How much does business insurance cost for pet care professionals?

Several factors contribute to the cost of pet care insurance, including the type of work you do with pets and your business risks. Cost estimates are sourced from policies purchased by Insureon customers.

Key pet business insurance policies and their expected costs

Here are the top commercial insurance policies purchased by pet care businesses and their average monthly costs:

- General liability insurance: $43 per month

- Business owner's policy (BOP): $86 per month

- Workers' compensation insurance: $97 per month

- Errors and omissions insurance: $61 per month

- Cyber insurance: $145 per month

- Commercial auto insurance: $147 per month

Our figures are sourced from the median cost of small business insurance policies purchased by Insureon customers who are pet care professionals, such as pet groomers, pet store owners, and dog walkers. The median offers a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

The cost of business insurance depends on a number of factors. This includes the types of pet care services you offer, your annual revenue, the value of your business property and equipment, your location, the number of employees you have, and the policy limits and deductibles you select.

General liability insurance

Pet care businesses pay an average of $43 per month, or $513 per year, for general liability insurance.

General liability insurance helps cover common third-party lawsuits from pet owners and visitors, including those related to bodily injuries, property damage, and advertising injuries.

For example, if you break a lamp at a client’s home while pet sitting, general liability would pay for the cost of repair or reimbursement of the lamp.

General liability insurance typically covers third-party bodily injuries as well, but due to the care, custody, and control exclusion, pet businesses aren't covered for pet injuries. To cover this gap, you would need animal bailee coverage which can be added to your general liability policy as an endorsement.

For instance, if a dog or cat is injured under your care at your day care and the pet parent sues your business, animal bailee coverage would pay for the medical treatment for the pet's injury and any legal fees.

This is the average general liability policy for pet care companies that buy from Insureon:

Insurance premium: $43 per month

Policy limits: $1 million per occurrence; $2 million aggregate

The cost of general liability insurance depends on several factors, such as the coverage limits you choose, the size of your business, the amount of foot traffic you have, your location, and any endorsements on your policy, such as an additional insured.

Your business risks are a large factor in determining costs

General liability insurance costs increase with the likelihood of third-party lawsuits, such as someone suing your pet business over an accidental injury. That's why pet companies with more foot traffic or more frequent interactions with animals and people can expect to pay more for this coverage than those with less.

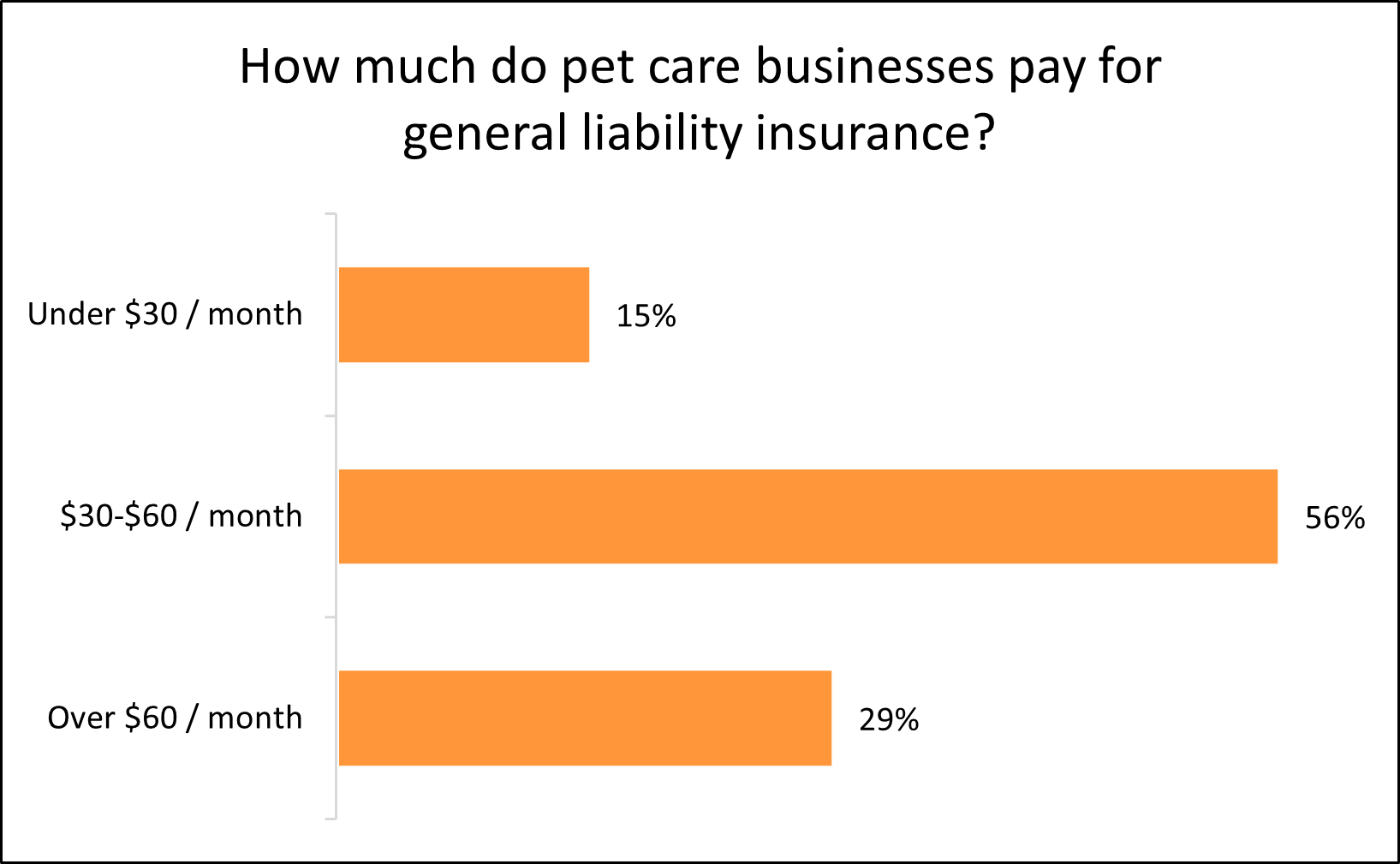

This leads to a wide range of insurance premiums for different professions. Among pet care businesses that purchase general liability insurance with Insureon, 71% pay less than $60 per month and 15% pay $30 or less per month.

Your profession plays a large role in determining costs

Professions that involve more frequent interactions with people and animals typically pay more for general liability insurance.

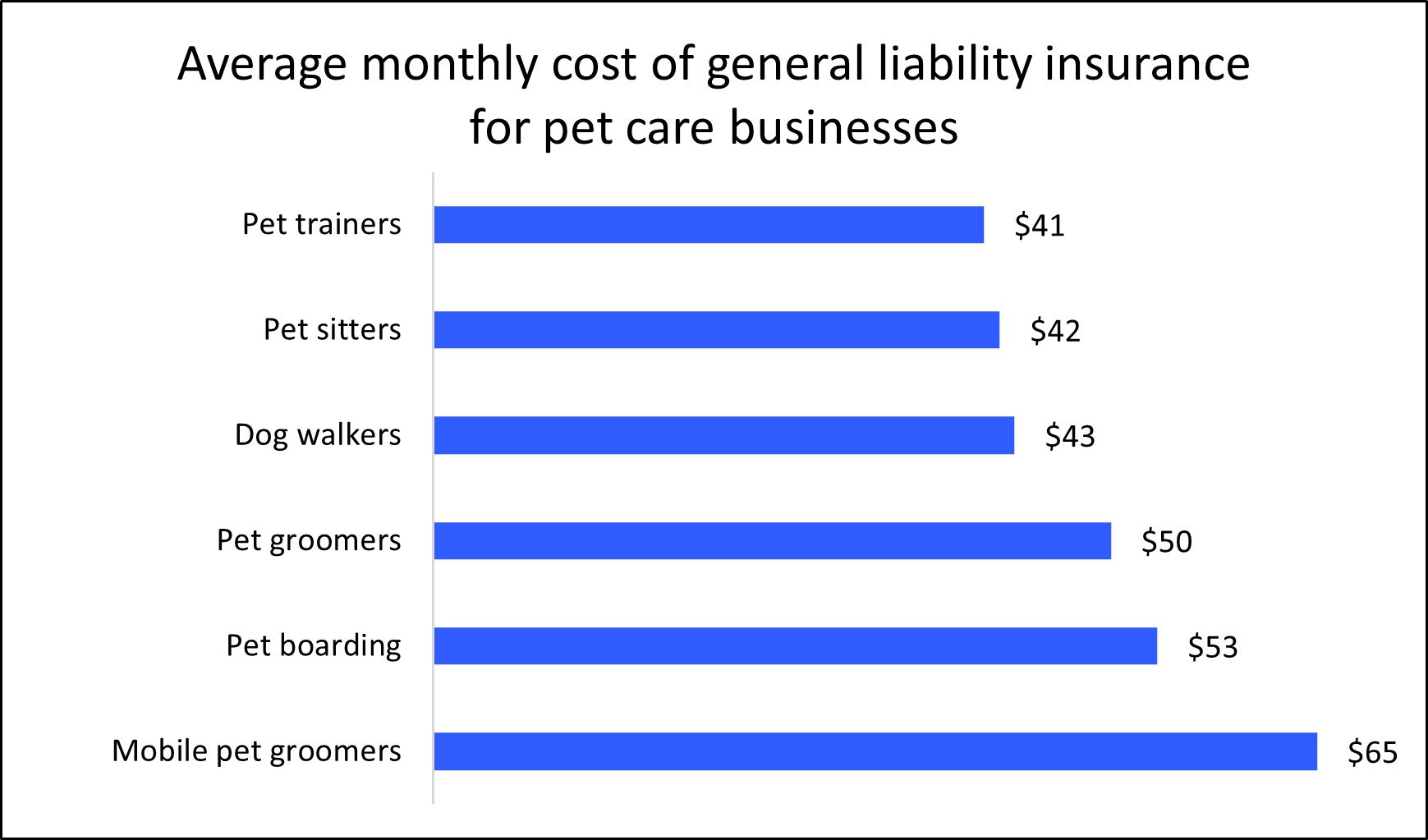

For example, mobile pet groomers pay a higher rate of $65 per month, whereas pet trainers only pay $41 per month. Below you can find more average monthly costs for different types of pet care companies:

Common general liability policy limits for pet care businesses

Policy limits are the maximum amounts your insurance company will pay for covered claims.

The per-occurrence limit is the most your insurer will pay for claims resulting from a single incident, while the aggregate limit is the most your insurer will pay for any claims during your policy period, typically one year.

Most pet care businesses (95%) choose a general liability policy with a $1 million per-occurrence limit and a $2 million aggregate limit. As your pet business grows, you may need to raise your policy limits.

Choosing lower limits is one way your pet care company can save money on general liability insurance, though you'll still want enough coverage to handle a lawsuit.

Business owner’s policy

Pet care professionals pay an average of $86 per month, or $1,031 per year, for a business owner’s policy.

A business owner's policy, or BOP, bundles general liability coverage with commercial property insurance to cover both third-party risks and your business property. It typically costs less than purchasing each policy separately.

A BOP protects against customer injuries and property damage. In addition, this type of insurance covers the repair or replacement costs of your physical building and pet care equipment if they're damaged due to vandalism and other covered claims.

Because of its increased coverage and affordability, it’s the policy most often recommended by Insureon’s agents for small business owners who rent or own a building.

This is the average BOP for pet care businesses that buy from Insureon:

Insurance premium: $86 per month

Policy limits: $1 million per occurrence; $2 million aggregate

Deductible: $500

Small, low-risk pet care companies are often eligible for a business owner's policy.

Small business owners may see higher costs if they choose to add endorsements to their policy. Insurance endorsements, such as business interruption insurance or equipment breakdown coverage, are often recommended to help avoid financial losses if a fire or power outage forces your business operations to cease for an extended period of time.

The cost of a business owner's policy is based on a number of factors. That includes the value of your building or office, the value of your pet care or grooming equipment, where you are located, the number of employees you have, and your specialty.

The cost of a BOP is driven by business property value

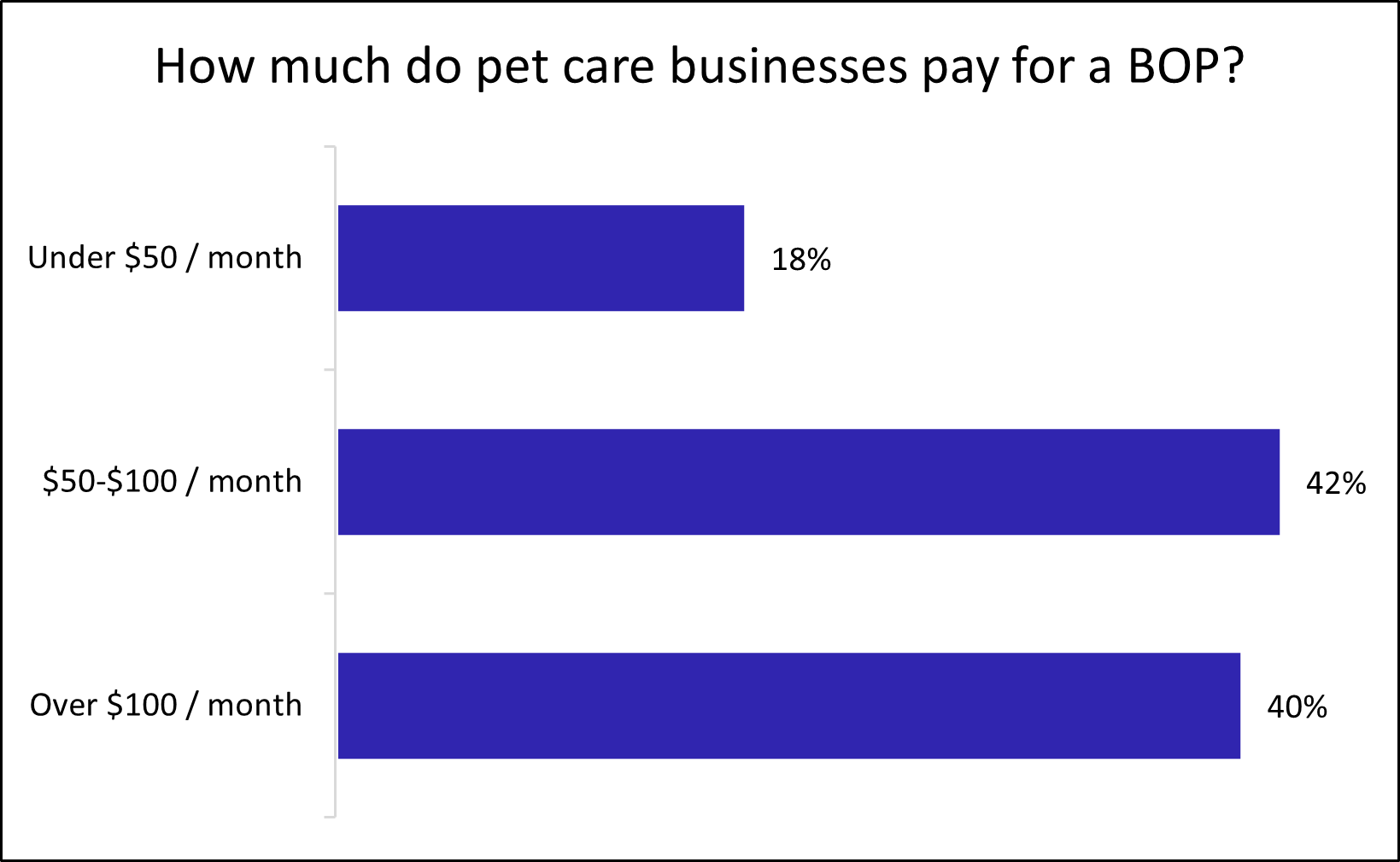

Among pet care businesses that purchase a business owner’s policy with Insureon, 60% pay less than $100 per month and 18% pay less than $50 per month.

Businesses with larger or more expensive business property will typically pay more for a BOP than pet care companies with smaller premises or lower value business property. Your industry risk, years in operation, and claims history will also affect your premium.

Workers’ compensation insurance

For pet care companies, workers’ compensation insurance costs an average of $97 per month, or an annual premium of $1,160.

This insurance policy covers medical expenses when an employee is injured on the job, and it also provides disability benefits while they're recovering and unable to work. For instance, if a pet sitter or dog walker gets bitten by a client's pet and they need stitches, a workers' comp policy would cover their medical costs and medication.

To comply with your state’s requirements and avoid penalties, pet care businesses with employees typically must purchase this coverage. It's also recommended for sole proprietors, as health insurance plans can deny claims for medical bills when an injury or illness is related to your job.

Most policies include employer's liability insurance, which covers the cost of lawsuits related to workplace injuries. There's usually no limit to how much a workers' comp policy can pay for employee benefits, though it depends on state laws.

The cost of workers' compensation insurance depends on several factors, including the number of employees you have and the level of risk involved with their jobs.

Get more information on how to find affordable workers' compensation coverage.

The cost of workers’ comp depends on the size of your workforce

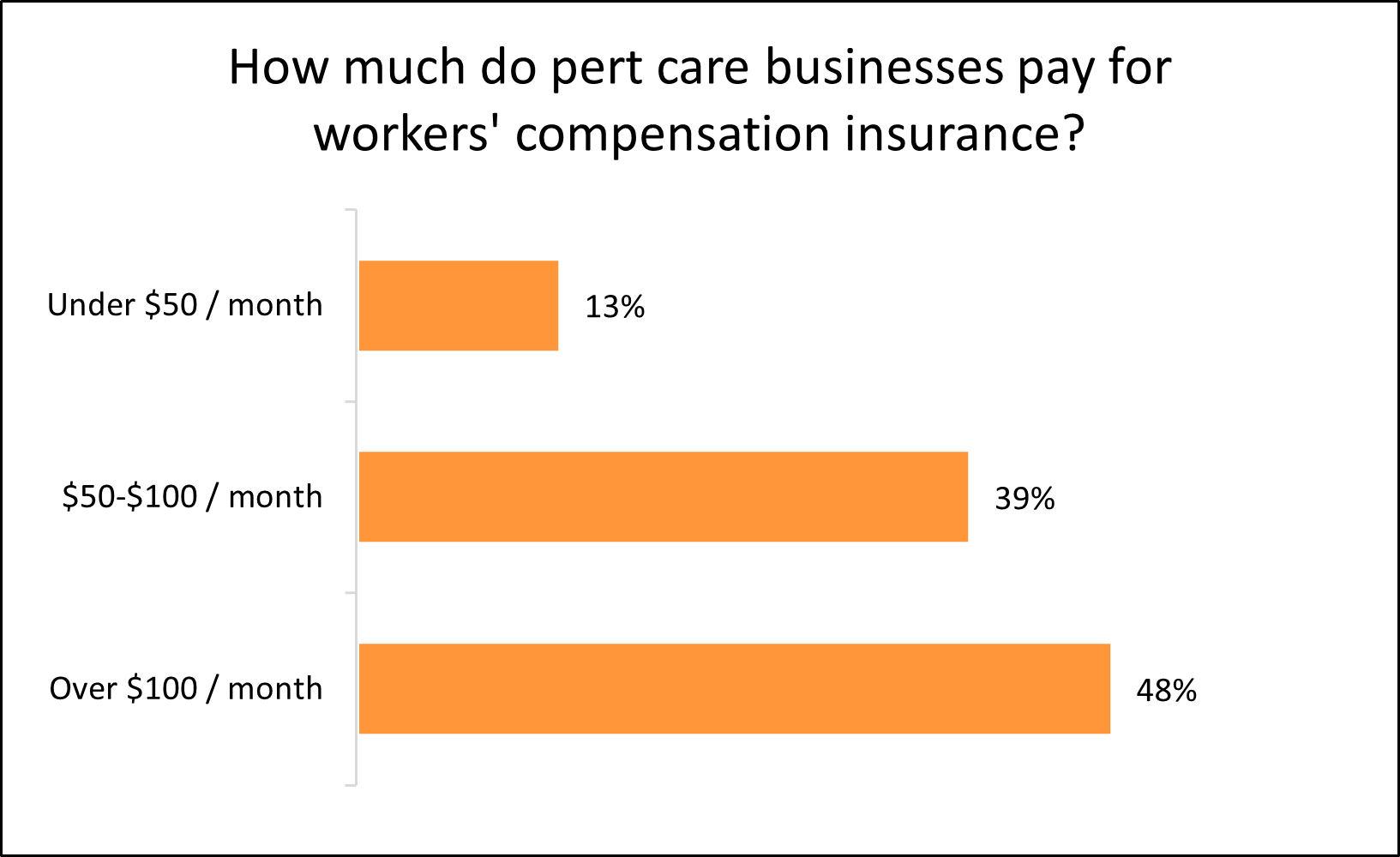

Among pet care businesses that buy workers’ compensation insurance with Insureon, 52% pay less than $100 per month and 13% pay $50 or less per month.

Workers' comp costs depend on the number of employees and staff you have at your business. A larger workforce brings a higher risk of worker injuries, which is why bigger pet companies tend to pay more for this type of insurance.

Errors and omissions insurance

Small businesses, including pet care businesses, pay an average premium of $61 per month, or $735 per year, for errors and omissions insurance (E&O). You might also see this coverage called professional liability insurance.

This policy offers critical coverage for any pet care company. It helps pay for legal costs if you're accused of professional negligence, such as a mistake, oversight, or failure to meet a standard of care.

Pet care small business owners can often combine this coverage in a business owner’s policy or general liability policy for savings. Many factors can affect the cost of E&O insurance, such as your line of work, your claims history, and the policy limits you choose.

It's possible to reduce your costs by selecting lower limits or a higher deductible. You can also manage your risks to avoid lawsuits and subsequent claims that would otherwise raise your premium.

Cyber insurance

Small business owners, including pet care professionals, pay an average of $145 per month, or $1,740 annually, for cyber insurance. This policy is also called cyber liability insurance or cybersecurity insurance.

Cyber insurance helps businesses recover financially after a data breach or cyberattack. It can help pay for customer notification costs, fraud monitoring services, and other expenses necessitated by state data breach laws.

The cost of cyber insurance depends on the amount of sensitive information handled by your pet care business, such as customers' phone numbers and credit card information, along with the number of employees who can access that information.

Commercial auto insurance

Small businesses, including pet care companies, pay an average of $147 per month, or $1,762 annually, for commercial auto insurance.

Most states require this liability insurance coverage for vehicles owned by a pet business. For personal, rented, and leased vehicles used by your business, look to hired and non-owned auto insurance (HNOA) instead.

A commercial auto policy provides financial protection in the event of an accident involving your business vehicle. It can help pay for property damage, medical costs, and legal expenses.

The cost of commercial auto insurance depends on several factors, including the policy limits you choose, coverage options, the value of the vehicles, the driving records of anyone permitted to drive, and additional insured endorsements you select.

Learn more about how to find affordable commercial auto insurance coverage.

How do you buy pet business insurance with Insureon?

Insureon works with top-rated U.S. providers to find affordable insurance coverage for pet care businesses, whether you work independently or own a business with employees.

Apply today to get free quotes with our easy online application. A licensed insurance agent who specializes in your profession's unique risks will help you find the right types of coverage for your business needs. They can also discuss common exclusions with you and help you cover any coverage gaps with add-on policies like animal bailee.

Typically, you can get a certificate of insurance within 24 hours of submitting your application, offering instant peace of mind.

What our customers are saying

Want free expert advice right in your inbox?

By entering your email address and subscribing, you agree to our Terms of Use and Privacy Policy