Medical malpractice insurance

Medical malpractice insurance

Medical malpractice insurance provides healthcare professionals with financial protection from legal claims related to professional negligence and mistakes. It’s a form of medical professional liability insurance.

Why is medical malpractice insurance important?

Medical malpractice insurance is often required for healthcare professionals. It covers legal costs if you're accused of a negligent act that harms a patient.

Medical malpractice coverage protects against claims of professional negligence, such as:

- Failure to provide quality care

- Causing pain, suffering, or mental anguish to a patient

- Economic damages from a patient’s lost wages or healthcare costs

Healthcare networks and healthcare facilities usually require their medical staff to have malpractice coverage. Doctors, nurses, and dentists sometimes must carry this type of insurance to comply with state laws.

Even when it's not required, malpractice insurance is a key part of risk management. Even the most experienced healthcare provider can make a mistake or be sued for substandard care, such as a misdiagnosis, documentation error, or incorrect dosage.

In other industries, malpractice coverage is referred to as professional liability insurance or errors and omissions insurance (E&O).

- May be required by state law for your profession

- Fulfills contractual obligations to work at most medical facilities

- Covers malpractice claims which could otherwise bankrupt your business

How do I get medical malpractice insurance?

It's easy to get free quotes for medical malpractice insurance with Insureon. We'll ask for basic facts about your business to help you find coverage that matches your unique risks and fulfills any insurance requirements.

Contact our dedicated medical malpractice insurance specialist to get started.

What does medical malpractice insurance cover?

Medical malpractice insurance is a type of medical liability insurance that defends healthcare professionals and clinics against claims of negligence when providing medical services or counseling.

While policy terms vary, it can also cover telemedicine and webinars, unfounded accusations of sexual misconduct, and violations of the Health Insurance Portability and Accountability Act (HIPAA).

Specifically, medical malpractice insurance can help pay for lawsuits related to:

Medical errors

In healthcare, a simple mistake can have far-reaching consequences. For example, a certified registered nurse anesthetist (CRNA) might be sued because a patient trips and falls while recovering from an overdose of anesthesia.

Medical oversights

Nurses and other healthcare workers often juggle multiple patients at once, which can lead to oversights in a patient's medical history, preoperative instructions, or drug interactions. For example, a registered nurse (RN) might fail to add a note about a medication allergy, which leads to issues when the drug is administered.

Misdiagnosis

If a medical professional fails to diagnose a patient's condition accurately or within a reasonable timeframe, it could result in harm. For example, an optometrist could fail to diagnose glaucoma in a patient, which could lead to severe vision loss or blindness.

Failure to refer

Failure to refer a patient to a physician or specialist can also result in a lawsuit. For instance, a nurse practitioner (NP) might see a patient whose symptoms fall outside of their expertise, but fail to refer them to the appropriate specialist. The NP could be sued when the disease progresses and leads to a worse prognosis for the patient.

How much does malpractice insurance cost?

The cost of medical malpractice insurance varies widely, depending on the specific risks of your profession.

Factors that affect malpractice insurance premiums include:

- Industry risks

- Business location

- Number of employees

- Policy limits and deductible

- Claims history

Verified business insurance reviews

Hear from customers like you who purchased small business insurance.

Who needs medical malpractice insurance?

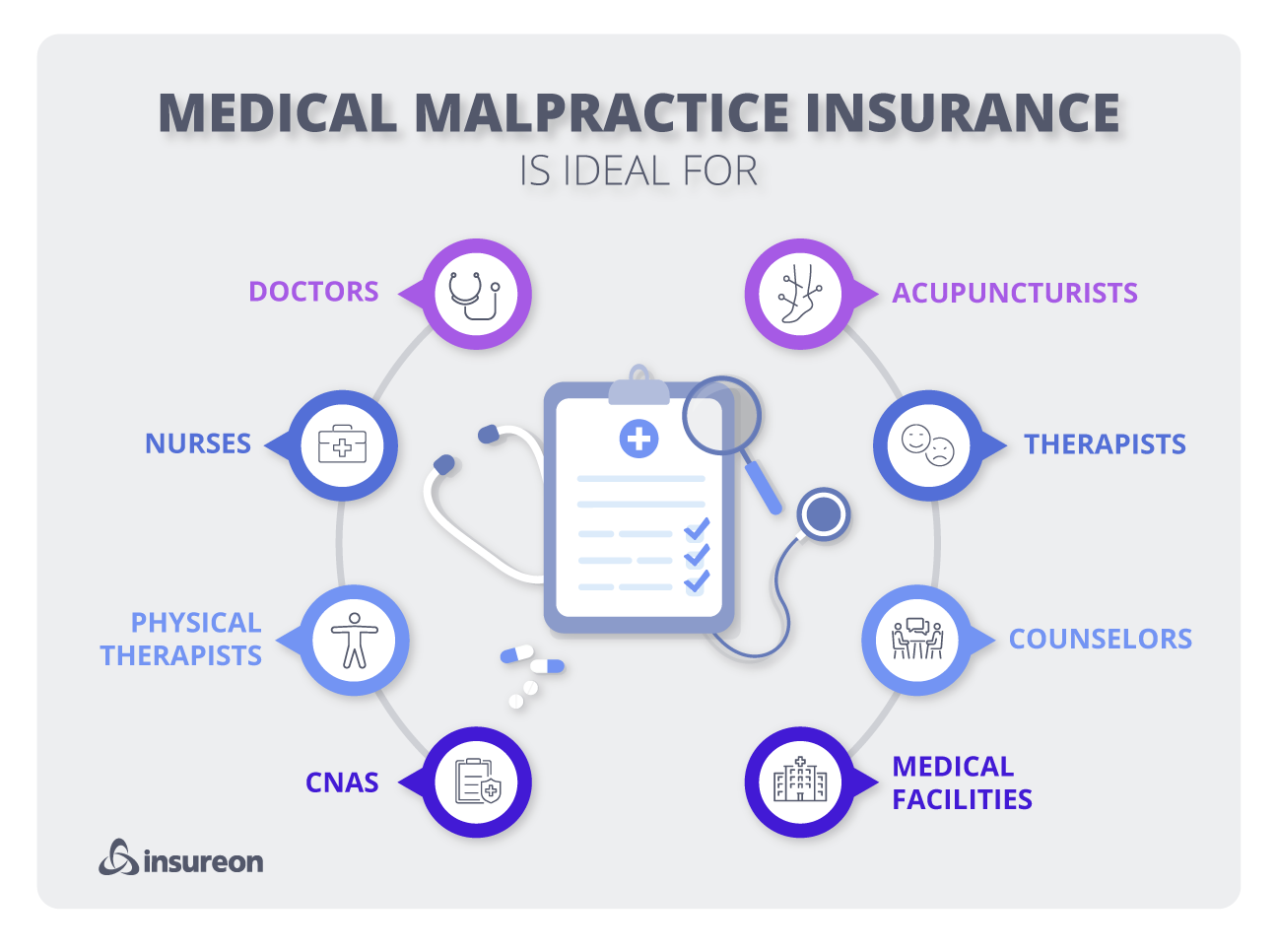

Medical malpractice insurance benefits a wide range of professionals who offer patient care, from doctors and nurses to therapists and counselors.

It's designed for both businesses and independent contractors that provide health-related services. Some professionals must carry this coverage to comply with the laws in their state.

Healthcare providers who need medical malpractice coverage include:

Nurses

Serving on the frontline in healthcare, nurses have regular interactions with patients that leave them vulnerable to risks. If a patient accused you of giving the wrong medication, you could face an expensive lawsuit.

The hospital, clinic, or temporary agency that employs you might have its own coverage, but this might not give you sufficient financial protection in the event of a liability claim.

Doctors

From creating treatment plans to performing surgeries or other medical procedures, doctors find themselves in the unique position of making critical decisions related to patient care. This brings a high risk of lawsuits from dissatisfied patients.

Medical malpractice coverage protects doctors from financial losses in the event of a lawsuit from a disgruntled patient, giving them peace of mind to focus on their work.

Physical therapists

Physical therapists come into contact with patients directly through stretching, exercise, and massage. Patients often experience some level of pain during treatment, and even the most experienced physical therapist could have an injured patient accusing them of a mistake.

Acupuncturists

A patient might accuse an acupuncturist of failing to recognize a serious issue and refer them to a physician. They could also say you caused nerve damage or an infection during treatment. Malpractice insurance provides financial protection against these types of claims.

Protect your healthcare business with medical malpractice

[video: an animated header displays the Insureon logo. Underneath it, a subheading displays the text: "What is medical malpractice insurance?"]

MALE VOICEOVER: Even the most experienced healthcare providers can make a mistake. From facing a lawsuit over a misdiagnosis to surgical and medication errors, medical malpractice insurance - sometimes called medical professional liability - insures healthcare professionals, therapists, counselors, and medical facilities against claims of medical negligence.

[video: an illustrated header displays the text: "Malpractice protects against medical negligence, including:"]

[video: Under above header, three bullet points display the text: "Failure to provide quality care"; "A patient's lost wages or healthcare costs"; "Causing pain, suffering, or mental anguish"]

Types of claims covered by medial malpractice insurance include medical errors, like an incorrect dosage of medicine; medical oversights, such as accidentally misreading a patient's medical history; and accusations of negligence, including surgical errors and poor follow-up care.

[video: an illustrated header displays the text: "Medical malpractice insurance covers:"]

[video: Under above header, four bullet points display the text: "Medical errors"; "Medical oversights"; "Accusations of negligence"; "Healthcare providers missing appointments"]

While not required in every state for every profession, if you provide health-related professional services, maintaining malpractice coverage can reduce your financial risk. Doctors and nurses are often serving on the frontline of healthcare and must make critical decisions, which can leave them open to lawsuits. Similarly, physical therapists and acupuncturists often have a high level of interpersonal contact with a patient, which could lead to accusations of malpractice.

The cost of malpractice coverage will likely vary from professional to professional, based on several factors.

[video: an illustrated header displays the text: "Cost is based on:"]

[video: Under above header, four bullet points display the text: "Your state of operation"; "Policy limits and deductible"; "Your liability claims history"; "Any malpractice lawsuits you've faced"]

Get free malpractice insurance quotes with Insureon today.

[video: an illustrated white header displays the text: "Insureon is your #1 agency for small business insurance"]

Click the link to get started.

[video: an animated header displays the Insureon logo]

Insureon helps a wide range of businesses get the coverage they need from top-rated U.S. insurance carriers. Complete our easy online application to get free insurance quotes.

You can call our dedicated medical malpractice insurance agent at (312) 854-2919, and they can help you choose the best malpractice policy that meets the needs of your small business.

You’ll typically be able to get coverage quickly and receive a copy of your certificate of insurance on the same day.

What does medical malpractice insurance not cover?

While medical malpractice insurance covers many situations in which a client takes legal action, it does have a number of coverage exclusions. For example, it only covers the cost of defending against lawsuits—it doesn't pay for lawsuits you initiate.

Unless your policy has prior acts coverage, it will only cover claims filed while the policy is active and for incidents that occurred after you bought the policy. In this case, endorsements can fill gaps in your malpractice coverage.

Other exclusions from medical malpractice insurance coverage include:

Patient accidents

If a patient trips on a rug and suffers an injury at your clinic, or you accidentally damage an item that belongs to a patient, your medical malpractice insurance will not cover you.

However, for these events, general liability insurance can help pay for medical expenses, or the cost of repairs or replacement. It can also cover legal expenses if the patient sues.

Employee injuries

If an employee at your practice or clinic gets injured, such as a physician assistant (PA) who slips on a recently mopped floor and breaks their arm, medical malpractice would not provide the necessary insurance protection.

Instead, you would need workers' compensation insurance, which helps cover medical expenses and disability benefits if an employee is injured on the job, or develops an occupational illness.

Damaged business property

The commercial property insurance included in a business owner’s policy (BOP) helps cover costs when business property is damaged, stolen, or destroyed.

For example, suppose a fire at your healthcare facility destroys your computers, furnishings, and medical equipment. The property insurance included in a business owner’s policy would help pay for replacement of the ruined items and renovation of your damaged building.

Auto accidents

If an employee gets into an accident while driving your business vehicle, commercial auto insurance would help cover medical bills and other damages.

For instance, suppose a hospital's ambulance gets into a head-on collision with another vehicle. The other driver is injured and their vehicle is damaged. The hospital's commercial auto policy would cover medical expenses and repairs for the other driver, including any legal costs or a settlement.

General liability insurance

Business owner’s policy

Workers’ compensation insurance

Commercial auto insurance

Cyber insurance

FAQs about medical malpractice insurance

Review answers to frequently asked questions about malpractice insurance.

Do clients require you to carry medical malpractice insurance coverage?

Healthcare networks usually require doctors, nurses, and other professionals to carry medical liability insurance, even when it's not required by law.

Some medical systems provide this coverage for their staff. Others self-insure themselves and their staff by creating a liability trust fund to cover any legal defense and settlement costs from malpractice claims.

Healthcare professionals may need to buy their own coverage, or may choose to do so to make sure they're sufficiently protected.

It’s important to make sure you comply with any requirements for malpractice insurance, while also taking the risks of your own practice into account.

How does medical malpractice insurance protect healthcare professionals?

The most experienced and attentive of professionals can make a mistake or find themselves facing a frivolous lawsuit. Medical malpractice insurance covers your cost of litigation, such as attorney's fees, as well as punitive and compensatory claims for patient harm.

Even if your employer or the facility where you work provides liability protection, it can be worth securing your own malpractice insurance to make sure you’re fully covered.

What are the different types of malpractice insurance coverage?

Most insurance companies sell medical malpractice insurance as a claims-made policy, but it's sometimes available as an occurrence-based policy as well.

- Claims-made policies cover incidents and claims that happen while the policy is active. If you face a lawsuit after canceling your policy, it would not be covered. Because claims must be filed while the policy is active, it's important to maintain continuous coverage.

- Occurrence-based policies offer more extensive coverage. An occurrence policy covers losses that happened during the policy period, even if the policy is no longer in effect when you file a claim. If you canceled this policy, you would still be covered for any incidents that happened during your coverage period.

What other coverage options are available for medical malpractice insurance?

When buying a malpractice policy, you can customize the amount of coverage and other factors to match your business needs and budget. This includes:

- Tail coverage. You can add a tail coverage endorsement to claims-made policies for increased protection. Also known as an extended reporting period (ERP), tail coverage allows you to file a malpractice claim even after your policy has expired. However, the incident related to the claim must have occurred while the policy was active.

- Policy limits are the maximum amounts your insurer will pay for each incident, and for aggregate claims during the policy period. Healthcare networks often have specific requirements for these coverage limits.

- The deductible is the amount you must pay before your insurer will cover a claim. A high deductible will lower your premium, but make sure it's an amount you can easily afford.

What is the difference between medical malpractice and general liability insurance?

For many small business owners, general liability insurance is often the first policy they buy. It covers the most common business risks, such as customer bodily injuries, customer property damage, and advertising injuries. It’s often required to sign leases and contracts.

If a patient is injured during a medical treatment or procedure, it would most likely be covered by your medical malpractice insurance. If a patient or a visitor is injured by an accident, such as tripping on a rug at your clinic, it would be covered by your general liability insurance policy.

What is the difference between medical malpractice and professional liability insurance?

Malpractice insurance is a type of professional liability insurance, sometimes referred to as errors and omissions insurance (E&O). While the terms are often used interchangeably, they’re not exactly the same.

Professional liability coverage relates to a healthcare provider’s business activities, while malpractice covers your legal defense and settlement costs if you’re accused of causing a patient’s injury or death.

If a patient accused you of an error in their treatment that resulted in pain or expensive additional care, it would likely fall under your medical malpractice insurance.

However, if someone accused you of a documentation error that caused them to lose money, it would probably be covered by your professional liability policy.

What are medical malpractice insurance exclusions?

Medical malpractice insurance has other coverage exclusions as well. The most common exclusions include:

- Illegal activities. Your policy won't cover acts of discrimination, assault, or sexual misconduct. However, it will cover legal defense costs if you're unjustly accused.

- Lawsuits you initiate. For example, this policy won't cover your legal costs if you sue a patient who refuses to pay you.

- Incidents and claims outside the policy period. Unless your policy has prior acts coverage, it only covers claims filed while the policy is active and for incidents that occurred after you bought the policy.

Endorsements can fill gaps in your medical malpractice coverage. To find the right insurance solutions for your business, contact our dedicated malpractice agent, [email protected].