Workers' compensation insurance for cannabis businesses

Workers’ compensation insurance covers medical costs and lost wages for work-related injuries and illnesses. This policy is required in almost every state for cannabis businesses with employees.

Workers' comp protects your employees

From dispensaries to cultivators to transporters, employees in every cannabis-related profession can suffer work-related accidents. Consequently, your business could be exposed to financial losses and litigation if you're held responsible for the workers' compensation claim.

Workers' compensation insurance provides coverage in three primary areas:

- Employee work injury and illness medical expenses

- State law compliance

- Injured employee lawsuits

Whether you currently own a cannabis business or are looking to start one, this policy is critical due to the potential risks of working with cannabis products.

What coverage can workers’ comp insurance provide for cannabis businesses?

Workers' compensation insurance can protect your business from the high costs of medical care and potential lawsuits associated with workplace injuries.

Employee work injury and illness expenses

If an employee suffers a work injury or develops an occupational illness, your business can be held responsible for their well-being. Workers’ compensation insurance helps cover:

- Medical bills, such as an emergency room visit

- Ongoing healthcare, such as physical rehabilitation and prescriptions

- Disability benefits while the injured worker is unable to work

- Death benefits for fatal incidents, such as funeral expenses and dependent support

Employee injury lawsuits

Employer’s liability insurance is typically included in a workers’ comp policy. It provides protection when an employee decides to sue a business owner over an injury.

This coverage can help protect your business from financial loss from:

- Attorney’s fees

- Court costs

- Settlements or judgments

Without insurance, you might have to pay for a costly legal battle – even if the suit is frivolous.

How are workers' compensation costs calculated for cannabis businesses?

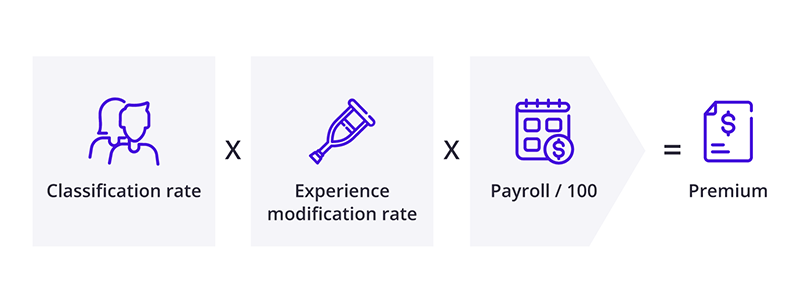

The amount you pay for workers’ compensation is a specific rate based on every $100 of your cannabis business’s payroll. Your premium is determined by the type of work done by your employees (classification rate), your experience modification rate or EMR (claims history), and your payroll (per $100).

The formula providers use in underwriting to calculate workers' comp rates is:

Many states set their workers’ comp rates based on guidance from the National Council on Compensation Insurance (NCCI), a workers' compensation insurance rating and data collection bureau.

The NCCI has a searchable database of cannabis business workers’ comp class codes online. Insurance providers use these classification codes to determine the level of risk for different job classifications, estimate workers' compensation rates, and set premiums.

States set their own requirements for workers' comp

Each state has unique laws regarding workers’ compensation insurance requirements. For example, every company in the cannabis industry in Colorado, New York, California, and Connecticut must carry workers’ compensation insurance for its employees – even part-time workers.

In most states, cannabis operations are required to provide workers’ comp. Sole proprietors, independent contractors, and partners don’t have to carry workers’ compensation, but you can purchase a policy to protect yourself, too. It's a good idea, as health insurance providers can deny policyholder claims for injuries related to your work.

Workers' compensation laws in your state

Lower workers' comp costs with workplace safety

Whether your employees work in a medical cannabis store-front or in a greenhouse, they aren't immune to common safety risks. One of the most prevalent work accidents is a slip or fall that causes an injury. When an employee is injured at work, it can result in an insurance claim and a hike in your premium.

Business owners can manage their risks through workplace safety training and the reduction of workplace hazards. For example, you could:

- Keep pathways and entrances clear

- Install brighter lights in the stockroom

- Proactively manage loss control

- Implement safety protocols and training

Taking these steps could reduce workplace injuries and help keep your insurance pricing low.

Other important insurance policies to consider

A workers’ compensation policy offers protection for your employees and your business, but it doesn’t provide coverage for your entire risk management plan. Owners of cannabis businesses should also consider the following types of insurance:

General liability insurance protects against the most common business risks, such as customer slip-and-fall injuries. Most states require this coverage for cannabis businesses.

Commercial property insurance helps businesses recover financially from fires, theft, vandalism, and other business property damage or loss.

Product liability insurance helps pay for lawsuits related to your products, including CBD and medical marijuana, such as a claim that a faulty battery in an e-cigarette started a fire.

Commercial auto insurance covers the legal costs and property damage from accidents involving your cannabis business's vehicle. It also covers vehicle theft and vandalism. This policy is also typically required by state law for businesses that own vehicles.

Surety bonds guarantee your cannabis business will fulfill the terms of its contracts and pay its suppliers. Many states require a surety bond as part of licensing requirements.

Get cannabis insurance quotes and buy online with Insureon

Are you ready to safeguard your cannabis business with general liability insurance? If you run a dispensary, you can complete Insureon’s easy online application to get quotes from top U.S. carriers. Once you find the right policies for your small business, you can begin coverage in less than 24 hours and get a certificate of insurance for your small business.

Verified workers' compensation insurance reviews

Want free expert advice right in your inbox?

By entering your email address and subscribing, you agree to our Terms of Use and Privacy Policy