Occurrence vs. claims-made insurance: Why it matters

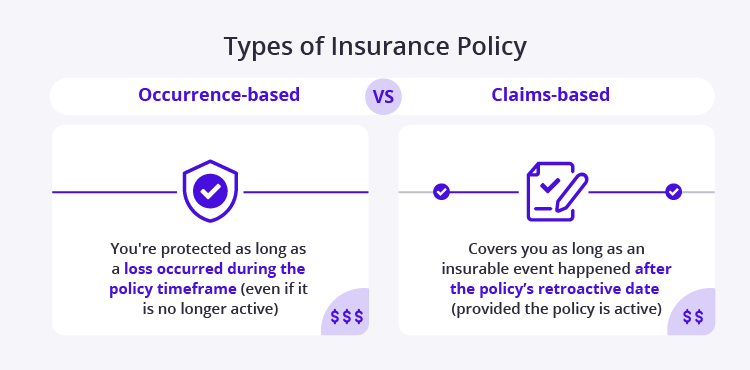

For small business owners, it’s important to understand the difference between occurrence vs. claims-made insurance before you purchase a policy.

The two policy types can affect what you pay for coverage and the lifecycle of some of the most common small business insurance coverages. For example, general liability insurance is mostly available as an occurrence policy, while professional liability insurance, errors and omissions (E&O) insurance, and directors and officers (D&O) insurance mainly have claims-made coverage.

How do occurrence and claims-made insurance policies differ?

[video: an animated header displays the Insureon logo and the video title: "Understanding policies with Insureon: Claims-made vs. Occurrence-based insurance policy"

As a small business owner, you know it’s important to understand how your insurance policy works. This includes understanding the difference between occurrence-based and claims-made policies.

An occurrence-based policy covers losses that happen during the policy period, even if it’s not active when you submit a claim.

[video: an illustrated header displays the text: "An occurrence-based policy protects your business from claims that don't happen right away, even if: Years pass before an incident becomes known; You switched to another policy or carrier, or canceled your insurance altogether"]

Let’s say you purchased a $1 million occurrence-based general liability policy. In year one, your business is sued for $1 million. When your policy is renewed at the beginning of year two, you’ll have another $1 million of coverage.

[video: an illustrated header displays the text: "Year 1: $1 million occurrence-based coverage, $1 million lawsuit; Year 2: $1 million occurrence-based coverage renewed"]

On the other hand, a claims-made policy provides benefits only if you file a claim after the policy start date. If you cancel your policy and then report a claim, it will not be covered.

[video: an illustrated header displays the text: "A claims-made policy protects your business from claims files during the policy period; This includes claims under previous claims-made policies with different carriers."]

In this case, if you had a $1 million claims-made policy and are sued for $1 million in your first year, you’d no longer have coverage. That is, unless you increase your policy limit in the second year.

[video: an illustrated header displays the text: "Year 1: $1 million claims-made coverage, $1 million lawsuit; Year 2: Uninsured, unless policy is increased (e.g., $2 million claims-made coverage)"]

Occurrence-based and claims-made policies are often found in specific types of insurance coverage. For example, your general liability, commercial auto, and umbrella liability insurance will be occurrence-based.

[video: an illustrated header displays the text: "Occurrence-based insurance policies: General liability, Commercial auto, Umbrella liability"]

Claims-made policies, on the other hand, will often be found in your directors and officers coverage and professional liability insurance, which is also referred to errors and omissions insurance.

[video: an illustrated header displays the text: "Claims-made insurance policies: Directors and officers (D&O), Professional liability, also called errors and omissions (E&O)"]

The biggest difference between claims-made and occurrence-based policies are the coverage limits. If you’re just starting out, you may want a lower cost claims-made policy.

[video: an illustrated header displays the text: "The type of policy and limits you choose all depends on your business size, industry, and risk level."]

[video: an illustrated header displays the text: "New business? You may want a budget friendly-claims policy."]

However, if you own a business with more assets at risk, it may be best to invest in an occurrence-based policy.

[video: an illustrated header displays the text: "Higher-risk? Several employees? An occurrence-based policy may be the best choice."]

Get the right coverage for your small business with Insureon today. Click the link to get started.

[video: an illustrated header displays the text: "Insureon is your #1 marketplace for small business insurance."]

[video: an animated header displays the Insureon logo"

What is an occurrence-based policy?

With an occurrence-based policy, you’ll be protected if the loss happened during your policy timeframe. As long as you were insured when the incident occurred, you can file a professional liability claim with your insurer. Occurrence coverage typically accommodates “long-tail” events – situations that don’t produce lawsuits or claims right away.

General liability insurance, commercial auto insurance, and umbrella liability insurance are the most common examples of occurrence-based policies, as they typically are needed for longer protection. For instance, if you get into a work-related car accident while your policy was active, but don't notice one of the effects of the accident until years later, you could still file a claim against your insurance even after your policy expired.

What is a claims-made policy?

With a claims-made policy, your coverage only kicks in when you file a claim during the policy period. As long as an insurable event happened after the policy’s retroactive date, your insurer should provide coverage. A claims-made policy covers claims filed while your insurance is active. If you canceled your policy – or forgot to pay your premium and the insurer canceled it – you’ll be uninsured.

D&O insurance is among the most common examples of a claims-made policy, as is professional liability insurance, which is also referred to as E&O or malpractice insurance. Policies like medical malpractice insurance are often offered as claims-made policies due to their high associated expenses, but may feature lower average premiums for businesses than if offered as an occurrence-based policy.

Extended reporting and prior acts coverage

If a loss or incident happened before your policy started, your insurer won’t provide coverage. Instead, you’ll need prior acts coverage. This coverage will provide protection back to your policy's retroactive date.

Some insurance carriers provide the option to purchase an extended-reporting period (ERP) or tail coverage for certain claims-made policies. An ERP can help your cover claims even past your policy expiration date. However, an ERP only applies to losses that happened during the prior policy period and for which you now need to file a claim.

Combined, prior acts coverage and tail coverage can provide you more peace of mind thanks to the added protection for your business.

Policy limits: Claims-made vs. occurrence

When you purchase a policy, you have to decide how much protection you need with your aggregate limit. This refers to how much coverage you have available for all future claims. Per-occurrence limit is the most your insurance company will pay for a given incident.

With occurrence policies, your aggregate limit resets every year. For example, let’s say you purchased a $1 million occurrence-based general liability policy. In year one, you get sued for $1 million. When your policy renews at the beginning of year two, you’ll have another $1 million of coverage to protect you.

In short, occurrence-based policies provide ample coverage as long as you keep renewing them. For this privilege, you’ll generally pay more than you would for claims-made policies.

With claims-made policies, the amount of coverage you purchase must last for as long as you keep your policy. For example, if you had a $1 million claims-made policy and a client sues you for $1 million in the first year, you would have no further protection in your policy. Unless you increase your policy limit in the second year, you would be uninsured.

What is better claims-made or occurrence?

With occurrence vs. claims-made, is one policy type better than the other? It depends on your business needs.

Occurrence-based policies are simpler to own

When you switch insurers, you’ll still have the ability to file claims on your prior work, unlike with claims-made policies.

Occurrence-based policies also offer more peace of mind

As you get a new aggregate limit each time you renew your policy, you won't have to worry about a large claim exhausting your limit.

Claims-made policies have lower initial premiums

But this can also pose problems when you cancel them or switch to an occurrence-based policy.

You run the risk of exhausting your claims-made policy limit

If you have several large claims under your current policy, you could reach your coverage limit in a short amount of time.

The final answer depends on what you and your business need

If you’re just starting out, you may want a lower cost claims-made policy. And if you don’t plan to cancel your policy, this may be perfect.

However, for a larger firm with more disposable cash and more assets at risk than a new firm, an occurrence-based policy may be more appropriate, even though it costs more.

When you’re shopping for small business insurance, always ask your agent which types of insurance are occurrence-based or claims-made.

Get quotes from trusted carriers with Insureon

Complete Insureon’s easy online application today to get insurance quotes from top-rated U.S. carriers. You can also consult with an insurance agent on your business insurance needs.

Once you find the right types of coverage for your small business, you can begin coverage and get your certificate of insurance in less than 24 hours.

When buying small business insurance, it’s important to choose reputable insurance companies. The following are some of the best providers for the most necessary and affordable types of business insurance coverage.

Harry J. Lew, Contributing Writer

Harry is an experienced content marketing strategist, writer, and editor, with a focus on insurance, B2B, and financial planning. He has a working knowledge of SEO practices, small business insurance lines, and transforming complex information into clear, useful insights.