Liquor liability insurance

Liquor liability insurance

Liquor liability insurance provides coverage for legal fees, settlements, and medical costs if alcohol is sold to an intoxicated person who then harms others or damages property.

Why is liquor liability insurance important for small businesses?

Though general liability insurance covers the cost of most accidents, it usually excludes alcohol-related liability. That's where liquor liability insurance, sometimes called dram shop insurance, steps in.

This policy covers the cost of bodily injuries or property damage related to selling or serving alcohol. For example, if your bar serves an intoxicated patron who goes on to start a fight or break someone's property, liquor liability insurance would cover your legal costs.

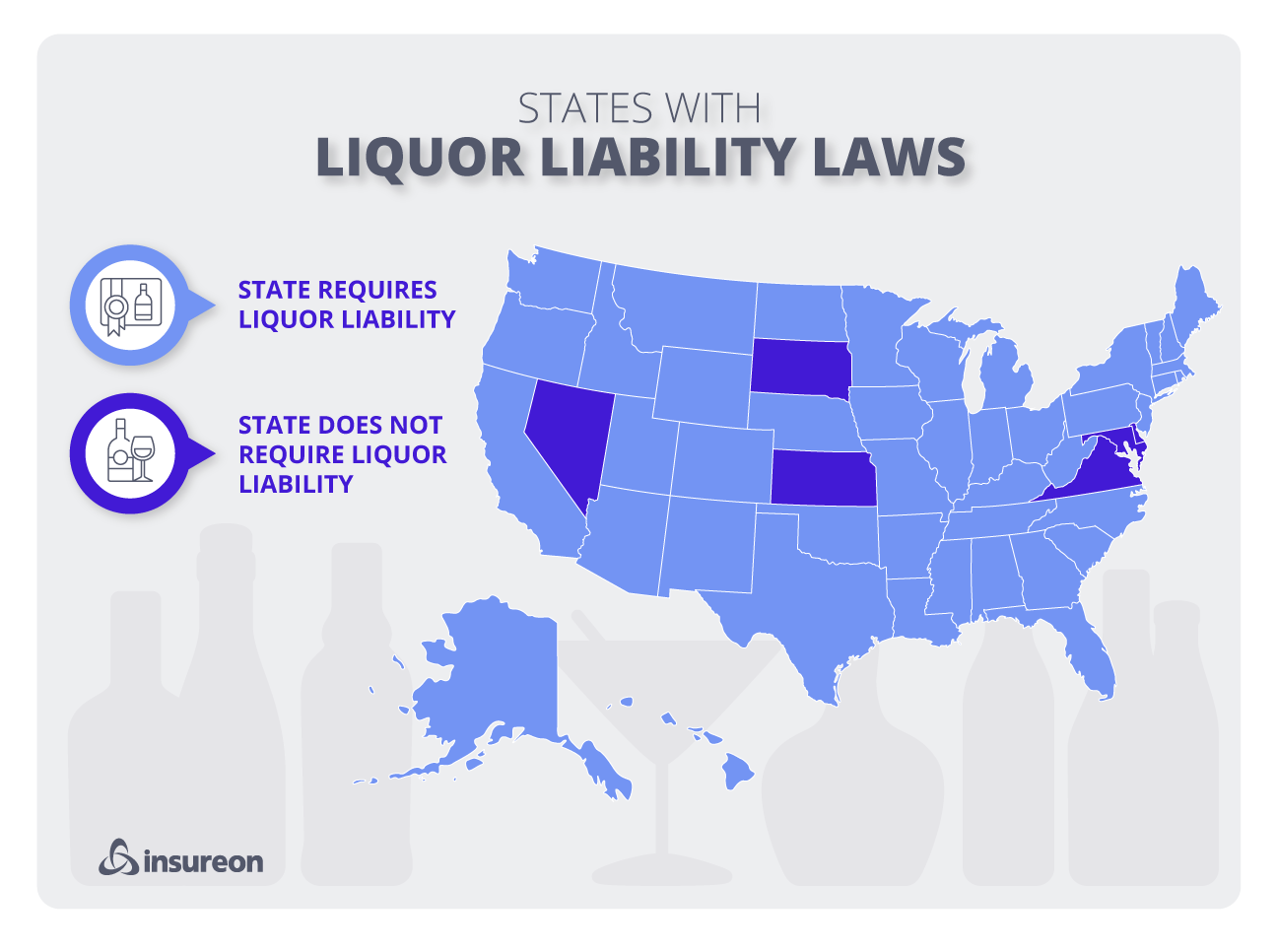

State laws typically require businesses to carry liquor liability insurance in order to get a liquor license. You might also need it to sign a commercial lease or an agreement with a lender.

Dram shop laws in most states, such as California, place the responsibility for damages caused by an intoxicated customer upon the business that served them, which can make this coverage important even in the rare case it's not required by law.

You might need liquor liability insurance in order to:

- Sell beer, wine, or liquor

- Serve alcoholic beverages

- Manufacture or distribute alcoholic products

- Obtain a liquor license

- Sign a commercial lease or loan

- Protect yourself from financial losses in a state with dram shop laws

What does liquor liability insurance cover?

Liquor liability insurance covers liability claims from third parties (people outside your business) who hold your business responsible for damages caused by an intoxicated individual.

This policy pays for your legal defense costs if someone sues over a bodily injury or property damage caused by someone who was sold or served alcohol by your business. Specifically, your liquor liability policy provides coverage for:

Third-party bodily injuries

If a patron who became intoxicated at your business injures another person, liquor liability insurance can help pay for their medical bills. It will also cover legal expenses if the injured person sues your business.

This is also true for drunk driving incidents where the injured party blames your business for overserving a patron.

Third-party property damage

Liquor liability insurance can cover the cost of repairing or replacing someone else's property that was damaged by an individual who became intoxicated at your business.

Legal costs

If a lawsuit is filed over an incident related to an overserved patron, liquor liability insurance can help cover your legal costs up to the policy's coverage limits. That includes everything from attorney's fees and court costs to a court-ordered judgment or settlement.

Additional claims, such as assault and battery

A liquor liability policy can be tailored to match your business needs. For example, the owner of a night club might want to make sure their policy includes assault and battery coverage to protect against violent customers.

How much does liquor liability insurance cost?

The average cost of liquor liability insurance for Insureon customers is $55 per month.

Insurance companies will look at several factors to determine your premium, including:

- Industry risks

- Business location

- Percentage of sales from alcohol

- Claims history

- Policy limits and deductible

Verified business insurance reviews

Hear from customers like you who purchased small business insurance.

Who needs liquor liability insurance?

Every business that sells or serves alcohol needs liquor liability insurance, either to protect against financial losses or to comply with state laws and contracts. A few industries in particular need this coverage more often than others, including:

Food and beverage businesses

Liquor liability insurance provides crucial protection against financial losses at restaurants, catering businesses, food trucks, and other establishments that serve alcohol. Most states require this coverage if you serve alcoholic drinks to your patrons.

For example, an intoxicated customer at a tavern might stumbles into another customer, who falls and breaks an arm. When the injured customer sues your business to recoup their medical expenses, your liquor liability policy would help cover the cost of the ambulance ride and emergency room visit.

Retailers

In most states, every business that sells beer, wine, or liquor needs liquor liability insurance. That's true for every type of business that sells alcoholic beverages, from grocery stores to convenience stores, breweries, and wineries.

If an intoxicated customer buys an alcoholic drink from your liquor store then goes on to break a car window, your liquor liability policy would help pay to replace the broken window, or cover legal costs if the car's owner decides to file a lawsuit.

Manufacturers and distributors

Breweries, wineries, and other companies that manufacture, distribute, or transport alcoholic products should carry liquor liability insurance, in addition to product liability insurance. That's because you can be held responsible for harm caused by your products, even if you're not the person who directly sold it to a customer.

For example, say a customer who drinks a beverage made by your business becomes intoxicated, and an argument escalates into physical violence. The injured party could seek damages from your business if they believe your company was responsible for selling a product with a deceptively high alcohol content.

What does liquor liability insurance not cover?

A liquor liability policy covers the most common claims related to selling, serving, or manufacturing alcoholic beverages, but it doesn't cover every risk. Your business will need other small business insurance policies for complete protection.

For example, your coverage has the following exclusions:

Libel and slander

For claims of libel and slander, your general liability policy can provide protection, as long as it doesn’t have an exemption for alcohol-related claims.

Damage to your business property

Liquor liability insurance does not cover damage to your business property, even if it is caused by an intoxicated customer. Commercial property insurance or a business owner's policy (BOP) can help pay for the cost of repairing or replacing your business property when it’s damaged or stolen.

Though incidents related to underage drinking cannot be protected against with insurance, you may have legal recourse if the minor had a realistic-looking fake ID. Train your employees to card every individual and be on the lookout for fake IDs.

General liability insurance

Business owner’s policy

Workers’ compensation insurance

Commercial auto insurance

Cyber insurance

FAQs about liquor liability insurance

Review answers for frequently asked questions about liquor liability coverage.

What's the difference between liquor liability and general liability insurance?

Both liquor liability insurance and general liability insurance can help pay for lawsuits against business owners for alcohol-associated risks. However, they do each provide unique coverage for certain types of situations.

General liability insurance protects your business against lawsuits related to third-party injuries or property damage. This policy often includes host liquor liability coverage, which can cover claims related to a guest who consumes too much alcohol at a business-hosted event, and then as a result causes third-party property damage or bodily injury because of their intoxication.

Liquor liability insurance operates differently from this coverage in that it protects businesses that sell or serve alcohol for profit against lawsuits related to inebriated customers who cause bodily harm or damage to others. Often this coverage is required by state dram shop laws for any business that manufactures, serves, or sells alcohol.

What's the difference between liquor liability insurance and host liquor liability insurance?

Liquor liability insurance is designed for businesses that sell alcohol, but other businesses can take on those same risks if they decide to serve alcohol at a company function. Host liquor liability insurance, often included in general liability insurance, covers corporate functions, fundraisers, and other events where alcohol is served.

If your business is hosting an event with other specialized risks, you may want to look into special event insurance, as your general liability policy typically covers only risks faced during its normal operations.

Find out more about the difference between liquor liability insurance and host liquor liability insurance.

Do I need liquor liability insurance coverage if my state doesn't have dram shop laws?

If your state doesn't have dram shop laws, you're still not immune from lawsuits related to selling or serving alcohol. In fact, anyone can file a lawsuit against your business if they believe you were in some way responsible for the actions of an intoxicated customer.

Even though the court is more likely to rule in your favor, your business will still have to pay for attorney's fees and court costs, which can be significant. Additionally, you might still need liquor liability insurance to get a liquor license, sign a lease, or qualify for a loan.

That's why it's important for any business that profits from liquor sales to carry this coverage, regardless of the laws in their state.

What other types of liquor liability coverage might I need?

You can customize your liquor liability insurance policy by adding coverage for specific risks, such as assault and battery claims or mental damages. You might also only need a short-term policy, such as one that would cover a bartender serving at a wedding or other event.

Depending on your needs, you may be able to add this coverage to your general liability insurance policy or buy it as a standalone policy.

Talk to a licensed insurance agent to determine which coverage options are important for your business, or apply for free online quotes if you're ready to buy a policy today.