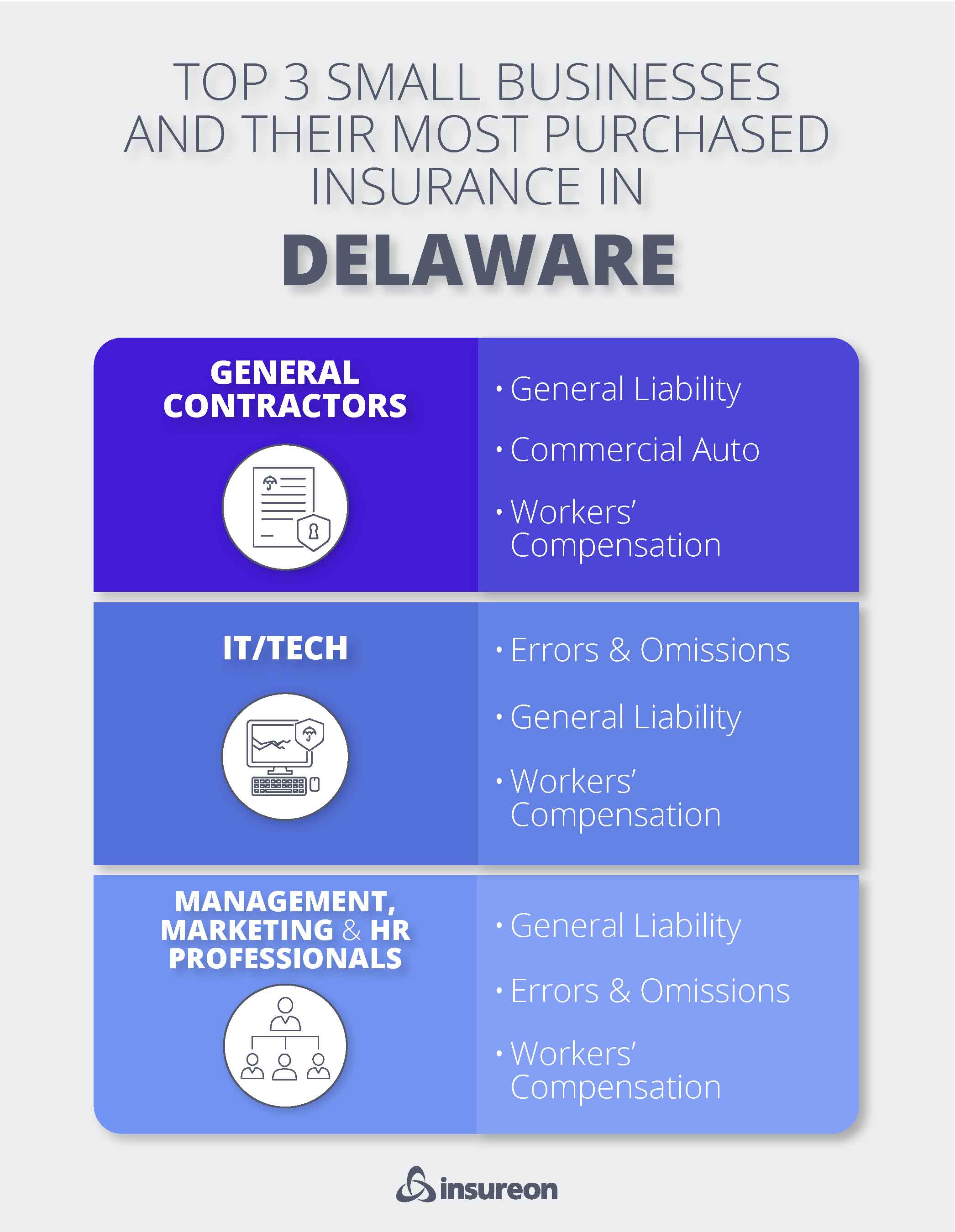

Get the right commercial insurance for your Wilmington business

Which insurance policies are recommended for Wilmington businesses?

General liability insurance

General liability protects Wilmington businesses from lawsuits related to customer accidents, defamation, and copyright infringement. Most commercial leases require this coverage.

- Customer injuries at your business

- Damages to a customer's property

- Libel and other advertising injuries

Professional liability insurance

This policy covers the cost of lawsuits related to mistakes and oversights. It's also called errors and omissions (E&O) insurance.

- Mistakes that cause financial loss

- Accusations of professional negligence

- Missed deadlines

Cyber insurance

Cyber liability covers costs related to a data breach or cyberattack at your business. Every Wilmington business that handles credit cards or other personal information should carry this coverage.

- Customer notification costs

- Fraud monitoring services

- Data breach investigations

Business owner’s policy

A BOP bundles general liability coverage and business property insurance together at a discount. It's the policy most often recommended for small businesses in Wilmington.

- Customer bodily injuries

- Damaged business property

- Business interruption coverage

Workers’ compensation insurance

Workers’ comp insurance is required for all Wilmington businesses that have one or more employees. It also protects sole proprietors from costs that personal health insurance might deny.

- Medical bills from employee injuries

- Disability benefits

- Workplace injury lawsuits

Commercial auto insurance

All vehicles owned by Wilmington businesses must be covered by commercial auto insurance. This policy covers auto accident injuries and property damage.

- Medical expenses from an accident

- Property damage caused by your vehicle

- Auto accident lawsuits

Errors and omissions insurance

Consultants and professional services in Wilmington carry this coverage to protect against legal costs from clients harmed by your advice or services. It's sometimes called professional liability insurance.

- Errors and oversights

- Late or incomplete work

- Negligence accusations

Commercial property insurance

This policy covers the cost of repair or replacement of your building's physical structure and its contents. Bundle it with general liability coverage in a BOP for savings.

- Storm damage

- Fires

- Theft and vandalism

Commercial umbrella insurance

An umbrella policy provides coverage once the limit is reached on your underlying general liability, commercial auto, or employer's liability policy.

- Customer lawsuits

- Auto accident lawsuits

- Employee injury lawsuits

Verified business insurance reviews

Hear from customers like you who purchased small business insurance.

Which business insurance policies are required in Wilmington?

State and local laws can determine the type of coverage you need. These policies help you comply with Delaware business insurance requirements.

Workers' compensation insurance

The state of Delaware workers’ compensation law requires this coverage for all businesses that have employees. That includes both full-time and part-time employees as well as corporate officers.

There are some exceptions to this rule for certain workers, including:

- Certain real estate professionals

- Government workers

- Farm and domestic workers

- Some independent contractors

Workers' compensation pays for medical expenses from job-related injuries and illnesses. It also provides disability benefits for injured Wilmington workers.

Commercial auto insurance

Delaware state law requires commercial auto insurance for all vehicles that are owned by a business. This insurance policy pays for medical bills, legal fees, and property damage after an auto accident.

Wilmington businesses must meet the state's requirements for auto liability coverage, which are:

- $25,000 per person bodily injury liability

- $50,000 per accident bodily injury liability

- $10,000 per accident property damage liability

- $15,000 personal injury protection (PIP) for any one person

- $30,000 PIP for all persons injured in any one accident

Keep in mind that this is the minimum you're required to carry. It's worth considering higher limits for your auto policy, given the potential cost of a lawsuit. Trucking companies may also need more coverage to comply with regulations.

If you need business insurance coverage for personal, rented, or leased vehicles used for travel to job sites or work-related errands, you may want to consider a hired and non-owned auto (HNOA) policy instead.

Personal insurance will not typically cover accidents that occur during work-related activities.

How much does business insurance in Wilmington cost?

Small businesses in Wilmington don't have to pay a lot for commercial insurance. Here are a few average costs for Delaware small businesses:

General liability: $40 per month

Workers' comp: $51 per month

Professional liability/E&O: $88 per month

Your business insurance costs depend on factors such as:

- Type of business operation

- Business revenue

- Number of employees

- Policy limits and deductibles

- Types of business insurance purchased

- Claims history

FAQs about Wilmington business insurance

How do I get a certificate of insurance for my business?

Sometimes you need to get insured quickly to sign a contract or other agreement. With Insureon, you can get same-day insurance in three easy steps:

- Fill out our easy online application to get quotes from top-rated insurance agencies.

- Choose a policy and pay for it online.

- Download a certificate of insurance (COI) by logging into your account.

Our licensed insurance agents will help you get coverage for your Wilmington small business that matches your risks and your budget. Most businesses can get their certificate of insurance within a few hours of applying for quotes.

You can also speak to one of our insurance agents if you have questions about the right types of insurance services for your business.

Can my business be held liable for a data security breach?

Yes – that's why cyber insurance is so crucial. Small businesses are a common target of cyberattacks since they often have fewer security measures in place.

Delaware's data breach laws require Wilmington businesses to notify any residents whose personal information is exposed in a data breach within 60 days of discovery.

Your business could also end up paying for a data breach investigation, a PR campaign, and other costs related to a breach or cyberattack.

Cyber insurance covers these costs and provides resources so you can get back to business fast.

Does my industry affect Wilmington insurance requirements?

Yes, the city of Wilmington may have special requirements for business insurance and bonds, depending on the type of work you do.

Every business operating in Wilmington needs a state business license and potentially a city license, depending on the type of business.

Here are a few examples of businesses that might have small business insurance needs or other protections:

- Contractors are not required by state law to carry general liability insurance or a surety bond to operate, but they should strongly consider it due to industry risks. Specific clients may also require it in order to sign a contract or bid on a project.

- Cleaning businesses may need a janitorial bond to fulfill the terms of a contract in Wilmington.

- Liquor stores and businesses that sell alcohol are required to carry liquor liability insurance in Delaware.

- Lawyers and doctors are not required to carry professional liability insurance in Wilmington, but their employer may mandate it.

Ensure you have the right insurance products and coverage options, whether you're in Dover, Newark, or elsewhere in the state.

When running a business in Delaware, from a cannabis dispensary to a hair salon, you need to be aware of laws and regulations on the city, county, and state level.

How can I get help starting a small business in Wilmington?

Starting a new business or growing an existing one can be quite the undertaking. Here's a list of local grants and resources for Wilmington business owners to help you get started:

- Delaware Division of Small Business assists small businesses with personalized advice and counseling as well as funding resources.

- Wilmington Small Business Support Center helps business owners with licensing, permit applications, tax support, and more.

- WilmingtonMade provides workshops, events, and a small business directory.

- SCORE Delaware supports businesses with mentorship, workshops, and partnerships to enrich the local small business economy.

- The U.S. Small Business Administration (SBA) is a trusted source for small business loans with competitive rates and fees.

Keep in mind that many lenders will require you to first obtain business insurance, which is yet another reason to insure your small business.

How can I save money on Wilmington business insurance?

Small business owners can save money on insurance by comparing quotes from different insurance companies. With Insureon, you can get free quotes from top-rated providers by filling out one easy application.

There are a few other ways to save, such as:

- Bundle policies for a discount. The most popular option is a business owner's policy.

- Choose less expensive policy options, such as lower limits or a higher deductible.

- Focus on workplace safety. Fewer accidents mean fewer claims, which helps keep your premium low.

Learn more about how to find cheap business insurance.