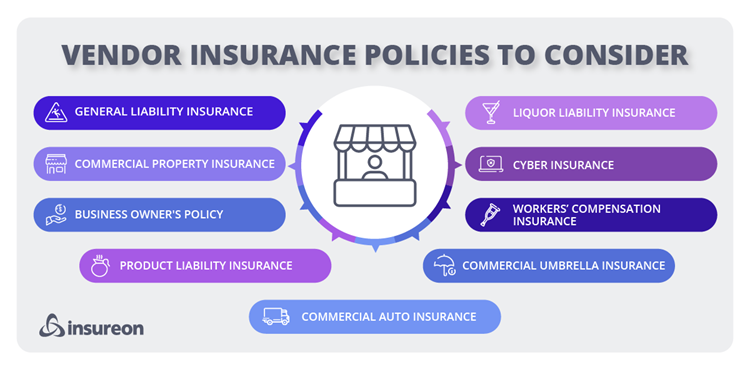

What kind of insurance do you need as a vendor?

Even if a venue doesn’t have vendor insurance requirements, it can be a smart investment for your business. Let’s consider the types of policies you might need for your business, and what they cover.

General liability insurance

General liability insurance is the most common type of small business insurance, and it’s often required by venues. It provides liability coverage and financial protection from common business risks.

If a shopper suffers an injury while visiting your booth, it would be covered by this policy. It also covers you if a customer falls ill after eating food you served at an event.

In addition, general liability coverage will pay for legal costs and judgments if a competitor sues you for an advertising injury, defamation, or copyright infringement.

Commercial property insurance

A commercial property insurance policy covers the repair or replacement of damaged or stolen business property. This could include any commercial spaces you own, as well as supplies, equipment, and inventory that you take to special events.

This coverage is particularly important for restaurants that must bring expensive equipment to events or artisans with high-priced inventory.

Business owner's policy

A business owner’s policy (BOP) combines commercial general liability and commercial property insurance under one policy, usually at a savings. It covers third-party lawsuits from customer accidents and damage to your property, such as fire and burglaries.

Product liability insurance

Product liability insurance protects you from any lawsuits over claims that a product you sold or made caused sickness, injury, or property damage.

If you’re an artisan or other retail vendor, you might consider this policy.

Commercial auto insurance

Commercial auto insurance covers accidents involving vehicles used for your business, including food trucks or delivery vehicles. It may also cover the cost of theft and vandalism.

Commercial auto insurance is typically required by state law, but if your business depends on your vehicles, you should consider a comprehensive insurance policy.

In addition, if you use your personal vehicle for business purposes, your regular auto insurance policy usually won’t cover any mishaps that occur during business use.

Liquor liability insurance

Liquor liability insurance is often required for vendors selling alcohol. It covers legal fees, property damage, and medical costs if alcohol is sold to a visibly intoxicated person who damages property or injures people.

If your microbrewery or bar provides liquor for special events, you’ll want to confirm that your liquor liability policy still provides coverage at any venue.

Cyber insurance

It might seem unusual for a vendor to consider cyber insurance, although anything can happen in today’s interconnected world. This coverage protects you from the cost of a data breach, cyber hacking, or malicious software attack. It covers expenses such as customer notification, credit monitoring, legal fees, and fines.

Workers’ compensation insurance

Workers’ compensation insurance is required in almost every state for businesses with employees. It helps cover medical bills and lost wages for work-related injuries and illnesses.

Commercial umbrella insurance

Commercial umbrella insurance raises the policy limit on your general liability, commercial auto, or employer's liability insurance when the underlying policy reaches its limit on a claim.

While unusual for smaller venues, this coverage is not unheard of when doing business with a university, a hospital, or other large venue. Vendors of all sizes may need it to meet requirements for higher liability limits at a specific event.

No matter your business, there’s a wide range of affordable vendor insurance options available to protect your venture and help it thrive.

How much does vendor insurance cost?

Insurance can be affordable for small businesses. For example, food vendors pay an average price of:

General liability: $31 per month

Workers’ comp: $101 per month

Business owner's policy: $60 per month

Factors that affect your premium include:

- Size of your business

- Level of business risk

- Value of your equipment

- Policy limits, exclusions, and deductibles

What amount of vendor insurance coverage will a venue require?

Many venues will specify the type and amount of insurance coverage they require. It’s a good idea to check with any places you’ll be setting up shop, to make sure you have enough protection.

Typically, you’ll need to sign a vendor contract to sell goods or services at a venue. The contract will specify rules and requirements, including the types of insurance they require and any minimum amounts.

If insurance is required, the venue will likely provide a minimum per-occurrence limit (coverage for a single claim) and aggregate limit (coverage for all claims combined).

Many venues will specify the type and amount of liability insurance coverage they require.

When does a vendor need a certificate of insurance?

Often, an event organizer or venue will ask you to provide a certificate of insurance (COI) from your insurance carrier as proof of coverage. A COI can be useful in fulfilling contractual obligations, as well as meeting venue-specific requirements.

What is an additional insured?

Many venues require to be named as an “additional insured” on your general liability policy and other coverages. Even if the facility carries their own event insurance, this additional insured endorsement on your policy offers added protection for the venue against liability claims over any harm caused by your business. This typically comes with an additional cost.

What if I want one day vendor insurance?

Year-round coverage is almost always the better choice—especially when it comes to cost—however, there are situations when a short-term policy may make more sense. You might not want to invest in a year long policy if you're testing out events for the first time, selling at events temporarily, or only working seasonally each year.

If that's the case, you might want to explore the one-day policy special event insurance.

How do I get vendor insurance?

Complete Insureon's free online application today to get quotes from top-rated U.S. insurance companies. You can also consult with a licensed insurance agent on your business insurance needs. Once you find the right types of coverage for your small business, you can being coverage in less than 24 hours.

Mike Mosser, Content Specialist

Mike spent several years as a reporter and editor covering politics, crime, and the world financial markets. He’s worked for several newspapers, a financial newswire, and a monthly magazine. As a copywriter, Mike has produced SEO-based content, marketing, public relations, and advertising work for a variety of companies.