How much does business insurance cost for wholesalers and distributors?

Several factors affect the cost of insurance for wholesalers and distributors, including your business operations, revenue, number of employees, and the products you sell. Cost estimates are sourced from policies purchased by Insureon customers.

Key wholesale and distribution insurance policies and their expected costs

Here are the top commercial insurance policies purchased by wholesalers and distributors and their average monthly costs:

- General liability insurance: $58 per month

- Business owner's policy (BOP): $134 per month

- Workers' compensation insurance: $91 per month

- Commercial auto insurance: $181 per month

- Cyber insurance: $187 per month

- Commercial umbrella insurance: $126 per month

Our figures are sourced from the median cost of policies that wholesalers and distributors purchased through Insureon. The median offers a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

Warehouse insurance costs depend on your annual revenue, your products, how many employees you have, your claims history, and your policy limits and deductibles. Additional factors like the size of your building, your location, and insurance requirements for suppliers and vendors can affect your premiums as well.

General liability insurance

Wholesalers and distributors pay an average of $58 per month, or $699 per year, for general liability insurance.

This policy provides financial protection for third-party bodily injuries and property damage, along with advertising injuries. It'll cover your legal costs if a client slips in a puddle in your warehouse and suffers a concussion, or breaks their smartphone in the fall.

General liability insurance usually includes product liability insurance, which covers lawsuits related to your products. For instance, a customer could have an allergic reaction to an undisclosed ingredient in a food product, or a defective plumbing fixture could leak and damage a customer's floor.

You might also need warehouse legal liability insurance, which is a type of bailee insurance that covers goods belonging to others that are stored at your warehouse.

This is the average general liability insurance policy for wholesalers and distributors who buy from Insureon:

Insurance premium: $58 per month

Policy limits: $1 million per occurrence; $2 million aggregate

The per-occurrence limit is the maximum your insurer will pay for a single incident, while the aggregate limit is the maximum your insurer will pay on any insurance claims during your policy period, typically one year.

Business risks affect the cost of general liability insurance

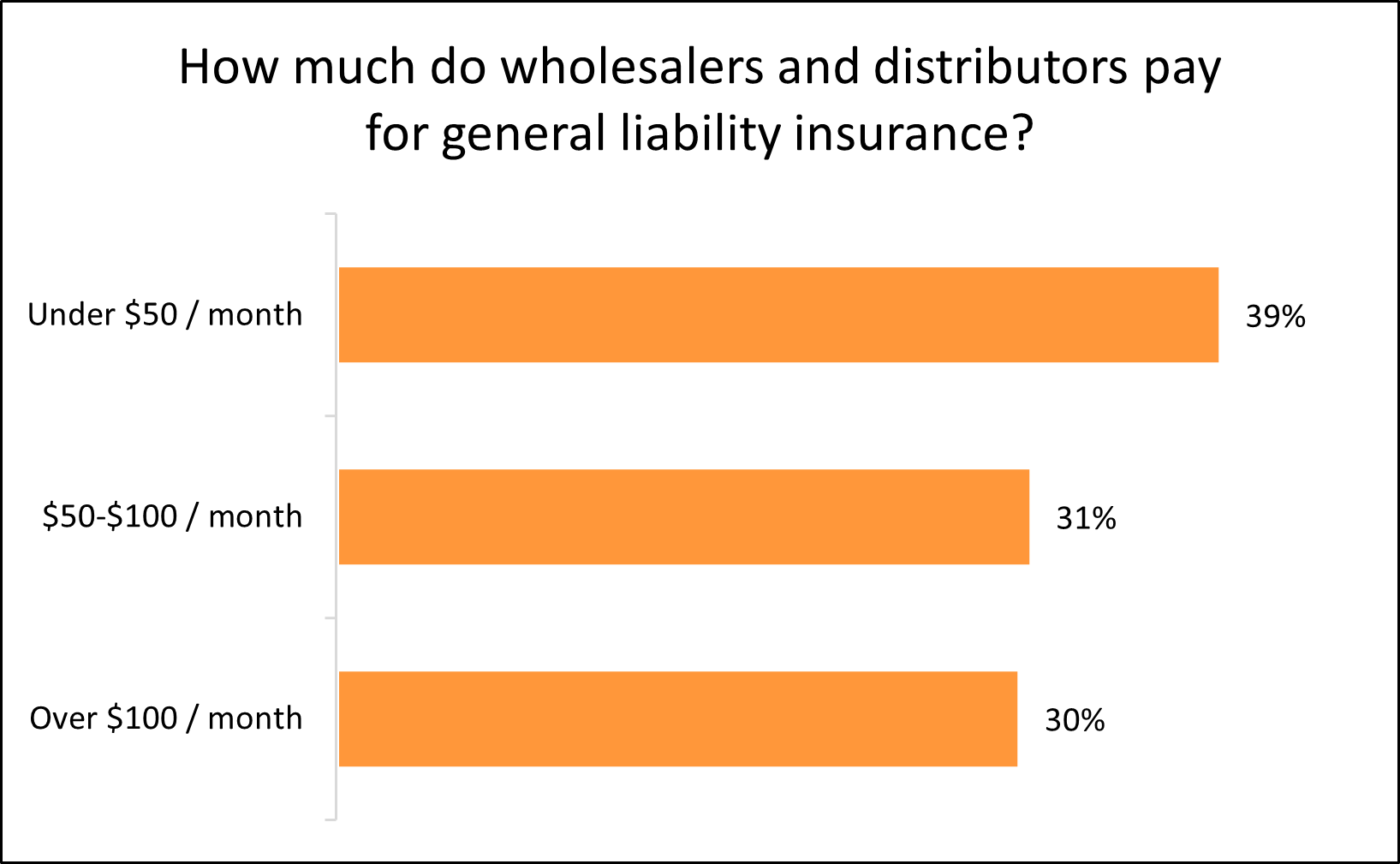

Among wholesalers that purchase general liability with Insureon, 39% pay less than $50 per month and 31% pay between $50 and $100.

General liability insurance costs depend on your risk of a customer lawsuit, which increases with the amount of foot traffic at your office or warehouse.

When this policy includes product liability insurance, high-risk products—such as foods or pharmaceuticals—can drive up costs as well. Other businesses you contract with, such as retailers, may ask you to carry a certain amount of this coverage to mitigate their own risks.

Other factors can also affect your insurance rates, such as the size of your business, your claims history, and any endorsements you might add, such as an additional insured.

General liability policy limits for wholesalers

Policy limits determine how much your insurer will pay on covered claims. These amounts are flexible, though suppliers and vendors might require you to carry a specific amount of coverage.

Most wholesalers (83%) choose general liability policies with a $1 million per-occurrence limit and a $2 million aggregate limit. As your small business grows, you may need to expand your policy limits.

As with other types of business insurance, you can opt for a higher deductible or lower coverage limits to save money on your policy.

Business owner’s policy

The average cost of a business owner’s policy for wholesalers and distributors is $134 per month, or $1,610 per year.

A business owner's policy, or BOP, bundles general liability coverage with commercial property coverage to cover both third-party risks and your business property. It typically costs less than purchasing each policy separately.

A BOP protects against customer injuries and property damage, along with damage to your office, warehouse, and inventory. Because of its increased coverage and affordability, it’s the policy most often recommended by Insureon’s agents.

This is the average BOP for wholesalers and distributors that buy from Insureon:

Insurance premium: $134 per month

Policy limits: $1 million per occurrence; $2 million aggregate

Deductible: $1,000

Small, low-risk businesses are often eligible for a business owner's policy. You can customize your policy by adding endorsements, though they will increase the cost.

For instance, you may want to add business interruption insurance in case a natural disaster, vandalism, or other covered property claim forces you to temporarily close your business, or equipment breakdown coverage to cover replacement costs if critical machinery malfunctions unexpectedly.

Business property value drives the cost of a BOP

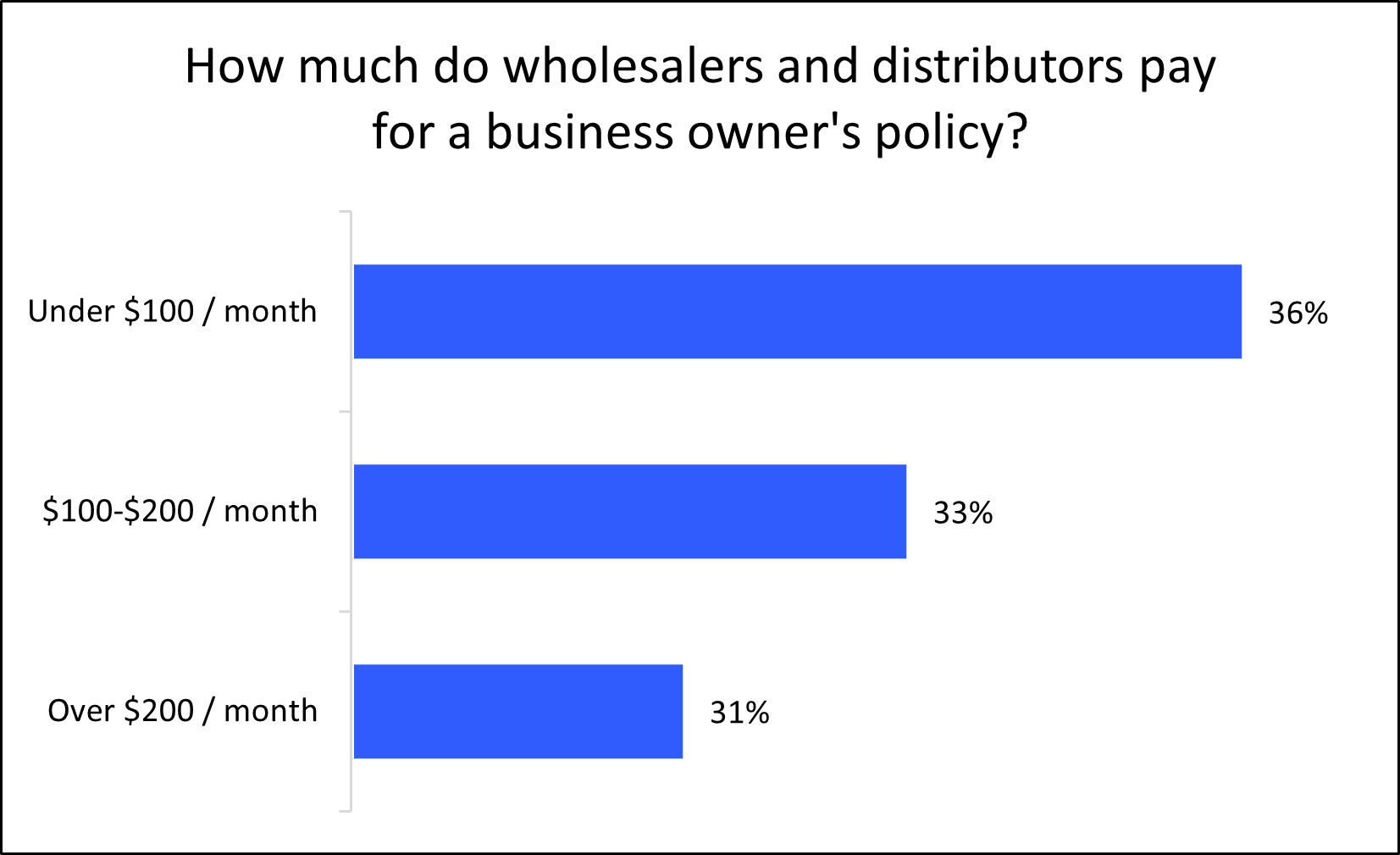

Among wholesalers and distributors that purchase a business owner’s policy with Insureon, 36% pay less than $100 per month and 33% pay between $100 and $200 per month.

Insurance costs for warehouses increase with the size of the building and the value of your inventory. Your industry risks, years in operation, the building's condition, and your claims history will also affect your premium.

Because it includes both policies, the factors that affect both general liability costs and commercial property insurance costs affect your business owner's policy premium. Other factors include your business's location, the number of employees you have, and your business operations.

Workers’ compensation insurance

For wholesale and distribution companies, workers’ compensation insurance costs an average of $91 per month, or $1,090 per year.

This type of coverage helps pay for medical expenses when an employee is injured on the job. It also provides disability benefits while they're recovering and unable to work.

To comply with your state’s requirements and avoid penalties, wholesalers and distributors typically must purchase this coverage for their employees. It's also recommended for sole proprietors, as health insurance plans can deny claims for medical bills that are related to your job.

Most workers' comp policies include employer's liability insurance, which covers the cost of lawsuits related to employee injuries. There's usually no limit to how much a workers' comp policy can pay for employee benefits, though it depends on state laws.

The cost of workers' comp depends on the number of employees and their risks

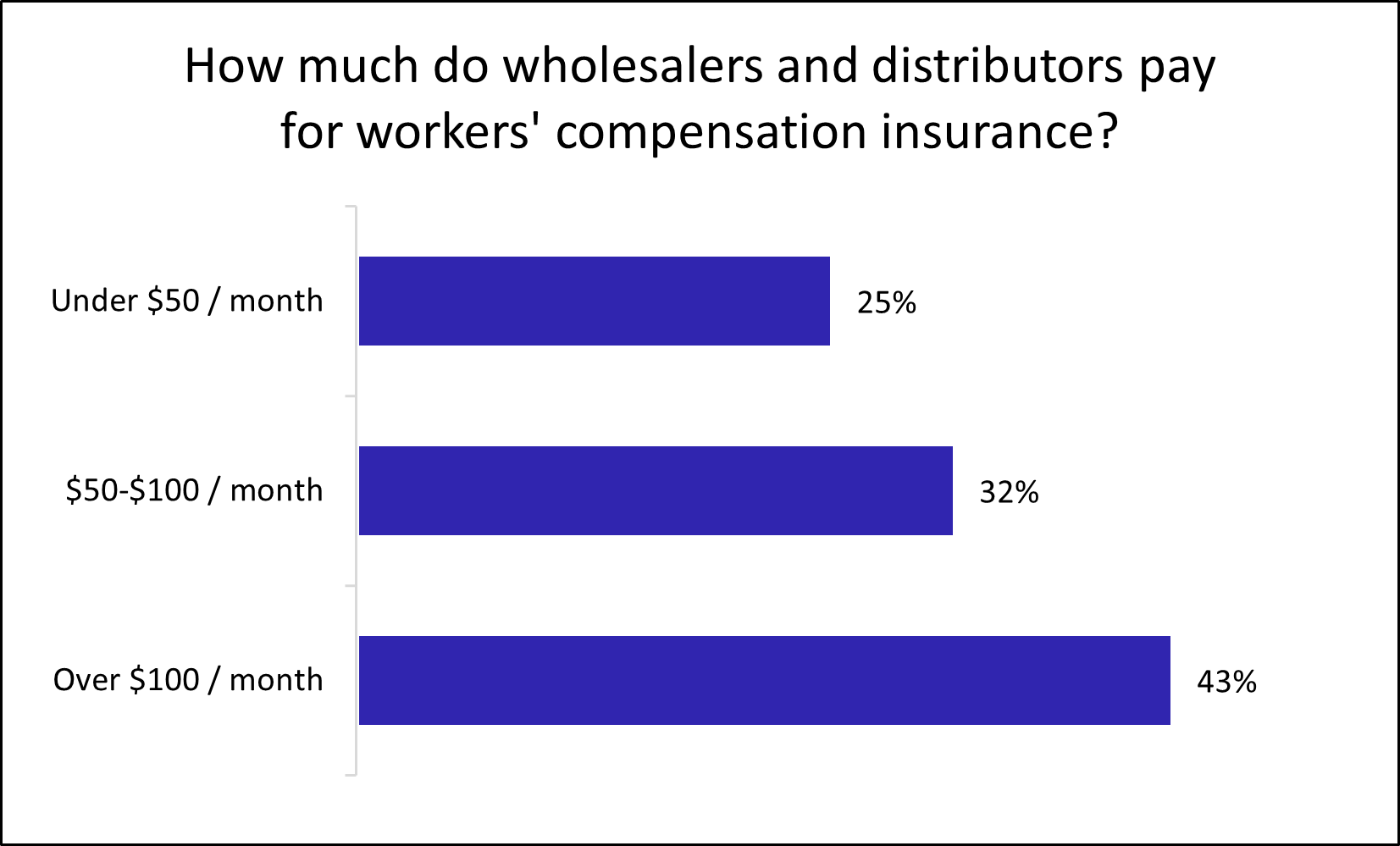

Among wholesalers that purchase workers’ comp insurance with Insureon, 25% pay less than $50 per month and 57% pay less than $100 per month.

The cost of workers' compensation depends on the number of employees at your business and the type of work they do, among other factors. A larger workforce brings a higher rate of worker injuries, which is why bigger businesses tend to pay higher premiums.

Warehouse workers and office workers are assigned different class codes used to determine premiums. It'll cost more to insure a warehouse operator who lifts heavy boxes all day, giving them a higher risk of physical injury, than a clerk who works at a desk.

It's important to classify your employees correctly to make sure you're paying the correct rate. You can save money on workers' compensation coverage by comparing rates from different insurance companies and focusing on workplace safety, among other strategies.

Commercial auto insurance

Wholesalers and distributors pay an average of $181 per month, or $2,168 annually, for commercial auto insurance.

Most states require this coverage for vehicles owned by a business. For personal, rented, and leased vehicles used by your business, look to hired and non-owned auto insurance (HNOA) instead.

A commercial auto policy provides financial protection in the event of an accident involving your delivery truck or other business vehicle. It can help pay for property damage, medical costs, and legal expenses.

The cost of commercial auto insurance depends on several factors, including your policy limits, the coverage options you choose, the value of the vehicles, where they are driven, and the driving records of anyone permitted to drive.

Learn more about how small business owners can save money on commercial auto insurance coverage.

Cyber insurance

Wholesalers and distributors pay an average premium of $187 per month, or $2,248 annually, for cyber insurance. You might also see this policy called cyber liability insurance or cybersecurity insurance.

Cyber insurance can help your business recover financially after a data breach or cyberattack. It can help pay for customer notification costs, fraud monitoring services, and other costs necessitated by state data breach laws.

The cost of cyber insurance depends on the amount of personal information handled by your wholesale business, such as customer credit card numbers, along with the number of employees who can access that information.

Commercial umbrella insurance

Wholesale and distribution businesses pay an average of $126 per month, or $1,510 annually, for commercial umbrella insurance.

This policy boosts the protection of your general liability insurance, commercial auto insurance, and employer's liability insurance. When a claim exceeds the limits of the underlying policy, umbrella insurance activates to provide coverage.

Wholesalers may need this type of insurance if a landlord, supplier, or vendor requires liability coverage in excess of $2 million. You must have a certain amount of underlying coverage before you can purchase umbrella insurance.

For example, a supplier might require you to have $3 million in general liability coverage before they'll sign a contract with your business. In that case, you could carry $2 million in general liability insurance along with a $1 million umbrella policy.

Umbrella insurance is usually available in $1 million increments. The amount of coverage you buy is one of the biggest factors that determine how much umbrella insurance costs.

How do you buy business insurance for wholesalers and distributors with Insureon?

Insureon works with top-rated U.S. providers to find affordable insurance coverage for your business, whether you're an independent distributor, an authorized distributor, a merchant wholesaler, or a manufacturer.

Apply today to get free insurance quotes with our easy online application. A licensed insurance agent who specializes in your profession's risks will help you find the right types of coverage for your business. They can also discuss state regulations, cost-saving bundles, and riders for any unique business needs.

Typically, you can get a certificate of insurance within 24 hours after submitting an application, offering instant peace of mind.

What our customers are saying

Want free expert advice right in your inbox?

By entering your email address and subscribing, you agree to our Terms of Use and Privacy Policy