What is HIPAA breach insurance and why small businesses need it

It requires any business that handles protected health information (PHI) to implement strict security measures in compliance with the HIPAA security rule. HIPAA violations can result in significant fines, possibly forcing a business into bankruptcy or closure.

HIPAA breach insurance is a critical safety net for any business that handles PHI. It typically covers legal fees, breach response costs, and may also cover certain regulatory fines and penalties up to the policy limits. HIPAA breach insurance is essential for businesses of all sizes, including small businesses, which are just as vulnerable to HIPAA violations as larger organizations.

What is HIPAA breach insurance?

HIPAA breach insurance, which is often referred to as cyber insurance or HIPAA liability insurance, protects businesses against financial losses stemming from a data breach involving PHI. It protects against a wide range of losses, including the costs associated with responding to a breach, legal fees, notifying affected parties, and potential penalties. This type of insurance is crucial because HIPAA compliance is essential for all organizations that handle PHI.

When a breach of PHI occurs, HIPAA breach insurance steps in to help covered entities get back on their feet. Without this coverage, these costs could quickly drain a small business's resources.

What qualifies as a HIPAA breach?

A HIPAA breach is when PHI is accessed, disclosed, or used in a way that compromises its privacy or security – and the event isn’t permitted under HIPAA rules. The breach can be intentional or accidental.

Examples of HIPAA breaches include:

- A stolen laptop containing patient records

- An email with PHI was sent to the wrong person

- A ransomware attack locks access to electronic health records

- Improper disposal of medical files

The HIPAA reporting requirements can be challenging for small businesses. Even if it's unclear whether there was unauthorized access to data in a breach, you're still required to report the incident. The law strongly protects patients' sensitive information, and businesses must report breaches even if there's a small/low chance PHI was compromised. That's why having HIPAA breach insurance is so important – it helps businesses manage the cost and complexity of dealing with these events.

What is the liability for violating HIPAA?

Breaches of PHI can lead to both civil and criminal penalties.

Civil penalties may involve monetary fines of $100 up to as much as $25,000 per violation, with an annual cap of $1.5 million for repeated violations. The U.S. Department of Health and Human Services (HHS) has significant discretion in determining penalties. They consider various factors for corrective action, including the number of patients affected and whether the organization has attempted to correct the problem.

The criminal penalties for HIPAA breaches can be severe and may include both imprisonment and substantial fines. The severity depends on the nature and intent of the violation. For example, someone who accidentally discloses PHI may face different consequences than someone who intentionally sells patient information for profit.

Are HIPAA violations covered by insurance?

HIPAA liability insurance covers the expenses associated with HIPAA violations. It provides coverage for regulatory fines, legal defense costs, notification expenses, and other costs. This essential coverage helps protect businesses financially after a breach so they can continue operating without their assets being drained by unexpected expenses.

However, HIPAA breach insurance coverage doesn't provide blanket protection for all violations. Coverage typically excludes intentional misconduct or criminal acts, and specific protections will vary depending on the terms of your policy. Some policies may have sub-limits for certain types of expenses, waiting periods before coverage takes effect, or exclusions for specific types of incidents. That’s why it's essential to review your policy carefully or speak with an insurance advisor to ensure you have the best coverage for your needs.

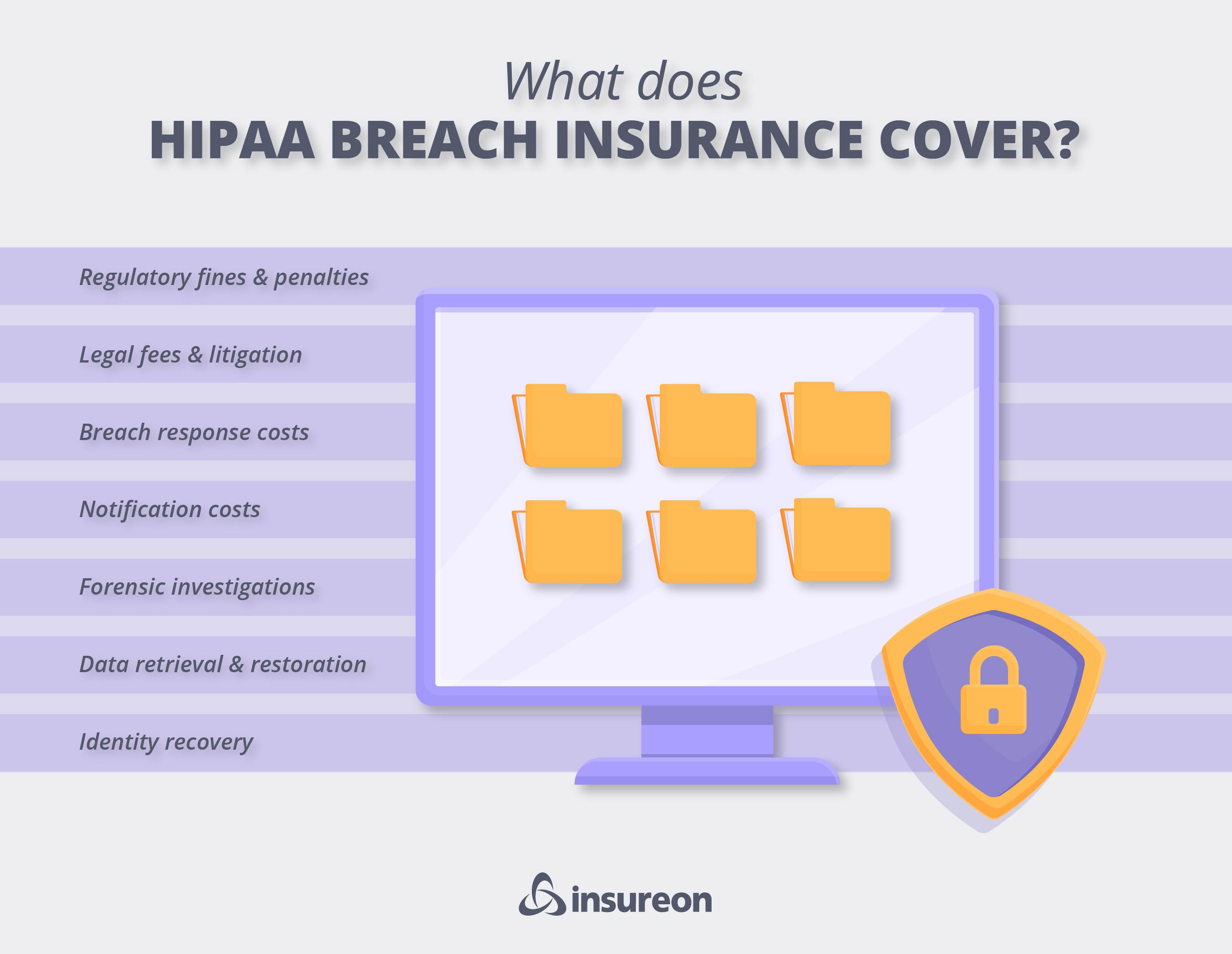

What does HIPAA liability insurance cover?

HIPAA breach insurance helps safeguard organizations from the financial impact of HIPAA violations. It typically covers the costs associated with responding to a breach of medical records, including notifying affected parties, legal fees, and potential penalties.

This type of coverage protects businesses from the substantial costs of responding to a data breach involving PHI. It turns what could be a business-ending financial catastrophe into a manageable incident. It allows businesses to focus on their core mission instead of struggling to cover legal fees, penalties, and other breach response costs.

Common coverage areas of HIPAA liability insurance include:

Regulatory fines and penalties

Legal fees and litigation

The cost of dealing with litigation following a data breach can also be significant. HIPAA violation insurance covers attorney fees, court costs, and potential settlements or judgments, depending on the policy terms and limits. This allows businesses to continue operating without depleting their financial reserves.

Breach response costs

The cost of responding to a breach may include hiring experts to investigate how the breach occurred, restoring systems, and implementing additional safeguards to prevent future incidents.

Notification costs

When a data breach occurs, you’re required by law to notify all affected patients. HIPAA breach insurance helps to cover data breach notification costs, which may include printing, postage, and administration expenses.

Forensic investigations

Finding out how a breach occurred and how many people were affected helps businesses implement stronger security measures to prevent it from happening again. Forensic investigators may be needed to determine the source of the breach and find out how much data was exposed. Cybersecurity experts may also be needed to remove malware, repair systems, and update security protocols to prevent future incidents.

Data retrieval and restoration

When patient information is compromised or held hostage by a ransomware attack, getting the data back is essential. Data retrieval often requires specialized recovery services, which can be expensive.

Identity recovery

After a data breach, patients will need a way to protect themselves from the long-term consequences of having their medical information compromised. Identity theft services help with credit monitoring and other support.

Is HIPAA breach insurance the same as cyber liability insurance?

Although HIPAA breach insurance and cyber insurance are similar, they aren't the same thing. Cyber insurance offers broader protection for various types of data breaches and cyber incidents for all industries. In contrast, HIPAA breach insurance is more specialized. It's specifically for businesses that handle PHI or electronic patient health information (ePHI).

HIPAA breach insurance specifically addresses the regulatory requirements of HIPAA, including fines, legal fees, and patient notification expenses if healthcare data is compromised. Many cyber liability policies include HIPAA-related coverage, but not all of them do. That's why it's important to verify whether your cyber policy includes HIPAA compliance insurance or if you’ll need to obtain a separate policy.

What are some limitations of HIPAA breach insurance?

While HIPAA breach insurance provides valuable protection for small businesses, there are some limitations you should be aware of.

Perhaps the biggest limitation is that most policies won't cover losses if your organization isn’t HIPAA compliant when a breach occurs. Insurance companies require businesses to meet certain security standards. If your business doesn't conduct risk assessments, train employees on handling PHI, or implement security measures, your insurer may deny a claim if a breach occurs.

Another limitation of HIPAA breach insurance is that some policies may have specific exclusions for HIPAA violations or regulatory actions. For example, certain penalties may not be covered if they result from willful neglect or repeated noncompliance. Additionally, some policies may cap coverage for certain costs or exclude coverage for reputational harm or business interruption losses.

It's also important to make sure you have the right policy for the risks your business faces. For example, a policy that works for a small home health agency might not be sufficient for a large telehealth provider. It's essential to work with an insurance provider who understands HIPAA and your business to make sure you get the right coverage for your needs.

Who needs HIPAA violation insurance?

HIPAA breach insurance is essential for any business or healthcare organization that handles individually identifiable health information (IIHI) as part of its risk management strategy, regardless of its size. Some small businesses in the healthcare industry that should consider obtaining coverage include:

Independent medical practices

Small healthcare facilities—like medical offices and medical spas—routinely handle electronic health records, billing systems, and communicate sensitive patient information. A single ransomware attack bypassing technical safeguards or an employee error could expose hundreds or potentially thousands of patient records. This could result in costly notification requirements and regulatory fines.

Therapists, chiropractors, and dentists

Healthcare professionals, like counselors, chiropractors, and dentists, store sensitive patient information, including mental health records and treatment histories. Breaches of patient data can cause significant damage to patients, which may result in lawsuits and regulatory fines.

Home healthcare providers

Home healthcare providers typically work outside of medical facilities, which is less secure. Because they're mobile, there's a greater chance of losing an electronic device or accidental disclosure of information.

IT firms or consultants handling PHI

Businesses that don't treat patients directly but handle PHI must comply with HIPAA regulations, the same as medical professionals. Any business that provides IT services, healthcare consulting, data security or storage, billing support, or any other service involving PHI needs HIPAA breach insurance to protect against information system security risks.

Do I need HIPAA liability insurance if I’m HIPAA compliant?

Some healthcare providers may believe they don’t need HIPAA liability insurance if they’re HIPAA compliant. But this isn't true at all. All it takes is a single accidental disclosure of PHI to trigger fines or a costly lawsuit. It could be as simple as a misdirected email, stolen laptop, phishing attack, third-party vendor or business associates, employee error, or other security incidents. HIPAA liability insurance provides a critical safety net for any business that handles PHI to cover the financial fallout from these events.

Businesses should be both HIPAA compliant and have HIPAA breach insurance to protect PHI and their operations. Compliance not only helps to prevent violations from occurring, but it also shows you're working to safeguard PHI. A breach can still occur even when you've done everything right, which is why HIPAA breach insurance is essential to protect your business if something slips through the cracks.

How HIPAA compliance insurance helps after a breach

Dealing with a HIPAA breach can be challenging for any business. It isn’t something you have to deal with alone, however. HIPAA insurance helps your business by covering many of the expenses involved in a recovery. This protects your operating capital so you can keep your doors open without being overwhelmed with fees, fines, and other expenses.

Consider a scenario involving a small physical therapist practice where the staff arrive at their office on Monday morning to find hackers have locked down their computer system with a ransomware attack. The attackers are demanding a large sum of money to restore access. Because the clinic stores PHI, the incident is considered a HIPAA breach, regardless of whether any data was stolen.

Without HIPAA breach insurance, the practice would face significant expenses, including:

- Forensic investigation to determine the scope of the breach

- Legal consultation to navigate HIPAA rules and notify affected individuals

- HIPAA fines

- Credit monitoring for affected patients

- Lost revenue during downtime

- Potential lawsuits

For a small practice, these costs could easily exceed $50,000 to $100,000, which could be enough to put it out of business. However, with HIPAA compliance insurance, the practice gets financial and professional support right away. This allows it to focus on taking care of its patients and getting back to normal as quickly as possible.

How to choose the right HIPAA liability insurance policy

Not all HIPAA liability insurance policies offer the same protection. That’s why it’s important to make sure you have the right coverage for your specific needs. Compared to the potential costs of dealing with a violation, HIPAA breach insurance is very affordable. Different coverage options allow your small business to get exactly what you need.

When selecting a policy, be sure to look for coverage for both first-party and third-party liabilities. First-party coverage takes care of expenses like forensic investigations, legal fees, and notification costs. Third-party coverage, on the other hand, protects you from lawsuits filed by affected individuals. Having both first-party and third-party coverage provides broad protection against various expenses that can occur after a HIPAA breach.

You'll also want to pay close attention to your coverage limits and find out what's excluded from your policy. Some policies might have insufficient coverage limits, for example, or exclude certain types of incidents. Be sure to discuss your needs with an insurance professional to make sure you get the right coverage.

When selecting a policy, you may be able to save by bundling HIPAA liability coverage with cyber liability insurance. Since many HIPAA breaches involve hacking, ransomware, or other cyber incidents, bundling both policies provides broader protection and helps you save on your premium price.

Get the best coverage for your business with Insureon

It's easy to get insurance for your small business with Insureon. Just fill out our online application to receive quotes from trusted providers. Our expert insurance agents are available to answer any questions and help you find the affordable small business insurance for your needs.

Most small business owners can get same-day coverage and easily download a certificate of liability insurance as soon as they purchase a policy.

Cyrus Vanover, Contributing Writer

Cyrus is a finance and insurance writer who is passionate about helping people and businesses succeed. He is also the author of the book "Earn a Debt-Free College Degree." He has written for some of the largest financial institutions in the country including TD Bank, Citizens Bank, and many credit unions. Cyrus has also contributed to Newsweek. Based in the Blue Ridge Mountains of Virginia, he enjoys hiking the local trails and exploring old Civil War battlefields and other historical sites in his spare time.