Business owner’s policy

Business owner’s policy

A business owner’s policy (BOP) bundles general liability insurance with commercial property insurance. It typically costs less than purchasing these policies separately.

Who needs a business owner's policy?

If you own or rent a workspace, you likely need a business owner’s policy (BOP).

Most small businesses need general liability insurance and commercial property insurance when they rent or own an office or other commercial space. On top of that, client contracts often require general liability coverage.

Even when coverage isn’t required, a BOP is a wise choice for small businesses that work directly with the public and own valuable business property. This policy protects against financial losses from customer accidents and incidents like fires and burglaries.

Is your business eligible for a business owner's policy?

To qualify for BOP savings, businesses typically must have:

- A low-risk industry

- Fewer than 100 employees

- Less than $1 million in annual revenue

- A small commercial space

What does a business owner's policy cover?

A business owner's policy includes both general liability insurance and commercial property insurance coverage, sometimes called business hazard insurance. Together, they protect your small business against common liability risks, such as slip-and-fall lawsuits, and stolen or damaged business property.

Specifically, a business owner's policy typically covers:

Third-party bodily injuries

If a customer is hurt on your property, the general liability insurance portion of your business owner's policy can help pay for medical expenses or legal expenses in the event of a lawsuit.

Third-party property damage

The general liability portion of a BOP covers accidents that damage or destroy other people’s property. It can also pay for legal fees if a customer sues over the damage.

Product liability

If a business sells, manufactures, or distributes products, it can be sued over the harm those products cause to people or property. Having product liability coverage in a BOP can provide protection from these types of risks, including product defects.

Advertising injuries

If someone sues a business owner or one of their employees over an advertising injury, such as libel, slander, or copyright infringement, the liability portion of a BOP can help pay for lawsuit expenses.

Business property damage

The commercial property insurance portion of a BOP can help pay for repair or replacement of your business property if it's damaged by fire, theft, and some weather-related events.

If you don't have a building, you can add a business personal property (BPP) endorsement to your general liability policy. It provides protection for the items your business owns, such as computers, furniture, and machinery.

How much does a business owner's policy cost?

The average cost of a business owner’s policy is $57 per month. About 40% of Insureon's customers pay less than $50 per month for this policy.

Your insurance premium is based on several factors, including:

- Value of your property and equipment

- Type of business

- Business operations

- Business location

- Number of employees

- Policy limits and deductible

- Claims history

Verified BOP coverage reviews

Protect your small business with a BOP

[video: an animated header displays the Insureon logo. Underneath it, a subheading displays the text: "What is a business owner's policy (BOP)?"]

MALE VOICEOVER: One of the most common commercial insurance policies, a business owner's policy or BOP is not only customizable to your unique business needs, it can often be more affordable than buying each coverage separately.

[video: an illustrated header displays the text: "A BOP is:"]

[video: Under above header, three bullet points display the text: "Affordable"; "Customizable"; "Great for small businesses"]

A BOP typically bundles general liability and commercial property insurance together, but you can also add endorsements to meet your business's coverage needs. Let's take a look at why a BOP is a smart choice for small business owners.

[video: an illustrated header displays the text: "A business owner's policy bundles:"]

[video: Under above header, two bullet points display the text: "General liability insurance" and "Commercial property insurance"]

General liability insurance protects your business from third-party lawsuits over bodily injuries and property damage. Should a customer slip and fall in your store and sustain an injury, you are covered.

[video: an illustrated header displays the text: "General liability protects against:"]

[video: Under above header, three bullet points display the text: "Customer or client injuries"; "Third-party property damage"; "Advertising & personal injuries"]

Commercial property insurance compensates your business if your assets are lost or damaged by incidents, such as fire and theft.

[video: an illustrated header displays the text: "Commercial property covers:"]

[video: Under above header, three bullet points display the text: "Business-owned property"; "Supplies & equipment"; "Inventory"]

These two policies are often required by landlords when signing a commercial lease and are usually the first types of insurance that small business owners will purchase. By getting both policies in a BOP, you get the coverage you need at a lower cost than buying each of them separately.

A business owner's policy can also be tailored to meet your specific insurance needs, from business interruption insurance to data breach coverage to liquor liability insurance.

[video: an illustrated header displays the text: "A BOP can include endorsements for:"]

[video: Under above header, four bullet points display the text: "Business interruption"; "Contractor's tools & equipment"; "Data breaches"; "And more..."]

To qualify for BOP savings, businesses typically must operate in a low-risk industry, have fewer than 100 employees, make less than $1 million in annual revenue, and maintain a small commercial space.

[video: an illustrated header displays the text: "To qualify for a BOP, you must have:"]

[video: Under above header, four bullet points display the text: "A lower-risk industry"; "Less than $1M in annual revenue"; "A small commercial space"; "Fewer than 100 employees"]

While it's not often required by law, a business owner's policy is a wise choice for small businesses that work with the public and own valuable business property.

Get free business owner's policy quotes with Insureon today.

[video: an illustrated white header displays the text: "Insureon is your #1 agency for small business insurance"]

Click the link to get started.

[video: an animated header displays the Insureon logo]

Insureon helps a wide range of businesses get the coverage they need from top-rated U.S. insurance carriers. Complete our easy online application to get free small business insurance quotes.

Our expert insurance agents can help you choose the best best business owner's policy that meets the needs of your small business.

You’ll typically be able to get coverage quickly and receive a copy of your insurance certificate on the same day.

What does a BOP not cover?

While business owner's policy insurance can help bundle coverage for a variety of business risks, it does not provide all the protection that a small business needs.

Specifically, a BOP will not include coverage for:

Employee injuries

Workers' compensation insurance covers medical expenses, physical therapy, and some lost income for employees who are injured at work. Most states require workers' comp for businesses with employees.

Employee discrimination lawsuits

Employment practices liability insurance (EPLI) can cover legal expenses related to claims of harassment, discrimination, and wrongful termination.

Vehicles used by a business

Commercial auto insurance provides coverage for business vehicles. It’s required in most states when your business owns the vehicle or you use it primarily for work.

Destroyed payment records

If a fire or other incident destroys your customer records, you could have trouble collecting outstanding payments. This is not a covered loss of commercial property insurance, unless your policy has an accounts receivable endorsement.

Workers’ compensation insurance

Professional liability insurance

Commercial auto insurance

Cyber insurance

Commercial umbrella insurance

FAQs about a business owner's policy

Find answers to frequently asked questions about business owner’s policies and other insurance products.

Is it possible to add coverage to a BOP policy?

Yes. Business owner's policies are flexible. You can add on other coverages, called endorsements, to a BOP to meet your specific needs.

Small business owners often bundle their BOP with other insurance policies, such as:

- Business interruption insurance, also called business income insurance, covers loss of income and day-to-day expenses when there is a temporary disruption in your business operations.

- Equipment breakdown insurance covers costs when equipment that your business depends on, such as a refrigerator or freezer, fails and causes a disruption.

- Business renter's insurance is an insurance bundle that covers your rented business space in the event of fire, vandalism, or weather damage. It is similar to renter’s insurance for apartment occupants.

- Contractor's tools and equipment insurance, a form of inland marine insurance, covers business property in transit and stored off-site. It can provide protection for a general contractor or handyman who transports tools and equipment to different jobsites.

- Data breach insurance, also known as cyber insurance, helps retail stores and other businesses recover when a data breach exposes email addresses, credit card numbers, or other customer information.

- Electronic data processing (EDP) insurance covers your business's computers, backup systems, and data in the event of a power surge, fire, natural disaster, or similar incident.

- Electronic data liability coverage protects against legal costs related to accidental damage to a client's computer, hard drive, or other data storage equipment. While cyber insurance usually covers data lost from a targeted software attack, electronic data liability insures a data loss when there’s accidental physical damage to a network or storage device.

- Employee dishonesty insurance protects your business from employee theft, such as an employee stealing from the cash register or forging a check.

- Hired and non-owned auto insurance (HNOA) provides coverage for leased, rented, and personal vehicles that a business owner occasionally uses for commercial purposes like visiting clients.

- Liquor liability insurance protects bars and restaurants if they serve alcohol to an intoxicated person who goes on to cause property damage or harm someone else.

- Professional liability insurance, also known as errors and omissions insurance (E&O), protects businesses when a client disputes the quality of a professional service.

- Commercial umbrella insurance extends the limits on your general liability coverage and other policies, meaning your insurance company can cover more expensive lawsuits. You may need it if you serve large clients or run a high-risk business.

What is the difference between general liability coverage and a business owner's policy?

Businesses that interact with the public rely on a general liability policy to cover third-party lawsuits over bodily injuries and property damage. But this insurance doesn’t cover fire, theft, and other incidents that damage or destroy your property.

A business owner’s policy, on the other hand, provides this same general liability coverage and also pays for theft and damage to your building, equipment, and inventory.

If you have a physical location, consider a business owner's policy. A BOP offers both general liability and commercial property coverage at a lower cost than buying the policies separately. That makes it a smart choice for small business owners.

Learn more about the difference between general liability insurance and a BOP.

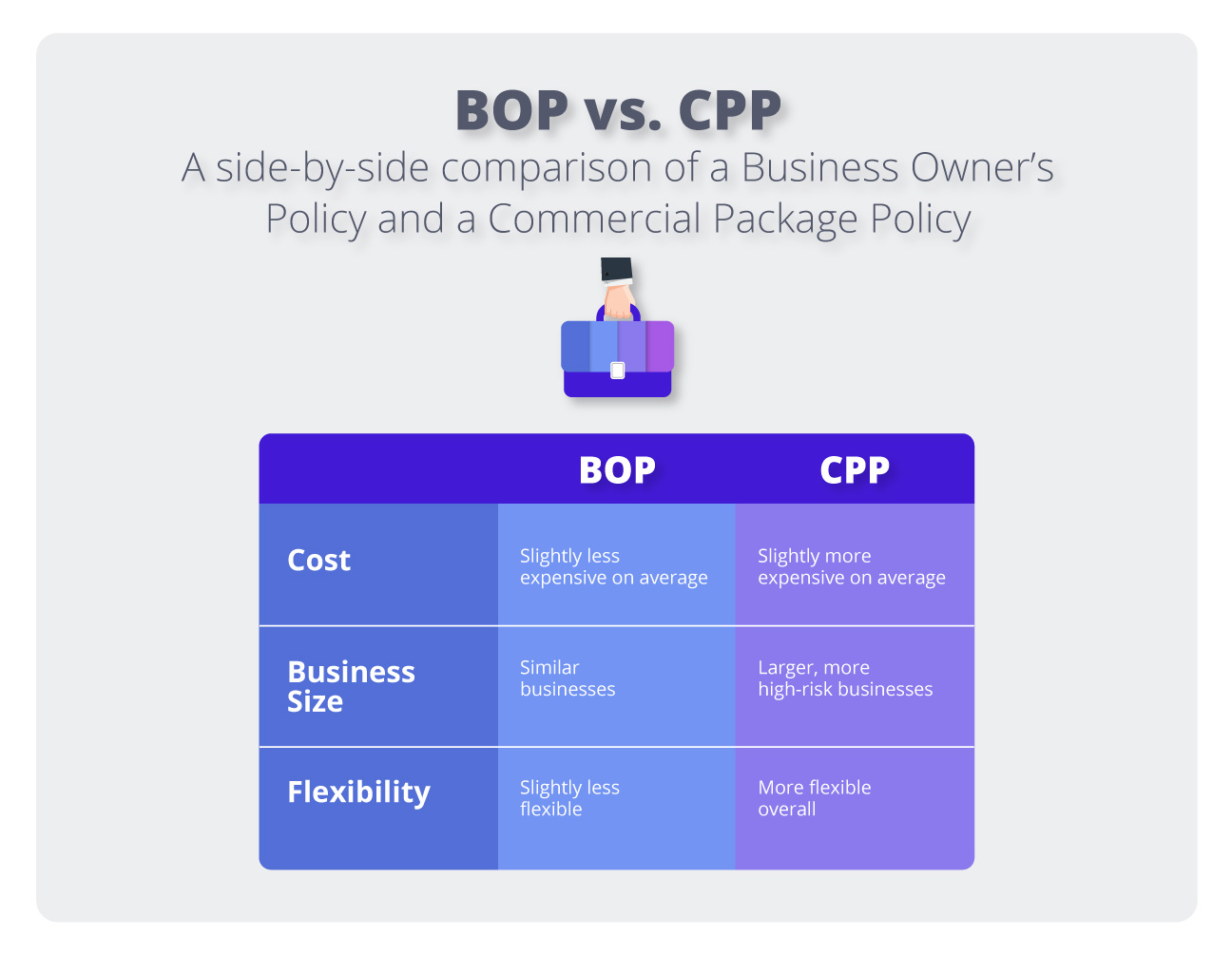

What is the difference between a business owner's policy and a commercial package policy?

A business owner’s policy combines general liability insurance and commercial property insurance in one policy, and it's usually less expensive than buying the coverages separately. It’s often purchased by small business owners and startups to save money on their liability insurance.

A commercial package policy (CPP) is typically purchased by larger businesses with higher risks, including small or midsize businesses with several employees. A CPP allows you to bundle multiple liability policies together, with more flexibility in terms of the risks covered and their coverage limits.

It also allows you to add endorsements, also known as riders, to increase or modify the types of coverage you have and tailor them to your specific insurance needs.

With an average premium of $90 per month, a CPP tends to be slightly more expensive than a BOP. The exact cost will depend on several factors, including your industry risks.

Learn more about the difference between a business owner's policy and a commercial package policy.

How do you get proof of insurance?

Business owners can usually get proof of insurance on the same day that they apply for insurance quotes with Insureon.

It can take several weeks for a traditional insurance agency to send a certificate of liability insurance to new customers. That’s an issue for business owners who need immediate proof of insurance to sign a lease or get licensed.

With Insureon, you can quickly provide proof of insurance to clients, landlords, and anyone else who requests it. If your bank or lessor requires other proof of insurance, you can contact an agent for assistance.

What are the exclusions on a business owner's policy?

BOPs have some coverage exclusions. For example, a BOP doesn't usually pay for property damage caused by natural disasters like earthquakes, hurricanes, tornadoes, and floods. If you need coverage for these events, you'll need to add a special endorsement to your policy.

A BOP also doesn't pay legal defense costs for lawsuits involving intentional copyright infringement or willful negligence—which can be criminal offenses. Purposeful customer injury or property damage falls into the same category and isn't covered by the policy.

Incidents that involve alcohol are also excluded from a BOP. With a liquor liability endorsement, you can get coverage for these claims.

Check with a licensed insurance agent to make sure your business owner's policy includes all the coverage you need.

Where can I learn more about a BOP?

If you want to learn more about this policy, you can find additional information in our frequently asked questions about business owner's policies.

If you have any other questions, or if you'd like help finding the right coverage options for your small business, ask an Insureon agent.