Cyber insurance vs. commercial crime insurance

What is cyber insurance?

Cyber insurance, also known as cyber liability insurance, protects your business from the high costs and financial losses associated with cybercrime, malware, cyber extortion, data breaches, scams, and other cyber risks.

If cybercriminals target your business through ransomware attacks, phishing, or social engineering techniques, you could be held liable.

Each state has different data breach notification laws, but most require consumers to be notified within a specific time frame if their private information has been compromised.

You may have to pay for investigations, data recovery, credit monitoring, and lawsuits if your company is affected by a cyber incident.

Cyber insurance will help cover expensive incident response costs and help your business recover from a costly cyber event.

What are the two types of cyber coverage?

There are two types of cyber insurance: first-party coverage and third-party coverage.

- First-party cyber insurance covers expenses related to a direct cyberattack on your business. This coverage helps pay for costs related to recovering from the attack and notifying affected customers.

- Third-party cyber insurance covers your business if a client sues, claiming your business caused or failed to protect against a cyber threat. For example, if a cybersecurity firm provides poor advice that leads to a data breach, their third-party cyber coverage would help cover legal expenses should their client decide to sue.

Both types of cyber insurance are often included as a part of a comprehensive risk management strategy, especially for small businesses that function largely online and store customer data.

What is commercial crime insurance?

Commercial crime insurance, also called fidelity insurance, protects your business against criminal activity committed by your employees.

Crime insurance covers thefts, embezzlement, forgery, and fraud, including funds transfer fraud, that employees commit against a business or its clients.

This policy is beneficial for any company that has employees with access to important and sensitive information, client data, and physical property.

Examples include cleaning businesses, where cleaners are often on clients' property, or consulting businesses, where consultants handle a large amount of client data.

What are the two forms of crime insurance?

There are two types of commercial crime coverage:

- First-party crime insurance coverage protects your company against losses from employee theft. This coverage is often purchased as a fidelity bond or as an endorsement to a business owner's policy (BOP) or a commercial package policy (CPP).

- Third-party crime insurance protects your client against losses that result from theft related to one of your employees. This is typically purchased as a fidelity bond.

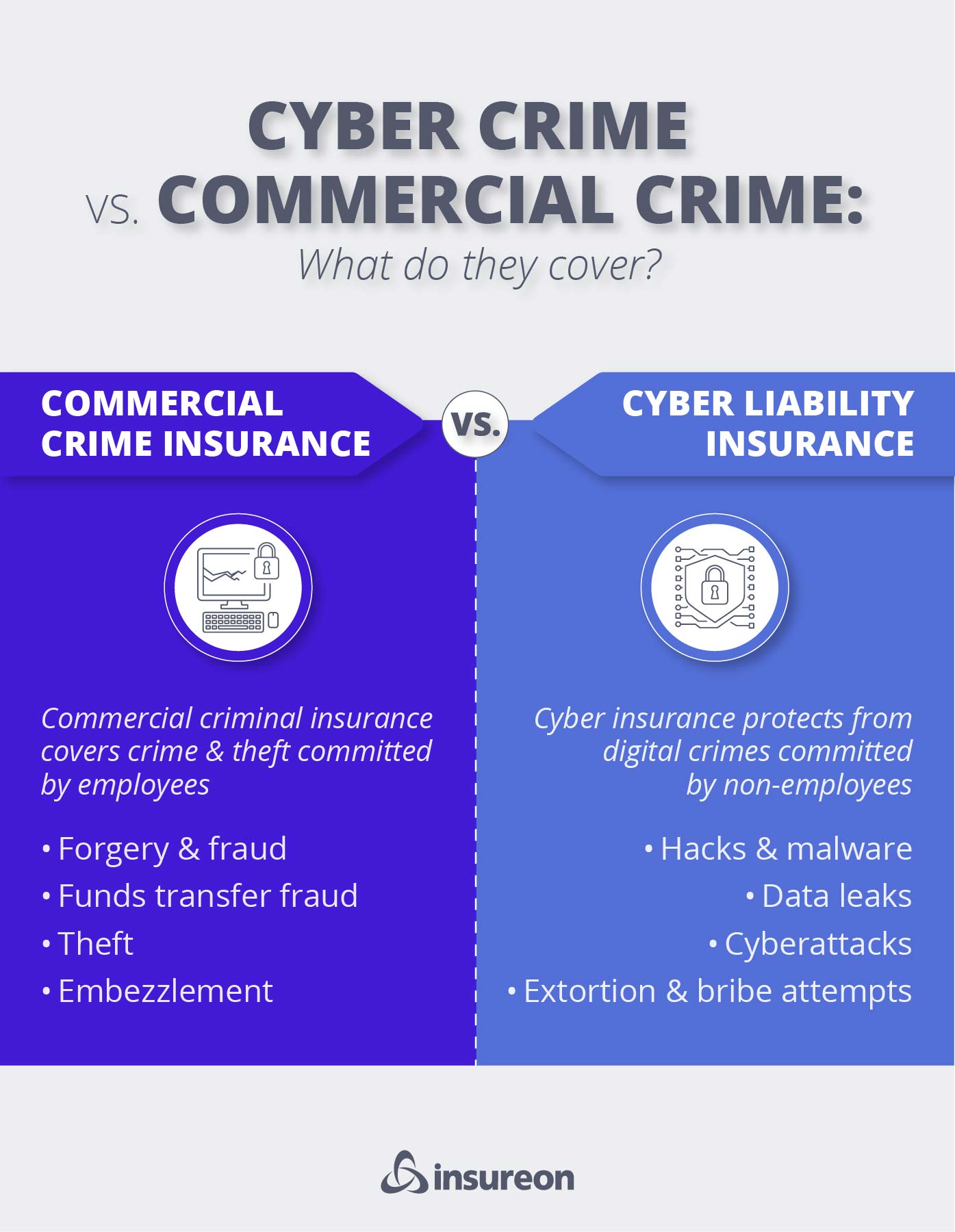

What is the difference between crime insurance and cyber insurance?

Both policies protect your business from the heavy costs resulting from crime, but each policy handles different types of crime.

Cyber insurance protects your business and your clients from costs related to cyberattacks and data breaches that are caused by non-employees, hackers, and cyber criminals outside your business.

Commercial crime safeguards your business and your clients from employee theft, fraud, and embezzlement.

You may need one or both types of insurance depending on the type of work you do and your business's specific risks.

Should businesses consider having both cyber and crime insurance coverage?

When deciding which policies are right for your business, consider the kind of company you run and the risks you face.

Any business that processes customer data should consider cyber insurance. Small businesses are common targets of cyber criminals because they generally have fewer protections and more vulnerabilities than larger corporations.

If you hire employees that have access to your client's financial information, commercial crime insurance is not only a good idea, but it may be required in order to obtain new clients and sign contracts.

An example of a company that should consider both policies is an insurance agency that stores private client data. If they are subject to a security breach, they could face an expensive business interruption that would be covered by cyber insurance.

Additionally, the same insurance agency could unknowingly hire an insurance broker who commits fraud and steals client data. In that case, the agency would want to be covered by a commercial crime policy.

It's important to factor in all the needs of your business when selecting which insurance options to purchase.

Protect your business with the right insurance policies with Insureon

With Insureon's easy online application, you can get free quotes to compare policies from top U.S.'s insurance companies.

Our licensed insurance agents can help answer any questions you have about the best types of coverage and policy limits for your business needs. Most customers get same-day coverage and a certificate of insurance within 24 hours.

Verified business insurance reviews

Hear from customers like you who purchased small business insurance.

Want free expert advice right in your inbox?

By entering your email address and subscribing, you agree to our Terms of Use and Privacy Policy