Get the right commercial insurance for your Bridgeport business

Which insurance policies are recommended for Bridgeport businesses?

Bridgeport is a growing hotspot for small businesses, with ample opportunities for new entrepreneurs. Protect your Bridgeport business with these insurance products.

General liability insurance

General liability pays for legal costs from customer accidents, along with defamation and copyright infringement claims. Commercial leases in Bridgeport often require this coverage.

- Customer accidents at your business

- Damage to a customer's property

- Slander and other advertising injuries

Professional liability insurance

A professional liability policy covers legal costs related to claims of negligence, such as advice that caused a client to lose money. It's sometimes called errors and omissions insurance (E&O).

- Mistakes that cause financial loss

- Accusations of professional negligence

- Missed deadlines

Cyber liability insurance

Cyber insurance helps small businesses in Bridgeport recover after a data breach or a cyberattack. Every business that handles customer information should have this coverage.

- Data breach notification costs

- Fraud monitoring services

- PR campaigns after a breach

Business owner’s policy

A business owner's policy, or BOP, is an affordable way to buy general liability coverage and commercial property insurance together. It's recommended for low-risk small businesses.

- Customer slip-and-fall injuries

- Damaged business property

- Theft and vandalism

Workers’ compensation insurance

Workers' comp is required for Bridgeport businesses with employees. It also covers work-related injuries for sole proprietors, which health insurance may deny.

- Medical bills from job-related injuries

- Disability benefits

- Legal fees from workplace injuries

Commercial auto insurance

All vehicles owned by Bridgeport businesses must be covered by commercial auto insurance. This policy primarily covers injuries and property damage caused by your vehicle.

- Injuries from an auto accident

- Damage caused by your vehicle

- Lawsuits from an auto accident

Errors and omissions insurance

E&O insurance protects consultants and professional services against legal defense costs from dissatisfied clients. It's also called professional liability insurance.

- Errors and oversights

- Breach of contract

- Professional negligence

Commercial property insurance

This policy covers physical damage to a Bridgeport business's building and its contents, including any computers and equipment. You can bundle it with general liability in a BOP.

- Burglaries

- Fires

- Storm damage

Commercial umbrella insurance

An umbrella policy provides coverage once the limit is reached on your underlying general liability insurance, commercial auto insurance, or employer's liability insurance.

- Customer lawsuits

- Auto accident lawsuits

- Employee injury lawsuits

Verified business insurance reviews

Hear from customers like you who purchased small business insurance.

Which business insurance policies are required in Bridgeport, CT

State and local laws determine the type of insurance solutions you need. These policies help you comply with Connecticut business insurance requirements.

Workers' compensation insurance

Connecticut state law requires all businesses with even just one employee to carry workers’ compensation insurance. This includes full-time and part-time employees with few exceptions, including housekeepers and caregivers who work fewer than 26 hours per week.

While not required, Bridgeport sole proprietors and independent contractors should also consider workers' comp to protect themselves from work-related injuries.

Workers' compensation insurance pays for medical costs from job-related injuries and illnesses. It also provides disability benefits for injured Connecticut workers.

Most workers' comp policies include employer's liability insurance, which protects employers against legal costs related to worker injuries.

Commercial auto insurance

From Fairfield to Norfolk, the state of Connecticut requires commercial auto insurance coverage for all vehicles that are owned by a business. This auto policy pays for legal defense costs and property damage after an auto accident.

Connecticut small businesses must meet the state's minimum requirements for auto liability coverage:

- $25,000 bodily injury liability per person

- $50,000 bodily injury liability per accident

- $25,000 property damage liability per accident

- $25,000 uninsured/underinsured motorist coverage per person

- $50,000 uninsured/underinsured motorist coverage per accident.

Keep in mind that this is the minimum you're required to carry. It's worth considering higher limits, given the potential cost of a lawsuit.

Trucking companies or businesses with vehicles that have an Connecticut Department of Transportation serial number likely need additional coverage to comply with regulations.

If you need business insurance coverage for a personal, rented, or leased vehicle, you may want to consider hired and non-owned auto insurance (HNOA) instead. Personal auto insurance typically will not cover if an accident occurs in a personal vehicle being used for business purposes.

How much does business insurance in Bridgeport cost?

Small businesses in Bridgeport don't have to pay a lot for commercial insurance. Here are a few average costs for Connecticut businesses:

General liability: $42 per month

Workers' comp: $65 per month

Professional liability/E&O: $81 per month

Business insurance costs depend on factors such as:

- Type of business

- Business revenue

- Business operations

- Number of employees

- Policy limits and deductibles

- Claims history

FAQs about Bridgeport business insurance

Review answers to common questions about Bridgeport business insurance.

How do I get a certificate of insurance for my business?

Sometimes small business owners need to get insured quickly to sign a contract or other agreement.

With Insureon, you can meet your business insurance needs and get same-day coverage in three simple steps:

- Fill out our easy online application to get quotes from top-rated insurance companies.

- Choose the insurance option that suits your coverage needs and pay for it online.

- Download a certificate of insurance (COI) by logging into your account.

Our licensed insurance agents will help you get the right coverage for your small Bridgeport business that matches your specific needs and your budget. Most businesses receive their certificate of insurance within a few hours of applying for quotes.

Can my business be held liable for a data security breach?

Yes – that's why cyber insurance is so crucial. Small businesses are a common target of cyberattacks since they often have fewer security measures in place.

Connecticut's data breach laws require Bridgeport businesses to notify any residents whose personal information is exposed in a data breach within 60 days of discovery.

Failure to comply with data breach notification laws in Connecticut is considered an unfair trade practice and could be investigated and enforced by the Attorney General's office.

Your business could be held responsible for paying for a data breach investigation, a PR campaign, and other costs related to a breach or cyberattack.

Cyber insurance covers these costs and provides resources so you can get back to business fast.

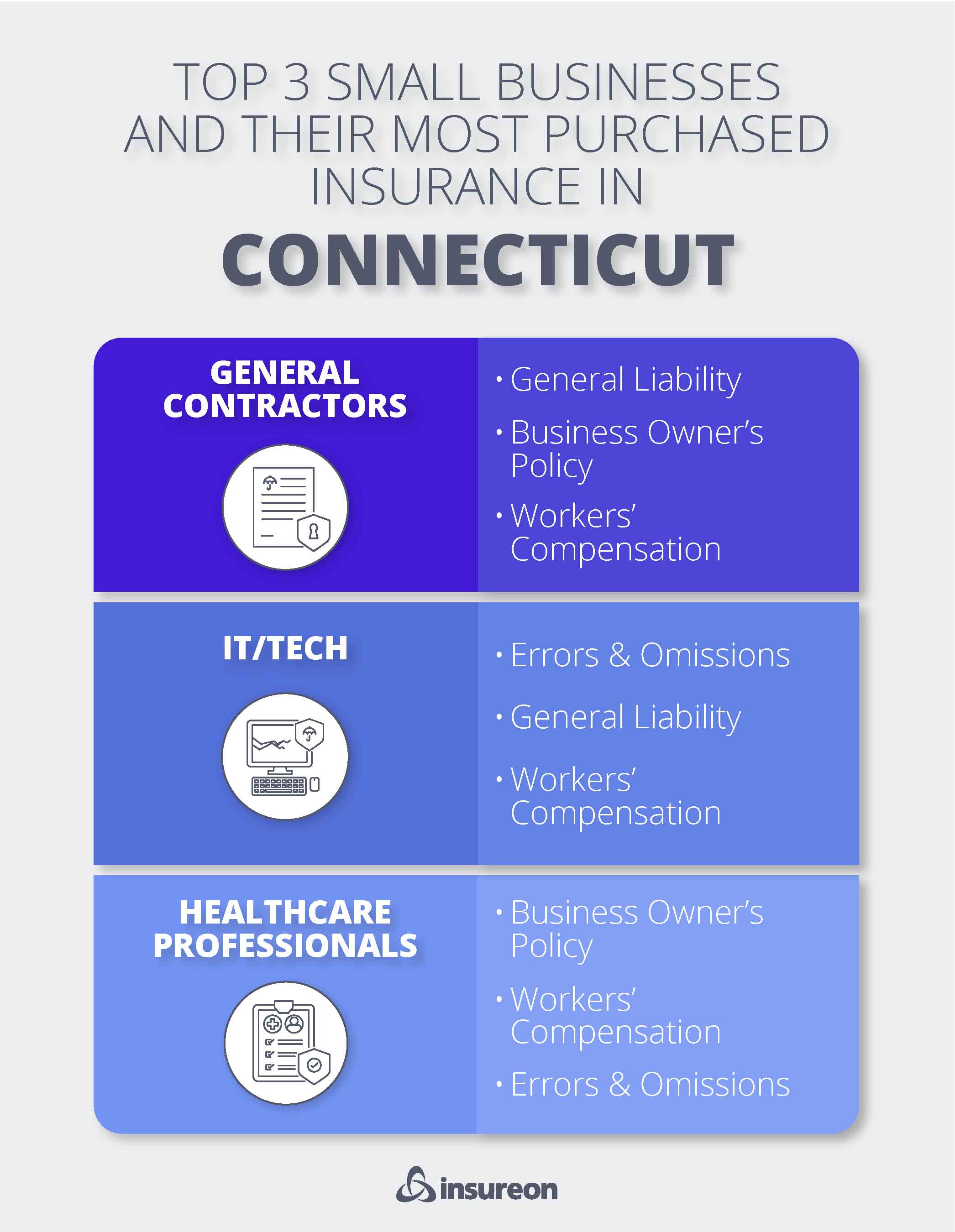

Does my industry affect Bridgeport insurance requirements?

Yes, the city of Bridgeport may have special requirements for business insurance and bonds, depending on the type of work you do.

Some Bridgeport businesses are required to have a business license if they're operating within city limits. Examples include food businesses and salons.

Here are a few examples of businesses with other obligations:

- Contractors must carry commercial general liability insurance for contractors to operate in Connecticut.

- Real estate agents and brokers are not required to carry errors and omissions insurance (E&O), sometimes called professional liability insurance, in order to operate but may want to consider it regardless.

- Cannabis businesses that produce medical marijuana are required to carry a $2 million surety bond.

- Home-based businesses may want to consider commercial property insurance as homeowner's insurance and renter's insurance likely won't cover commercial property.

- Physicians are required by law to carry malpractice insurance to practice in Connecticut.

Check with your local laws and industry requirements before beginning operations within Bridgeport.

How can I get help starting a small business in Bridgeport, CT?

Bridgeport is known to be business-friendly with favorable conditions for entrepreneurs to start and grow their companies.

To help you get started, here's a list of local organizations available to provide guidance and resources:

- The City of Bridgeport provides resources for its citizens, including funding and grant support, recovery relief, and other small business tools.

- Bridgeport Regional Business Council assists small and minority businesses with free advising and funding support.

- Colorful Bridgeport has a small business directory, social media community, newsletters, and more resources for small businesses.

- Connecticut Small Business Development Center assists with advising, growth programs, and funding for entrepreneurs.

- SCORE Fairfield County offers free business advice and training, with support from experienced entrepreneurs from diverse industries and specialties.

- The Small Business Administration Connecticut District assists entrepreneurs with funding, certifications, counseling, and disaster recovery resources.

Many lenders will require you to first obtain several types of business insurance, which is yet another reason to insure your investment.

How can I save money on Bridgeport business insurance?

Small business owners can save money on insurance by comparing quotes from different insurance companies. With Insureon, you can get free business insurance quotes from top-rated providers by filling out one easy application.

There are a few other ways to save, such as:

- Bundle policies for a discount. Insurance agencies often provide lower rates for bundles; the most popular is a business owner's policy.

- Choose less expensive policy options, such as lower limits or a higher deductible.

- Focus on workplace safety and risk management. Fewer accidents mean fewer claims, which helps keep your premium low.

Learn more about how to find cheap business insurance.