How much does commercial truck insurance cost?

Several factors contribute to the cost of trucking business insurance, including your business's size, its unique risks, and your insurance needs. Cost estimates are sourced from policies purchased by Insureon customers.

Key commercial truck insurance policies and their expected costs

Here are the top commercial insurance policies purchased by trucking businesses and their average monthly costs:

- Commercial auto insurance: $816 per month

- General liability insurance: $51 per month

- Workers' compensation insurance: $650 per month

- Motor truck cargo insurance: $129 per month

- Surety bonds: $60 per month

- Cyber insurance: $145 per month

Our figures are sourced from the median cost of small business insurance policies purchased by Insureon's customers in the trucking industry. The median offers a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

Your premium is based on the trucking services you offer, the type of trucks you own, your annual revenue, your cargo, how many employees you have, your claims history, and your policy limits and deductibles. Additional factors like the distance you travel, your location, and U.S. Department of Transportation (DOT) insurance requirements can affect your premium as well.

Commercial auto insurance

The average cost of commercial auto insurance for trucking businesses is $816 per month, or $9,794 annually.

A commercial auto insurance policy provides financial protection in the event of an accident involving your company's truck. It can help pay for property damage, medical costs, and legal expenses.

Most states require this coverage for trucks owned by a business. For personal, rented, and leased trucks used for business purposes, look to hired and non-owned auto insurance (HNOA) instead.

Choosing lower limits or a higher deductible is one way to lower your truck insurance premium. You should also endeavor to hire individuals with a clean driving record. Learn more about how to find affordable commercial vehicle insurance.

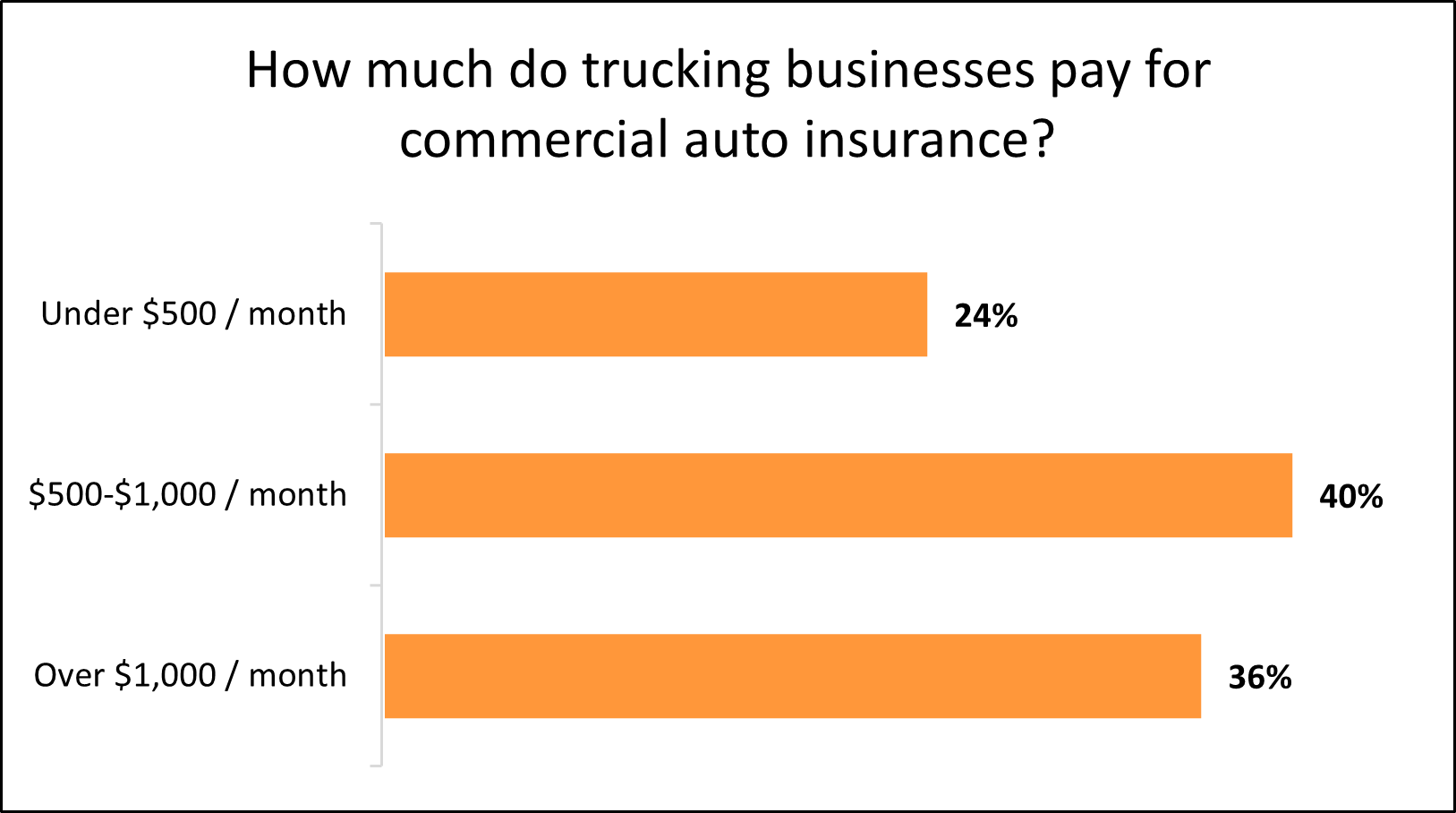

The number of vehicles and their use determine commercial auto insurance costs

Among trucking businesses that buy commercial auto liability insurance with Insureon, 24% pay less than $500 per month and 64% pay less than $1,000 per month.

The cost of commercial truck insurance depends on several factors. That includes the value of your vehicles, how they are used, the driving history of anyone permitted to drive them, and any add-on coverages you select, such as an additional insured endorsement.

You might also choose to buy non-trucking liability (NTL) insurance to cover personal use of your truck, or physical damage insurance which covers everything from collisions to falling branches.

A company with a large fleet of trucks, especially ones that are driven regularly, has an increased risk of accidents and vandalism. These types of companies can expect a higher premium for auto insurance than a small business with fewer trucks.

The vehicle type, such as semi-truck, box truck, or car hauler, will also affect your commercial truck insurance rates.

General liability insurance

Trucking businesses pay an average of $51 per month, or $606 per year, for general liability insurance.

General liability coverage helps pay for common lawsuits from third parties (people outside your company), including those related to bodily injury, property damage, and advertising injury.

For instance, it will cover your legal costs if a trucker accidentally knocks over a shelf in a warehouse, or if a client slips and suffers an injury in your dispatch office. Social media and copyright infringement lawsuits are also covered by general liability insurance.

This is the average general liability policy for trucking companies that buy from Insureon:

Insurance premium: $51 per month

Policy limits: $1 million per occurrence; $2 million aggregate

Deductible: $750

The majority of trucking businesses (96%) choose a $1 million per-occurrence limit and a $2 million aggregate limit for their general liability insurance.

As with other types of business insurance, you can opt for lower coverage limits or a higher deductible to save money on your policy.

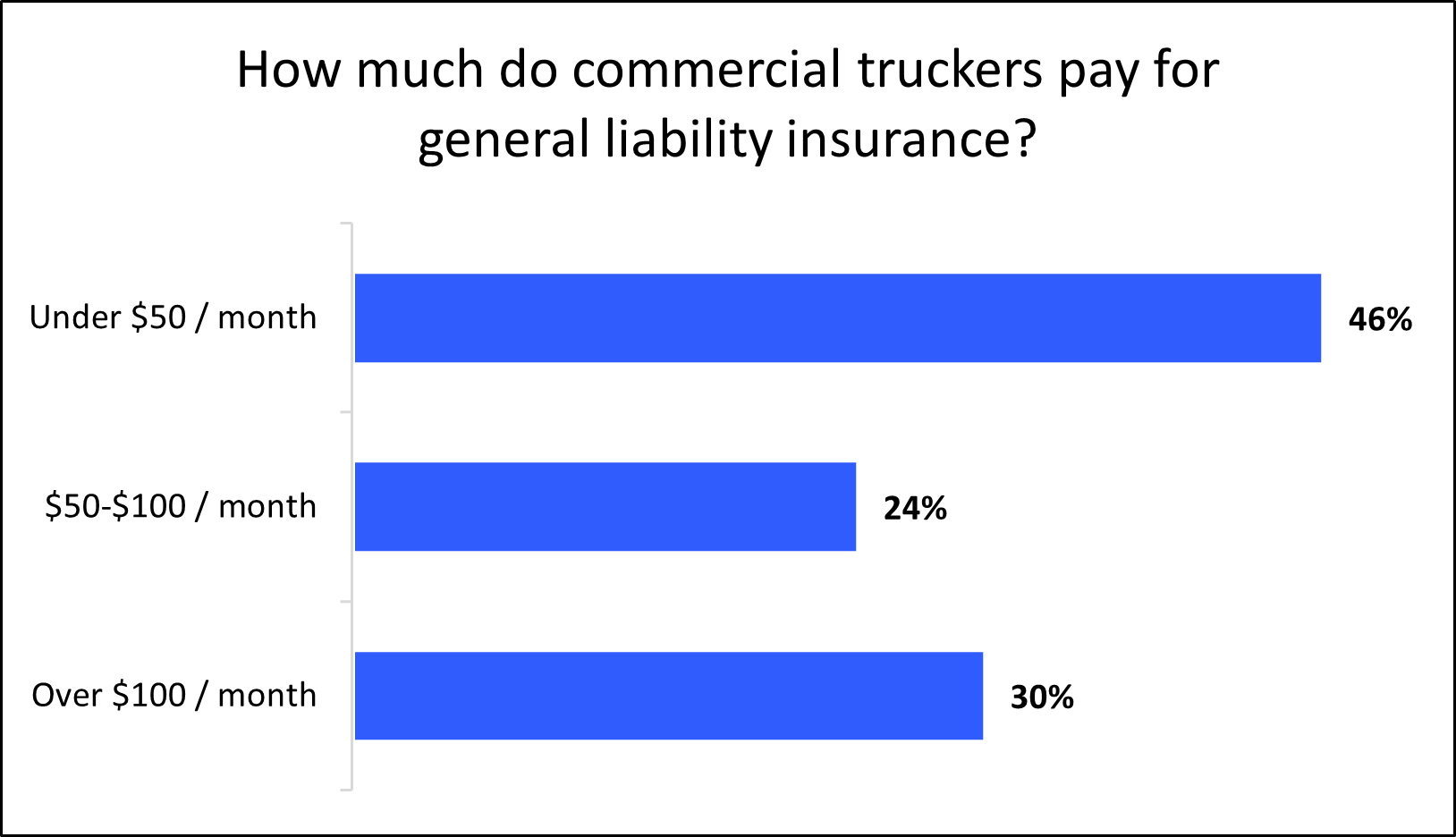

The cost of general liability insurance depends on your industry risks

Among trucking companies that purchase general liability insurance with Insureon, 46% pay less than $50 per month and 70% pay less than $100 per month.

General liability insurance costs depend on your risk of a third-party lawsuit. Professions that interact frequently with customers, such as towing companies and movers, are considered high risk.

Other factors that affect the cost of general liability insurance include your annual revenue, the size of your business, your trucking operations, and any endorsements on your policy, such as an additional insured.

Workers’ compensation insurance

For trucking companies, workers’ compensation insurance costs an average of $650 per month, or $7,795 per year.

This type of coverage helps pay for medical expenses when an employee is injured on the job. It also provides disability benefits while they're recovering and unable to work.

To comply with your state’s requirements and avoid penalties, trucking businesses typically must purchase this coverage for their employees. It's also recommended for sole proprietors, as health insurance plans can deny claims for medical bills that are related to your job.

Most workers' comp policies include employer's liability insurance, which covers the cost of lawsuits related to employee injuries. There's usually no limit to how much a workers' comp policy can pay for employee benefits, though it depends on state laws.

It's important to classify your employees correctly to make sure you're paying the correct rate. You can save money on workers' compensation coverage by comparing rates from different insurance companies and focusing on workplace safety, among other strategies.

Truckers who work as independent contractors often choose to insure themselves with occupational accident insurance as an alternative to workers' comp.

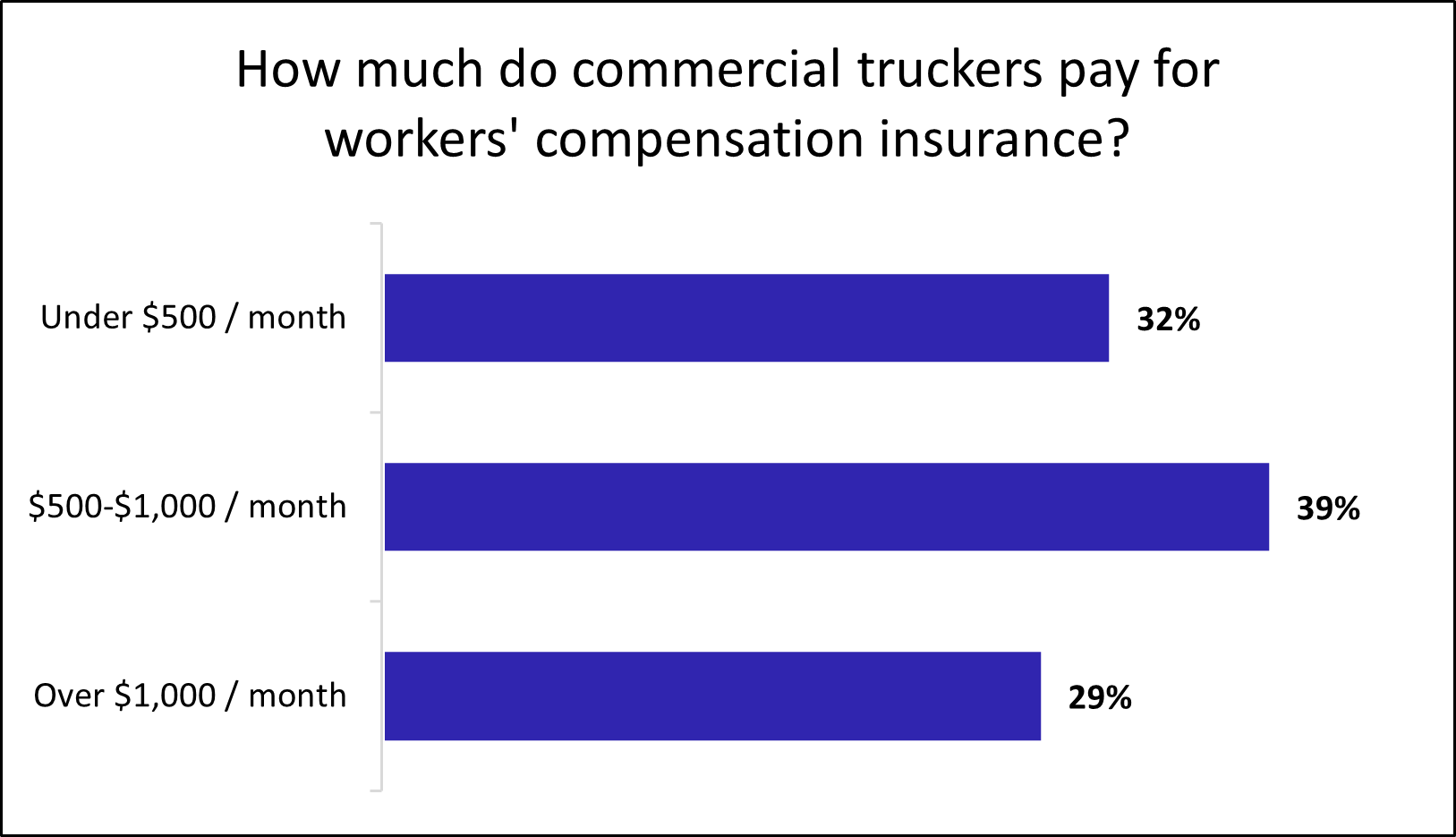

The cost of workers' comp depends on the number of employees and their risks

Among trucking companies that buy workers’ compensation insurance with Insureon, 32% pay less than $500 per month and 71% pay less than $1,000 per month.

Truck drivers pay a much higher rate for workers' comp than employees with office jobs or other less strenuous work, who are assigned different codes used to determine premiums. A trucker could suffer an injury from unloading heavy cargo, an auto accident, or simply from long hours behind the wheel.

Your workers' compensation costs depend on the number of employees at your trucking business and the type of work they do, among other factors. A larger workforce brings a higher risk of worker injuries, which is why bigger businesses tend to pay more for this type of insurance.

Motor truck cargo insurance

Truckers pay an average of $129 monthly, or $1,553 annually, for motor truck cargo insurance.

Motor truck cargo insurance covers financial losses if your cargo is destroyed, stolen, or damaged while in transit. It's a type of inland marine insurance, which covers property that's transported over land or stored off-site.

The type of cargo you transport and its value determine the cost of motor truck cargo insurance. For instance, an Amazon Relay driver who delivers household goods can expect to pay a lower premium than a company that transports hazardous materials.

Trucking businesses with a dispatch office or other physical location also need commercial property insurance. This policy covers your building and its contents in the event of a fire, storm, or burst pipe.

The cost of property insurance depends on the value of your business property, the age and condition of your building, and the coverage options you choose. For instance, you can insure your items for their actual cash value, which is their current depreciated value, or their replacement value, which is the cost of buying a brand-new replacement.

Other ways to save money on property insurance include comparing quotes from different carriers, bundling your property insurance with general liability insurance in a business owner's policy (BOP), and paying your premium annually instead of monthly.

As with other small business insurance policies, be aware of any exclusions on your property insurance policy. Hurricanes, earthquakes, floods, and other natural disasters are often not covered.

Surety bonds

Trucking businesses pay an average of $60 per month for surety bonds, or about $720 annually.

A surety bond acts as a financial guarantee that your business will comply with laws and regulations. It can reimburse your clients if you fail to deliver goods, pay for completed services, or otherwise fulfill a contract.

Surety bonds are often required in the trucking industry. As one example, the Federal Motor Carrier Safety Administration (FMCSA) requires a $75,000 bond for freight brokers and forwarders who cross state lines.

Unlike insurance, the amount paid out by a surety bond must be paid back to the company that issued the bond.

The cost of a surety bond is a percentage of the total bond amount. It may also be influenced by your type of work and your credit score.

Cyber insurance

Small businesses pay an average of $145 per month, or $1,740 annually, for cyber insurance. This policy is also called cyber liability insurance or cybersecurity insurance.

Cyber insurance helps trucking companies recover financially after a data breach or cyberattack. It can help pay for customer notification costs, fraud monitoring services, and other expenses necessitated by state data breach laws.

The cost of cyber insurance depends on the amount of personal information handled by your trucking business, such as customer credit card numbers, along with the number of employees who can access that information.

How do you buy commercial trucking insurance with Insureon?

Insureon works with top-rated U.S. providers to find affordable trucking insurance coverage for your company, whether you work independently as an owner operator or you have a courier business with several employees.

Apply today to get free trucking insurance quotes with our easy online application. A licensed insurance agent who specializes in your profession's unique risks will help you find the right types of coverage for your business. They can also discuss state regulations, cost-saving bundles, and riders to help fill any coverage gaps.

Typically, you can get a certificate of insurance within 24 hours after submitting an application, offering instant peace of mind.

What our customers are saying

Want free expert advice right in your inbox?

By entering your email address and subscribing, you agree to our Terms of Use and Privacy Policy