Do business associates need to comply with HIPAA?

Why HIPAA compliance matters to small businesses

HIPAA, an acronym for the Health Insurance Portability and Accountability Act, is a set of laws that require businesses with access to patient health data to take extra precautions to ensure the security of those records.

HIPAA can require businesses to:

- Use encryption while transferring data

- Go to extra lengths to secure their network

- Strictly limit access to data

- Take extra measures to protect hard drives, laptops, and mobile devices from being stolen

While HIPAA requirements directly protect individual health information, the privacy rules don’t just apply to medical providers and hospitals. Many small businesses and consultants also fall under the “business associate” umbrella.

If your business isn’t compliant with HIPAA regulations, you could face consequences like expensive fines, criminal charges, and reputational harm. However, certain types of small business insurance can protect independent contractors and subcontractors against these risks.

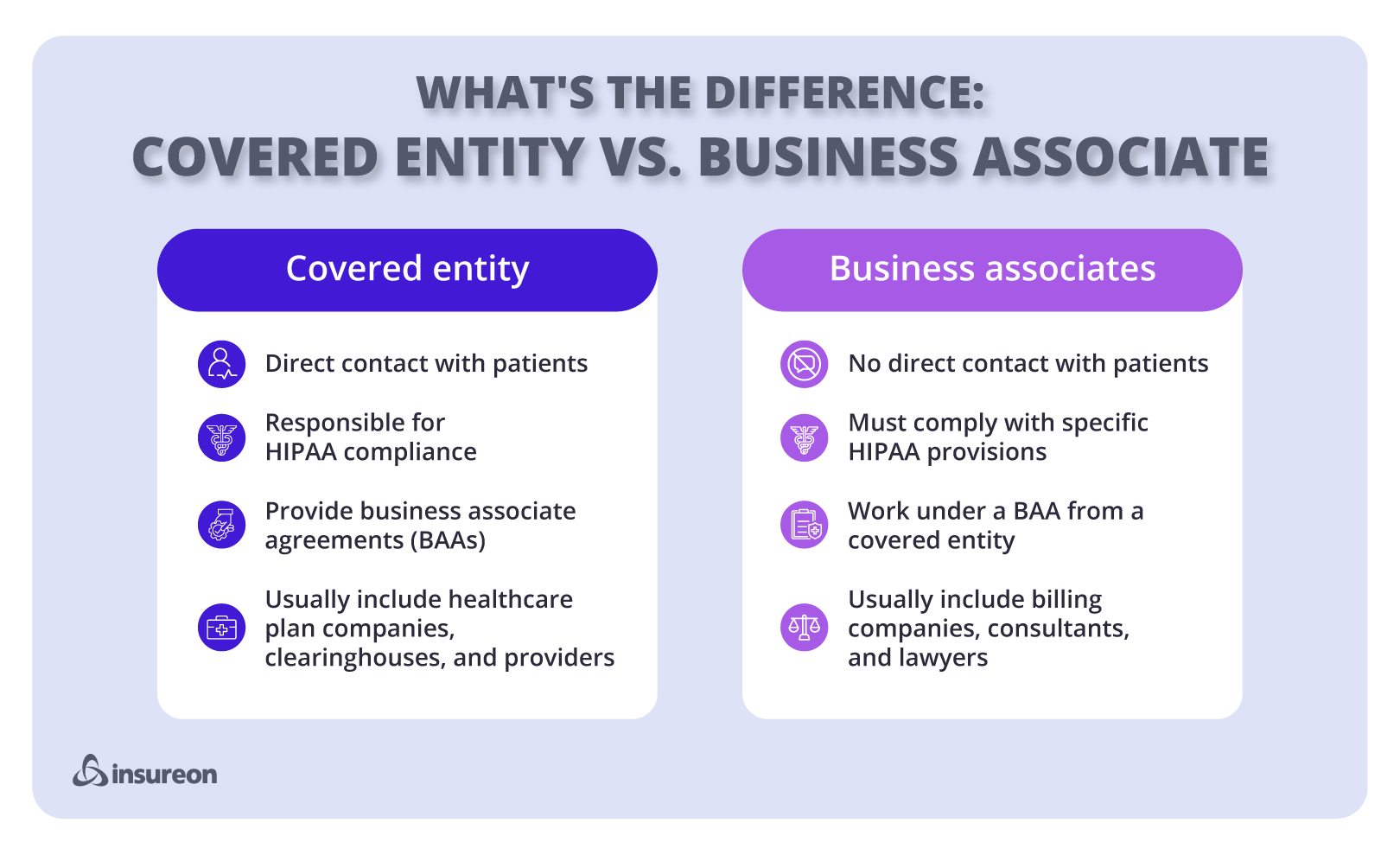

Who counts as a covered entity vs. a business associate?

A covered entity refers to an organization that’s required to comply with HIPAA privacy rules. This includes businesses like:

- Health plan administrations, including insurance companies and insurers that sell Medicare and Medicaid plans.

- Healthcare clearinghouses that process non-standard health information into standardized formats.

- Healthcare providers, including doctors, hospitals, medical offices, and pharmacies.

A business associate, on the other hand, is an individual or entity that performs services using PHI on behalf of a HIPAA-covered entity. Business associates are often independent contractors or consultants – employees of the covered entity aren’t considered business associates.

Here are some of the main differences between covered entities and business associates under HIPAA:

- Relationship with patients: Covered entities interact with patients directly, while business associates usually don’t.

- HIPAA compliance responsibility: Covered entities are directly responsible for HIPAA compliance. Business associates aren’t responsible for compliance overall, but they must comply with specific provisions.

- Business Associate Agreements (BAAs): Covered entities that work with business associates must have written BAAs that outline responsibilities for safeguarding PHI.

What is PHI?

Protected Health Information (PHI) refers to any individually identifiable health information created, used, disclosed, or maintained by a healthcare provider or other covered entity under HIPAA. PHI is usually context-dependent based on its use and the potential for identifying someone.

Some of the most common examples of PHI are:

- Demographic information, i.e., name, date of birth, phone number, email address, and Social Security number

- Geographic data, like home address and ZIP code

- Medical history, including diagnoses, treatments, medications, test results, and medical records

- Insurance information, like the person’s health insurance plan and policy numbers

- Financial information, i.e., bank account and credit card numbers

- Biometric data, such as fingerprints and facial photographs

- Device identifiers, like serial numbers for medical devices

What is a business associate under HIPAA?

According to the U.S. Department of Health and Human Services (HHS), a business associate is defined as: “A person or entity that performs certain functions or activities that involve the use or disclosure of protected health information on behalf of, or provides services to, a covered entity.”

Some examples of business associates under HIPAA are:

- IT service providers that have access to medical records

- Billing service providers that process payments from patients

- Legal offices or accounting firms that handle patient data

You might be wondering, does HIPAA apply to consultants? The answer is yes. Business consultants are typically considered business associates under HIPAA because they’re working for a covered entity.

For example, if you get hired by a hospital to do a utilization review, you’ll get access to the hospital's data, files (physical and digital), and network. In this case, you’d have to sign a BAA requiring that you know and follow HIPAA guidelines.

It’s important to note that being a business associate can be unintentional. If you get hired by a covered entity and you’re required to use PHI, or you have access to patient data, you’ll most likely have to comply with HIPAA.

HIPAA compliance requirements for business associates

Independent contractors who work with covered entities must meet certain obligations to comply with HIPAA’s privacy laws. Here are the main HIPAA business associate requirements:

- Sign a BAA with the covered entity: When you get hired by a covered entity, the organization will require you to sign a Business Associate Agreement (BAA), which is a legal contract that outlines your responsibilities when using PHI. BAAs are required for all HIPAA-covered entities.

- Implement safeguards to protect PHI: As a business associate, you’re required to implement administrative, physical, and technical safeguards and risk management strategies to protect the sensitive data you’re handling. This might include using multi-factor authentication on your devices and shredding paper records that contain patient information.

- Report breaches of unsecured PHI: Contractors and consultants must self-report breaches of unsecured PHI to the covered entity within 60 days of discovering a data breach. The covered entity is typically responsible for notifying individuals of the breach, but this duty can also be passed onto the business associate.

- Emphasize training, data security protocols, and breach response plans: Business associates must adhere to their data security protocols and should create a recovery plan if PHI is compromised. The business owner is also responsible for training their workforce on how to appropriately access and handle sensitive information.

What happens if a business associate violates HIPAA?

HIPAA business associate compliance is required for any individual or entity that handles PHI. If you violate HIPAA privacy rules, you can face serious financial and/or legal consequences.

Civil penalties for violations: The HHS Office for Civil Rights (OCR) can impose civil money penalties that range from $100 to $50,000 per violation, depending on the severity of the violation and the business associate's knowledge of the violation. Civil penalties are assigned based on a tiered system of negligence. The fine for an unknowing violation is lower than the fine for willful neglect.

Criminal penalties for violations: If you knowingly misuse PHI, you can receive a maximum fine of $50,000 and face imprisonment for up to one year. The penalties increase to $100,000 and up to five years imprisonment for violations committed under false pretenses. Fines can reach $250,000 and 10 years' imprisonment for violations intended for commercial advantage, personal gain, or malicious harm.

Over the last several years, numerous covered entities have been penalized for violating HIPAA’s privacy regulations.

In 2025, Warby Parker was ordered to pay a penalty of $1.5 million after the OCR investigated multiple data breaches involving unauthorized access to PHI from nearly 200,000 people. The OCR also determined the company hadn’t conducted a HIPAA-compliant risk analysis and wasn’t regularly reviewing activity logs in systems that stored electronic PHI (ePHI).

In 2024, Children’s Hospital Colorado Health System was fined $548,265 after a phishing attack exposed the ePHI for 10,840 patients. In addition to the breach, the OCR investigation found the hospital didn’t provide HIPAA training to more than 6,600 staff members, including 3,495 nursing students.

These are examples of large covered entities that have been penalized for violating HIPAA, but even small consultants can face financial consequences for non-compliance.

Imagine you run an accounting firm that processes payments for a local hospital. Someone breaks into your office after hours and steals your computer, which contains payment information for patients. Even worse, you forgot to log out before you went home. Now, the burglar has easy access to the data, and you could get fined for violating the HIPAA security rule.

To be a HIPAA-compliant consultant, not only will you need to make sure you’re adhering to the proper security protocols for data transfer, storage, emails, and data entry, but you'll need to avoid simple mistakes like this, which could lead to million-dollar fines.

Does my business need to worry about HIPAA?

Now that you understand the HIPAA rules that apply to business associates, you might be wondering if your business needs to worry about these requirements. To figure it out, ask yourself these questions:

- Do you handle, store, or transmit any patient health data on behalf of a healthcare organization or provider?

- Do you create, receive, or access PHI in any way?

If you answered ‘yes’ to either question, your business most likely has to comply with HIPAA’s privacy laws. This goes for small businesses of any size, including freelancers.

Another way to determine if your business has to comply with HIPAA is to look at the types of clients you work with. In general, working with any professional or business in the healthcare industry will bring HIPAA liability. That includes doctors, nurses, physician assistants, and healthcare facilities, like hospitals, dental offices, and nursing homes.

Do business associates need to conduct HIPAA training?

How can insurance help protect business associates

Most small businesses can benefit from having business insurance, especially if you’re required to comply with HIPAA.

Cyber insurance covers costs associated with a data breach, ransomware attack, PHI exposure, or HIPAA breach. There are two types of cyber liability insurance: First-party coverage, which pays for things like customer notification and ransomware payments, and third-party coverage, which pays for legal fees and regulatory fines.

Some cyber liability policies can be tailored for healthcare businesses and often include specific HIPAA breach coverage.

Professional liability insurance for consultants and independent contractors covers expenses related to HIPAA violations that arise from negligence, work errors, breach of contract, or unsatisfactory work. If a client sues your business, professional liability insurance can help pay for your legal defense costs, settlements, and judgments.

Some professional liability insurance policies include HIPAA-related coverage or offer endorsements for HIPAA proceedings, which can potentially pay fines.

Technology errors and omissions (E&O) insurance is beneficial for IT service providers. This policy covers work oversights and mistakes, negligence, and third-party cyber liability for data breach lawsuits. Tech E&O insurance combines cyber insurance with professional liability insurance for less than it would cost to buy the policies separately.

Directors and officers (D&O) insurance is important for covered entities and business associates who handle PHI. D&O insurance primarily covers board members and executives if they get sued for a decision they make that causes the business financial loss. However, it may also include coverage for HIPAA violations.

Although insurance can protect your business against various liabilities and certain HIPAA penalties, there can be exclusions. For example, some policies may not cover HIPAA breaches if the organization isn’t compliant, which is why it’s important to create and maintain a comprehensive HIPAA compliance program.

Before you purchase insurance, it’s a good idea to speak with a knowledgeable insurance agent about your business's unique needs and risk exposure. An agent can help you find a policy that provides adequate protection for HIPAA policies, as some policies have limitations on coverage.

Get the right coverage with Insureon

If your business is required to comply with HIPAA, having the right types of insurance can provide valuable financial and legal protection in case something goes wrong. Remember, even the smallest businesses can face significant fines for violating HIPAA.

Complete Insureon’s easy online application today to get quotes for business insurance from top-rated U.S. insurance providers. Our team of licensed insurance agents can help you find the best policies for your situation and get the most affordable coverage.

Once you find the right policy for your small business, you can begin coverage in less than 24 hours and get a certificate of insurance (COI).

Elizabeth Rivelli, Contributing Writer

Elizabeth is a freelance writer with extensive experience covering commercial insurance and personal insurance lines. Her work has been featured in dozens of online finance publications, including Forbes, Bankrate, and Investopedia. Elizabeth also writes for several insurance carriers.