Special event insurance cost

The cost of special event insurance varies based on a number of factors. Your premium is directly impacted by the type of event being held, coverage limits, your industry, and more.

What is the average cost of special event insurance?

Special event insurance costs are determined by several factors, including industry risks, the type of event, and its duration. On average, small businesses pay a premium of $250 to $285 for special event liability insurance.

This amount is paid upfront and many times special event coverage can be added to your general liability insurance policy. You can also include additional insureds on your special event insurance policy, such as the event venue.

Our figures are calculated using the median cost of policies sold by leading insurance companies to Insureon's small business customers. The median offers a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

Typical special event insurance costs for Insureon customers

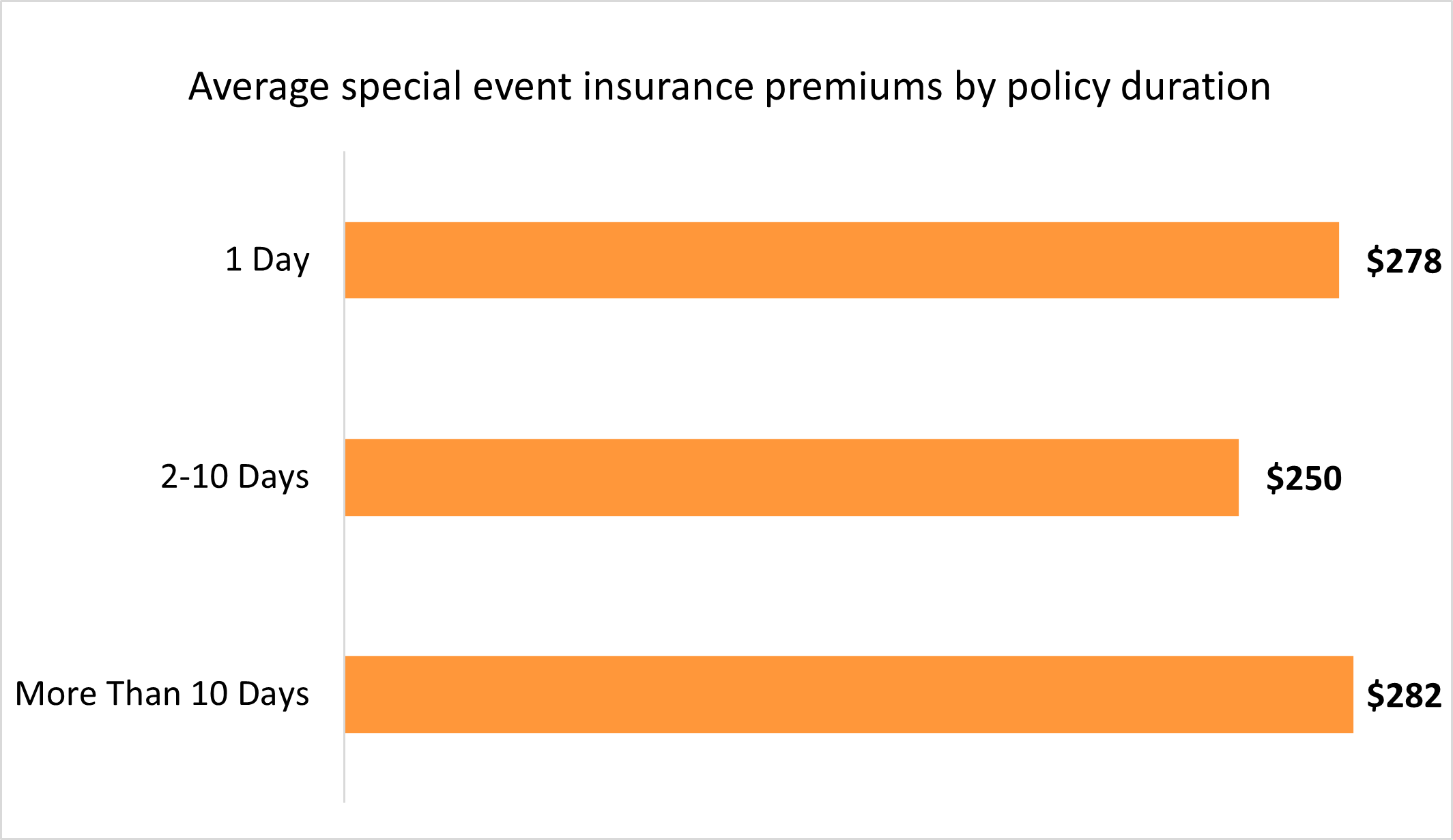

Insureon's small business customers pay an average of $278 for one-day special event insurance coverage, while a policy duration of 2 to 10 days has an average cost of $250. Events that run longer than 10 days cost an average of $282 to insure.

The exact cost will vary depending on your risks and other key factors.

Understanding special event insurance cost factors

Insurance companies consider several factors when determining how much to charge for special event coverage, including:

- Industry risks

- Coverage limits and deductible

- Venue location

- Number of people attending the event

- Event duration

- Food and drink service

- Type of event (e.g., reception, sporting event, birthday party, trade show, etc.)

- Coverage type

Industry risks

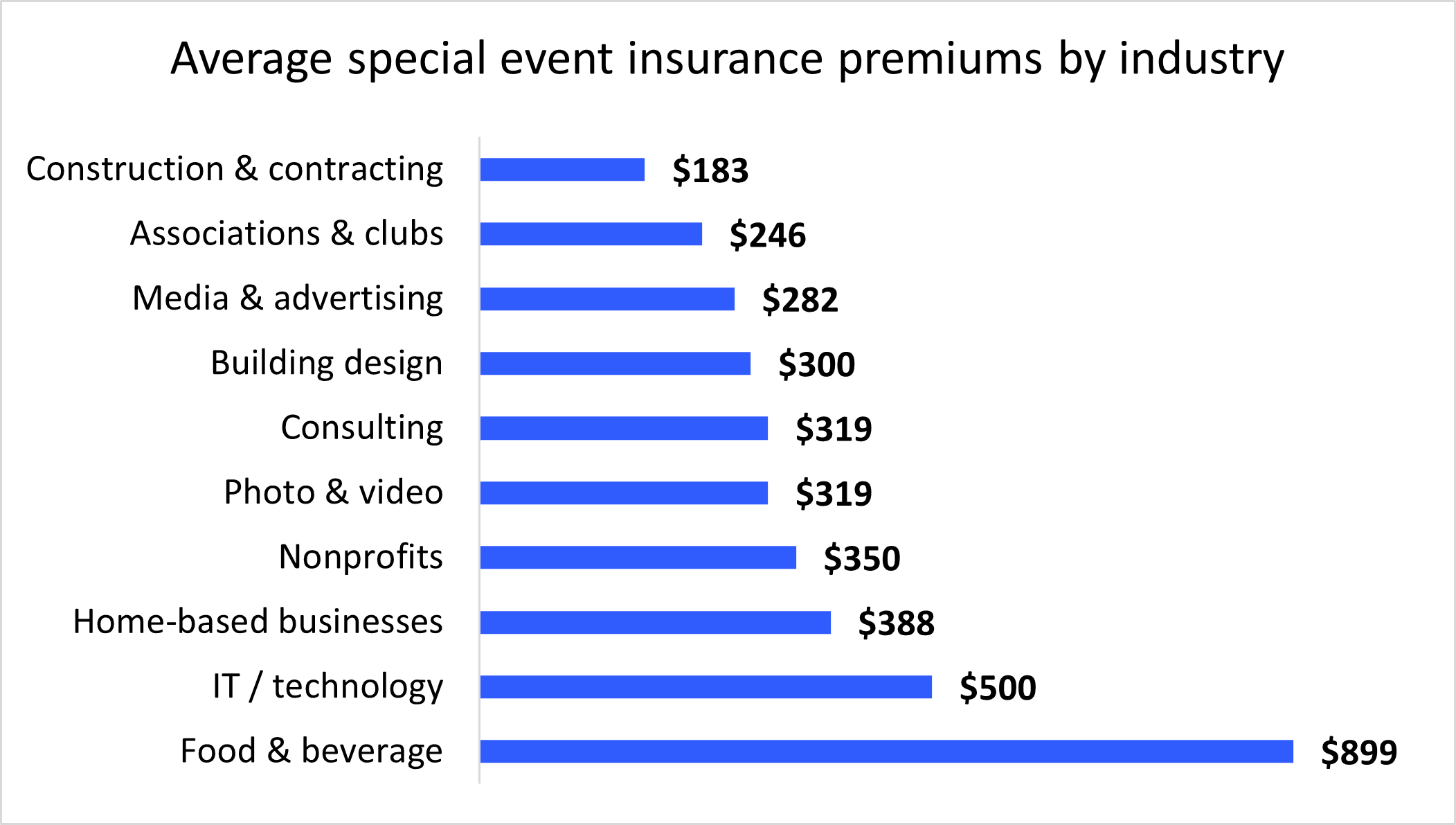

Our analysis of special event insurance costs reveals that for small businesses, your industry has the biggest impact on your premium. Generally, insurance carriers charge higher risk industries higher premiums, while lower risk industries enjoy lower rates.

Food and beverage professionals, such as caterers and restaurant owners often have greater risks and pay an average of $899 for their coverage compared to construction contractors who pay $183 or advertising agencies that pay $282 for their special event insurance.

This is because food and beverage sales and consumption often lead to event incidents, such as accidental poisoning, allergic reactions, and alcohol-related issues. For example, an intoxicated guest at a class reunion hosted by a restaurant could cause accidental property damage.

The graph below illustrates how your type of business affects what you'll pay for a special event insurance policy.

Top industries we insure

Coverage limits and deductible

If you want car insurance that pays for more expensive damages, you have to pay more for it. The same rule applies to business insurance. If you want a policy with higher liability limits, expect to pay more than you would for basic coverage.

The most popular special event policy among Insureon customers is the $1 million / $2 million policy. This includes:

- $1 million per-occurrence limit. While the policy is active, the insurer will pay up to $1 million to cover any single claim.

- $2 million aggregate limit. During the policy’s lifetime, the insurer will pay up to $2 million to cover claims.

Event location

The location of your special event can impact your insurance costs. Certain locations carry higher risks, such as metropolitan areas with higher populations, or cities with higher instances of adverse weather events.

Insurance companies will often consider the risks of a location when factoring in your special event insurance rates.

Size of event and guest count

Larger business events will likely cost more than smaller events. This is typically because smaller events are less likely to experience accidents or incidents than larger, more expensive ones.

For example, single-day wedding insurance will likely cost more for an event planner than a small baby shower.

Event duration

Longer events that span several days will cost more for small business insurance than shorter, partial-day or one-day events.

A craft fair that only lasts for a couple of hours, for example, will cost less to cover than a craft fair that spans several weekends.

Activities at event

The types of activities featured at the event can impact insurance costs for special events. More dangerous activities carry increased opportunities for accidents and medical bills.

Additionally, certain venue requirements may expect event planners to carry more insurance if the event carries a higher risk based on the types of activities to be featured.

Food and drink service

Whether or not your event will serve or sell food and drinks can play a role in the cost of your special event insurance. Events with food and drinks will often cost more than events without them because of the increased risk of food-based illnesses and injuries.

In particular, events with alcohol will likely pay a higher premium compared to those without due to the risks associated with serving and managing environments where alcohol is being consumed.

Event type

The type of event you host can directly impact your special event insurance rates. For example, a large corporate party will likely cost more than a small, private event.

Insurance underwriters often take into consideration the type of event when determining insurance costs.

Types of coverage

The coverage types you select for your event will directly impact your insurance costs. Certain types of coverage provide more extensive (and subsequently, more expensive) insurance benefits.

You can add a cancellation insurance policy to your special event insurance, for example, but it will cost an additional fee.

Does my business need special event insurance coverage?

Special event insurance is a must-have for small businesses that hold events that differ from their day-to-day operations. This includes holiday parties, networking events, employee retreats, and fundraisers.

Even if you've done all the necessary preparation for your event, there are always risks that are out of your control, such as third-party bodily injuries and property damage, or cancellations due to extreme weather or scheduling issues.

These unexpected liabilities can get expensive, and you might find yourself having to pay for legal defense costs, medical expenses, and cancellation fees.

Special event insurance covers all of these costs, often including cancellation coverage and liquor liability coverage. Not only will this policy offer you peace of mind, it could very well save your business from bankruptcy.

How can you save money on special event insurance?

It's possible to reduce your special event insurance premium through a couple simple steps:

Shop around

Insurance companies offer a range of special event premiums and coverages. Compare quotes from different carriers with Insureon's easy online application.

Bundle coverage

Small business owners can often save money by bundling several policies to address a range of business risks. A common small business bundle is a business owner's policy (BOP).

Keep continuous coverage

When getting special event coverage, you have the flexibility to choose your policy duration. For example, wedding photographers may opt for one-day event insurance for the "big day" or companies with events centered around the holidays may get seasonal insurance.

While these types of coverages provide savings in the short term, most small businesses benefit from investing in continuous coverage.

Choosing continuous insurance that includes key policies for your small business is often less expensive in the long term, as you'll be covered for lawsuits that could happen at any time. Because there aren’t any gaps in your coverage, your business is always protected against third-party claims. It also won't jeopardize your ability to keep business licenses that require insurance.

Why do small business owners choose Insureon?

Insureon is the #1 independent agency for online delivery of small business insurance. We help business owners compare quotes from top-rated providers, buy business insurance policies, and manage coverage online.

By completing Insureon’s easy online application today, you can get free quotes for special event liability coverage from top-rated U.S. insurance companies.

Our licensed insurance agents are here to help with any questions you may have along the way, such as whether your policy includes event cancellation coverage or how host liquor liability insurance differs from liquor liability insurance.

Once you find the right liability policies for your small business, you can begin coverage in less than 24 hours and get a certificate of insurance (COI) for your small business.