The cost of your commercial auto insurance policy is based on several variables, such as where you work, your driving history, and what vehicle you are operating. Insureon customers pay an average of $147 per month for this policy.

Auto insurance protects against costly accidents

Commercial auto insurance is must-have coverage for small businesses on the move. Whether you own a food truck, dump truck, or a lawn care business, you know there are certain risks that are unavoidable when you drive to different venues or job sites. Not only are auto accidents dangerous, they can lead to costly court battles.

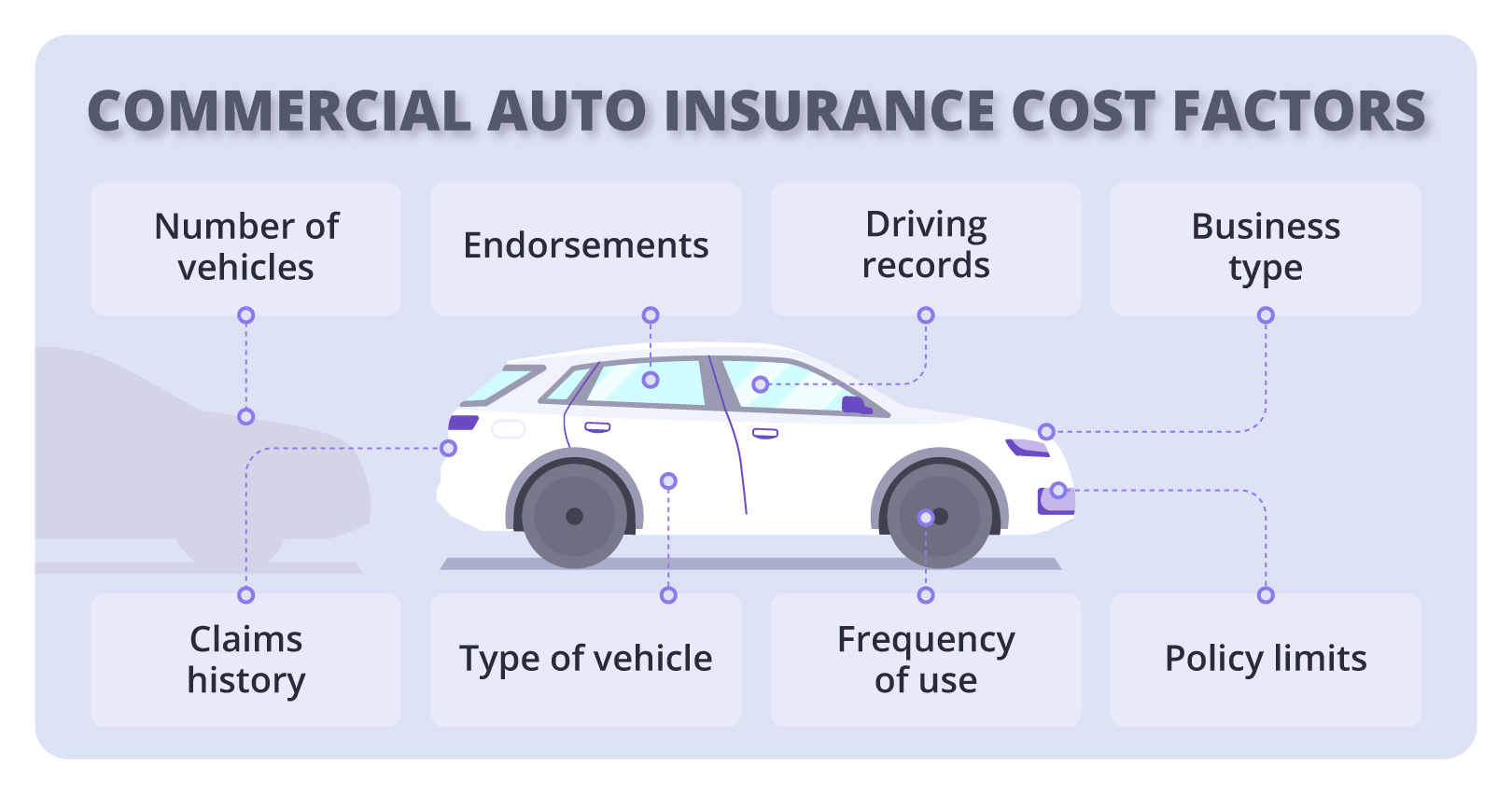

When you start your search for commercial auto insurance, you may wonder how providers determine your coverage rate. You might be surprised to learn which variables can affect the cost of a commercial auto policy. Let's take a look.

How car insurance rates are calculated

For both commercial and personal auto insurance, your premium quote is essentially a risk assessment. Your provider is determining how much risk it’s willing to cover – and at what price.

That's why your insurance application will ask you pointed questions about your insurance needs, the use of your vehicles, and the nature of your ownership. Specifically, the following factors affect your auto insurance premium.

1. Type of coverage

Different types of auto insurance comes with different costs. The less coverage a policy offers, the less you can expect to pay for the plan.

For business-owned vehicles, a regular commercial auto policy is typically required. It covers both property damage and liability suits, similar to a personal auto insurance policy.

Commercial auto insurance usually costs more than your personal auto insurance, since the claims tend to be more expensive. If you have two or more business-owned vehicles, look to fleet insurance for savings.

For those who drive their own vehicle for work, hired and non-owned auto insurance (HNOA) can protect against lawsuits, but not damage to your own vehicle. This policy also covers leased and rented vehicles. Since it doesn't include property damage protection, HNOA is often quite affordable.

Some drivers may want to add collision coverage or comprehensive coverage to guard against costly repairs, which will also raise your premium.

2. Where and how much you drive

Where your company car is parked during the business day and overnight can also affect your policy premium. For example, if your car is regularly parked in high-crime or accident-prone areas, you may see higher rates for insurance. By contrast, if you park in a locked parking lot that deters theft, you may qualify for lower premiums.

If your business operates in a region that often experiences heavy windstorms and traffic, these conditions can increase the chance of damage to your vehicle and collisions, both of which would affect the cost of company car insurance.

Similarly, if you commute 50 miles each day to offer your services, your premium may be higher than someone who only commutes 10 miles. After all, more time on the road means increased risk of an accident occurring.

3. Your demographics

Providers can assess risks based on the demographics of the driver, too. So if you are the person operating your company's vehicle, the carrier will need to know your:

- Age

- Sex

- Marital status

4. Driving record and claims history

Anyone driving on behalf of your business should have a relatively clean driving record. A history of claims, collisions, and speeding tickets can mean higher premiums.

5. Type of driving

Another consideration for commercial auto rates is how the vehicle will be used. For example, your provider may ask if you use the vehicle to:

- Transport people and work supplies

- Deliver packages or food

- Carry hazardous materials

As you may have guessed, transporting hazardous materials poses more liability risks and compliance issues, which can drive up the cost of your premium.

6. Type of car

The kind of vehicle you choose to represent your business can also alter premium rates. Before you buy, lease, or rent a vehicle, you may want to check the insurance rates before you make your final choice.

Trucking companies can expect to pay more to insure their vehicles (e.g., box trucks), and must also comply with state and federal regulations for insurance.

7. Safety devices

You can potentially reduce your auto insurance rates by choosing a vehicle with:

- Anti-lock brakes

- Side airbags

- Automatic seat belts

- Daytime running lights

- GPS trackers and other anti-theft devices

Though these features may seem minor, they can decrease the severity or chance of accidents and thefts.

8. Amount of coverage

The higher your car insurance coverage limits, the higher your premium will be.

Before you select the lowest coverage option, consider the fact that inadequate protection could leave your business vulnerable to the high cost of collision liability suits. If you're unsure what amount of auto liability coverage is appropriate for your business's vehicle, one of our Insureon agents can help.

Learn more about how your policy limits affect your premium.

9. Deductible amounts

Choosing a higher deductible is one way to lower insurance costs. The deductible is the amount you pay on an insurance claim before your coverage kicks in.

For example, say a collision leaves you with $1,000 in damage and your deductible is $250. You would pay the $250 before your insurer pays the remaining $750. If you choose a high deductible, you can expect lower auto insurance prices.

Get a commercial auto insurance policy if you drive to and from work sites, transport clients, or rely on drivers or couriers.

It can handle accident costs and is only about 136 dollars per month.

Don't put your business at risk, apply for your policy today! Beep beep!

More ways to save on commercial auto insurance

Looking for ways to save on your commercial auto insurance without cutting corners? Here are some tips to help avoid more expensive rates:

- Work with an independent insurance agency that isn't tied to any single provider and can find you the best rates.

- Find an agent trained in your industry, such as the agents at Insureon. Our agents can help you get the right insurance for your industry (no gaps or extras!).

- Fill out an online insurance application with Insureon. We can send you competitive quotes from multiple providers within 24 hours of your application.

What our customers are saying

Want free expert advice right in your inbox?

By entering your email address and subscribing, you agree to our Terms of Use and Privacy Policy