Excess and surplus lines insurance

Excess and surplus (E&S) lines insurance provides coverage for unique, high, or catastrophic risks that standard, or "admitted," insurance companies are unwilling or unable to take on. This type of coverage is purchased from non-admitted carriers, which have greater flexibility in policy design but are not backed by the state's guarantee fund.

What is excess and surplus lines insurance?

E&S insurance covers businesses with unusual risk profiles that are unable to secure coverage in the standard (admitted) insurance marketplace. This includes companies with very high risks, extensive claims histories, or those operating in new or emerging industries, where standard policies and premiums have not yet been established.

The term is used to distinguish the way the policy is sold and regulated, and it can apply to most types of property and casualty (P&C) insurance, including:

- General liability insurance

- Commercial property insurance

- Professional liability insurance / errors and omissions insurance (E&O)

- Directors and officers insurance (D&O) and other management liability policies

You may see this coverage referred to as E&S insurance, excess lines, surplus lines, or specialty lines insurance. While the name can vary by state (for example, it's called excess lines in New York and surplus lines in California), the core function remains the same.

Insurance companies that sell this coverage are called non-admitted carriers or surplus lines insurers. They are licensed and regulated in their home state, but they do not need to be licensed in every state where they sell policies. This allows for greater flexibility in the insurance solutions they can offer, as they are not subject to the same strict rate and form regulations as admitted carriers.

Because non-admitted carriers are not backed by the state, the state's guaranty fund will not cover claims if the carrier becomes financially insolvent.

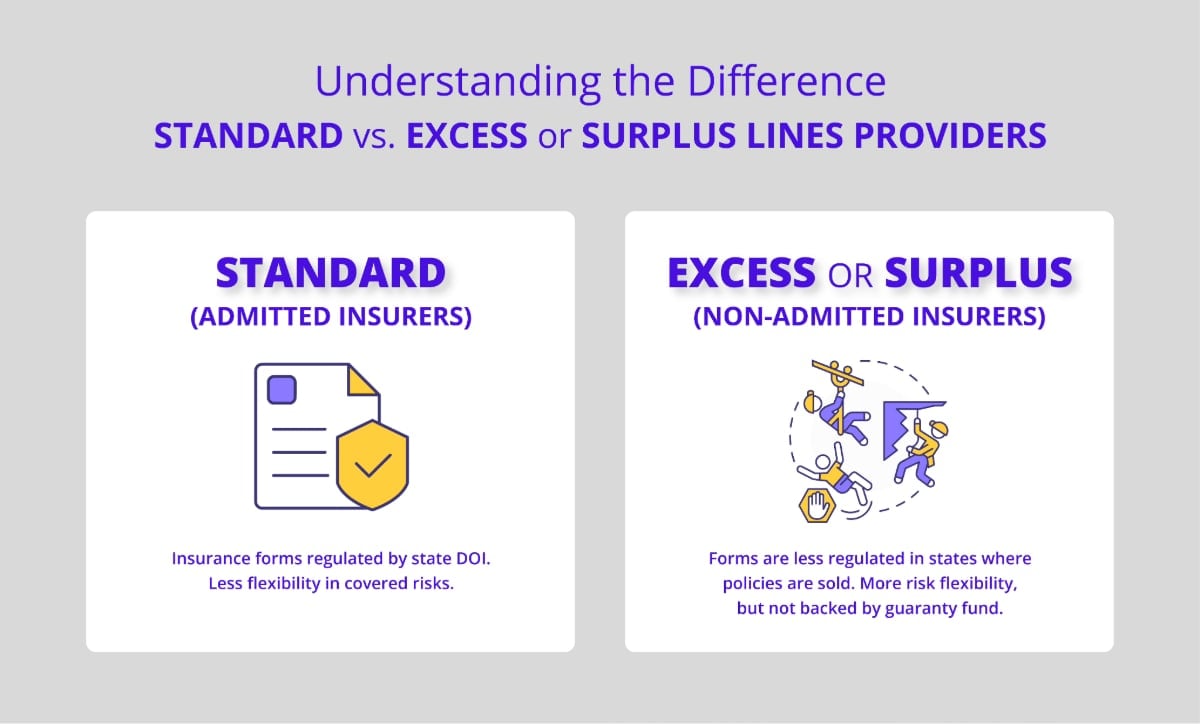

What is the difference between standard and E&S insurance?

Standard insurance and excess and surplus lines insurance differ most in these areas:

- Type of carrier. Standard insurance is offered by admitted carriers that are licensed and adhere to all regulations in the state where the policy is sold. E&S insurance is offered by non-admitted carriers, which are licensed in their home state but do not need to be licensed in all states where they operate.

- State guarantee funds and oversight. Because non-admitted carriers are not backed by the state, the state's guaranty fund will not cover claims if the carrier becomes financially insolvent. You also cannot appeal to your state's department of insurance (DOI) if you think a claim was mishandled. That makes working with a non-admitted carrier more risky.

- Flexibility. With standard insurance companies, each state's department of insurance (DOI) reviews and regulates admitted carriers' insurance forms, rates, and financial standing. Because non-admitted carriers are not subject to the same regulations, they can offer creative solutions to your business's high risks.

- Premiums. Because they cover higher, non-standard, or specialized risks, policies bought from the E&S market almost always cost more than comparable policies purchased from the standard market.

You can expect a surplus insurance policy to provide protection that is similar to a standard insurance policy of the same type. As with any policy, you'll need to read the fine print and consult an agent to make sure it includes everything your business needs.

Who needs excess and surplus lines insurance?

Your business may need to secure E&S insurance in the following instances:

- Your profession has high or unique risks. Roofers almost always need surplus lines coverage due to their increased risk of injuries. Commercial landlords may also need lessor's risk only (LRO) and building insurance policies purchased from the surplus lines market due to their specialized risks.

- You have a claims history. If your business has filed claims in the past, especially multiple or expensive claims, then standard carriers may be unwilling to insure your company.

- You work in a new or emerging industry. For example, businesses in the cannabis, cryptocurrency, or drone operation industries often have a hard time buying insurance from standard carriers as the industry is new and traditional risk models do not yet exist.

- You face risks of natural disasters. Floods, earthquakes, and wildfires are more likely in some states, which can make it harder to secure coverage from admitted carriers. For example, businesses in California may need to find a non-admitted carrier for commercial property coverage because insurers are increasingly concerned about losses from forest fires. Coastal businesses in Florida and elsewhere may need to turn to surplus lines for wind and hail coverage because of costly damages from storms.

- Your business's event has unique risks. If your business holds a special event with unique liability exposures, you may also need surplus lines insurance. That might include golf carts, fireworks displays, bungee jumping, or obstacle courses.

- Your business is new. Startups and businesses with less than three years of experience may be difficult to insure, as their short track record is considered high risk.

Basically, it comes down to your risk exposures. If a carrier's underwriting process determines they are likely to lose money from insuring your business, your application will be denied and you may need to seek coverage from non-admitted carriers.

How much does E&S insurance cost?

Small businesses that buy surplus lines insurance can expect higher insurance costs due to their increased risk.

Insurers will look at the same factors to determine your premiums as they would for standard insurance policies, such as:

- Industry risks

- Business revenue

- Value of your business property

- Number of employees

- Business location

- Claims history

Verified business insurance reviews

Hear from customers like you who purchased small business insurance.

How do I get excess and surplus lines insurance coverage?

You cannot buy E&S insurance directly. You must work with a licensed insurance broker or agent who has access to the surplus lines market in your state. This broker acts as an intermediary, working on your behalf to find a non-admitted carrier for risks that are difficult or too expensive to place with an admitted provider.

In most states, your insurance broker cannot immediately place your policy with an E&S carrier. Before going to the surplus lines market, the broker is legally required to prove they made a "diligent effort" to find coverage in the standard (admitted) market. This usually means they must receive at least three formal declinations from admitted carriers before seeking an E&S solution. This step ensures the E&S market is used only as a last resort for unique and difficult risks.

Credit rating firms such as A.M. Best assign grades to insurance companies so you can easily compare the stability of companies within the insurance industry. A non-admitted carrier with a strong rating of A or better from A.M. Best is often a much better choice for your business than a low-rated admitted carrier.

Insureon partners with top-rated carriers like Nationwide, Chubb, and Liberty Mutual to offer E&S policies for small businesses. You can fill out our easy online application to get quotes for policies that match your business's risks, or consult an insurance agent to find specialized coverage.

When it comes time to renew your E&S policy, your risks will be thoroughly reevaluated, as the insurance market may shift in terms of coverage offered.

Is excess liability insurance the same as excess lines insurance?

No, these terms refer to two different insurance products:

- Excess lines insurance is another name for surplus lines insurance or E&S insurance, which is coverage that is not available through the standard insurance marketplace.

- Excess liability insurance is a policy that boosts the limits on your underlying liability insurance. It is similar to commercial umbrella insurance, which boosts coverage across several liability policies. For both, the coverage activates when the underlying policy reaches its limit, typically with the same terms and exclusions.

What is an assigned risk plan?

There is one other way for high risk businesses to get coverage for policies that are required by state law.

Individuals or businesses that have been denied coverage from multiple providers can apply to their state's assigned risk plan, also called the assigned risk pool. They are then assigned to an insurance company that must provide coverage.

States usually have assigned risk plans for:

This allows high risk businesses to comply with their state's requirements for coverage, even when insurers are unwilling to offer them a policy. As with surplus lines, insurance purchased through an assigned risk pool costs more than standard coverage.

Get quotes from trusted carriers with Insureon

Insureon makes it easy for small business owners to get insured as part of their risk management strategy. Fill out our free application to get quotes from top-rated insurance companies. Our licensed agents will help make sure you get the right coverage options at a price you can afford. Policyholders can get their certificate of insurance quickly to show as proof of coverage.

Want free expert advice right in your inbox?

By entering your email address and subscribing, you agree to our Terms of Use and Privacy Policy